September 27, 2023

What is an NFC Tag? A 2024 Guide

An NFC tag can be programmed with a wide range of information and easily embedded into different products. That’s why there’s no surprise that, with over 80% of smartphones now equipped with NFC, companies are exploring new ways to incorporate NFC technology into their customer experiences.

September 27, 2023

What is Selfie Identity Verification?

Selfie identity verification is the latest ‘it’ trend when it comes to different industries and their top KYC picks. That’s because this verification measure is simple and effective both for the user and for the business, aiming to safeguard its assets. And it’s exactly as it sounds — it requires users to take a selfie, typically during the customer onboarding process. Learn more about its benefits, susceptibility to fraudsters, and more.

September 25, 2023

Top 5 Use Cases of Biometrics in Banking

There are many examples of how biometrics can be used in banking. For example, biometrics can help financial institutions prevent fraud, support regulatory compliance, and provide an alternative way to authentication. That’s why, due to the technology’s convenience, it’s now storming the financial industry, replacing passwords and paving the way to becoming one of the top technological solutions for both KYC and fraud prevention. Read more.

September 21, 2023

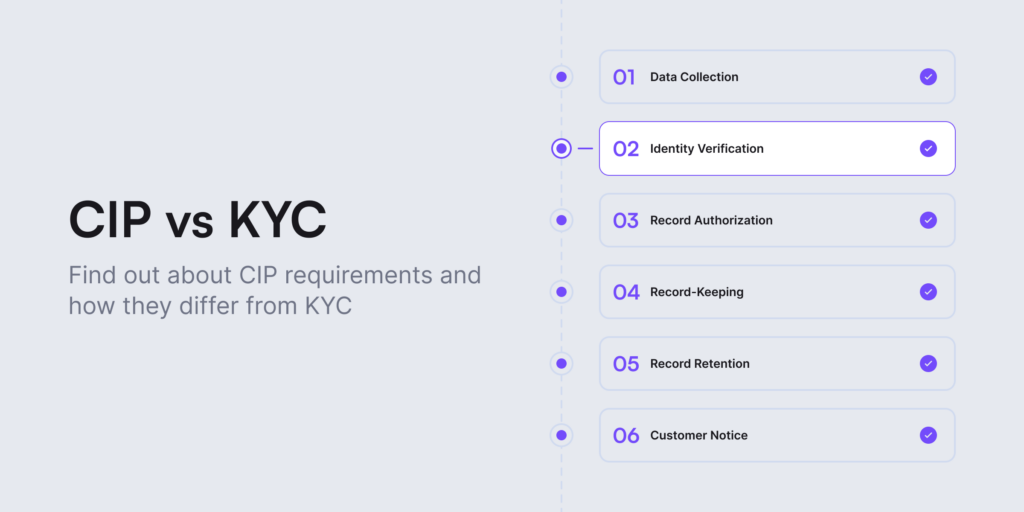

What is the Difference Between CIP and KYC? Examples & FAQs

Customer Identification Program (CIP) and Know Your Customer (KYC) are two different business operations that don’t work the same. However, businesses often confuse these terms when talking about ensuring Anti-Money Laundering (AML) compliance and preventing illegal activity. In this blog post, we’ll explain each process in detail, highlighting the key differences to help you create a strong customer identity verification system.

September 19, 2023

What is Identity Proofing? Complete Security Guide with Examples

The Federal Trade Commission (FTC) reported receiving a total of 5.7 million reports related to fraud and identity theft, with 1.4 million of these reports specifically involving identity theft cases. With this level of crime and illicit activity, identity proofing is an inevitable process for businesses that want to protect their assets and their customer’s data.

September 15, 2023

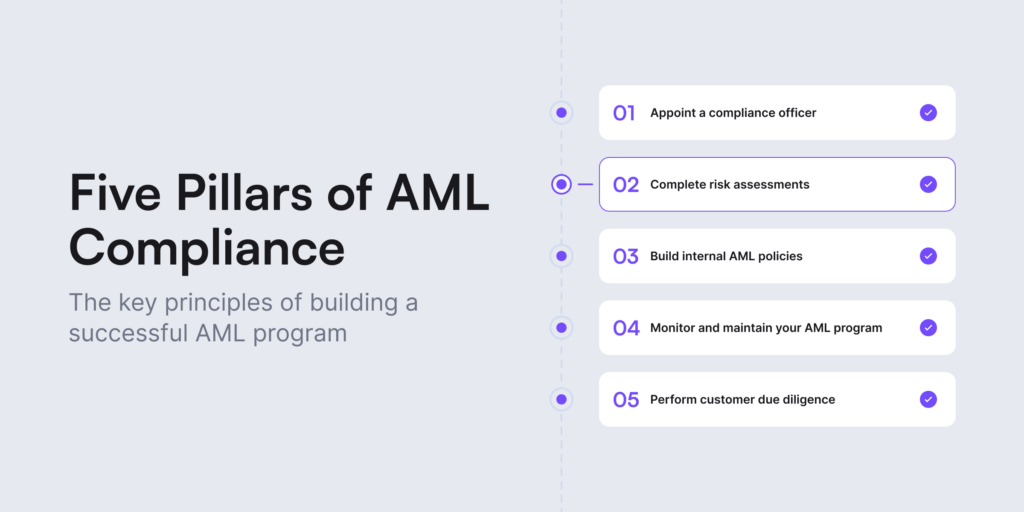

What are the Five Pillars of AML Compliance?

When establishing a robust AML compliance program, financial institutions must prioritize their ability to identify and assess potential risks. This is particularly crucial when dealing with customers who pose a higher risk of engaging in money laundering. To achieve this, a robust compliance program with the five key AML pillars is required.

September 13, 2023

What is a Customer Identification Program (CIP)?

As a piece of a broader Know Your Customer (KYC) strategy, companies must conduct Customer Identification Programs (CIP) to establish their customer identities. Any business classified as a financial institution, according to the Bank Secrecy Act (BSA) is required to create a CIP. Learn more about its requirements.

August 31, 2023

KYC Requirements in the UK

The UK ranks at the top regarding fintech adoption. Not only that but also the idea of RegTech and Open Banking originated here, making the UK and its businesses the key players when it comes to technological advancements. Consequently, the evolution of the regulatory landscape led the UK to have strict compliance regulations. In this article, we’ll review different industries and their KYC requirements.

August 30, 2023

What are the EU’s Anti-Money Laundering Directives (AMLDs)? Complete History Overview

EU anti-money laundering directives (AMLDs) require obliged entities — financial institutions and companies that handle transactions in EU member states — to conduct due diligence checks, including identity verification and transaction monitoring, when forming new business relationships. Learn more.

August 25, 2023

What is a Risk-Based Approach to AML?

A Risk-Based Approach, known as RBA, facilitates proactive risk management rather than a post-analysis of a money laundering incident. It’s one of the most used terms in Anti-Money Laundering (AML) compliance. A risk-based approach to AML helps companies focus on preventing money laundering, bribery, corruption, or terrorist financing while taking dynamic precautions against financial crime. Read more.

August 22, 2023

New Account Fraud: Alarming Red Flags and Ways to Fight Back

New users are great…Unless they turn out to be fraudsters creating accounts only for their devious scams. Yet, companies always search for ways to attract new customers who help them scale and earn profit. But what about protection? We explain how not to get tangled up in the growing threat of new account fraud.

August 21, 2023

Case Study: Neobridge

Find out how Neobridge overcame the challenges linked to traditional banking structure’s compliance requirements and minimized costs by switching to a fully automated KYC/AML workflow.

August 10, 2023

How to Improve KYC Verification? Tips For a Frictionless User Experience

KYC verification shouldn’t take multiple steps and more than five minutes. Compliance regulations are getting stricter, at the same time, customers are getting more demanding. Now that not only banking, but sectors like crypto or online gambling are regulated, many consumers don’t want to disclose their identities, not to mention get stuck during a lengthy identity verification process. Read more.