Financial institutions and regulated organizations must establish Know Your Customer (KYC) programs to verify user identities. However, conducting checks and due diligence on both new and existing customers, including businesses, is crucial as well. This is where specific regulations like Know Your Business (KYB) address the business customer aspect.

KYB and KYC checks are somewhat similar. They involve verifying companies and the individuals associated with them. KYB/KYC processes are essential due to regulatory requirements, fraud prevention, and overall trust and safety in any business.

In general, Anti-Money Laundering (AML) regulations require businesses, both financial and non-financial, to actively monitor and safeguard against potential fraud and other financial crimes. While financial companies must conduct KYB and KYC checks, non-regulated entities should also consider specific use cases where verifying their business partners or new individual clients can be beneficial.

Obviously, both processes are vital for upholding the integrity of the financial system and mitigating risks related to money laundering and terrorist financing. But what else is there? We deeply dive into the topic of KYB vs KYC and explain the differences, benefits of each process, and regulatory requirements.

What are KYB and KYC Checks?

KYB and KYC checks are key components of a company’s Customer Due Diligence (CDD) process. These checks often consist of verifying a company’s registration documents, ownership structure, and beneficial owners to ensure compliance and mitigate the risk of fraudulent activities.

Both KYB and KYC are critical in preventing financial crimes and maintaining regulatory compliance. The extent of ongoing monitoring during the business relationship is determined by the risk level identified in KYB and KYC checks. They aid in comprehending the individuals associated with the organization and contribute to the prevention of money laundering activities.

What is KYB (Know Your Business)?

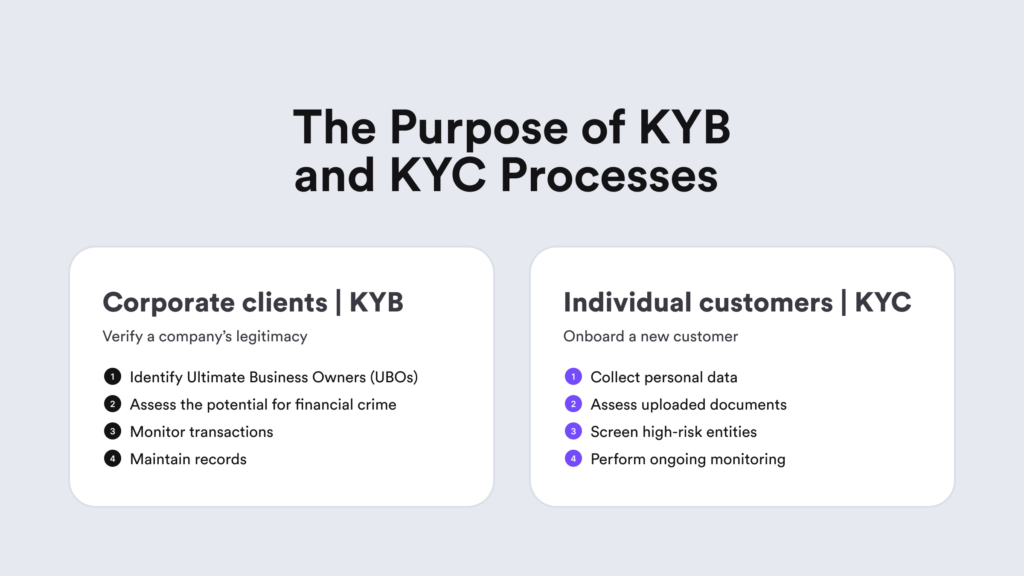

KYB, or Know Your Business, is a process designed to verify customer identities and assess the risk associated with a business relationship. While the principle is similar to the KYC process, KYB is used when companies interact with other businesses that they’re dealing with, for example, service providers or customers.

KYB also extends to confirming the identities of the individuals associated with the companies that are being screened during KYB checks. During the process, companies gather and verify information, such as government reports, tax records, or financial statements, to assess the legitimacy of businesses seeking their services.

Effective KYB checks help companies answer three key questions:

- Who are the ultimate beneficial owners of the business? Beyond verifying legitimacy, KYB helps companies analyze the ownership structure, including directors and ultimate beneficial owners (UBOs), providing insights into potential links to illegal activities or the involvement of criminals that hide under anonymous parties.

- Is the business legitimate and trustworthy? KYB helps assess if an entity is a genuine organization or, for example, a front for illicit activities, such as a shell company used for money laundering.

- Are these individuals authentic in their identity, and can they be considered safe for business dealings? KYB checks also help businesses assess risk by checking individuals for sanctions and adverse media linked to the company or its employees.

Additionally, during KYB checks, companies should monitor transactions for any suspicious activities, such as potential money laundering or fraud. In case of any suspicious activity, companies are obligated to report them to regulatory authorities in order to comply with Anti-Money Laundering (AML) rules.

Related: Know Your Business (KYB) — Quick-Start Compliance Guide & FAQs

What is KYC (Know Your Customer)?

KYC, or Know Your Customer, is a process designed to verify a customer’s identity and monitor their financial activities. Like, KYB, KYC is a legal requirement aimed at preventing money laundering and terrorism financing. KYC checks are applied during the customer onboarding stage and continue on an ongoing basis throughout the whole business relationship.

To comply with KYC regulations, companies must, at a minimum, collect and verify the customer’s:

- Name

- Date of birth

- Address

- Identification number (such as a Social Security number)

Regulated industries, including financial services like fintech or investment platforms, as well as iGaming and cryptocurrency, are more susceptible to financial crime, including identity fraud; therefore must follow strict KYC requirements.

Regulators only provide recommended guidelines for how to conduct KYC checks in practice, allowing businesses to use different ID verification vendors with various KYC solution options, such as document verification, biometric verification, or database checks.

This enables organizations to categorize new users based on certain red flags and apply a risk-based approach to ensure compliance while understanding their customers’ backgrounds and financial histories better.

Related: What are the 3 Steps to KYC?

How Does KYB Differ from KYC?

KYB and KYC differ in their focus or the type of customer the processes deal with. KYC focuses on verifying individuals for business transactions, while KYB involves understanding businesses and the individuals associated with them. You can say that KYC helps companies identify people while KYB helps companies assess the businesses they work with.

KYC refers to conducting business with individuals, while KYB is centered on establishing trusted relationships with corporate customers. That’s why KYB is also sometimes referred to as corporate KYC. The interaction between KYB and KYC is inevitable because KYC is embedded within KYB. Onboarding and verifying a business includes verifying the UBOs, emphasizing the close nature of both processes.

KYB vs KYC vs an AML Check

KYB is often seen as one part of a larger KYC compliance piece. AML involves verifying that a business or consumer being onboarded is not entangled with any criminal activity. KYC and KYB are specific checks that fulfill AML requirements.

After the initial checks, customers should be regularly monitored. There are a few ways to achieve this:

- With the customer’s risk assessment reviewed periodically

- As often as the customer’s risk level requires

- Continuously through perpetual KYC (pKYC).

All checks — KYB, KYC, and AML — are vital to ensure companies understand their customers and associated risks. It’s a legal obligation. As a result, regulated businesses that don’t stick to compliance regulations can face huge fines.

Key Reasons Why KYB and KYC are Important

Both KYB and KYC are crucial for companies for three primary reasons: to mitigate risks, ensure compliance, and build trust among their clients. Both processes work together to create a comprehensive approach to due diligence, enhancing the integrity of business relationships and the overall security of the financial system.

We look into each factor explaining why KYB and KYC are vital below:

1. Risk Management and Fraud Prevention

Fraud prevention is crucial to safeguard businesses from illegitimate customers, for example, those who are trying to open new accounts on fintech platforms using forged documents and criminal activities like smurfing. This is no surprise, as the rise of technology has increased the risk of various fraud types, including fake companies or notorious AI uses like deepfakes.

In this sense, KYB focuses on understanding and verifying the businesses themselves, including their ownership structure and beneficial owners. This is vital in preventing issues like money laundering or fraudulent activities, especially when dealing with corporate entities.

In the meantime, KYC helps businesses verify the identity of individual customers, reducing the risk of fraud, such as the use of synthetic identities, and ensuring that they are not engaging in illicit activities. For example, banks often require customers to provide ID documents during the new account setup process.

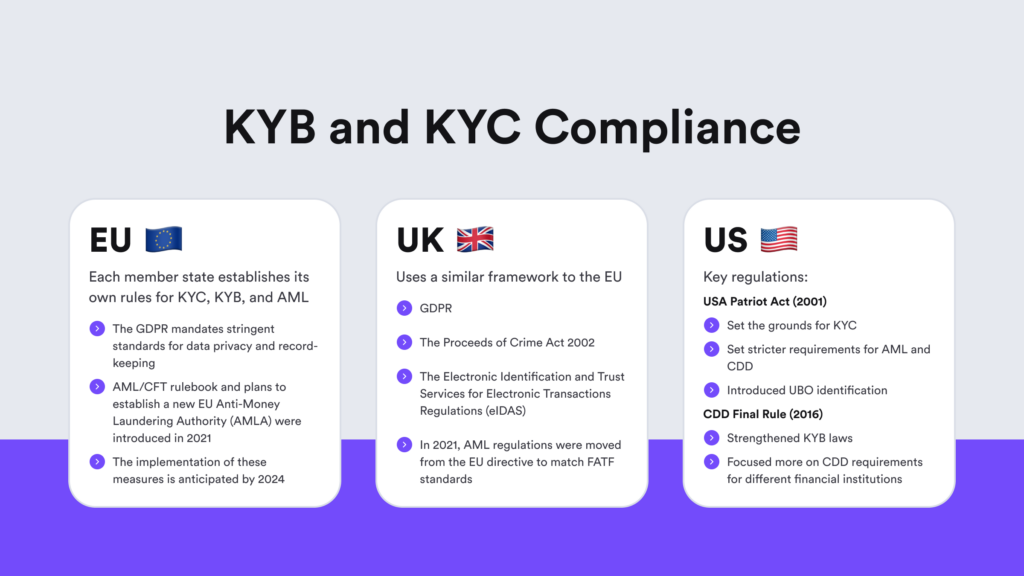

2. Regulatory Compliance

KYB and KYC requirements are not standardized across all companies, as regulations vary based on the business location and other specifics, for example, such as partner requirements. However, there are standardized frameworks that most countries use universally. For example, the Financial Action Task Force (FATF) has established a special rulebook of 40 Recommendations. These guidelines serve as global standards for different jurisdictions.

Other key KYB and KYC regulations that are important for companies to stay compliant include:

- The Bank Secrecy Act

- The CDD Final Rule

- EU’s Anti-Money Laundering Directives (AMLDs)

While verifying identities during onboarding is crucial for both when onboarding new customers and corporate entities, ongoing monitoring is equally essential to comply with regulations and safeguard the business. That’s why the CDD process doesn’t stop at the first stage of the relationship with the client. Companies should implement ongoing monitoring into their KYC/KYB and AML program to evaluate user risk throughout their whole life cycle.

Related: What is the Difference Between KYC and CDD?

3. Trust and Safety

Trust and safety are critical for retaining customers. When users believe their personal information is secure and their experience is safe, they are likely to continue using a platform. That’s why businesses that invest in trust and safety, including KYB and KYC measures, can establish user confidence.

For example, KYB demonstrates the company’s commitment to ensuring the authenticity of individuals and companies using their service, providing users with the assurance that the business has vetted each participant. The same goes for KYC checks, they help guarantee that each customer doesn’t have fraudulent intentions of, for example, laundering money or stealing personal data using a fake identity.

In practice, having a proper trust and safety program means you need to build a good end-user experience, especially as the first interaction with the user often involves collecting personal information. Ensuring a secure and trustworthy data collection flow through KYB or KYC is essential. A cohesive user experience is key, and during both identity verification and business verification processes, it’s vital to maintain a frictionless onboarding flow, guiding clients through each step.

Additional KYB and KYC Benefits

When describing both processes, there are other key benefits that highlight the significance of KYB and KYC checks. These include:

- Identifying and assessing complex ownership structures.

- Preventing business relationships with sanctioned entities.

- Establishing a comprehensive background check of each customer.

- Enhancing efficiency through automated RegTech software.

- Reducing the risk of onboarding illegitimate companies, like illegal shell corporations.

What are the Main KYB and KYC Compliance Requirements?

Regulatory requirements and implementation rules for KYC and KYB can vary. KYC regulations, having been in place longer, are more straightforward, with many countries listing acceptable practices and other established industry norms. Meanwhile, KYB regulations are less well-defined, leading to a certain level of uncertainty.

We look into each process below.

KYB Verification Requirements

- Gather company details, including company address, registration or incorporation documents, and key personnel information.

- Verify the collected information.

- Identify the company’s UBOs.

- Screen the company and the people involved against government registries and sanctions lists.

- Screen against PEP lists.

- Continuously monitor transactions to detect suspicious activity.

- Screen adverse media to detect potential negative news mentions.

Related: Know Your Business (KYB): Detailed Explanation and Examples

KYC Verification Requirements

- Gather personal information (name, date of birth, address, nationality, etc.)

- Verify the person’s identity using a government-issued ID document.

- Collect data on the person’s financial background when applying a risk-based approach. The user risk assessment results determine the level of due diligence to be applied, which can be simplified, standard, or enhanced.

- Screen and identify if the person has the PEP status.

- Screen against government registers, sanction lists, and global watchlists.

Related: Top 5 KYC Challenges and How You Can Overcome Them

Automation Capabilities When Solving KYC/KYB Challenges

In KYC, a significant challenge is the prevalence of forged or altered identification documents. Simultaneously, there is a need to maintain a seamless onboarding process for all customers while building trust to prevent customer attrition.

On the other hand, KYB checks typically involve the usage of various tools and sources, including government registries, AML checks, and KYC checks — all in order to obtain a full picture of a business and what it is really about. This can pose a challenge for businesses, particularly when integrating multiple third-party service providers, which are often necessary to ensure complete KYB and KYC compliance.

Through automation solutions, companies can solve their KYC/KYB challenges and achieve these business goals:

- Improve KYC/KYB onboarding, reduce alert remediation time, and ensure scalability without compromising efficiency or accuracy.

- Deliver consistent and reliable results while minimizing the risk of errors in decision-making and oversight during the remediation process

- Enhance risk identification and improve detection of illicit activities, including preventing account takeovers, chargebacks, and more — depending on your use case scenario.

So, instead of manual document reviews, and handling large datasets from endless sources, you can use automation. For example, OCR for data extraction and matching live selfies to ID documents (for KYC) and automatically ordering credit bureau reports or collecting shareholder data (for KYB).

AI-powered software automates tasks such as identity verification checks, KYB verification, AML screening, transaction monitoring, and assessing the risk associated with both individuals and corporate entities.

At iDenfy, we offer the complete toolset for KYC, KYB, and AML compliance, helping you solve the mentioned challenges. Book your demo to find out more, and read our success stories.