An Ultimate Beneficial Owner (UBO) is an individual who owns or has control over a company. Identifying UBOs is a crucial element in Know Your Business (KYB) and Know Your Customer (KYC) processes. UBO verification aims to prevent major financial crimes like money laundering and terrorist financing.

Regulatory authorities mandate all financial institutions, such as banks, insurance companies, or investment firms, to identify and verify the UBOs associated with their business transactions. That’s why when UBOs are undisclosed, companies open new possibilities for individuals to use the company for money laundering.

Key facts to remember:

- The UBO legislation has been designed to provide corporations with clarity regarding the individuals or entities with whom they are conducting business, reducing the chances of doing business with shell companies and other entities that are facilitating criminal activities.

- UBO verification is crucial for countries to address financial crimes effectively. By accurately identifying UBOs, financial institutions can take necessary measures to reduce the risk of illegal activities and comply with regulatory standards.

Why is UBO Verification Important?

In recent years, regulators strengthened their efforts in terms of combating money laundering and terrorism financing. UBO legislation helps identify fraudulent entities resorting to using off-shore accounts to conceal their activities.

The key reasons why companies must accurately conduct UBO verification include:

- Ensured security. UBO verification acts as a deterrent against criminals using shell companies to conceal their identities, thereby preventing money laundering. When identifying UBOs, companies must frequently track suspicious transactions that might lead to PO boxes, private residences of unsuspecting residents, and other fictitious addresses.

- Compliance with AML regulations. Companies must identify and verify UBOs to comply with Anti-Money Laundering (AML) regulations. The definition of a UBO varies by jurisdiction, but typically, a UBO is considered an individual holding at least 25% of the capital or voting rights in the company.

The EU introduced the Fifth Anti-Money Laundering Directive (5AMLD) to enhance transparency in financial transactions. As per 5AMLD, UBO checks should extend to higher-ranking officials and senior managers. Additionally, under this directive, UBO lists must be accessible to the general public, and information regarding trusts must be available to authorities.

Who is Considered an Ultimate Beneficial Owner?

Customers are considered to be the Ultimate Beneficial Owner if they represent the legal owners or entities that ultimately exert control over a company.

In many jurisdictions, a person is considered a UBO if they are:

- A beneficiary of at least 25% of the capital of the legal entity.

- Holding a minimum of a 25% stake in the capital of the legal entity.

- Possessing at least 25% voting rights in the general assembly.

An ultimate beneficial owner is considered to be a natural person who owns or exercises control over a company, trust, or legal entity, deriving benefits from its assets and profits. A UBO is an actual person behind a legal entity, exerting control over it, whether through direct or indirect means.

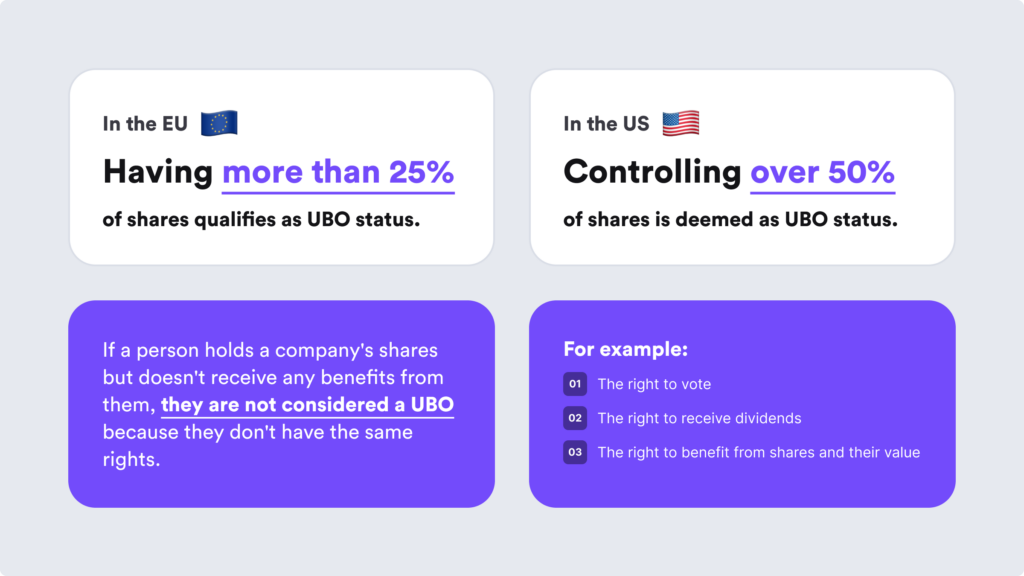

Ultimate Beneficial Owner vs Beneficial Owner

In certain scenarios, an individual may hold a company’s shares without deriving any benefits from them. In this case, the beneficiary is not considered a UBO because they do not have (1) the right to vote, (2) the right to receive dividends, and (3) the right to enjoy benefits from the shares and their value.

So, a UBO is an individual with ultimate control over a business and ownership of at least 25% of its shares. A Beneficial Owner is any person who owns shares and derives financial benefits from a company. In broad terms, when a customer initiates the opening of a new account at a bank, the bank is required to identify and verify the identity of each individual owning 25% or more of the company, as well as one individual who has control over it.

Is UBO Declaration Mandatory?

Any financial institution falling under the purview of AML/CTF obligations must verify the identity of the UBO for all of their business transactions. According to the KYB framework, regulated entities must also submit the identities of their UBOs to the relevant registries. At the same time, they are required to consult these registries to identify UBOs before establishing a relationship with a customer entity.

According to the Financial Crimes Enforcement Network (FinCEN), there are exceptions to the beneficial ownership reporting requirement. These exemptions consist of publicly traded companies that meet specific criteria, numerous nonprofits, and specific large operating companies.

Typically, companies can check the directors of their counterparties through automated AML software and screen UBO data. This step is crucial for evaluating whether the owners or shareholders of the other company might pose potential threats. By rejecting high-risk entities, the company conducting the UBO screening avoids engaging in shady business transactions, this way, safeguarding its reputation.

How Do Banks Verify UBOs?

Banks use different approaches to verify UBOs. One common approach involves requesting documentation such as government-issued identification, proof of address (PoA), and legal ownership records to validate the identity of individuals holding significant ownership stakes.

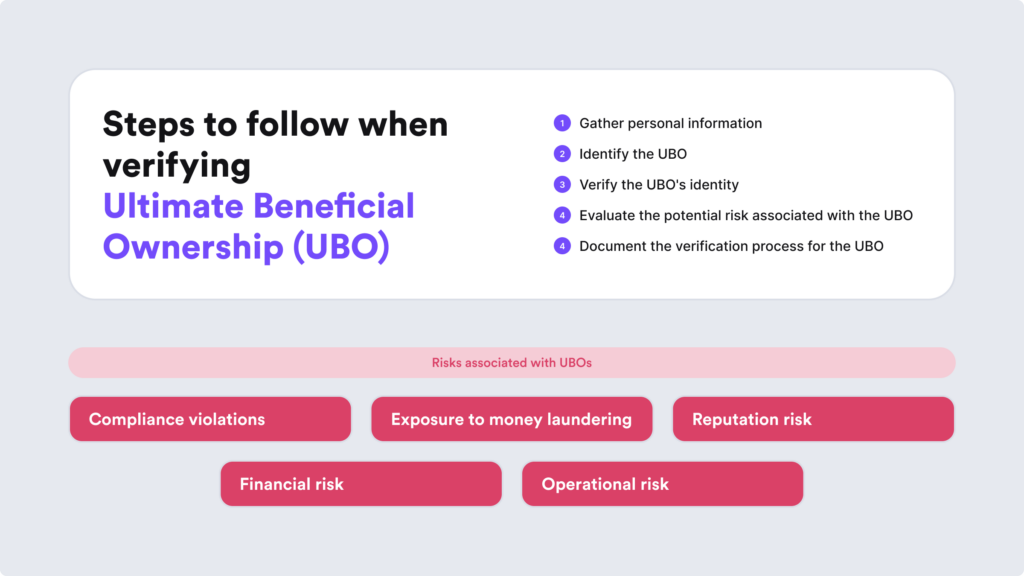

Typically, these are the actions banks take to conduct UBO verification:

1. Collect the Company’s Data

Gather comprehensive and current information, including the firm’s registration number, name, address, official status, and the names of top management employees for verification and accuracy.

2. Review Ownership Structure

Analyze the individuals or entities with a stake or interest in shares, specifying whether their ownership is direct or indirect. Seek information on shareholders, directors, and other intermediate entities that might be part of the hierarchy.

3. Identify the Ultimate Beneficial Owner(s)

Detect shareholders holding substantial ownership stakes by recognizing specific percentage thresholds of shares or voting rights. Identify those individuals whose holdings meet the criteria defining Ultimate Beneficial Owners.

4. Verify UBO Data

Authenticate the provided UBO information by cross-referencing it with reliable sources, such as government databases, public records, or other trustworthy sources, to ensure its accuracy.

5. Conduct AML/KYC Checks

Ensure that all UBOs AML/KYC checks, maintaining consistency in the filing process. This involves verifying their identity through document verification, selfie verification, and proof of address. Additionally, financial institutions must cross-reference the UBOs against sanction databases and Politically Exposed Persons (PEP) lists to ensure that they aren’t associated with any corrupt activities. Additionally, companies can perform adverse media checks to review negative mentions in the news automatically.

6. Proceed with Enhanced Due Diligence (EDD)

Move forward with additional due diligence measures for high-risk customers, such as PEPs, or when navigating through complex ownership structures that require enhanced due diligence (EDD). For companies, that means conducting more comprehensive research, enlisting third-party providers, or using automation to gather in-depth UBO information.

What Risks Do Companies Face Regarding UBOs?

Infiltration of UBOs into a company that provides financial services can lead to serious risks, including consequences like:

- Money laundering. For example, there’s a risk if the UBOs remain undetected and their identities are concealed. They can manipulate the company to facilitate money laundering.

- Undetected financial crimes. By misusing the company’s digital platform and transactions, these hidden owners can obscure the origins of illicit funds. This makes it challenging for authorities to trace and prevent criminal activities.

This level of exploitation not only jeopardizes the company’s integrity and compliance with regulatory standards but also exposes it to legal consequences and reputational damage.

Can RegTech Tools Help Mitigate UBO Risks?

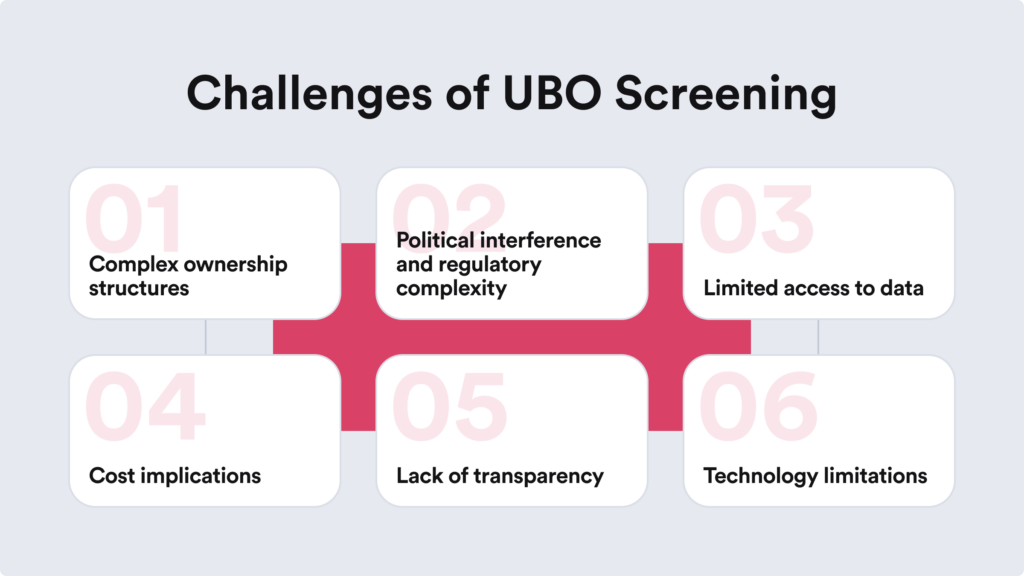

Automated KYB software and various RegTech tools minimize UBO risks by streamlining the due diligence process. These AI-powered solutions use advanced algorithms and data analytics to efficiently verify UBO identities, cross-reference information against regulatory databases, and monitor for suspicious activities.

At iDenfy, we carry the complete AML/KYC/KYB toolkit to ensure a robust Ultimate Beneficial Owner identification process, including solutions for:

- PEPs and sanctions screening

- Adverse media screening

- KYC verification using document verification, selfie verification, and manual checks performed by in-house review specialists

For more customized onboarding flows regarding both individual and business clients, book a free demo.