Know Your Customer (KYC) and customer due diligence (CDD) are both vital processes in Anti-Money Laundering (AML) compliance. These are the measures that help detect bad actors and are mandatory in many industries, including financial services or crypto.

In simple terms, KYC involves conducting CDD, which means verifying a customer’s identity. KYC assists CDD by providing verified customer data to the company to use in CDD transactions. KYC also ensures that essential information is collected and assessed prior to the customer’s account opening process, helping to assess their risk level.

It’s challenging to separate KYC from CDD, as CDD is an essential component of KYC. So, without further ado, let’s get into the main differences between these two processes in a more detailed way.

What are the KYC and CDD Processes?

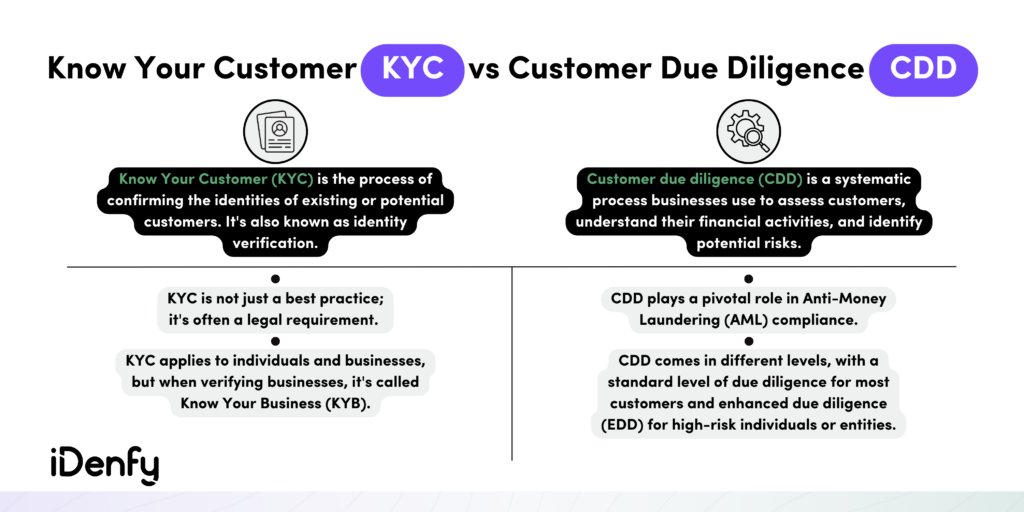

Know Your Customer (KYC) is a process that is designed to confirm the identities of existing or potential customers. KYC also helps determine a customer’s risk profile by collecting their information before entering into a business relationship. Typically, businesses accomplish this through a digital onboarding process, which involves checking the legitimacy of personal data and identity documents.

KYC is also known simply as “identity verification.” This process is applicable to both individual users and businesses. For companies, KYC is known as Know Your Business (KYB) or corporate KYC. These standards help detect, report and ultimately prevent all sorts of fraud and financial crimes.

Customer due diligence (CDD), on the other hand, is an ongoing process designed to evaluate customer risk, serving as a pivotal aspect of KYC. Companies conduct CDD checks periodically during the whole cycle of the customer relationship, as it’s mandatory to maintain and update transaction records.

That means CDD is a vital component of the KYC process that lasts during customer onboarding and persists throughout the entire lifecycle. Initially, an account may appear to be in compliance with legal requirements, but it can later reveal suspicious activities. In other words, customer risk profiles change, which makes CDD an ongoing process.

What is the Key Difference Between KYC and CDD?

The main difference between KYC and CDD processes is the timing in terms of customer interaction. KYC checks are made at the early stage of establishing business relationships, when companies screen potential customers, while CDD involves ongoing monitoring of suspicious activities aimed at money laundering. Both KYC and CDD processes are a crucial part of an AML program.

In other words, KYC is all about making sure the company knows who their customer is by verifying their identity. The CDD process incorporates a continuous assurance framework. This ensures the consistency of the KYC measures from the start to the end of the customer relationship and stakeholder activity while also helping maintain an effective AML compliance program.

Is CDD the Same as AML?

CDD is commonly considered a central element of AML, but it isn’t the same process. AML procedures help prevent money laundering and terrorism financing within an organization. When integrated into the company’s AML framework, CDD helps the organization understand its clients and the risks better.

To sum up, AML compliance consists of the overall actions taken to identify and prevent money laundering. In the same sense, CDD and KYC are elements in the AML framework that assist institutions in risk management by conducting customer assessments. Both CDD and KYC are indispensable components of AML compliance.

What are the Main Components of KYC?

KYC compliance has stringent requirements. While this process depends on the operating industry and varies among jurisdictions, companies should follow a standardized three-step approach. It’s also referred to as the “three pillars of KYC,” which include the following components:

1. Customer Identification Program (CIP)

A customer identification program (CIP) is a set of measures that businesses must create and adhere to for the purpose of confirming the identities of their customers or users. However, CIP is just one component of a company’s larger KYC strategy.

The initial step in the KYC process is confirming the customer’s identity. This means that businesses must collect four key pieces of identifying information from potential clients: their full name, date of birth, address, and a valid identification number, such as a TIN or SSN.

KYC applies to all customers, whether they are individuals or businesses. For corporate customers, verification documents consist of a business license, financial statements, or partnership agreements. Companies also need to verify the company’s ownership structure and identify Ultimate Beneficial Owners (UBOs).

That said, every CIP must comply with the six requirements of the CIP Final Rule, as mandated by the Bank Secrecy Act (BSA). These rules include:

- Establishing a documented CIP program.

- Collecting four pieces of identifying information.

- Creating identity verification processes.

- Maintaining recordkeeping requirements.

- Comparing customers against official government lists.

- Notifying customers about the request to verify their identity.

Related: What is the Difference Between CIP and KYC

2. Customer Due Diligence (CDD)

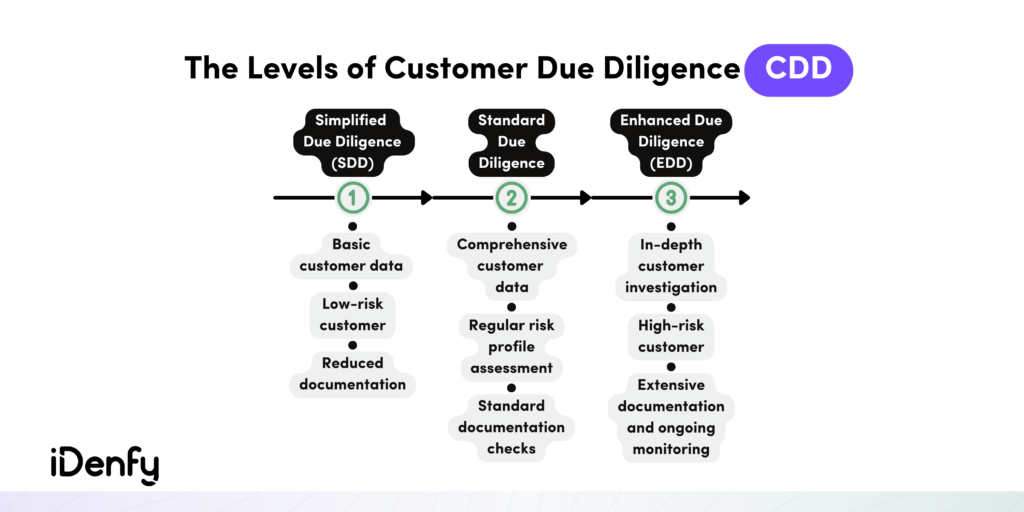

Customer due diligence (CDD) is designed to determine the customer’s risk level and the degree of trustworthiness. CDD consists of three levels.

Simplified due diligence (SDD) is applied to all customers in order to collect additional information, confirm their location, and analyze transactional patterns. In the case of corporate customers, due diligence is required for all UBOs.

Standard due diligence is used for customers who don’t meet the criteria for simplified due diligence. This process involves verifying essential customer information aimed at reducing risk.

Enhanced due diligence (EDD) is reserved for high-risk individuals. For example, high-risk customers who are politically exposed persons (PEPs). These checks mean that companies must request extra verification efforts before authorizing transactions.

In general, low-risk scenarios necessitate simplified due diligence. In contrast, situations with higher risk may necessitate an enhanced due diligence process.

As an obliged entity, you need to apply CDD when:

- Establishing a new business relationship. Companies should perform CDD checks to assess the customer’s risk profile and verify their identity when initiating a new business relationship.

- During certain transactions. Some transactions carry higher risks. For instance, if a transaction involves a substantial amount of money or the customer is associated with a high-risk region known for increased money laundering activities.

- In case of suspicious activity. For example, if a customer displays red flags or exhibits behaviors indicative of potential money laundering or terrorism financing.

- If the customer’s data doesn’t match. When the information provided by the customer doesn’t meet regulatory requirements or raises suspicion, additional CDD checks help ensure the customer’s legitimacy.

Related: What is the Difference Between CDD and EDD?

3. Ongoing Monitoring

Continuous monitoring of onboarded customers is vital for safeguarding the company and its assets. Ongoing monitoring is also critical for establishing the customer’s identity and initial risk level. That’s because customer activities can evolve over time, which means that performing a KYC check at the initial customer onboarding stage isn’t enough. An ongoing monitoring system helps companies keep track of any changes or developments.

That said, screening and monitoring transactions also assist in detecting such suspicious activity and prevent potential financial crimes. Ongoing monitoring usually consists of two key aspects:

- Maintaining up-to-date knowledge of the company’s business relationships.

- Continuously screening transactions to ensure they align with the expected behavior of the business relationship.

Ongoing monitoring involves examining the company’s risk factors, including:

- The types, frequency, and amounts of customer transactions.

- Alterations in customer or transaction locations.

- Whether the customer appears on PEPs and sanctions lists.

- Instances of adverse media mentions.

In addition to ongoing monitoring, an effective KYC program should incorporate well-defined anti-fraud controls, including clear limits for different account types to detect any unusual activities better. The extent and regularity of the ongoing monitoring process depend on the risk associated with the customer and the company’s overall strategy.

What Else Makes KYC and CDD Important?

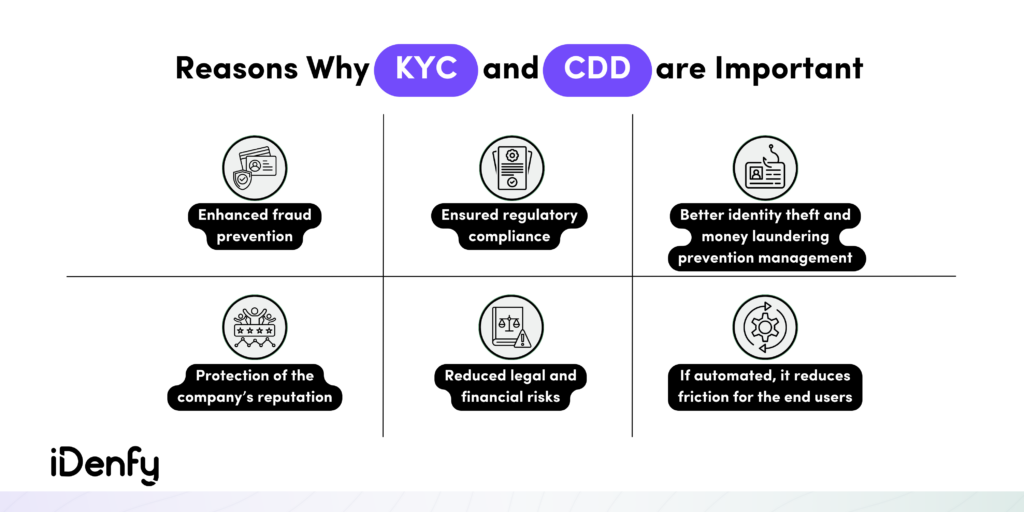

KYC and CDD procedures are crucial steps to confirm the legitimacy of the company’s customers, evaluate risks, and continually monitor them. Both KYC and CDD measures are designed to detect money laundering, terrorism financing, and various illegal corruption schemes.

KYC and CDD processes are important for several reasons, such as:

- Conducting a proper risk assessment. KYC and CDD help companies in assessing risk by providing insights into a customer’s financial history and asset ownership.

- Building a robust fraud prevention strategy. Both processes help prevent fraud, particularly when individuals attempt to conceal their true identities or conduct money laundering crimes.

- Ensuring AML compliance. KYC and CDD are crucial tools to ensure AML compliance for companies by verifying the identity of customers, assessing their risk profiles, and continuously monitoring transactions. These measures are essential to create a robust AML program and prevent money laundering and related financial crimes.

Consequently, poorly constructed KYC and CDD procedures can lead to various issues. First, this increases the risk of financial crimes such as money laundering and fraud, potentially resulting in legal and financial consequences. For example, if a business fails to verify a customer’s identity properly, they may unknowingly facilitate illicit transactions. Second, this scenario can harm their reputation and lead to major losses.

How to Improve Your KYC and CDD Processes?

An exceptional customer experience is as important as ensuring complete compliance with KYC and CDD processes. That means companies are striving to find the right solution that would cater to this requirement. And, spoiler alert, without automation, it’s practically impossible.

Automated KYC/CDD solutions can help your company find the needed balance by streamlining the verification process and reducing human errors. iDenfy’s KYC software can be customized to minimize friction, which means additional checks for higher-risk customers and standard KYC flow for low-risk users.

Additionally, our automated AML solution can quickly cross-reference customer information with global databases, including PEPs, sanctions, adverse media, and watchlists, flagging discrepancies or suspicious activity in real-time.

Our identity verification can help you reduce operational costs by up to 70% (pay only for approved verifications), making your compliance strategy more cost-effective and scalable.

Read our customer success stories, or get started right away.