Tailored Identity Verification for the Trading Industry

Leverage our KYC/KYB and AML platform to streamline onboarding and scale your trading business. Verify identities from 3,000+ documents across 200+ countries and territories with ease.

Trusted by over 1,000+ businesses

Automated trading experience

Simplify processes and boost sign-up rates by quickly accepting genuine investors ready to trade commodities, stocks, or digital assets with speed and accuracy.

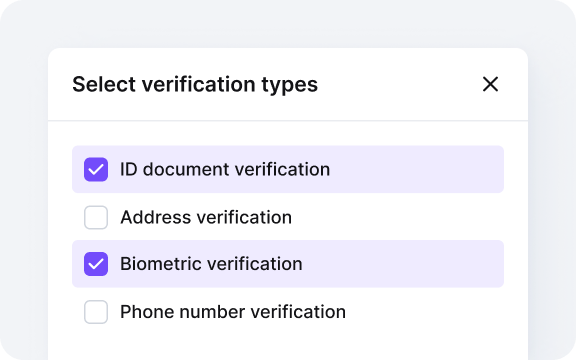

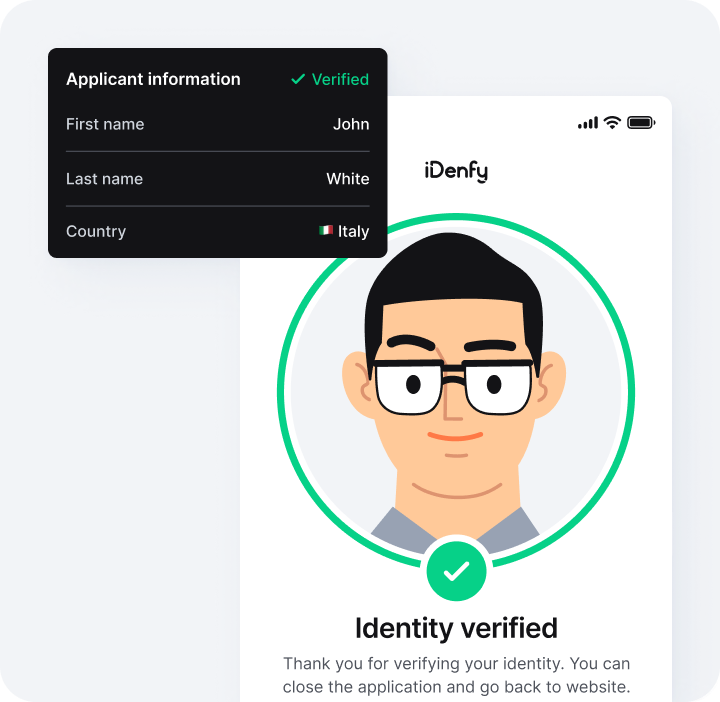

Multiple verification types

Maintain an optimized workflow by combining document and biometric selfie verification. Choose the checks you need to gather comprehensive insights on your customers.

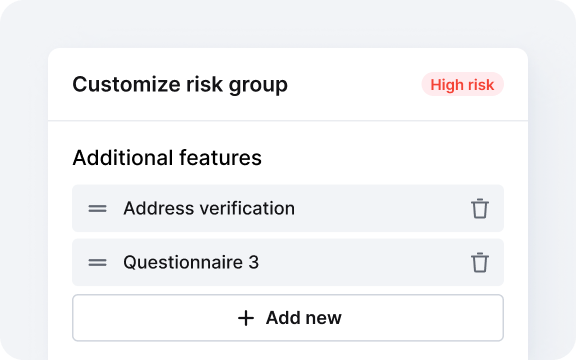

Balance risks and conversions

Boost pass rates with automatic ID data extraction. Add steps like address verification for high-risk entities while keeping security standards high.

Choose KYC/AML elements for compliant onboarding

Tailor your onboarding with our platform by selecting from features like address verification, PEPs and sanctions screening, and automated risk assessment to meet global standards.

Prioritize speed and security

Verify customers in under 60 seconds with over 85% success on the first attempt. Minimize errors and costs by accepting IDs in users’ native languages from around the world.

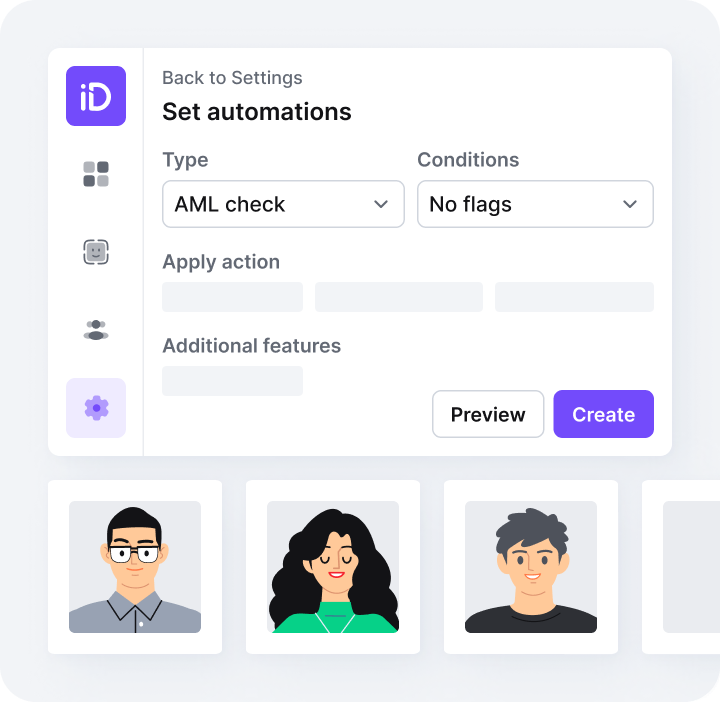

Automate decisions to boost efficiency

Simplify compliance with a single automation solution. Reduce clutter and backlogs while managing thousands of customers efficiently, improving both your compliance and operational efficiency.

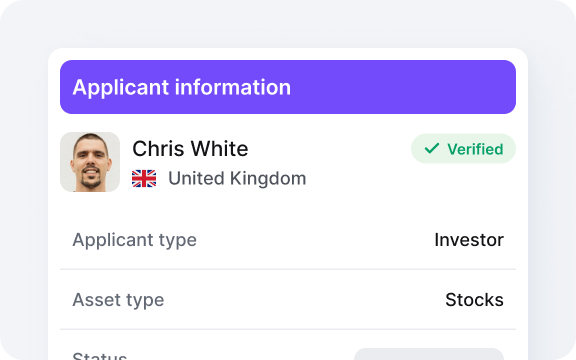

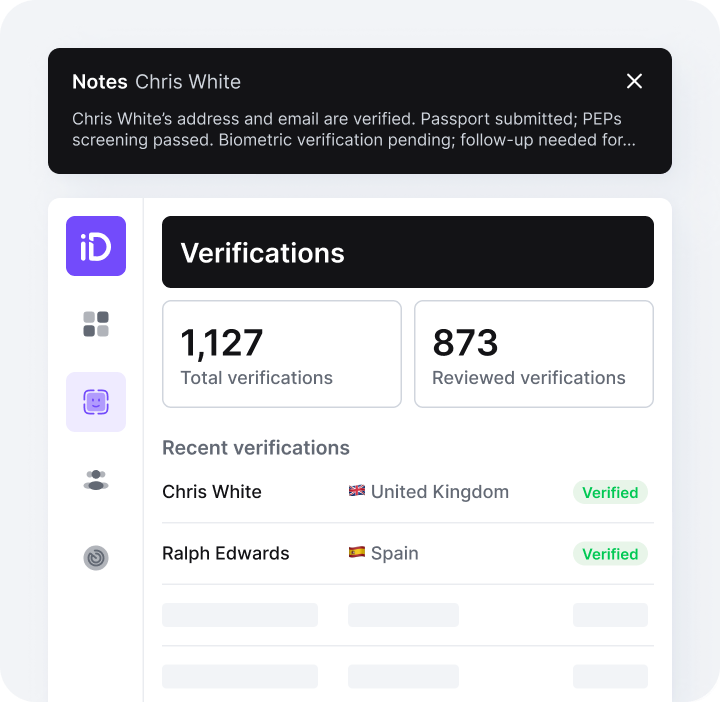

Keep track of verification results

Monitor status changes, add notes, and maintain an audit trail. Manage both KYC and KYB onboarding from a single dashboard. Get real-time updates and use custom questionnaires to gather additional client information.

Ensuring a safe trading environment for a growing user base

Document Verification

Quickly accept more than 3000 ID documents from over 200 countries and territories to scale globally with ease. Add manual KYC checks that we conduct in-house for high-risk customers.

Biometric Verification

Ask users to snap a quick selfie and match their biometrics with the uploaded document photo to prevent any chances of fraud.

Face Authentication

Reverify returning customers with a simple selfie check instead of lengthening the process and adding unnecessary friction.

AML Screening & Monitoring

Prevent fraud and non-compliance by streamlining PEPs and sanctions checks, global watchlist screening and adverse media. Detect red flags, download reports, and reduce manual effort.

Business Verification

Onboard and screen your partners, third-party suppliers, and other companies, including their beneficial owners, to prevent missing any red flags.

Customer Risk Assessment

Take KYB checks to the next level and use our template to build a proper risk customer assessment based on certain risk factors, such as location or operating industry.

Frequently asked questions

Why is KYC important in forex trading?

KYC, or Know Your Customer, is a legal requirement for forex platforms that mandates the verification of customer identities. The required information varies by country but typically includes data such as first and last names, addresses, and ages, with additional details like the purpose of the trading account and source of funds. Due to the decentralized and anonymous nature of the forex market, KYC is important for maintaining security and compliance.

What AML regulations broker-dealers should follow?

How can iDenfy help you solve compliance challenges?

KYC practices are standards now adopted by industries outside the financial sector. At MGID, we’re implementing ID verification to ensure an effective tracking system for suspicious activities and transactions.

Oleksandr Nazarenko

Head of the FPD at MGID

Save costs by onboarding more verified users

Join hundreds of businesses that successfully integrated iDenfy in their processes and saved money on failed verifications.