Living in the 21st century certainly has its perks. The immense technological advancements made the world more practical than ever. It’s hard to believe that anyone could predict our lives to be digital to the extent that they are today.

It used to be that only simple services could be provided online or via phone – ordering food, booking a meeting, ordering a reservation at a restaurant, etc. Without a reliable method to verify documents, certain services could not be provided in a digital environment for security reasons. Now, even that has changed. Among other things, citizens can apply for credits, open bank accounts, or receive insurance remotely.

However, many of the issues with document verification persist. Solutions to certain obstacles create alternative problems, demanding a resolution of their own.

Let’s discuss the state of affairs in the present and what can be done to tackle the issues of our digital environment with regard to document verification.

Why Do Organizations Need Automated ID Document Verification?

The world is not what it used to be. People are going about their lives at a much greater pace than before. In a time of abundance and a rapid, racing environment, the most significant value becomes that which can neither be traded nor bought – time. Even though we’ve become more practical than ever, hours saved become hours invested in something else.

Some corporations provide work and services more quickly, creating enormous pressure for others to follow.

Even though long queue lines had been replaced with registered appointments, the new status quo proved insufficient when remote services appeared in the market – both for the clients valuing their time and companies aiming to lower their customer support costs. This, in turn, led to most companies being able to provide their clients with the possibility to receive services in the comfort of their homes.

The supply, as is always the case, was following the demand. Although various institutions encouraged people to go digital, many still felt more comfortable doing business in person. The situation had changed when COVID-19 spread worldwide.

The question of time became the question of safety. Schools, universities, banks, state institutions, and even hospitals, in some cases, have begun to operate remotely. The world has transformed yet again, and it is questionable, at best, if we’ll ever return to the way that it used to be. Most businesses failing to adapt to this change are on the course of failure, while those, who do modify, begin to thrive – including various industries, such as gaming or fintech.

Ensure your customers are real. Schedule a free demo here.

How Identity Verification Poses New Challenges

The rapid changes in different industries bring an increasing number of challenges. Innovation often comes with a price – practical as they are, new ways of solving various issues are implemented quicker than removing all the flaws. In the past, ID verification was easy enough – validating the documents provided by a person face-to-face was somewhat reliable, and, at the very least, it scared away fraudsters to an extent.

How Does Identity Document Verification Work?

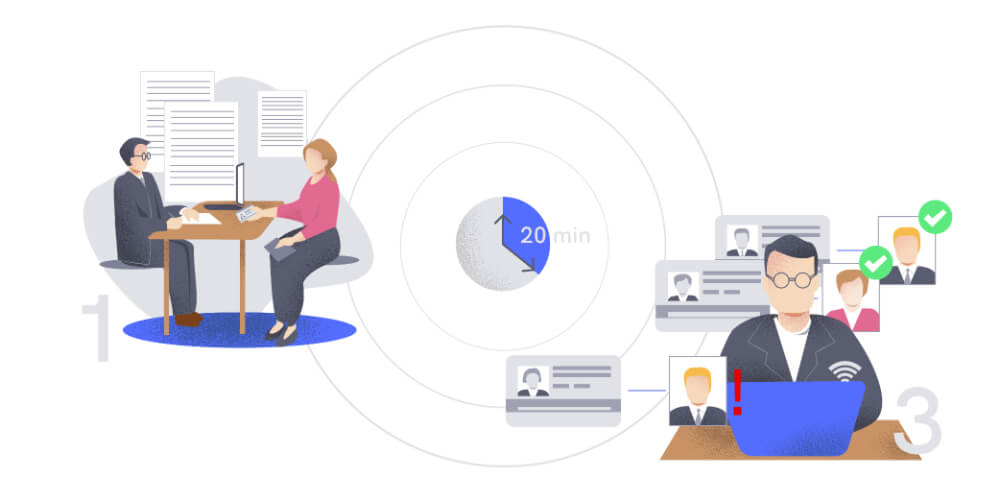

The process of verifying documents is quite simple. Let’s use iDenfy’s service as an example.

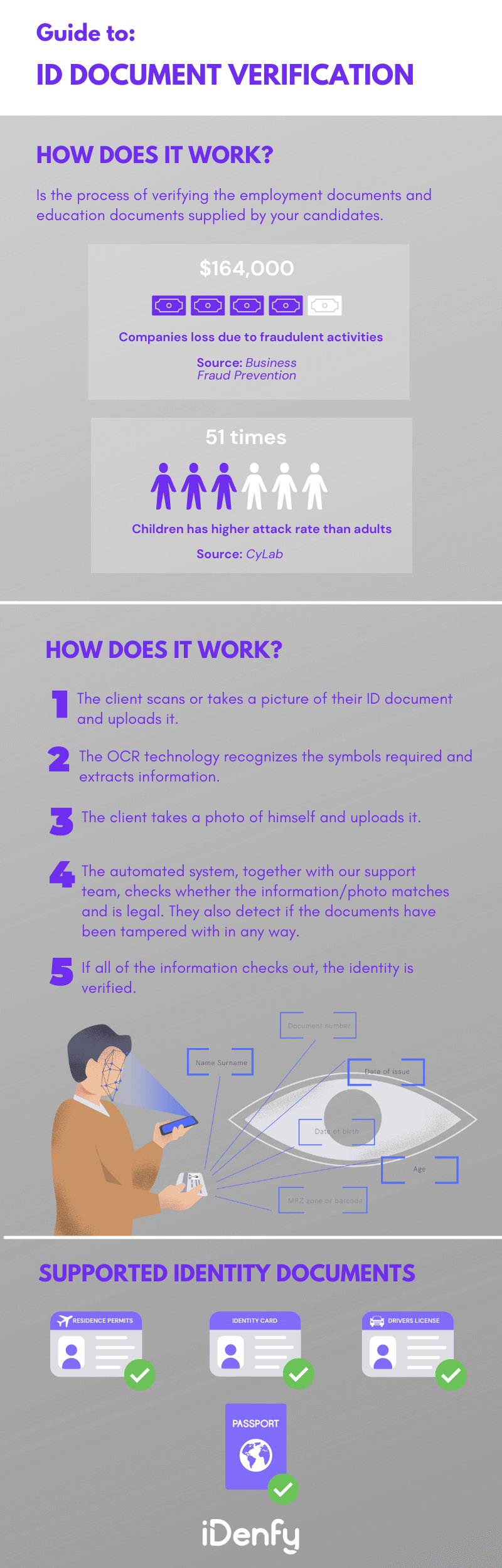

Our ID verification method utilizes AI, machine learning, and human intelligence. It supports more than 3000 documents from 200+ countries, such as:

- ID cards;

- Passports;

- Drivers license;

- Residence permits.

The procedure goes as follows:

1. The client scans or takes a picture of their ID document and uploads it.

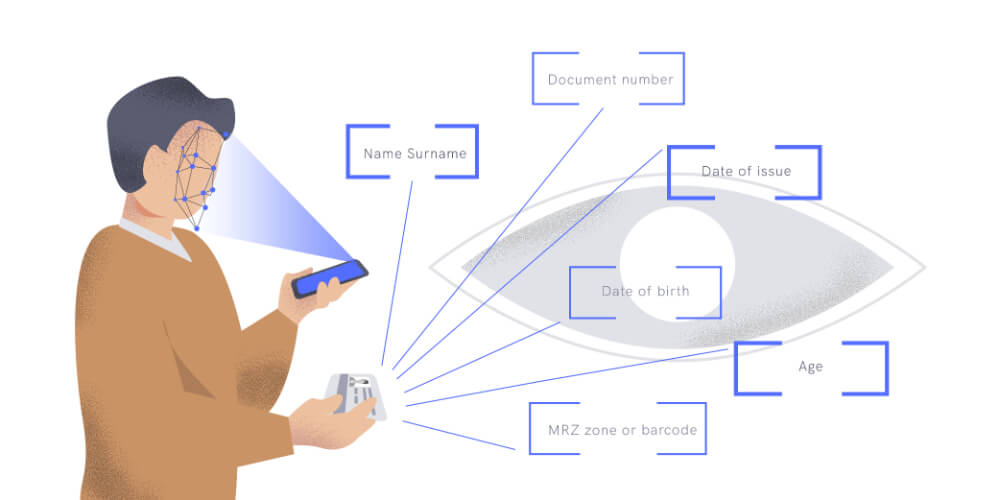

2. The OCR technology recognizes the symbols required and extracts the relevant information:

- Name

- Age

- Date of birth

- Date of issue

- Document number

- MRZ zone or barcode

- Country of origin.

3. The client takes a photo of himself and uploads it.

4. The automated system, together with our support team, checks whether the information/photo matches and is legal. They also detect if the documents have been tampered with in any way.

5. If all of the information checks out, the identity is verified.

Verify customers identity within 15 seconds. Schedule a free identity verification demo here.

How ID Document Verification Tackles Identity Theft

Identity theft was present even without remote services. However, the practice was also more dangerous for the fraudsters, and it was often enough to discourage a significant number of them.

However, the digitization of the modern world sets the stage for fraud to be as prevalent as it is. Criminals take advantage of flaws in the processes, especially document verification. Getting one’s hands on stolen personal information, such as their name, address, social security, and bank account numbers, has become easily achievable via the black market. Social Security Numbers (SSNs) can be bought on the dark web for as little as $1!

Identity theft is primarily prevalent in the U.S. – according to Proofpoint, 33 percent of U.S. adults had their identities stolen at least once.

How Organizations Can Detect Synthetic Identities With Automation

Another trend in the criminal world is the use of real and fake personal data to craft new, synthetic identities. Fraudsters then use these fake identities to build a reliable and trustworthy credit history. After months or even years, they finally maximize all of the credits and disappear for good, leaving the banking industries chasing ghosts that never existed in the first place.

Detecting synthetic identities is a challenging task for organizations, as these identities are often created using a combination of real and fake information, making them difficult to identify. However, with the advancement of automation technology, it is now possible to detect synthetic identities quickly and accurately.

Here are the main benefits that explain the value behind AI-powered identity document verification:

- Automation tools can analyze large volumes of data from various sources, such as social media profiles, financial records, and public records, to identify patterns and inconsistencies in the information provided.

- By leveraging automation, organizations can detect and prevent synthetic identity fraud before it causes significant damage, ensuring the safety and security of their operations.

Fraud detection and prevention service from market leaders. Schedule a free demo here.

How Does Avoiding Identity Document Verification Lead to Fraud Losses?

The fraud losses are immense. According to Business Fraud Prevention (BFP), private companies, including small businesses, have a median loss of $164,000 every year in the U.S. due to fraudulent activities – and the most significant contributing factor is the lack of internal controls. In other words, the losses are preventable if companies take the necessary steps.

Corporations are not the only ones who suffer. People whose identities or personal data have been stolen may later fail to get credit due to compromised credit history. Most of the time, it’s the children – according to a recent study, they are 51 times more likely to become victims of identity theft than adults. The stolen personal data may only surface after they grow up.

It does not reflect well on the companies either – after all, who would want to do business with a company that fails to protect all potential clients from identity fraud by being negligent?

Why Automated Identity Document Verification is Crucial

Grim as they are, these problems have a solution. Most identity and other frauds can be prevented if an efficient and reliable identity verification method is set in place. In an ideal world, every company should strive to implement these safeguards – both for the sake of their security and the reduction of global corruption. It’s not enough to adhere to laws and regulations – the aim should be to stay ahead of the curve.

We encourage every corporation to accept the responsibility falling on their shoulders. It may not be possible to prevent everything, but it is crucial to govern what we can control.

Don’t know where to start? Book a meeting with iDenfy, and let us introduce you to a reliable solution to document verification.