Gabija Stankevičiūtė

November 13, 2023

Case Study: HollaEx

See how HollaEx simplified its ID verification process by switching to a fully automated compliance workflow, creating a universal KYC system for both their platform and their partner exchange businesses, eliminating the need for manual management of IDs.

November 9, 2023

AML/CTF Compliance in Estonia [Guide]

In the past decade, Estonia has become an attractive choice for fintech startups and financial institutions aiming to broaden their operations in Europe. However, this “rising star” title burdens companies to stay compliant with the ever-evolving AML/CTF compliance requirements, which we explore in this in-depth article.

October 31, 2023

How Can RegTech Improve AML Compliance?

RegTech, short for Regulatory Technology, refers to the use of advanced software and data analytics. That means RegTech solutions today can help businesses and financial institutions comply with regulations more efficiently and effectively. But how does that look in practice? Does RegTech actually improve AML compliance? Let’s find out.

October 31, 2023

Smurfing in Money Laundering Explained

Smurfing isn’t something related to the famous blue fictional characters. In money laundering, smurfing refers to a fraudulent practice of breaking a larger amount of money into numerous smaller portions. In this blog post, we answer the questions of how the funds get laundered later, how smurfing is different from structuring, and more.

October 26, 2023

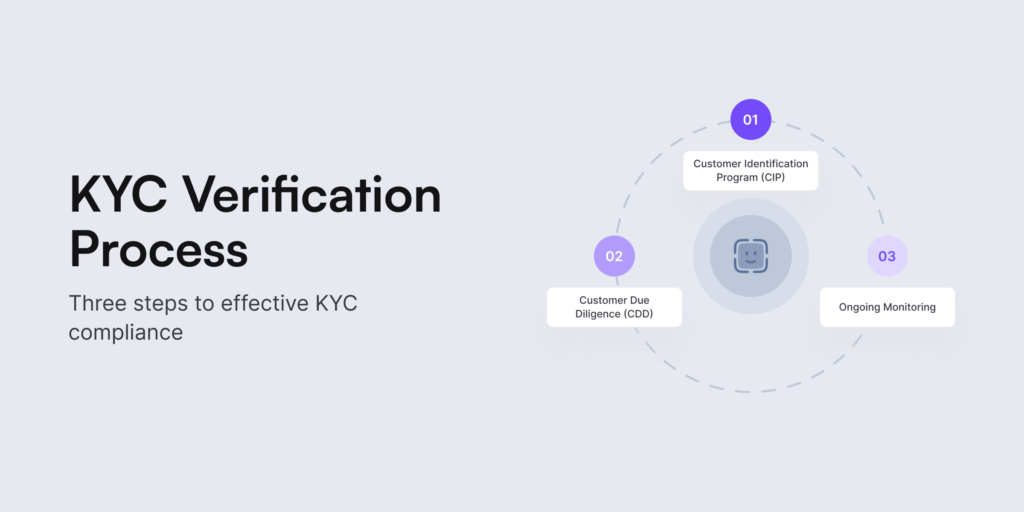

What are the 3 Steps to KYC?

Knowing your customers properly isn’t possible without KYC or Know Your Customer. Chances are that as soon as you hear this phrase, identity verification comes into mind. Today, this process is also known for strict regulatory compliance across various industries and jurisdictions. What’s the best way to verify a user’s identity? How do we keep the balance between compliance requirements and user experience? What are the 3 steps to KYC? We answer all the burning questions and provide the latest insights below.

October 24, 2023

What is the Difference Between KYC and CDD?

KYC is designed to verify a current or potential customer’s identity, whereas CDD is a set of measures that lead to the KYC process. CDD is also a key step in KYC compliance. You can say that past KYC practices have evolved into present CDD solutions designed to assess customer risk. Both KYC and CDD can’t work without each other. But what are the biggest differences, and how can businesses stay compliant? Continue to read and find out.

October 19, 2023

Money Services Business (MSB) — AML Compliance Guide

A money services business (MSB) refers to an entity engaged in activities such as transmitting, converting, or exchanging money. This term is commonly used when talking about Anti-Money Laundering (AML) compliance, especially when trying to identify which MSBs are the obliged entities. This term includes a much broader spectrum of all kinds of financial institutions. Learn more.

October 13, 2023

Examples of Money Laundering and Prevention Methods

Fraudsters use money laundering tactics to run their schemes without leaving a paper trail. Money laundering remains a major and costly form of fraud for both businesses and the overall global economy. That’s why businesses must actually know their customers and their backgrounds before allowing them to start their transactions. This is where AML compliance and knowing the main examples of money laundering become extremely important. Read more.

October 10, 2023

What are the Key AML Laws in the US? [Business Guide]

Transaction monitoring, verifying business relationships, working with regulators, or training your staff is just the beginning of ensuring compliance with AML laws in the US. Since the BSA was implemented in 1970, the basics for the current AML framework in the country have elevated, posing more restrictions and processes for US companies to stay compliant. Follow our guidelines to learn more.

October 6, 2023

DEXs and KYC: Addressing Compliance Challenges

Decentralized exchanges (DEXs) are cryptocurrency trading platforms that enable direct transactions between users, aiming to lower transaction fees. They are considered to be fairly anonymous since users need to connect to a crypto wallet to get started. However, DEXs also encounter regulatory hurdles, such as addressing Know Your Customer (KYC) and Anti-Money Laundering (AML) concerns. Read more.

September 27, 2023

What is an NFC Tag? A 2024 Guide

An NFC tag can be programmed with a wide range of information and easily embedded into different products. That’s why there’s no surprise that, with over 80% of smartphones now equipped with NFC, companies are exploring new ways to incorporate NFC technology into their customer experiences.

September 27, 2023

What is Selfie Identity Verification?

Selfie identity verification is the latest ‘it’ trend when it comes to different industries and their top KYC picks. That’s because this verification measure is simple and effective both for the user and for the business, aiming to safeguard its assets. And it’s exactly as it sounds — it requires users to take a selfie, typically during the customer onboarding process. Learn more about its benefits, susceptibility to fraudsters, and more.

September 25, 2023

Top 5 Use Cases of Biometrics in Banking

There are many examples of how biometrics can be used in banking. For example, biometrics can help financial institutions prevent fraud, support regulatory compliance, and provide an alternative way to authentication. That’s why, due to the technology’s convenience, it’s now storming the financial industry, replacing passwords and paving the way to becoming one of the top technological solutions for both KYC and fraud prevention. Read more.