Know Your Business (KYB) is a process that verifies the legal status of a business and its compliance with Anti-Money Laundering (AML) regulations. Regulated entities must perform KYB verification to protect their interests. This background check prevents forming ties with shell companies or any illegally operating organizations.

In brief:

- To ensure that they are working with legitimate businesses that operate within the law, financial institutions such as banks and fintechs must perform both Know Your Customer (KYC) and Know Your Business (KYB) checks.

- While KYB and KYC involve verification processes, KYB requires an additional layer of complexity since it focuses on confirming the legitimacy of both the business and ultimate beneficial owners (UBOs).

So, knowing the true nature of a company is essential in preventing financial crimes such as terrorist financing and money laundering.

KYB, in particular, takes this step further by additionally requiring companies to establish UBOs. This layer of security enables businesses to determine who directly benefits from the company’s profits, making it harder for criminals to conceal their illegal funds.

Know Your Business (KYB) Compliance Requirements

Although KYC verification has been a requirement for individuals for many years, businesses were not previously subject to similar checks. However, this changed with the introduction of KYB requirements by the Financial Crimes Enforcement Network (FinCEN) in the Final Rule of Customer Due Diligence (CDD).

By implementing KYB requirements, companies can avoid conducting business with entities that are involved in:

- Money laundering

- Terrorist financing

- Sanctions lists

- Tax fraud

- Other related offenses

Even though Know Your Business regulations vary by jurisdiction, general KYB rules oblige businesses to follow a risk-based AML compliance approach and perform due diligence.

The History of Know Your Business Regulation

AML compliance in the US goes back to the Bank Secrecy Act (BSA) of 1970. It includes tracking suspicious activity, scrutinizing foreign transactions, and reporting cash transactions over $10,000, which are regulations we observe today.

Fast-forward to 2001, when the world was shocked by the 9/11 events, we faced another significant AML compliance requirement with the Patriot Act. It obliges financial institutions to collect information on individuals holding or opening new financial accounts.

However, the Panama Papers scandal exposed the Patriot Act’s limitations. We learn that enhanced due diligence measures were ineffective in stopping the rogue offshore finance industry from using illegal funds. To address this issue, in 2016, the government introduced new requirements specifically for onboarding business customers, known as KYB.

Know Your Business Requirements

KYB requirements are not universally standardized and may differ based on where you do business. Nonetheless, the main regulatory compliance requirements you can encounter include:

- Financial Crimes Enforcement Network (FinCEN)

- Financial Action Task Force (FATF)

- EU’s Anti-Money Laundering Directives

Which Companies Need to Implement KYB?

Financial companies are required by law to conduct KYB verification. The Final CDD Rule states that the following businesses need to follow KYB compliance regulations:

- Commodities brokers

- Mutual funds

- Banks

- Fintechs

- Securities brokers or dealers

- Commodities brokers

- Futures commission merchants

- Other financial institutions

Similarly, according to the EU’s 5th AML directive, crypto marketplaces, gambling operators, tax advisors, auditors, asset managers, credit institutions, notaries, and other financial companies need to carry out KYB checks to maintain compliance.

It’s worth noting that even though it’s not legally mandatory, companies operating in unregulated industries also conduct KYB checks for security reasons. So, to have a clearer understanding of KYB, it’s crucial to consider your specific use case rather than solely focusing on your industry as a whole.

Related: What are the EU’s Anti-Money Laundering Directives (AMLDs)?

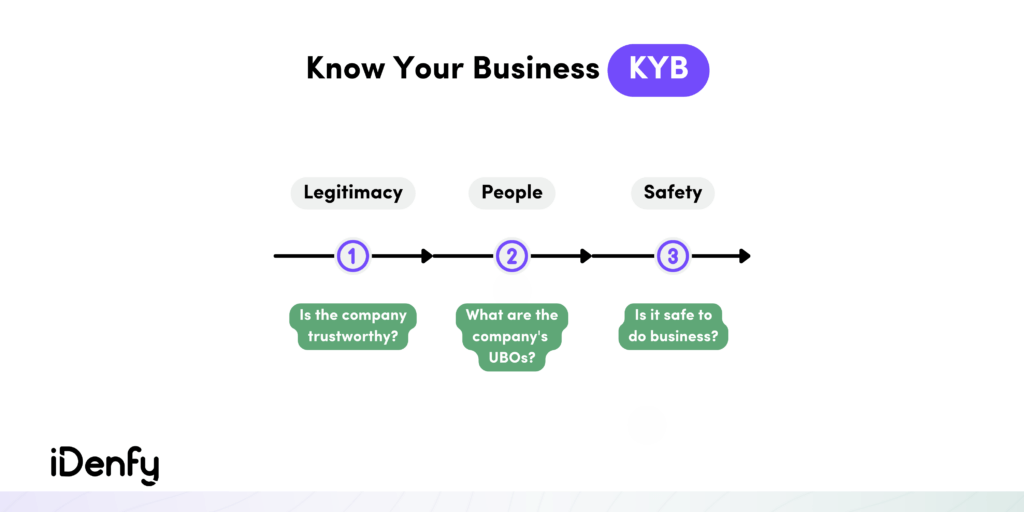

How Does the Know Your Business Process Look Like?

The CDD Rule does not provide specific instructions on how each organization should perform KYB checks. However, organizations should include the following stages in their KYB verification checks:

- Verifying the business

- Identifying the company’s ultimate beneficial owners (UBOs)

- Maintaining updated customer information and monitoring risk on an ongoing basis

The KYB process entitles companies to comply with AML laws, including the mentioned CDD Rule. To ensure compliance, companies must collect and verify different data points:

- Name: the company’s legal name.

- Address: the company’s operating address. Remember that a business operating address might not match the registered address.

- Business registration status: the current legal standing of a business entity, indicating whether it’s authorized to conduct business activities.

- Licensing documentation: the verification of licenses and permits that a business entity requires to operate legally in a particular jurisdiction.

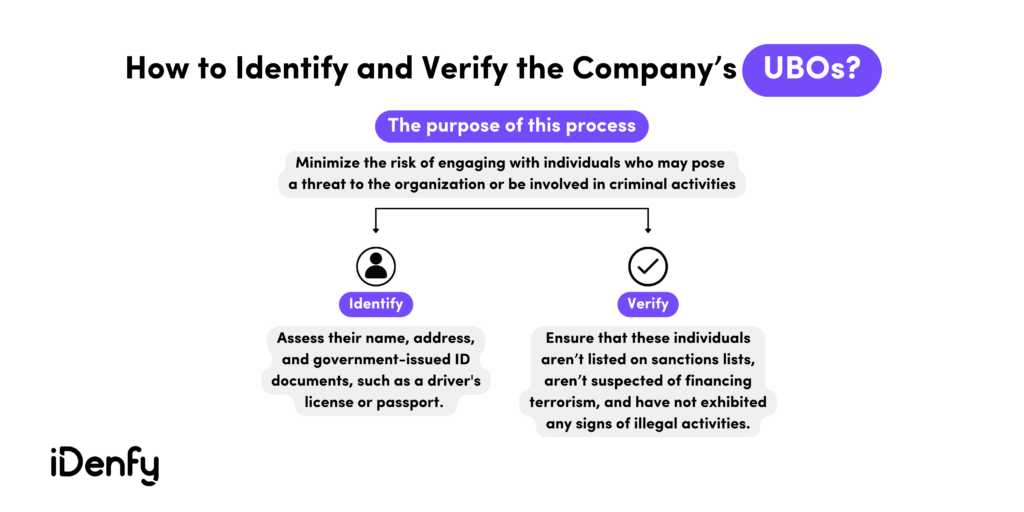

- Ultimate beneficial owners (UBOs): the identification and verification of shareholders who have 25% or more beneficial ownership in the company.

Regarding Know Your Business checks, it’s crucial to focus on two factors: proper due diligence and a suitable compliance program that will guarantee that you are not doing business with criminals.

How to Comply With Know Your Business?

KYB regulatory requirements mandate that companies must assess the risk associated with their business relationships. This involves conducting due diligence to evaluate the level of customer risk, which helps companies understand the individuals or entities they are considering doing business with.

So it’s the company’s responsibility to verify the business and its beneficial owners, as well as ensure that neither the company nor the individuals are on any global watchlists or sanctions lists.

To achieve this goal, businesses should implement a proper AML strategy that encompasses the following processes:

- Due diligence: It’s the process of evaluating the level of risk associated with a potential business relationship. Unlike customer due diligence, which involves verifying a customer’s identity, due diligence for businesses entails determining the company’s ultimate beneficial owners (UBOs). If the UBO poses a higher risk, the company might follow enhanced due diligence.

- Sanctions screening: It’s the process of identifying and verifying if sanctions imposed by regulatory authorities prohibit the potential business relationship. It involves checking whether the company or its employees are listed on any sanctions lists.

- PEP screening: It’s the process of assessing any potential risks related to political corruption or influence. That means regulated companies screen their business relationships to detect any involvement with politically exposed persons (PEPs). Businesses with a positive PEP status also pose a higher level of risk due to their potential for political corruption.

- Adverse media check: It’s the process of monitoring news sources and other media outlets to identify any negative information about the business. This monitoring provides frequent updates in real-time, allowing companies to respond to adverse media coverage.

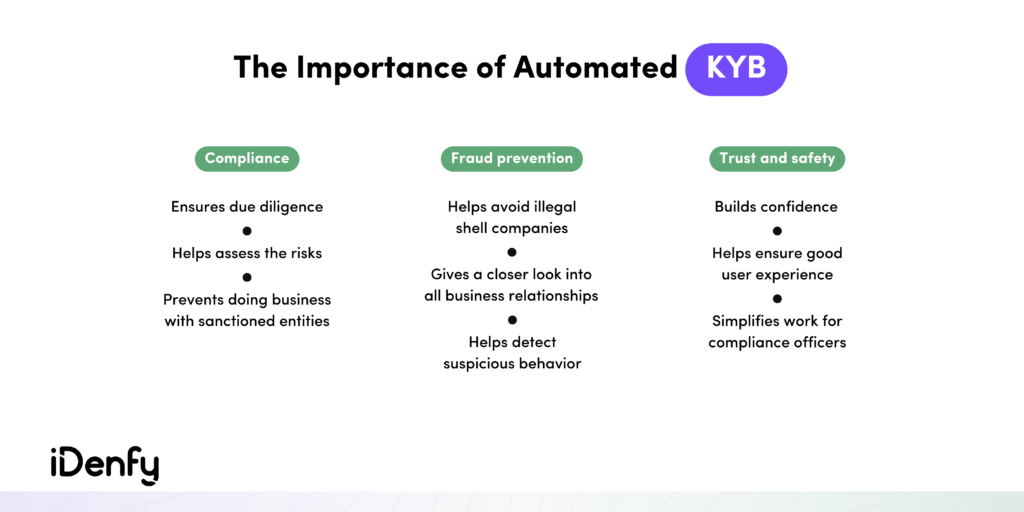

How to Automate Your KYB Verification Checks?

Historically, Know Your Business checks were known for their complexity, especially when discussing manual back-and-forth research and data collection struggles between multiple sources and third-party vendors.

Collecting information, verifying data, and examining beneficial owners lacked a unified system for integrating all these steps. As a result, manual KYB checks created potential errors, data inconsistencies, and lengthy manual processes.

Today, the situation has significantly improved. Modern KYB solutions are fully automated, allowing compliance officers to avoid difficult manual screening processes by streamlining their work through automation.

Despite that, compliance remains a difficult task for many companies, especially now that KYB applies not just to banks and financial institutions. So, if you want to meet regulatory KYB requirements without slowing down the efficiency of business onboarding, there’s only one solution, and it’s automated KYB.

If you’re looking for an accurate, fast, and user-friendly KYB verification solution, try out our free demo to check out how automated Business Verification works with iDenfy. See our customer success stories here.