It seems that regulatory expectations just keep getting higher. Along with them, financial institutions and other regulated entities need to get up to speed with various anti-money laundering (AML) and counter-terrorist financing (CTF) policies and controls. One of them is an AML audit, which serves a vital role in a company’s AML program.

Instead of looking at an AML audit as a mere regulatory burden, consider it as an opportunity to take a proactive stance. By going the extra mile and building a robust anti-money laundering strategy, you not only meet regulatory requirements but also gain control over your AML program. This strategy, when carried out regularly and adapted to the ever-changing regulatory landscape, can significantly enhance your institution’s financial security.

Below, we explore the practical measures that help you build a proper AML auditing system, share tips on evaluating your AML compliance program, and identify and rectify any gaps along the way.

What is an AML Audit?

An AML audit is an evaluation process of the company’s AML/CTF program. It helps assess how well an organization complies with anti-money laundering regulations, pinpointing any weaknesses and suggesting improvements for key compliance measures, such as internal controls, customer due diligence (CDD) processes, and transaction monitoring systems.

An AML audit’s main goal is to help you review and assess how adequate and effective the company’s AML policies, controls, and procedures are. In other words, your AML audit should assess whether your compliance program:

- Is functioning as planned.

- Meets all legal obligations.

- Effectively addresses money laundering risks and other crimes like fraud and terrorism financing.

By conducting an AML audit, you can determine whether all AML controls are implemented effectively and if they’re functioning in a successful and compliant manner.

The True Meaning of Anti-Money Laundering (AML)

When we talk about AML, we refer to the laws, strategies, procedures, and regulations designed to prevent illegally obtained money from being integrated into the financial system. AML compliance is a term that describes unified rules governments worldwide have established in order to help local and global institutions to monitor and address money laundering and other financial crimes.

For example, in the US, the Financial Action Task Force (FATF) was established as a leading entity to fight money laundering and financial crimes. In the meantime, the EU and many of its member states are also part of the FATF and follow key regulations such as the Anti-Money Laundering Directives (AMLDs).

Why are AML Audits Important?

The most important factor of AML audits is regulatory compliance, which makes the auditing process a mandatory requirement for regulated industries. However, looking into the bigger picture, AML audits are vital steps of AML programs, helping you prevent getting tangled in fraud and all sorts of financial crimes or even unknowingly filtering illicit money into the general financial system.

Regular AML audits mean that you’re updated with changes in the regulatory landscape and are able to achieve three key steps:

- Establish an effective independent audit function for your company.

- Develop and improve your strategy for a robust AML program.

- Review your internal compliance department’s management processes, such as risk assessment or regulatory reporting policies.

Regular audits also maintain your company’s reputation, showing a true dedication to AML compliance and boosting your standing with regulators and stakeholders. Additional benefits also include the classics, such as minimized risks of hefty non-compliance fines and improved trust among your clients.

What’s the Difference Between an AML Audit and a Financial Audit?

An AML audit specifically evaluates a firm’s AML program. In the meantime, a financial audit is different because it’s designed to selectively examine evidence that supports the figures and disclosures in a company’s financial statements. Additionally, the audit evaluates the accounting principles used and the significant estimates made by the organization.

An AML audit focuses on verifying whether a company maintains an appropriate anti-money laundering program and adheres to its stated policies and procedures. This type of audit specifically checks for compliance with AML regulations. Even if not mandated by law, companies are encouraged to assess the potential benefits of both audits.

How to Tell if You Have an Effective AML Audit Program?

Proper AML audits have the power to assure your company’s management that all operations adhere to international and national laws, thereby safeguarding you against potential threats.

An effective AML audit will always:

- Have detailed policies, procedures, and controls tailored to combat money laundering and terrorist financing.

- Comply with relevant laws and regulations in all jurisdictions where you operate.

- Conduct regular risk assessments to identify and mitigate risks associated with money laundering and terrorist financing.

- Verify the identity of clients and understand the nature of their business.

- Ensure that your staff follows AML policies, procedures, and controls.

- Analyze unusual activities and review how they are reported to appropriate investigative bodies.

- Conduct enhanced due diligence (EDD) and monitor transactions involving high-risk products, services, customers, and geographic locations.

- Maintain and retain data records as required by law.

- Have clear consequences for non-compliance with both internal policies and regulatory requirements.

Related: AML Automation — Streamlined Compliance 101 for Businesses

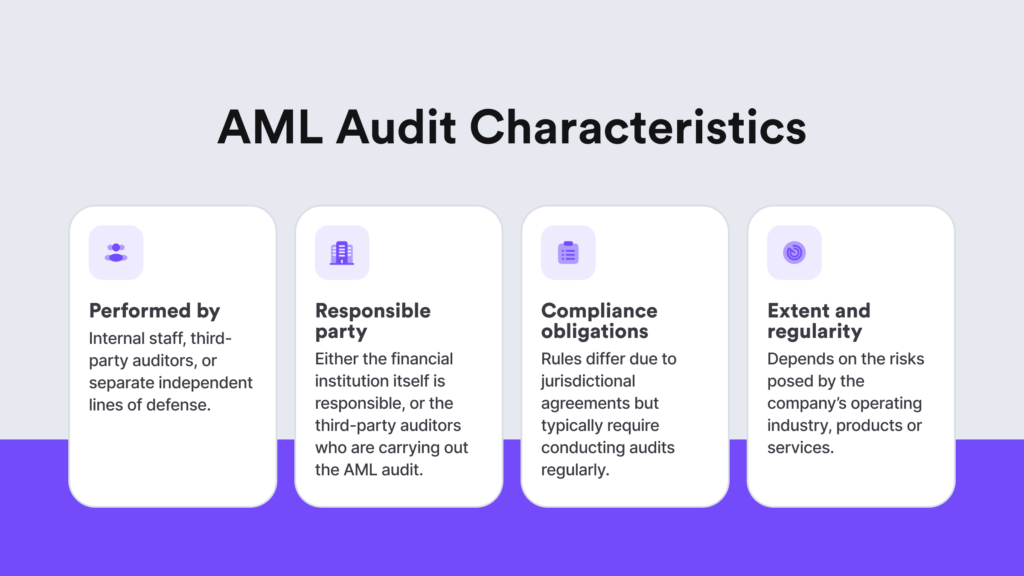

Who Should Conduct AML Audits?

An independent third-party auditor or an internal audit team is typically responsible for conducting an AML audit. The person, or the independent reviewer, should be a qualified specialist in terms of:

- Being knowledgeable about various AML red flags.

- Having a clear understanding of your business and what you do.

- Not having any links to any aspect of developing the program, including assessing ML/TF risks, creating controls, or implementing or maintaining the program.

The auditor’s job is to review your company’s compliance processes using various methods, such as conducting interviews with employees, examining policies and procedures, evaluating transaction monitoring, and other AML compliance systems. Auditors lacking sufficient expertise might not detect weaknesses in the AML program.

The results are then placed into a report that shows weaknesses in the AML compliance program. The company can use it to enhance its AML program and strengthen its overall AML risk management.

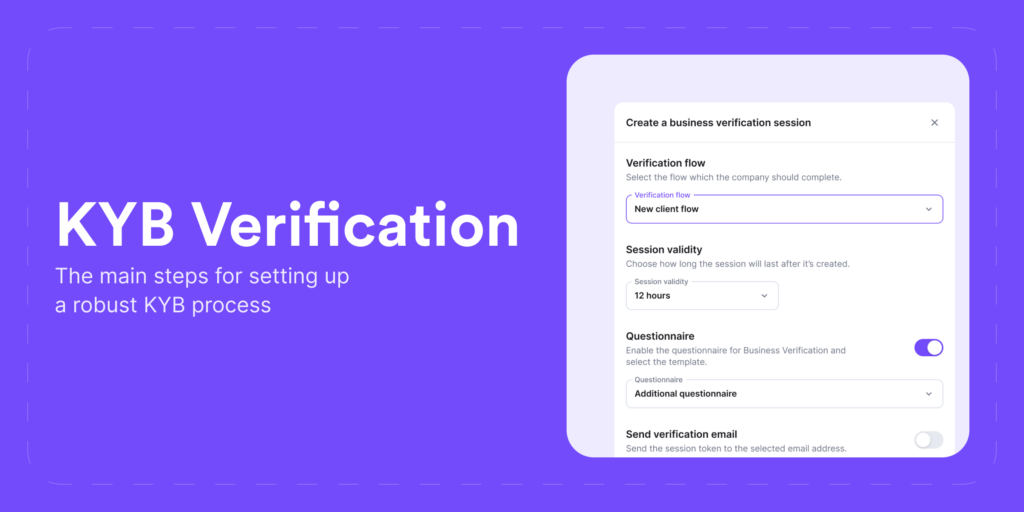

What Does an AML Audit Look Like in Practice?

An AML audit isn’t plain data collection. It requires time and effort to define clear objectives. For example, whether the particular audit is part of a routine check or is required for a specific AML investigation. For an audit to be effective, it should be an ongoing process that is regularly reviewed from multiple perspectives.

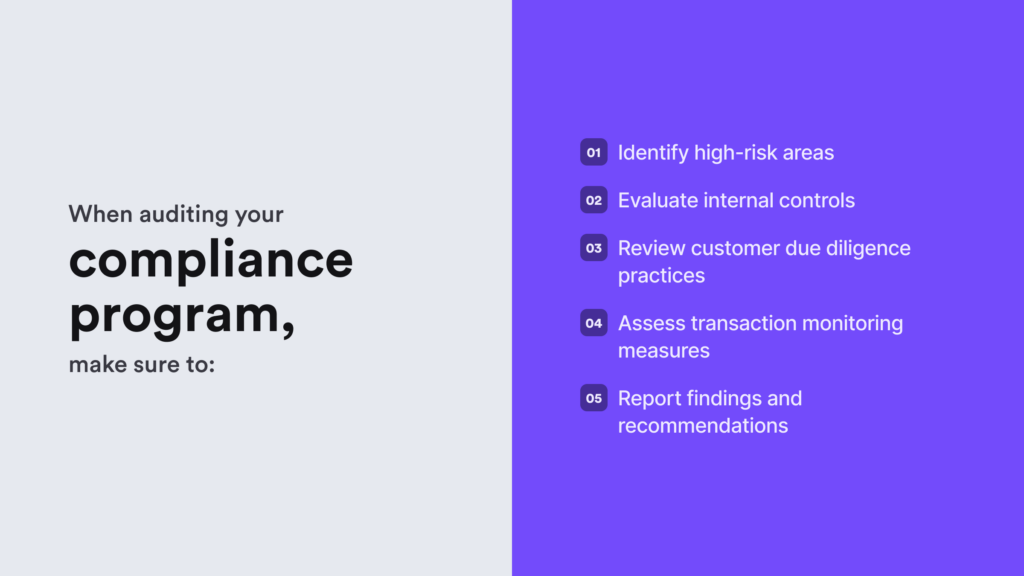

To ensure effective AML audits, you should integrate several critical steps, including:

- Assessment of internal AML policies and practices or the overall AML program.

- Evaluation of all procedures for identifying customers.

- Evaluation of legal compliance in terms of adjusting to current laws.

- System assessment in terms of your current RegTech tools.

- Assessment of standard, enhanced, and ongoing due diligence (CDD and EDD).

- Evaluation of AML screening systems that monitor transactions and screen for sanctions.

- Evaluation of the level of competence and training for employees.

- Potential risk analysis linked to your company’s industry and business model.

- Assessment of recordkeeping practices.

- Examination of our company’s AML breach response plan.

- Analysis of cases for managing conflicts of interest.

- Review of the methods used for reporting information to senior management.

Before hiring an independent auditor, your internal AML department should have a system already that has produced various reports that effectively support the documentation of the company’s AML strategy. These reports should use clear language, define any unfamiliar terms, and link findings directly to specific transactions, customers, or entities.

The Frequency of AML Audits

The frequency of AML audits for financial organizations varies based on product or service offerings. According to the Financial Crimes Enforcement Network (FinCEN), the regularity and intensity of these audits should meet the level of risks posed by the company’s products and services. In simpler terms, the frequency of audits should be proportionate to the level of risk — industries with higher risks should undergo audits more frequently.

It is a common practice for larger financial institutions to audit different AML areas each year. For example, broker-dealers are required to conduct an AML audit annually. The scope and depth of such AML audits for high-risk industries are significantly greater, ensuring a comprehensive evaluation over time. This approach allows for a more thorough examination of each area than wouldn’t be possible if all areas were audited at once.

What are the Risks of Non-Compliant AML Programs?

Having an inadequate AML program with poor auditing practices means that a company is risking its finances and, obviously, its brand image. Generally speaking, AML compliance failures can lead to a lack of customer due diligence, non-compliance with sanctions, violations of the Bank Secrecy Act (BSA), or other security inadequacies.

The most common challenges you can face for non-compliance include:

- Criminal activity. Fraud, money laundering, terrorist financing, and the list goes on. Poor AML measures may lead you to inadvertently facilitate criminal transactions, resulting in serious legal, financial, and ethical consequences. That’s exactly why regular audits and compliance reviews ensure regulatory adherence, helping to protect against such risks.

- Damaged reputation. Adverse media and negative publicity are the number one factor that comes into play with a damaged reputation, and nobody wants this. These effects can persistently tarnish your image and customer loyalty. Recovering from such reputational damage is often a lengthy and difficult process.

- Financial penalties. Companies with weak AML programs risk major financial consequences. Many of these penalties come from lengthy investigations. For instance, Deutsche Bank was fined $186 million by the US Federal Reserve for ongoing deficiencies in its sanctions compliance and transaction monitoring controls. They received this fine despite having already been fined $99 million for the same issues a few years earlier.

Many penalties related to insufficient due diligence came from poor identity verification practices, not adequately assessing the nature of business relationships, conducting Know Your Business (KYB) checks, neglecting the ongoing monitoring of customer transactions, and — the cherry on top — not conducting proper AML audits, which aim to uncover such weaknesses in the company’s AML program.

Five Tips You Should Consider When Building an AML Audit Strategy

Conducting an AML audit requires lots of steps and preparation. Here are some vital steps that will help you get ready for this task:

- Understand the basics. The first step is to learn about the compliance requirements and AML rules that affect your company in particular, including the local, state, and federal levels. Ensure that your board has approved your AML procedures and risk assessments, which are in line with the latest regulations.

- Organize your documents. Use a clear and simple naming system for all client files. Organize all the required AML-related documents to make it easier for the auditor to look through them.

- Prepare your risk assessment reports. That means listing customers and their risk rating for both high-risk and low-risk customers.

- Check your ID verification processes. Ideally, there shouldn’t be a backlog in the system, especially for atypical alerts or unresolved cases.

- Get ready for questions and feedback. Due to industry specifics and certain jargon-like phrases, auditors can have questions. This also applies to AML software, which you’re responsible for demonstrating how it works. An AML audit aims to help you improve, which means the auditors will give you valuable recommendations to help strengthen your AML controls.

But if it all sounds easy on paper but a bit different in practice, we can help you improve your AML screening and monitoring practices, along with identity verification for both individual and corporate clients. These include custom automation features such as watchlist, PEPs and sanctions screening, or automated risk-scoring — all under a single RegTech platform for a better AML audit experience.

Get started right away.