Why choose iDenfy vs. Sumsub?

Convert more users, scale faster, and tackle security challenges with the powerful, all-in-one identity verification, fraud prevention and compliance platform.

| AI Identity Verification | ||

| OCR Data Extraction | Unlimited fields in all plans | Limited |

| Active 3D Liveness Detection | ||

| Passive Liveness Detection | ||

| Case Management System | ||

| Hybrid Verification Method | ||

| “Do it Yourself” Manual Review | ||

| “24/7 Done for You” Manual Review | ||

| Negatives Elimination with Thorough Human Review | ||

| Error Correction for Incorrect Country Selection | ||

| Error Correction for Incorrect Document Type Selection | ||

| Increased Data Extraction Accuracy (When OCR Leaves Typos due to User Mistakes) | ||

| Additional Fraud Pattern Detection (With Manual ID Verification) | ||

| Address Verification | ||

| Additional Face Duplicates Manual Review | ||

| Fully White-Labeled Mobile SDKs | ||

| Data Retention | 5 or 8 years | 5 years Maximum |

| Pricing | Choose How to be Charged | Charged for Each Verification |

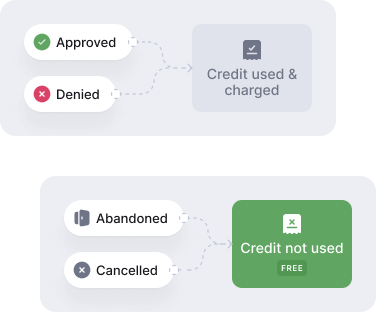

| Pay per onboarded customer (all denied, unfinished verifications are free of charge) | ||

| Paying per every verification | (Starting at 1.75 USD) | (Starting at 1.35 USD) |

| Address Verification check | (Starting at 0.5 USD) | (Starting at 1.35 USD) |

| Integration | All Major Platforms | Limited Integration Options |

| API Integration | ||

| iFrame and Web Redirect | ||

| Dedicated Account Manager and Support | (Trained Experts for All Plans) | (Chat Widget for Starting Plans) |

| Mobile SDKs (Native Android, Native IOS) | ||

| Mobile SDKs Wrappers (React Native, Flutter) | ||

| E-Commerce Suite (WordPress, WooCommerce, Magento, Shopify) | ||

| Zapier | ||

| AML Services | ||

| One-Off PEP & Sanction Check | (From $0.5 per Check) | (From $0.5 per Check) |

| Daily PEP & Sanctions Monitoring (With 365 Checks per Subject) | (From $0.0055 per Check) | (From $0.07 per Check) |

| In-House Adverse Media Checks (With Fuzzy Matching) | ||

| AML Company Check | ||

| Business Verification | ||

| Business Verification with Custom Rules Features | ||

| G2 Customer Reviews | 1st Easiest to Use | 8th Easiest to Use |

| Overall Satisfaction Score | 98 | 75 |

| Ease to Use | 0.99 | 0.9 |

| Meets Requirements | 0.99 | 0.89 |

| Ease of Doing Business With | 0.99 | 0.91 |

| Quality of Support | 0.99 | 0.88 |

| Ease Of Setup | 0.96 | 0.82 |

Automated compliance for complete security

While Veriff offers similar automated ID verification tools like iDenfy, including liveness and facial recognition checks, these steps can introduce friction in the user journey and cause issues for internal teams.

Using only an AI-based automated verification tool means that, as a result, you might encounter situations where you need to review denials to understand the reasons behind them manually.

Reduced onboarding times with human supervision

At iDenfy, we take a different approach by providing a comprehensive service rather than just a standalone tool like Veriff.

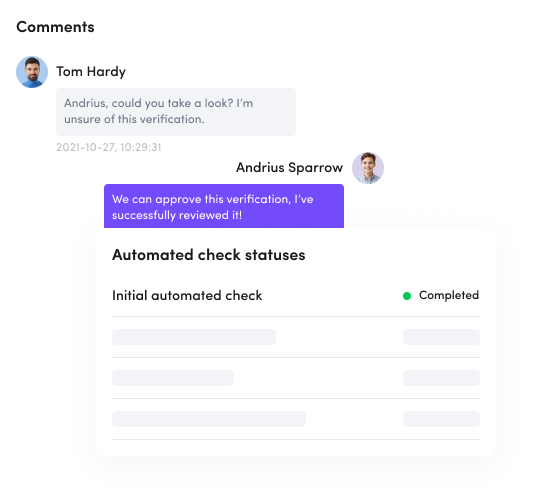

We have a dedicated 24/7 manual review team for each verification. This ensures that you receive accurate data, better fraud prevention, and a higher rate of approved customers. With our experts overseeing the verifications, you won’t need to worry about doing it yourself.

Optimized to save costs for your business

Our unique pricing model allows you to pay only for approved verifications, resulting in an average cost reduction of 70% for IDV expenses.

In the past five years, we’ve partnered with over 500 companies, ranging from small businesses to large enterprises. iDenfy has also been named the best identity verification provider in the market by G2 twice since joining the platform.

Guaranteed security with insurance

Master the complex security landscape without stress. All iDenfy’s products are protected with the number one cyber insurance package and the Technology Errors & Omissions insurance.