Proof of address (PoA) has a vital role in identity verification. Companies request proof of address documents as part of the due diligence procedure and verification obligations regarding Anti-Money Laundering (AML) compliance. Typically, a customer verifies their identity by taking a photo of their ID document. Despite that, there are cases when businesses are obliged to dig deeper and ask their clients to provide proof of address information. This is where the challenges begin.

So, what documents are accepted as proof of address, and when is it mandatory to proceed with PoA check? Keep on reading to find out.

What is Proof of Address?

Proof of Address (PoA), also sometimes referred to as proof of residence, is evidence that companies use to verify a person’s residential address. Due to Know Your Customer (KYC) and AML requirements, regulated entities, like bans and crypto platforms, are required to ask the users to upload their proof of address during the onboarding process.

Accepted proof of address documents include utility bills, credit card or bank account statements, government tax letters, and other similar documents.

In simple words, it’s exactly what it sounds like. Proof of address proves that the customer who provided the document lives in the registered location. For instance, financial institutions ask clients to verify their identity and provide proof of address if they want to open a bank account. That’s why PoA measures keep customers’ funds and identities safe.

A valid proof of address must have the user’s full name. The document should also show their current residential address, match their ID document, and be issued by a recognized official authority. Once proof of address documents, such as bank statements or utility bills, are collected, they require manual or semi-manual review. This way, businesses that fall under AML regulations can prevent restricted residents from accessing their services more efficiently.

Use Cases of Proof of Address Verification

As part of the compliance process specified by AML laws, customers must provide PoA documents as evidence to prove their residential address when:

- Performing transactions. In cases when customers exceed a specified threshold, which is determined by AML obligations.

- Registering for financial services. During the onboarding process, the client can be asked to provide an extra proof of address document as part of the AML compliance process.

- Restricting account openings. There are regional compliance requirements that determine restrictions for customers living in high-risk regional areas and countries. Checking their proof of address ensures compliance and prevents fraud.

Additionally, there are other benefits to proof of address verification. Finding out where a person lives helps when a company wants to send physical documents, especially in legally challenging situations. For example, when the bank is obliged to contact the customer physically.

Related: Address Verification Explained

How Does Proof of Address Work?

Common proof of address processes work by implementing optical character recognition (OCR) into their systems. This technology enables accurate and fully automated address data collection, extraction and verification. Often, the user’s PoA document is compared with their government-issued ID or personal details in the database or another reputable source, like their utility service provider.

If the data matches, the system then confirms that the address is genuine and that the user actually resides there. However, partial matches are also common. Sometimes, they require conducting manual checks or asking the user to submit additional info if certain address details are missing.

What Makes a Valid Proof of Address?

The PoA document should be valid. It can be accepted only when:

- It’s issued in your name.

- It matches your ID document.

- It includes your current address data.

- It is issued by a bank or government agency (has all the official logos and security details).

- It is issued within the required timeframe (for example, the utility bill is not older than 3 months, and the bank statement is not older than 6 months).

Proof of address practices can differ, and each company has specific requirements. The most common examples of proof of address include:

- Utility bills (electricity, water, gas, etc.)

- Tax bills

- Bank statements

- Credit card statements

- House purchase deeds

- Tenancy agreements

- Employment letters

Keep in mind that most organizations will not accept bank statements or utility bills that are not older than 3 months, as it is the general period for relevance. Statements can be accepted from credit unions, building societies, and banks. Credit card statements are typically considered valid proof of address documents if they are recent.

However, accepted proof of address verification methods depend on the company and its operating industry, along with other details such as compliance nuances based on the jurisdiction. That’s why some banks prefer electronic bills and reject insurance documents.

For example, other documents also have address verification data specified. They can be accepted as alternative proof of address documents:

- ID card

- Passport

- Driver’s license

- Residence permit

- Social security card

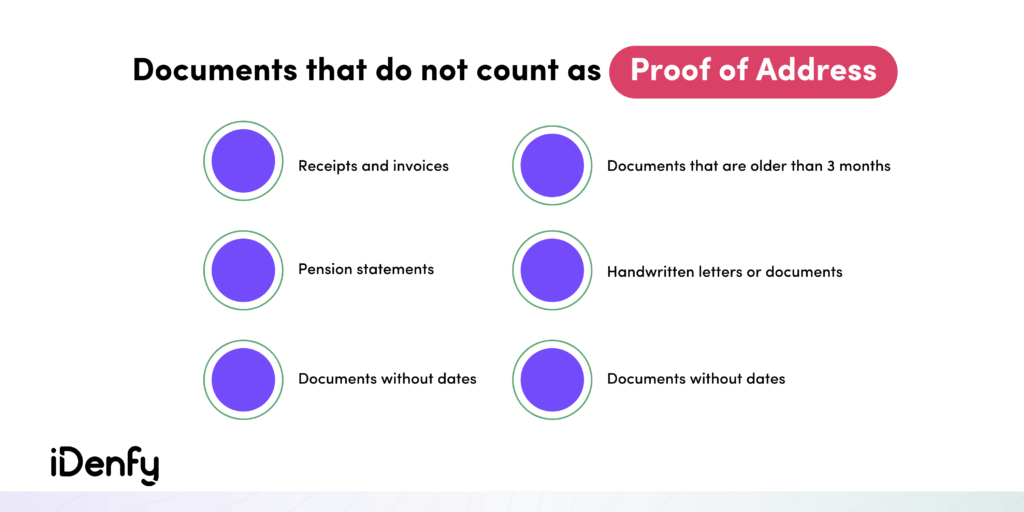

What is Not Accepted as a Document for Proof of Address?

Certain documents can’t be accepted as valid PoA because they don’t meet the criteria.

Some examples include:

- Handwritten notes and bills that are not approved by recognized authorities.

- IDs, driver’s licenses, and passports when provided alone (because they are used for identity verification and not address verification).

- Documents that are outdated and older than three or six months (depending on the PoA document type).

- PoA documents that are copied or scanned (original copies are typically acceptable).

➡️ Bear in mind that some jurisdictions do not allow using the same document for both identity and address verification.

What You Should Do if the Utility Bill isn’t in Your Name

If you’re a minor, a student, or have a partner who’s responsible for paying utility bills and don’t have any other valid PoA document that you can provide, you’ll need to:

- Request the utility bill provider to add your name to the bill.

- Use a family member’s PoA document (this is acceptable by some institutions only if you can provide extra documentation proving your relationship is legitimate).

Get another official document confirming your residency (a residency letter is usually acceptable, but it should be signed by your landlord, employer, or family member through a notary).

How Can You Verify Proof of Address Manually?

Specialists typically review all submitted proof of address documents manually to ensure accuracy. But it’s not as easy as it sounds since fraudsters tend to forge PoA documents, especially if they don’t have security markings.

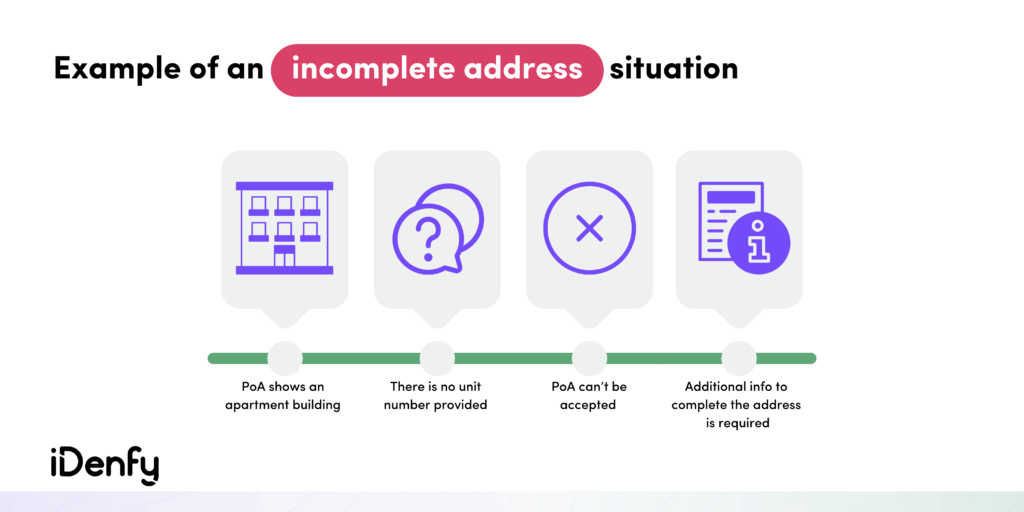

Here’s a standard example of reviewing a proof of address document:

- Step one. Inspect the PoA document’s issuing date and check if it’s valid.

- Step two. Check if the document contains the person’s name and surname.

- Step three. Look for common fraud patterns to detect fraudulent alterations. For more details, check our guide on how to spot fake documents.

- Step four. This is the most important part. Carefully examine the document’s address and authenticate its legitimacy using a search engine. If the client doesn’t provide full address data on their PoA document, they must specify it to complete their address.

iDenfy’s Automated Proof of Address Solution

As technology evolves, new services come into the market. Proof of address isn’t an exception. To speed up onboarding and simplify compliance, modern businesses tend to switch from complicated manual proof of address methods to swift automated Address Verification services.

So how does iDenfy verify proof of address? We explain it below.

1. Automated Address Verification

iDenfy’s in-house experts manually extract the address information from the identity document.

Here’s what the Address Verification flow looks like:

- The client uploads the document.

- iDenfy’s specialist manually extracts the address.

- The specialist compares the address with the partner’s provided address via API.

As the fourth step in the proof of address verification, our team can perform an additional Address Lookup procedure to validate the authenticity of the address.

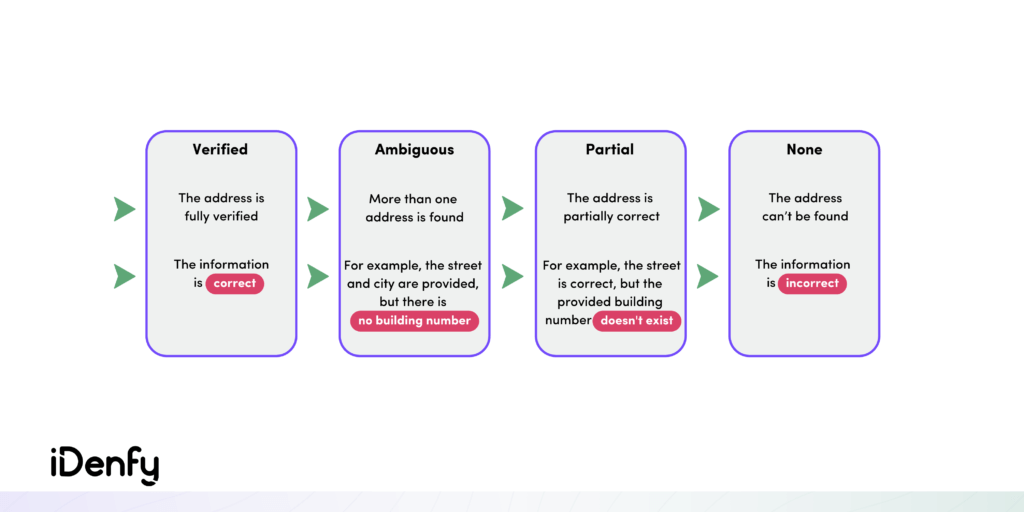

There are four possible Address Lookup outcomes: VERIFIED – AMBIGUOUS – PARTIAL – NONE.

As an optional step, iDenfy’s specialists can cross-check the address across databases to identify if the address is legitimate.

2. Direct Utility Provider Data Comparison

With the endless capabilities that technology brings us today, you can fake any proof of address document. To combat crime and prevent the misuse of fraudulent, photoshopped documents, iDenfy created a unique feature for proof of address verification.

To maximize security, you can customize the Address Verification flow and ask the user to connect to their utility provider. After the user connects to their utility provider, iDenfy’s team checks the document to ensure that it exists and captures their residential address.

3. Utility Bill Verification

This feature is particularly designed for smoother and faster utility bill verification, taking 20 seconds on average to approve the user’s address. With easy API integration, companies can avoid complex coding and quickly get AI-generated utility bill responses without needing to deal with complicated parameters.

The utility bill verification enables you to:

- Verify the user’s full name. This means collecting, extracting, and verifying personal information.

- Check the user’s address legitimacy. This includes different languages, symbols, and their comparison, ensuring accurate address data comparison and approval.

- Complete the PoA check. The final step means that you verify and confirm that the document isn’t older than three months. In this case, the selected utility bill is valid and can be accepted as a PoA document.

What’s more, this feature can be easily adjusted and added to your standard KYC flow, depending on the user’s risk profile. This is beneficial for use cases like:

- When you need extra address verification checks. This depends on the user’s profile and your operating industry. Our system can redirect the user to a new window where they’re asked to upload their proof of address (image or PDF), and you can merge the received results with the user’s general onboarding data.

- When you need to reverify existing users. This can be done in higher-risk scenarios when the user hasn’t been on their account for a longer period of time or before a large, atypical transaction.

- When you want to improve your fraud prevention system. This can be done depending on your internal risk assessment. For example, you might need to add transaction limits and request additional utility bill checks after the user has reached a certain transaction threshold.

Don’t hesitate. Book a free demo to get a hands-on experience with our address and utility bill verification tool.

This blog post was updated on the 8th of January, 2025, to match the latest insights.