While the cost of compliance rises, there’s a way to save your funds. You’ve guessed it: automated RegTech solutions. With many options in the market and more complex fraudulent schemes out there, finding the right anti-money laundering (AML) compliance solution is now crucial.

However, to actually overcome the ongoing challenges of fraud and money laundering, businesses must go through what often seems a never-ending labyrinth of compliance hassles, often requiring careful attention to detail.

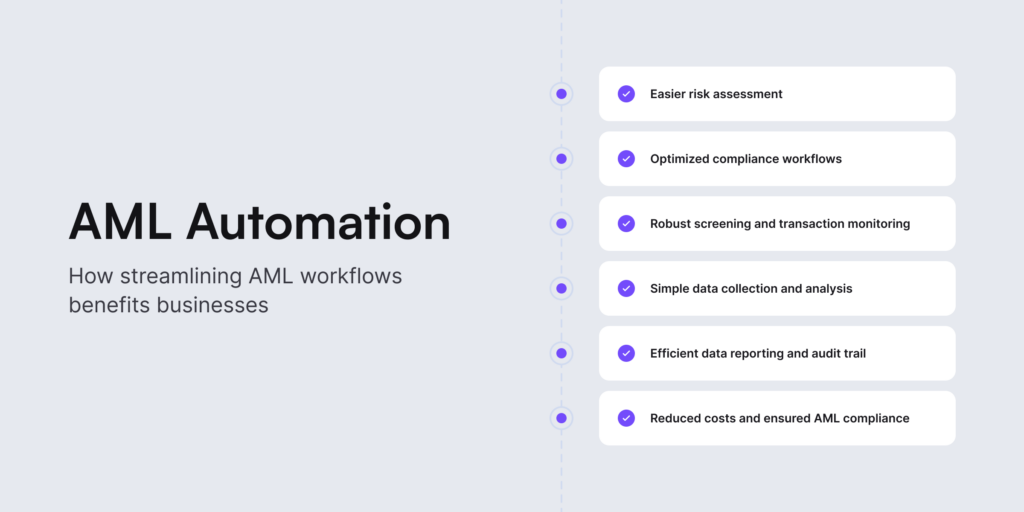

In this blog post, we discuss AML automation, what it takes to build a compliant AML program, and how an automated AML compliance workflow can benefit your business.

What is AML Automation?

AML automation is a program or software that uses AI and machine learning to streamline compliance tasks linked to customers and their transactions. For example, an automated AML system can identify and flag high-risk users on an online platform in real-time. Such a solution is used to detect suspicious activity without having to screen and check multiple databases manually.

In practical terms, AML automation is designed to recognize various risk indicators, consisting of not just high-risk individuals but also identifying suspicious transactions and enabling continuous transaction monitoring. Despite the technological aspects, the human element is crucial. Automated AML systems require training and dedicated staff who can use the AML automation and its dashboard to manage AML risks more easily.

For instance, real-time AML screening enables instant detection of fraudulent behavior, allowing quick response to mitigate potential impacts on customers and your business. AML automation can be customized to automatically approve or deny customers, blacklist suspicious users and enhance efficiency for your compliance team through streamlined operational workflows.

What is AML Compliance?

Anti-money laundering, known as AML compliance, is a set of regulations established by different governments worldwide in order to help financial institutions and other obliged entities to follow a recommended framework for preventing illegal activities, such as money laundering or terrorism financing.

Initially presented by the Bank Secrecy Act of 1970, AML compliance is consistently revised and adopted to better scrutinize activities for signs of financial crime over the years. It’s like a constantly evolving foundation for regulated entities, helping them implement effective policies, procedures, training, and technologies, such as AML automation.

What is an AML Program?

An AML program is a company’s strategy and approach to staying compliant with anti-money laundering laws. To have a strong AML program means that the business must follow stringent requirements and procedures.

AML programs play a crucial role in preventing illicit funds from infiltrating the lawful financial system. They help different businesses, both traditional financial institutions and other entities specified in government regulations, such as money services businesses.

An AML program is designed to identify and report suspicious activities, including the underlying offenses that lead to money laundering and terrorist financing, such as securities fraud and market manipulation. That means stopping the money earned from most crimes is a strong way to reduce corruption, tax evasion, theft, fraud, and many other crimes on a larger scale.

Key Elements for an Effective AML Program

The Federal Financial Institutions Examination Council (FFIEC) recommends building an effective AML program around the following processes:

- Internal controls. Ensuring continuous compliance through an established system of internal controls.

- Independent testing. Conducting compliance testing independently, either by bank personnel or an external party.

- Designated compliance officer. Appointing a BSA compliance officer responsible for day-to-day oversight of compliance.

- Ongoing employee training. Providing ongoing training for employees.

- Risk-based customer identification program (CIP). Implementing a risk-based CIP to verify customer identities.

- Ongoing customer due diligence (CDD). Using a risk-based approach for continuous CDD and adhering to beneficial ownership requirements outlined in regulations by the Financial Crimes Enforcement Network (FinCEN).

Related: What are the Five Pillars of AML Compliance?

What AML Processes are Typically Automated?

Companies automate various aspects of AML compliance, including processes that are rules-based, as opposed to those necessitating human intervention and characterized by high volume and repetition.

Most common examples of AML compliance include:

- Verifying customer identities and conducting CDD, which is a part of the Know Your Customer (KYC) process.

- Screening and monitoring for AML purposes to assess risk levels through Politically Exposed Person (PEP) checks, sanctions screening, and global watchlist screening.

- Ongoing monitoring to detect any changes in customer risk profiles or suspicious transactions, such as Source of Funds (SoF) checks.

Several practices linked to the mentioned AML processes can be automated using software. Typically, to fulfill AML requirements, companies employ a combination of automated AML tools. For example, AML automation platforms can convert manual risk policies into digital workflows, automatically recording actions and simplifying the tracking and reporting of audit history.

Companies also use AML automation to complete general tasks, such as conducting a proper risk assessment, collecting large volumes of data, or recognizing suspicious patterns and anomalies. For example, if there are regular deposits of $3,500 into a checking account, even if the individual deposit amounts aren’t individually flagged as suspicious, the suspicious pattern can be recognized as unusual and flagged by the automated software.

Related: KYC and AML Compliance — Key Differences and Best Practices

Is AML Automation a Mandatory Requirement?

Financial institutions and banks are legally obligated to comply with anti-money laundering regulations to uphold the integrity of the global financial system. For all obliged entities, it’s essential to establish and implement an AML program to prevent money laundering. However, regulations don’t necessarily specify that companies must do it through AML automation.

In theory, you can monitor customers and their transactions manually, but in practice, such manual operations are costly and cause delays. That’s why swift action is crucial in preventing financial crime. Manual processes are inadequate to match the rapid pace of criminals.

How Can Businesses Benefit from AML Automation?

AML automation enhances the efficiency and effectiveness of AML compliance programs for businesses and financial institutions. More importantly, automating the AML processes not only reduces the resources dedicated to compliance operations but also minimizes the risk of reputational harm.

Businesses can reap numerous benefits from implementing AML automation in other aspects, such as:

Adapting to Regulatory Changes

It’s safe to say that all AML controls must evolve alongside rapidly changing regulatory updates. As a result, companies benefit more from maintaining their compliance, at least by using some degree of automation. For example, automated AML solutions help businesses detect fraud threats, review existing risk-scoring frameworks, and maintain regulatory procedures, such as screening and monitoring, more effectively.

AML automation also helps maintain a constant examination of suspicious activities that enables determining whether a customer is using the financial institution for money laundering. Optimizing investigations involves implementing targeted AML and anti-fraud initiatives, reducing turnaround times, and enhancing task performance.

Optimizing AML Workflows and Reducing Costs

AML automation benefits businesses by boosting efficiency and lowering compliance costs. Such solutions also play a vital role in promptly identifying and addressing potential fraud threats. That’s why this streamlined approach allows businesses to mitigate risks and safeguard against potential financial losses.

Using an automated AML system decreases reliance on inefficient manual checks. This is particularly beneficial for small-scale organizations, relieving business owners from the burdensome task of manually tracking compliance processes. Automation not only streamlines compliance oversight but also cuts costs, allowing businesses to allocate resources to other critical areas.

Helping Internal Compliance Teams

Automated AML solutions not only simplify investigations through user-friendly dashboards and advanced analytics features but also assist in prioritizing alerts, enabling internal compliance teams to use their time more effectively. So, by using contextual data, AML automation enables the identification of fraudulent customer behavioral patterns.

On top of that, compliance teams can promptly address and remove questionable users and enhance the overall end-user experience. Moreover, AML automation helps maintain a proper risk management system. It involves systematically documenting all business risks, regularly assessing them, instantly assigning scores to threats, and devising a mitigation plan to eliminate each risk.

Related: What is a Risk-Based Approach to AML?

Factors to Consider When Implementing an Automated AML Solution

The right automated AML solution can positively impact the revenue and growth of your company. At the end of the day, it’s all measured by the scale, speed, and accuracy of detecting criminal activities. So, to outpace criminals, companies can enhance their AML infrastructure by investing in automated AML solutions.

Certain factors describe a good automated AML solution. For example:

- Global document base. It’s best to choose a global automated solution that supports a wide range of documents for onboarding and screening customers. For example, the AML system should support various local and international sanctions or watchlists. This helps to function effectively in the regions where you conduct business.

- Responsive customer support. A solution that’s backed by a transparent, fair, and responsible customer support team that can consult you 24/7 is very important. It helps companies solve any technical issues or even work further on AML automation and its capabilities for further development.

- Increased level of automation. A proper AML solution should automate many repetitive tasks, saving time and internal resources. Most tools will streamline processes like customer onboarding or risk assessment and effectively identify risks earlier in the customer lifecycle.

- Smooth integration process. The solution should be straightforward to set up and seamlessly integrate with your existing systems. The quicker you can implement the AML solution, the less exposure you have to criminals and their illegal activities.

Great news! iDenfy offers all of these features in a single, full-stack platform with built-in AML screening and monitoring capabilities:

PEPs and sanctions checks, global watchlist screening, as well as various KYC services (document verification, selfie checks, manual review, and more).

Get started today, and don’t forget to read our customer success stories to see our AML software in action.