So here’s the deal. Know Your Customer (KYC) and Anti-Money Laundering (AML) are similar terms, but they have distinct regulatory differences. KYC focuses on verifying customer identities, while AML covers broader efforts to detect and stop money laundering. Both regulations are designed to stop criminals from obtaining illicit funds and illegally disguising dirty money as legitimate income.

Like many compliance rules, KYC and AML laws require businesses to be familiar with the difference between the two compliance components and understand how they are connected in the whole regulatory process. Both KYC and AML are essential in fighting financial crime. However, each compliance process serves a distinct, and, at the same time, connected role within a bigger, more complex regulatory program used in industries like banking or e-commerce.

In brief:

- KYC refers to identity verification checks that businesses perform to guarantee their users are who they claim to be, especially before providing them with access to their network.

- AML refers to the set of policies and processes that companies take to prevent criminals from laundering money that comes from illicit activity. AML regulations were primarily created to prevent terrorist financing and money that comes from crimes like human trafficking.

In this guide, we’ll explain their key differences, how they work together in compliance programs, and best practices to stay KYC/AML-compliant.

What is KYC?

KYC, or Know Your Customer, is a verification process, which involves collecting personal data used for verifying a user’s identity during the onboarding process (when they first create the account). Otherwise, KYC checks can be repeated later on. For example, companies conduct identity verification in riskier scenarios, such as:

- When a customer makes a large transaction: AML regulations require financial institutions to proceed with KYC for security reasons.

- When a customer establishes a business relationship: For example, during the onboarding process or before opening a bank account.

- When a customer is flagged for suspicious activity: For instance, if they’re suspected of being linked to potential criminal activity, such as money laundering.

Identity verification or KYC compliance checks mean that a business is familiar with its customers and their financial transactions. The main goal of KYC is to help institutions gather sufficient information about their customers to assess risk, prevent fraud, and comply with regulations. Automatically, that makes KYC-compliant companies more aware of suspicious activity, helping them reduce severe risks, including being exploited for money laundering reasons.

➡️ A customer in KYC is considered to be either an individual or a business. Despite that, KYC for businesses has a separate term, corporate KYC, often called Know Your Business (KYB).

What is AML?

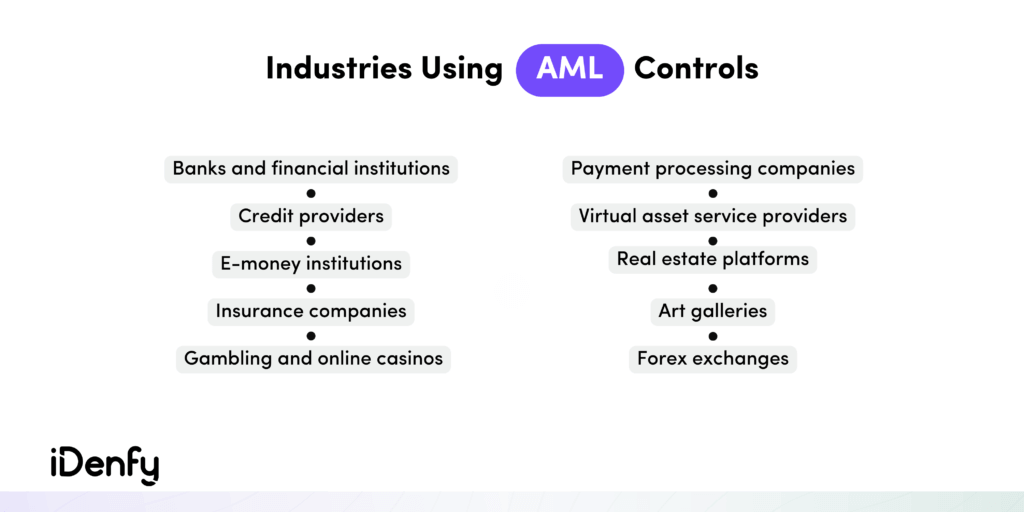

AML, or Anti-Money Laundering, refers to a set of measures companies must apply to protect themselves from money laundering. Common AML processes include screening against various AML databases to check if there are any matches. This helps identify risky customers, as they often require extra AML processes, such as ongoing monitoring using transaction monitoring or period screening of PEPs and sanctions lists, including screening against adverse media. For example, doing business with a sanctioned person or company is illegal in many countries; therefore, AML measures, particularly AML screening, help prevent such illicit practices.

AML compliance also requires financial companies and other regulated entities to develop their own AML program, which consists of several steps and related AML tasks. That said, AML program measures depend on particular jurisdictions. Banks, insurance businesses, gambling and online casino platforms, forex and crypto exchanges, art dealers, online real estate platforms, or insurance companies are all subject to AML compliance rules.

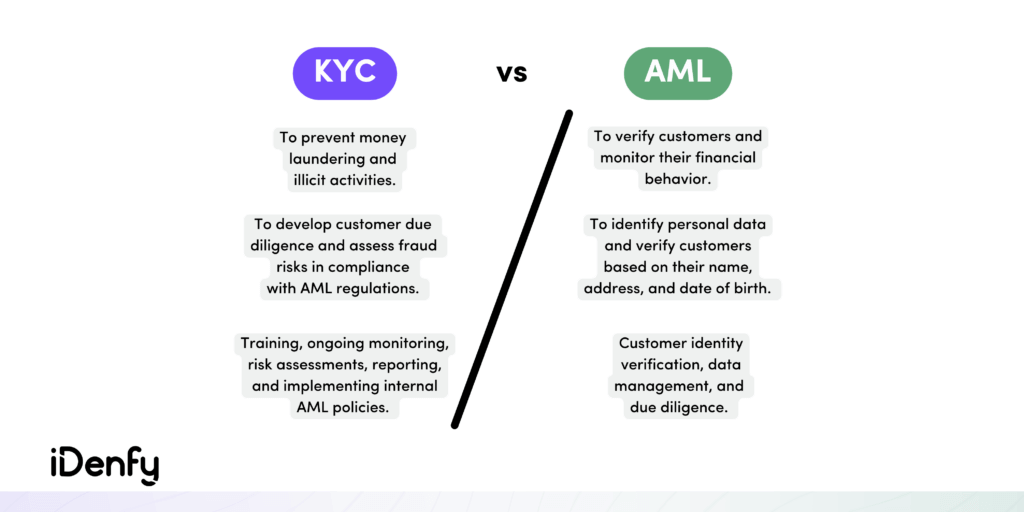

What is the Difference Between KYC and AML?

KYC and AML are separate compliance components. At the same time, they are closely linked processes that work together to protect the integrity of the overall financial system. Both KYC and AML help identify red flags and suspicious customers, which are or could potentially be linked to fraud.

The difference between KYC and AML is that KYC is only a fragment of a bigger AML compliance program:

- AML unites a wide range of processes related to preventing money laundering, including verifying customers’ identities or monitoring transactions for suspicious activity.

- KYC refers to customer identification, which is part of AML compliance designed to confirm a customer’s identity. Both regulations help companies prevent fraud.

The easiest way to distinguish the two is to see AML as a broader framework that includes KYC, along with other components like transaction monitoring and customer due diligence. Together, these elements form the complete AML process.

We look into each of these measures in more detail below:

➡️ The Process of KYC

KYC involves checking new customers who provide identity documents, such as a valid ID card, passport, or driver’s license.

It helps businesses understand who they’re interacting with better. Typically, after the company collects the customer’s identity data, this information is verified through third-party resources, such as credit bureaus or government records.

Once a customer finishes their identity verification procedure, the company can choose to keep the data for monitoring purposes in order to detect any potential fraudulent activity during other stages of the customer journey.

The user may also be asked to provide additional documents for security reasons. For example, AML compliance involves asking the user to provide proof of address (PoA). That’s why KYC overlaps with AML compliance and can get tricky for some.

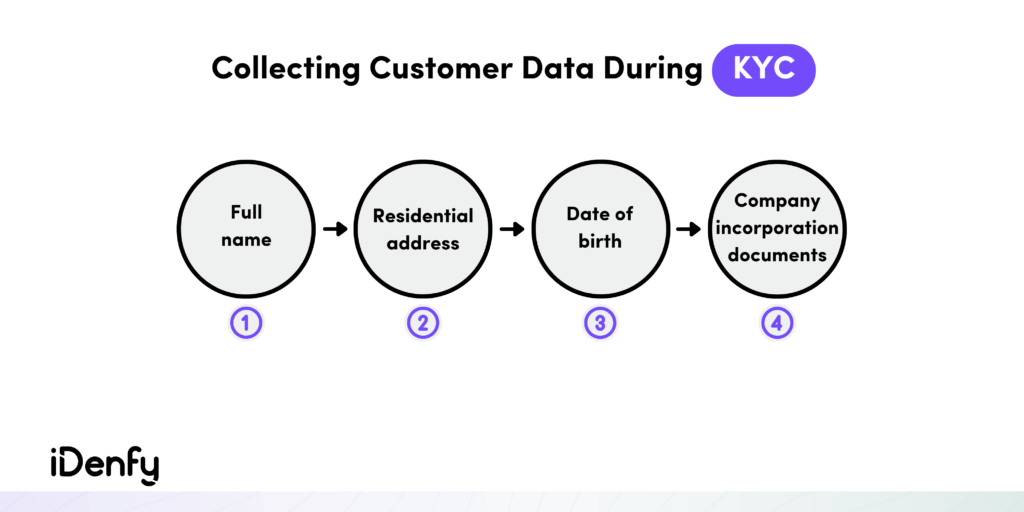

Usually, the KYC process involves:

- Verifying the user’s identity

- Screening the user against third-party databases

- Determining the customer’s risk profile

- Continuing with ongoing monitoring to prevent fraud

Note: As we go digital, even more sectors will most likely become obligated by KYC and AML compliance to enhance their security in the future. Although not mandatory for all industries, unregulated entities can benefit from integrating KYC for better overall protection of their data.

➡️ The Process of AML

AML refers to a set of laws, regulations, and procedures aimed at detecting and preventing the use of illicit funds within the financial system. This includes implementing internal controls, such as transaction monitoring, and reporting suspicious activity to regulatory authorities. By actively using AML measures and monitoring customers for potential fraud and illegal activities, companies can minimize the chances of illegal transactions. This helps financial institutions prevent financial crime and avoid sanctions or fines.

The Financial Action Task Force (FATF) has issued global standards helping businesses shape their AML compliance measures. In most jurisdictions, AML laws require companies to create and integrate their own AML program tailored to specific risk factors that their business presents. A company’s AML program describes the practical AML screening and monitoring process. It’s worth mentioning that AML legislation may change depending on the trends.

What Are the Main Components of an AML Program?

Companies typically build their AML programs based on the five main AML pillars. Here are the key steps that a successful program must follow:

Step one: Designate a compliance officer

Step two: Educate and train employees

Step three: Develop internal policies

Step four: Ensure independent testing and auditing

Step five: Perform in-depth risk assessment and ongoing due diligence

To comply with AML regulations, it’s important not to miss any of the mentioned steps. The fifth pillar, in particular, suggests companies regularly conduct watchlists and sanctions screening on individuals. This component of the AML program helps verify if they are not linked with any lists of people who should not be served. Naturally, that’s why continuous monitoring is also essential to maintain compliance with AML regulations.

What Are the Three Main Components of a KYC Program?

Like AML compliance, KYC verification programs vary, depending on the business and the jurisdiction. Some examples:

🇬🇧 UK: The Money Laundering, Terrorist Financing and Transfer of Funds Regulations.

🇺🇸 US: Bank Secrecy Act (BSA) and the USA PATRIOT Act, along with local laws, such as the California Consumer Privacy Act (CCPA).

Usually, building a successful KYC program involves three main processes that complete an effective risk-based approach, helping companies prevent fraud and money laundering:

1. Customer Identification Program (CIP)

Customer Identification Program (CIP) is the part where an entity needs to ensure a customer is who they say they are. There are many ways and layers to identity verification:

- The higher the risk, the more security measures you’ll need.

- The minimum requirements are to collect the individual’s name, address, date of birth, and identification number.

However, you can not only request the customer to provide an onboarding selfie but also check other information, such as their IP address.

Note: At iDenfy, we have a separate AI-powered tool to assess customer risk scores via customer risk assessment.

2. Customer Due Diligence (CDD)

While KYC helps companies understand the level of money laundering risks by verifying customers’ identities, standard Customer Due Diligence (CDD) measures guide businesses to take a risk-based approach to AML. That means businesses need to follow due diligence to assess customer risk levels, as FATF recommends.

If the customer is low-risk, businesses must follow standard CDD measures. They include:

- Identifying and verifying customers’ identities

- Identifying and verifying beneficial owners (anyone who owns 25% or more)

- Conducting ongoing due diligence and developing risk profiles

- Continuously monitoring customers and their transactions

Types of Customer Due Diligence

Depending on the risk level of each customer, you can choose the type of CDD:

➡️ Simplified due diligence (SDD): When there’s a low risk of fraud, money laundering, or terrorism. For example, if a customer opens a savings account with a small balance, the bank may choose to apply SDD.

➡️ Basic due diligence (BDD): When the entity must collect and verify basic information to decrease risk. For example, when a business deals with a new customer, it applies BDD to verify their identity and assess the risk associated with the customer.

➡️ Enhanced due diligence (EDD): When the business needs to gather additional data for higher-risk individuals, such as Politically Exposed Persons (PEPs). For example, businesses must apply EDD when dealing with high-value transactions, which indicates a higher risk of money laundering or terrorist financing. This could involve additionally verifying the source of funds.

It is important to remember that customer due diligence is a flexible approach that allows organizations to tailor their measures to the specific risk associated with the customer or transaction. If you detect a user as a higher risk during the identity verification process, you can simply tailor the KYC flow and add additional security checks.

Related: What is the Difference Between CDD and EDD?

3. Continuous Monitoring

To ensure KYC and AML compliance, organizations must monitor account activity throughout the whole business relationship. That said, continuous monitoring is the last yet most important component of any effective KYC program.

Monitoring customers, screening their transactions, and reporting suspicious activity are a must to stay compliant.

Watch out for the following red flags:

- Unusual transactions. Such as a large cash deposit or a series of transactions that are outside the customer’s normal behavior.

- Suspicious behavior. Such as frequent withdrawals of atypically large amounts or transactions in high-risk areas known for potential money laundering.

- Unverifiable information. Such as submitting false information, fake identity documents, or being unable to provide proof of source of income.

- Sanctions and embargoes. Such as identifying a transaction involving a sanctioned or embargoed entity, including new additions on PEP, adverse media, and sanctions lists.

Note: Ignoring these red flags and failure to report suspicious activity can result in penalties and legal consequences. The specifics depend on the entity’s risk assessment and the regulatory requirements in their jurisdiction.

Why is it Essential to Follow KYC and AML Regulations?

Abiding by KYC and AML regulations is critical for companies to protect themselves and their customers, build trust and avoid legal penalties.

Verifying customers’ identities prevents identity theft and ensures that your business is working with legitimate individuals, along with these benefits:

- Reducing reputational risks

- Enhancing operational efficiency

- Ensuring accurate customer data

- Guaranteeing effective fraud prevention

The legal importance of regulatory compliance enables organizations to actually know the difference between KYC and AML and, naturally, help build effective compliance programs.

Improving KYC/AML Compliance With Automation

To maintain effective KYC/AML compliance, businesses should adopt a risk-based approach tailored to their specific industry and customer base. However, this is a very complex task without automated software. Automation and AI-powered tools like iDenfy’s AML platform help collect, verify and assess customer information more accurately. This involves conducting fully automated KYC checks, such as ID document verification, biometric verification, database verification, and, at the same time, applying ongoing due diligence measures, such as ongoing AML screening and monitoring, to help keep up with evolving customer risk profiles and changing regulations.

However, it’s no secret that AML and KYC checks can add friction when onboarding new customers. Nobody wants to wait in line for hours when completing a simple identity verification process, especially now that more businesses are going digital. iDenfy offers both KYC and AML compliance tools under one platform, helping businesses lower KYC operating costs while improving overall customer experience. With iDenfy, you can customize your identity verification flow, add AML checks, and verify plus screen your customers in seconds. We cover all industries, including crypto, real estate, fintech, gaming, etc.

Additionally, we have an internal KYC specialist team to double-check each verification result in real-time. Apart from automated KYC and AML tools, we offer Business Verification (KYB) and Address Verification (PoA) checks – all fully automated and tailored to your brand’s needs.

Read our case studies to see how our AI-powered fraud prevention tools perform in numbers. Have any questions? Book a free demo to see our KYC/AML software in action.