Andrius Juodis

Spotting Fake Businesses in Singapore: KYB Tips You Need

In a business environment as efficient and well-regulated as Singapore, legitimacy can be convincingly hidden. A company can be incorporated in days, issued a Unique Entity Number (UEN), appoint nominee directors, and secure a registered address – all without demonstrating meaningful operational substance.

February 11, 2026

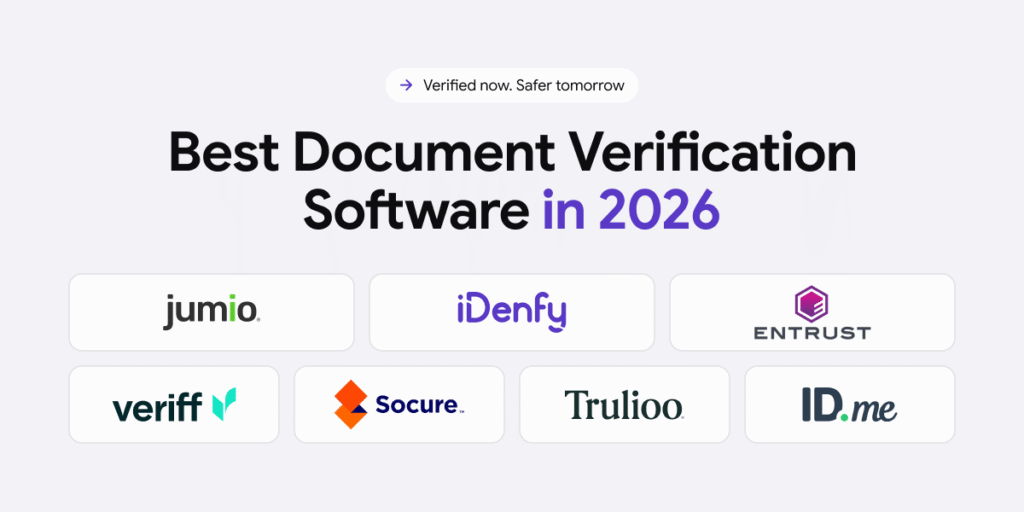

Best Document Verification Software in 2026

Document verification is about speed, security, and compliance. The top companies each bring unique strengths, such as scaling globally and more, setting new standards for verification.

January 20, 2026

Mastering Complex B2B Onboarding Flows

B2B onboarding has become more complex as businesses face higher risk and pressure to move fast, but it is where trust really begins, as onboarding is clear and well-designed, helping teams move forward with confidence instead of slowing growth.

Germany’s Unique KYB Issue and Its Possible Solution

Germany’s KYB process is formed by complex legal forms and registries. Generic verification frameworks often struggle in this environment, making it essential to design KYB processes that works well in Germany’s environment.

December 17, 2025

Fraud Risks in Onboarding Systems

Onboarding may seem like a routine administrative step, but small gaps in identity checks and process design can turn it into one of the most vulnerable entry points for fraud.

November 10, 2025

How Banks Use Data to Make Smarter Onboarding Decisions

Banks now use data-driven onboarding to verify identities and predict risk, turning a once manual and difficult process into a foundation for trust and smart decision-making.

November 10, 2025

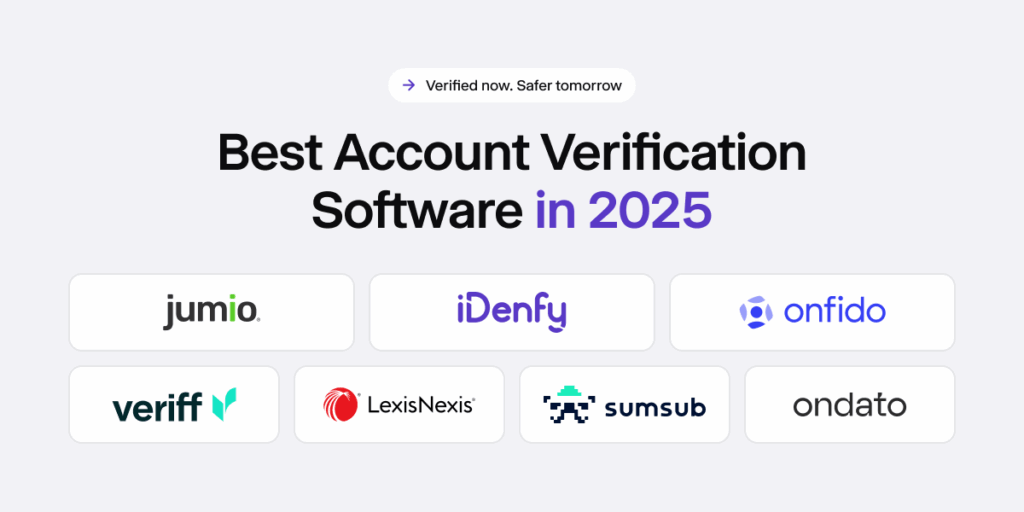

Best Account Verification Software in 2026

Account verification is about speed, security, and compliance. The top companies each bring unique strengths, such as scaling globally and more, setting new standards for verification.

KYB for Stablecoins

Stablecoins were built to bring stability to crypto, but true stability requires trust. As these digital currencies move into mainstream of finance, Know Your Business (KYB) is becoming the foundation of trust – verifying who stands behind issuers and partners.

October 16, 2025

Best Background Verification Companies in 2026

Background verification is about speed, security, and compliance. The top companies each bring unique strengths, such as scaling globally, criminal background checking, and more, setting new standards for verification.

August 29, 2025

Validating Company’s Legitimacy: Key Indicators For Effective KYB

KYB (Know Your Business) is essential for verifying legitimacy, ensuring transparency, compliance, and financial stability for your business. Additional benefits include building trust, protecting reputation, and strengthening relationships.

August 27, 2025

The Difference Between KYB and KYC in Business Verification

KYC (Know Your Customer) verifies individuals, KYB (Know Your Business) confirms the legitimacy of companies and their owners, forming a security against fraud and money laundering, helping businesses stay compliant.

August 22, 2025

Best Biometric Authentication Software Providers in 2026

Biometric authentication is about speed, security, and compliance. The top providers each bring unique strengths, such as scaling globally, fighting fraud, or serving niche markets, setting new standards for verification.

KYB in Finance and Banking

Know Your Business (KYB) is mandatory for banks and in various finance sectors, mainly to face fraudsters, regulations, and complex corporate structures. KYB looks into business legitimacy, transparency, and financial health to protect institutions from fraud.