One of the most valuable industries in the financial sector, lending comes with a good share of risks. For many, this comes off as no surprise since many credit card companies or fintechs offer online loan applications, making it easier for fraudsters to bypass security checks. For this reason, financial institutions still struggle to find the balance between offering convenience and actually securing this high-value market.

Fraudsters can open a mortgage in another person’s name, leaving the victim with huge repayment burdens. Other related crimes like third-party fraud are even more alarming since the borrower has no intention of repaying the loan. Without proper identity verification measures during the application process, criminals can use stolen credentials, damage the victim’s credit and leave the financial institution and the person with huge financial losses.

Naturally, such illegal transactions result in financial losses for both customers and businesses. In this blog post, we get our hands on loan fraud, its specifics, what this crime can do to lending companies, and what fraud prevention solutions can help minimize chances of dealing with devastating consequences.

The Definition of Loan Fraud

Loan fraud, also referred to as lending fraud, is a deceptive practice, which involves illegal actions to gain financial benefits by obtaining loans using stolen personal data. The goal of the fraudster is to access the funds without getting caught, and, as a result, the remaining party is left with financial losses.

Loan fraud can occur anywhere people can borrow money or extend their credit. It has various forms, and it involves mortgage and payday fraud, account takeover (ATO) fraud, as well as other loan scams, including online landing fraud. Loan fraud is quite common since some institutions providing such services require minimal information and identification during the application process.

The Importance of Managing Loan Fraud Chances

To prevent loan fraud, companies should pay attention to their security practices. While this may seem standard practice, loan fraud is still an issue, affecting at least 1 in 134 mortgage applications, according to a recent study. Managing fraudulent activities is important for a business to scale properly instead of only thinking about quickly attracting new customers through an easy sign-up process.

Many loan companies only ask for basic information during the application process, making it easy for criminals to obtain critical details like the user’s bank account number. In essence, loan fraud prevention helps prevent criminals from exploiting vulnerabilities in the system while protecting the whole financial system and the company’s assets or important personal data.

Who Becomes the Victim in Loan Fraud?

Unfortunately, anyone can become a victim of fraud. However, the roles of fraudsters and victims vary in terms of loan fraud. The creditor offering the loan can act fraudulently, and the debtor receiving the loan can also become a fraudster.

In general, no matter the scenario, loan fraud is an issue mainly because:

- Lenders struggle to find the right identity verification processes that wouldn’t be easily bypassable and wouldn’t be too hard on the user.

- Users, once they become victims, face challenges in restoring their financial stability and their credit scores.

Lending fraud also targets mortgages, bank accounts, home or car loans, and other financial channels where large sums of money are involved. That said, both users and lenders need robust security practices to strengthen their defense against financial crimes.

How Does Loan Fraud Happen?

Loan fraud works by relying on deception and various fraudulent practices that are designed to trick the institution into accepting the loan application. For example, a person can intentionally misrepresent data to obtain a loan they wouldn’t typically qualify for. So, to put it simply, loan fraud often starts with the consumer.

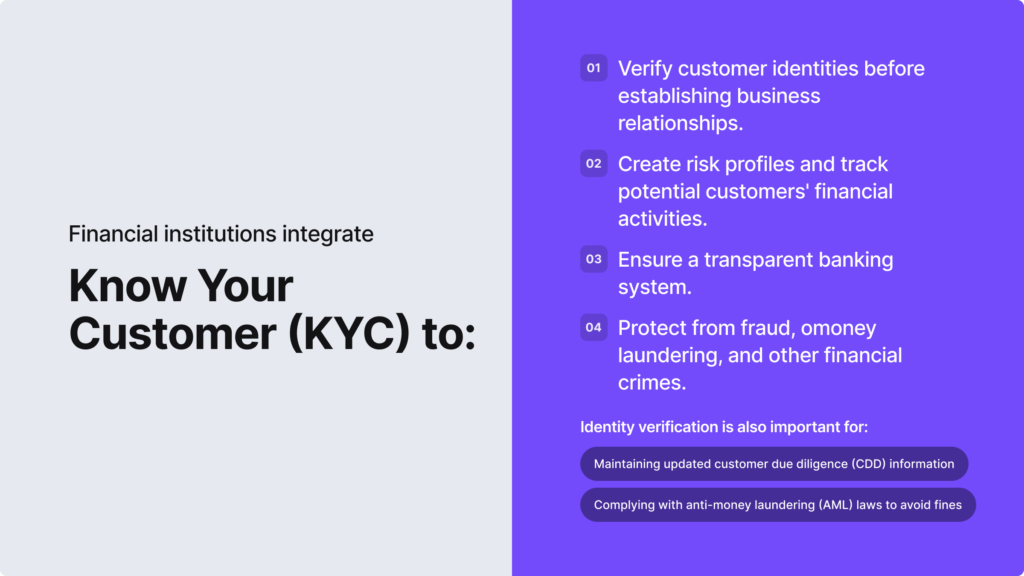

The principle of this type of fraud relies on pretending something you’re not, and it can be either a person or a company providing the false information. After securing the loan, the debtor disappears without repaying it. For this reason, both customer and corporate client (KYC and KYB) verification checks are important.

Attackers use various methods to obtain personal information, so it all depends on their approach. For example:

- A criminal can steal documents from the trash to gather personal information.

- A bad actor can use a synthetic identity during the loan application process, which is hard to trace due to the combination of real and fabricated data.

- A fraudster can use phishing emails and fake companies, while others install malware on a potential victim’s device.

- A criminal can forge tax returns or alter other documents like bank statements with fake signatures to paint a different picture of their assets.

- A bad actor can use bots to automatically test credentials and access financial accounts, later using them to access loans.

Other complex techniques require some skills. For example, fraudsters can use a bank account and make regular payments just to build a good credit history. Afterwards, they use the established credibility and “proper” financial history to take out a large loan and vanish.

What are First-Party, Second-Party and Third-Party Loan Fraud?

Loan fraud types have three categories based on who engages in the malicious activity:

- First-party loan fraud. Also known as personal loan fraud, this practice refers to when a criminal uses their real personal data but twists it to their own benefit and provides a level of false information to the loan service provider.

- Second-party loan fraud. This is a type of fraud where the fraudster uses another person (known as the straw buyer) and their data to apply for a loan. Typically, this is a person with a good credit rating. The star buyer doesn’t control the process but they receive a profit from helping the fraudster.

- Third-party loan fraud. Essentially, this form of loan fraud is identity theft. This means the criminal steals personal information from another person and applies for a loan under their name. Since it causes damage both to the lender and the victim, identity theft remains the most dangerous crime in loan fraud.

Related: AML Fraud — Types and Prevention Measures

The Most Common Types of Loan Fraud

Financial institutions must know how to deal with all sorts of fraudulent activities, including different loan fraud types. As a result, businesses need to be aware of criminals’ tactics.

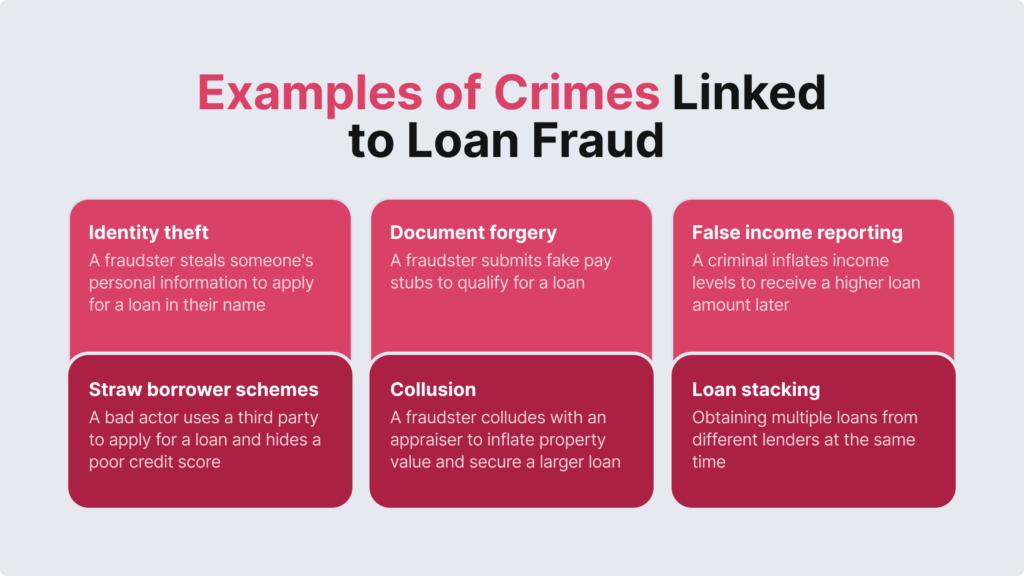

The most common fraudulent schemes linked to loan fraud are:

Mortgage Fraud

Mortgage fraud is one of the most popular types of loan fraud. It happens when a criminal uses false information to obtain a mortgage. Other methods include when a criminal steals personal information, such as another person’s SSN and tax return number. Such criminals also use deed fraud to sell the home to another buyer and then apply for a reverse mortgage in order to steal the victim’s home equity.

There are other schemes intertwined with loan fraud, such as:

- Income fraud. This is when the person exaggerates their salary to receive a larger mortgage.

- Occupancy fraud. The borrower lies about using the home but actually rents it out and secures a lower interest rate.

- Omission of information. The person doesn’t disclose liabilities.

- Straw borrower scheme. This is a type of fraud where a homeowner, a buyer and appraiser agree on an overpriced mortgage loan in order to split the proceeds. The victim is referred to as the straw borrower because they are misled to believe that this scheme is an “investment”.

However, not only borrowers but also lenders, similar to straw borrower fraud, can conduct mortgage fraud. Industry officials like mortgage bankers or bank officers can use their knowledge, skills, and power to obtain funds and equity from homeowners.

Business Loan Fraud

Business loan fraud is a fraudulent practice that is based on providing false information to obtain funding from special business loan programs curated by agencies like the Small Business Administration (SBA). Some scammers use stolen identities to apply for business loans, even though the victim doesn’t even own a business.

It can also be a fraudulent practice that borrowers follow in order to inflate their creditworthiness and then secure a loan from the lender. Some scammers also impersonate lenders and steal money from borrowers. Therefore, conducting thorough background checks and screenings of companies and their associated individuals is crucial.

Related: 6 Steps to Conduct a Know Your Business (KYB) Verification Check

Loan Stacking

Loan stacking occurs when the fraudster applies for multiple loans on purpose. The “stacking” happens without the lender’s knowledge within a short period of time. However, this practice can be used to quickly obtain funds for a legitimate purpose as well, but more often, to commit fraud by securing funds with no intention of repayment.

Fraudsters exploit delays to their advantage. New applications and credit inquiries can take up to 30 days to appear on a client’s profile, so lenders might not detect multiple loan applications until it’s too late. This type of loan fraud is damaging and results in financial losses for companies like fintech institutions, small startups, and microlenders.

Student Loan Fraud

Student loan fraud is an intentional misrepresentation linked to student loans, often involving a scammer falsifying information, like students forging documents when they don’t have a visa to study abroad in order to access funds. In general, there are several types of student loan fraud. It can be neglecting to repay the loans on purpose or stealing identities for the student loan application process.

Some common scams linked to student loan fraud include:

- Pseudo fees related to consultations. Fraudsters charge fees for assistance with student loans when, in reality, most of them are free. Once the victim transfers the money, the scammer disappears. It’s likely a scam if a person requires an up-front fee or insists on an immediate contract.

- Fake promises linked to debt cancellation. Using aggressive marketing tactics, fraudsters target vulnerable students who are looking for loans. Promises to cancel the loan contract or immediately inform about loan forgiveness are scams. Debt relief companies can’t negotiate any deals with students’ creditors.

Without proper onboarding measures, especially in remote enrollment processes that became popular after the pandemic, universities risk accepting students who don’t want to study and have no intention of repaying the loans. Another emerging fraudulent practice is organized crime groups that now target student loans. According to the National Audit Office, such groups have conducted student loan fraud involving £60 million in unregulated colleges in England due to weak oversight.

Related: How Does Student Identity Verification Work?

What is the Impact of Loan Fraud on Businesses?

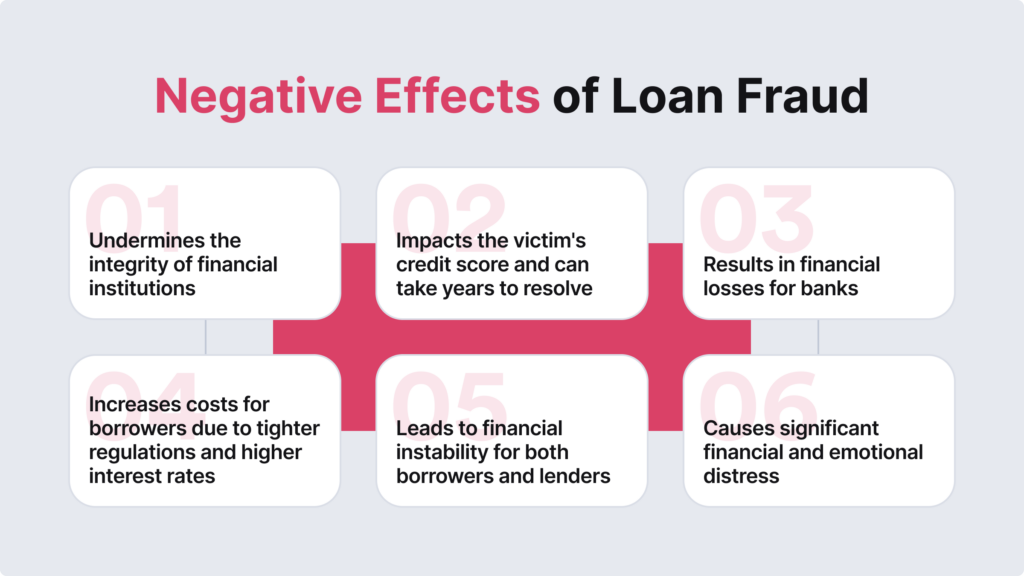

Like any kind of fraud, loan fraud can harm businesses’ reputations and finances. Lending institutions can also face legal penalties, increased regulatory scrutiny, and, in severe cases, even lose their licenses.

Lending fraud also significantly increases the risk of loan default. Consequently, lenders must spend time and resources managing defaults, especially with unsecured loans that may be written off as losses. Even secured loans are at risk if assets are nonexistent, overvalued, or not owned by the debtor.

Simply put, loan fraud results in unpaid loans and the additional costs of investigating fraud. This can also cause negative publicity, brand damage, and loss of customer trust, ultimately reducing future business opportunities.

iDenfy’s Solutions to Prevent Loan Fraud

As a lender, you’re responsible for accepting and verifying genuine loan application profiles. For proper loan fraud prevention, iDenfy offers multiple solutions, including:

- Automated KYC and KYB solutions for a smoother onboarding of both individual and corporate clients

- AML screening and ongoing monitoring, including transaction monitoring

- Customer risk scoring, which allows you to detect fraud in real-time and automatically assess risks based on tailored, pre-made workflow options (including custom risk factors) using automated risk assessment.

- Additional RegTech features, like automated PoA verification, utility bill checks, and more.

Book a free demo today, and let’s discuss your specific use case.