Assess Your Customer’s Risk Score

In-depth customer evaluation from a different perspective using multiple data points to ensure legitimate transactions

Transactions Fraud Detection & Monitoring

Financial transactions between financial institutions, merchants, and customers seem quick and easy these days. However, if we look closer, we realize that, in reality, a financial transaction is a complex process involving various actions by different parties and the exchange of information. This is where fraud can occur, so controlling and understanding this process can have a positive impact on unexpected financial losses and security.

Risk assessment breakdown

All are checked for recent criminal activity or traces of fraudulent transactions:

- Full name

- Address

- Phone number

- IP Address

- Device fingerprint

Vendors’ timestamps, types, and security features are also checked:

Bank and credit card security features are evaluated:

- Payment card risk evaluation

- Bank risk evaluation evaluation

Black market shops are monitored:

- A history check is carried out for the recently sold stolen card details

A customer risk score based Smart Verification

Trigger additional verification based on your own custom rules

- If a risk score is Low proceed with an order

- If a risk score is Medium verify the customer’s identity with quick identity verification

- If a risk score is High verify the customer’s utility bill and identity using advanced liveness detection

- If a risk score is Very High cancel the order

Multiple Fraud Accident Reports Analyzed

We scan databases, including the black market, to provide you with your potential customer’s risk score. Measuring these different customer details can detect fraud patterns and help you stop unwanted transactions from happening.

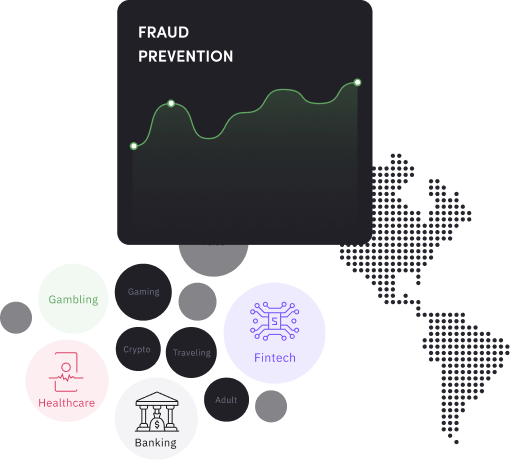

Effective Within Industries

After thorough research, we have concluded that our fraud prevention system delivers impressive results in the following industries:

- Fintech

- Gambling and Gaming

- Banking

- Blockchain and Crypto

- E-Commerce & Real Estate

- Adult

- Traveling

- Sharing economy

- Health care

- Telecommunication

- Transportation

iDenfy HUB

The innovative iDenfy HUB enhances flexibility by encouraging customers to connect additional fraud prevention services to our core ID verification process.

Our range of additional services is constantly growing. It currently includes:

Reinforce your business with "iDenfy shield" - fraud prevention package

Book a demo and try our product on the go!