Government agencies, financial institutions, and businesses use document verification to confirm the authenticity and validity of a document. This process helps to ensure that the document is genuine and has not been tampered with, altered, or counterfeited in any way.

Document verification is also a crucial step in the customer onboarding process. It allows companies to quickly and securely verify the authenticity of identity documents provided by new customers. By using document verification and other security methods, businesses can enhance their verification processes, ensuring that only legitimate customers are onboarded.

Although the task of onboarding customers may seem straightforward, businesses actually face multiple challenges in the process. They must balance the need to mitigate fraud, build customer loyalty, and comply with regulatory requirements, all while ensuring a fast and secure onboarding experience for their customers.

How to achieve this major goal? One way is to incorporate document verification. To find out more, keep on reading.

What is Document Verification?

Document verification is the process of checking the authenticity of a document, such as a passport, driver’s license, or ID card. This process is essential for businesses that deal with money flow and high-value transactions.

That means financial institutions, such as banks or cryptocurrency platforms, must verify documents to find out who their customers are and who they are conducting business with. Typically, companies conduct document verification by examining the document’s physical and digital features, including its format, security features, and other details, such as the machine-readable zone (MRZ).

The document verification process involves these stages:

- The customer wants to create a new account. They prove their personal data as part of the account opening process. Typically, the data includes the name, date of birth, address, etc.

- The customer additionally provides documents for verification. For instance, they may be asked to send a birth certificate to prove their age or include a utility bill for a form of address verification.

- The organization checks the provided details. They compare the sent details with the provided document to check if it’s authentic and not forged in any way.

- The organization decides if the document can be verified. If the verification is completed successfully, and the document appears to be authentic, then the customer is deemed as legitimate.

Why is Document Verification Important?

Document validation is critical in identifying forgeries and preventing fraud. Without proper authentication, fraudsters can easily open an account using fabricated or stolen information. By validating documents, companies can ensure that the information users provide is accurate and legitimate. This way, organizations reduce the risk of fraud and ensure their operations are secure.

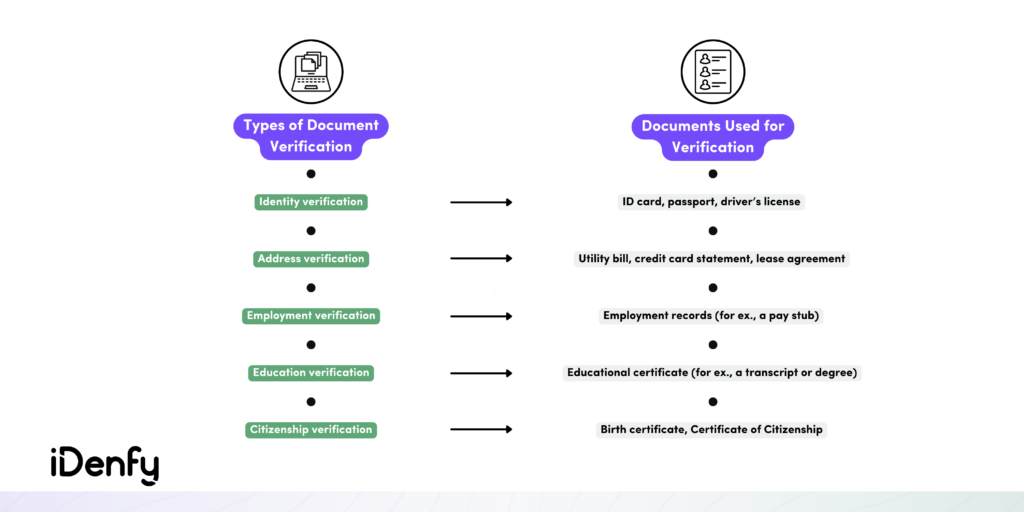

By verifying documents such as ID cards, passports, and other official documents, companies can ensure that the person presenting the info is who they claim to be. Document verification is also essential in various industries, such as fintech, gaming, or transportation, where sensitive information is at risk. Other examples include:

- Financial institutions. They use document verification to ensure that customers are who they claim to be when opening accounts or applying for loans.

- Healthcare. Medical service providers use document verification to verify patient identity, ensuring that the correct treatment is provided to the right person.

- E-commerce. Online marketplaces integrate document verification to verify the identity of sellers and buyers, preventing fraudulent transactions.

What’s the Difference Between Physical and Digital Document Verification?

Physical document verification involves examining the physical attributes of a document, such as its texture or color, to ensure its authenticity. For example, a border control officer may inspect a passport to verify its authenticity by examining its physical security features, such as holograms, watermarks, and microprinting.

Physical or manual document validation involves several steps. If you need to find out if a document is legit, there are several factors to consider when verifying its authenticity:

- Security features. Many official documents, such as passports and driver’s licenses, have built-in security features that are difficult to replicate. Look for watermarks, stamps, special fonts, and other features that are unique to the document.

- Colorspace and edge analysis. Remember to check the shadows, lighting, and colors to check for clues in case the document is forged, tampered with, or has been altered. Inspect the document’s edges to check if it hasn’t been cropped.

- General data. Verify that the information on the document matches what you would typically expect. Check for spelling errors, incorrect dates, and other inconsistencies that could indicate a fake document.

Digital document verification uses AI-powered software tools to verify the authenticity of documents. Organizations use this method for remote verification processes, where physical documents cannot be examined. By authenticating images of government-issued ID documents, businesses can onboard customers remotely and mitigate fraud risks.

Digital document verification requires online data extraction and comparison. This is how these processes typically look like:

- Document data extraction. When a user submits a document for online verification, companies must access the information contained within the document. They automatically extract the data through various methods, such as pattern recognition or optical character recognition (OCR).

- Document data comparison. After organizations extract the data, they compare it to the user’s information. For instance, if the user has uploaded a utility bill as proof of address, the address listed in the document will be compared to the one the user initially provided. This way, the organization confirms that the document is authentic and belongs to the user.

Many companies incorporate document verification alongside other verification methods to enhance their identity verification processes and ensure that only legitimate customers are onboarded. For example, a fintech platform can use facial recognition technology to verify the identity of a new user by comparing a live video of the customer to the photo on their ID card.

Why Do Businesses Use Document Verification?

With the increasing number of customers interacting online, document authentication methods have evolved. That’s why it’s not uncommon anymore for businesses to ask their customers to upload documents or a selfie that proves their likeness when opening a new account.

Today, businesses use document verification, especially digital authentication. This helps them expand to global markets without asking customers to bring physical documents. Some other advantages are:

- Enhanced risk management. With online document verification, customers can easily upload their documents from anywhere, making the verification process more convenient and user-friendly.

- Increased efficiency. Online document verification is a fast and efficient way to verify documents, reducing the time and effort to check documents manually.

- Easy global access. Digital verification enables businesses to verify documents from anywhere, including those who reside in regions with low data source penetration.

- Ensured compliance. Document verification helps organizations ensure compliance with regulations and laws related to customer identification, such as KYC, AML, and CDD.

But there’s one issue for businesses. It’s necessary to balance out a safe document verification process and a swift and simple experience for the customer. Customers expect swift, sometimes real-time document verification, which can be a complex task to achieve.

What are the Challenges of Manual Document Verification?

While manual document verification is still necessary in some cases, this type of verification presents challenges for companies seeking to automate their operations and improve efficiency. Typically, manual document verification is a lengthy and labor-intensive process.

It can be difficult to ensure that the person verifying the documents is knowledgeable enough to identify fraudulent documents. Organizations must conduct extensive training and hire skilled specialists with experience, which usually leads to increased costs.

On top of that, there’s a risk of human error, as even the most knowledgeable specialists can miss details or make mistakes. Ultimately, this leads to incorrect decisions and further risks for the organization. Manual verification processes can be particularly slow, especially when dealing with large volumes of documents, leading to delays and customer frustration.

How Does Online Document Verification Work?

Online document verification is the process of using digital technology to verify the authenticity and validity of a document. Companies use various tools and techniques to assess and determine its legitimacy.

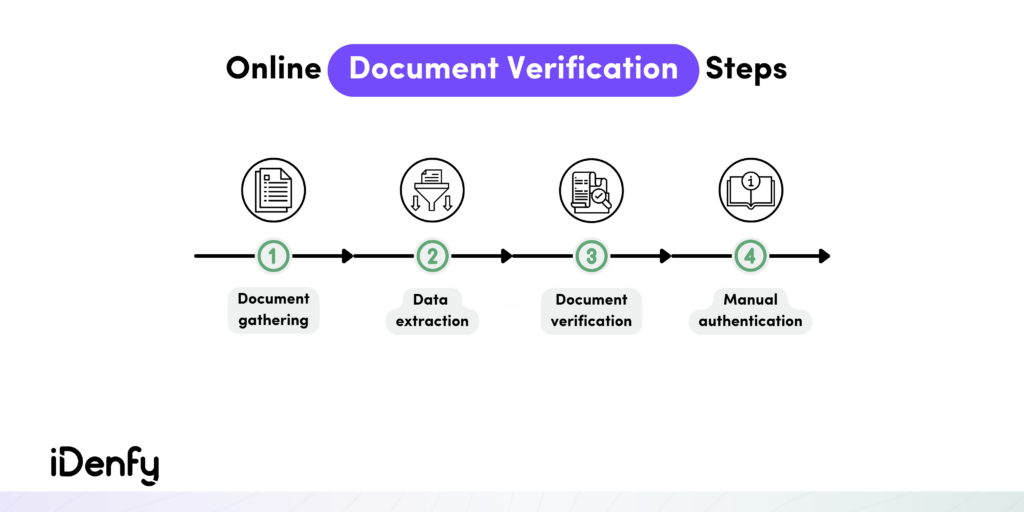

Here’s the online document verification process in more detail:

- A user takes a photo of their ID card, passport, or driver’s license for further analysis.

- The document verification software provides real-time feedback and instructs the user on capturing a good-quality photo of their document.

- The user then uploads a selfie to ensure they are live and present during the verification process. This helps prevent fraudulent attempts to pass the verification, such as deepfakes or masks.

- The system compares the photo of the document to the selfie picture to ensure that they are both the same person and the document is not altered.

Online document verification has become very popular due to the rise of digital transactions and remote work. It offers a convenient and efficient way to verify documents. Organizations that use this verification method require fewer manual processes that can be error-prone and time-consuming.

How Do Companies Verify Identity Documents?

Companies use various methods to verify identity documents, such as conducting manual checks, using automated software, and outsourcing the process to third-party ID verification providers. Key facts to remember:

- Manual checks involve reviewing the documents to ensure they are valid and match the information provided by the individual.

- Automated software uses algorithms and machine learning to analyze documents and compare them with existing databases.

- Third-party providers usually offer more advanced ID verification solutions, including facial recognition, liveness detection, biometrics, and other advancements.

To save time and costs, most modern businesses use automated software. Typically, AI-powered verification system extracts, scans and validates the collected personal identification data against third-party sources. It’s especially important for businesses offering age-restricted services, such as adult-oriented platforms or car rentals.

Factors Helping Businesses Choose Document Verification Software

As much as we’d like to simplify this matter, there’s no such thing as a single template for document verification, especially when we talk about ID verification and customer onboarding. To choose the right identity verification types and providers, you must consider several factors, asking yourself such questions:

Does the potential IDV service provider support global document coverage? How easy is the implementation process? How many languages are there? What are the costs? Is there a real human manual verification team as well? And so on.

You must have knowledge about where your organization operates, the regulatory compliance requirements, and your customers’ risk profiles. But don’t worry, iDenfy’s team can help you build a proper onboarding process tailored to your needs.

We offer post-sale support, white-label options, an internal KYC specialist team for manual verification checks, additional AML checks integrated with identity verification, proof of address document verification, customer risk scoring, and more tools – all in one place. Get started today!