Throughout the years, governments and institutions have tried to reduce corruption, fraud, and other illegal and immoral activities globally. It would be tough to find a country with little to no regulations on financial institutions. Anti-Money Laundering (AML), Know Your Customer (KYC), and Know Your Business (KYB) guidelines are expanding each year in an attempt to fight various acts of money laundering, fraud, and terrorist financing.

PPEP screening has become one of the branches of KYC guidelines, requiring institutions to perform enhanced Customer Due Diligence (CDD) procedures on people who are PEPs.

The significance of identifying PEPs lies in their potential risks regarding money laundering, bribery, and corruption. Due to their influential positions, PEPs may have access to public funds and be susceptible to engaging in illicit financial activities. Their involvement in corruption schemes can result in the misappropriation of public funds, undermining economic stability and hindering the development of democratic institutions.

To properly screen a person, companies have to check the relevant information in two ways:

- Sanctions – to ensure the individual is not allowed to make transactions if she or he is on global law enforcement or a sanction list. Here are the main sanctions databases: United Kingdom – HM Treasury Consolidated, United Nations – Consolidated sanctions list, European Union – Consolidated list of sanctions, United States – The Office of Foreign Assets Control (“OFAC”, “OFAC Non-SDN”, “OFAC SDN”), International Organization of Securities Commissions (IOSCO)

- PEP screening – to assess whether the person is a PEP and to conduct CDD processes correctly.

It’s important to note that the watch lists are continuously updated. Therefore, a thorough screening must be done in real-time and based on the latest databases to comply with KYC and AML regulations.

What is PEP Screening?

Politically exposed persons or PEP screening is a crucial process that helps prevent financial institutions (FI) from becoming involved with illicit financial activities. PEPs are individuals with significant political influence, such as government officials or their family members.

PEP screening aims to verify individuals against PEP databases and sanction lists to detect any potential risks. This way, financial institutions can proactively recognize and address risks, ensuring adherence to regulatory requirements. That’s why PEP screening is crucial to KYC/AML compliance operations.

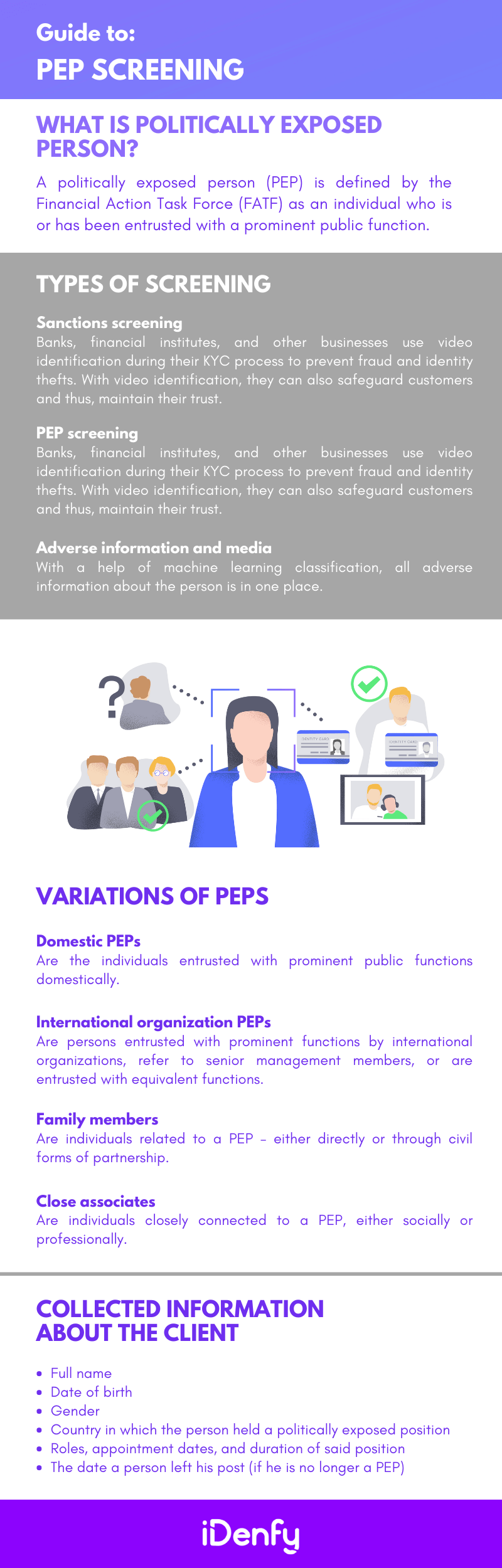

What is a Politically Exposed Person (PEP)?

A Politically Exposed Person (PEP) refers to a person who holds a prominent public position or has a significant role in a government, either currently or within the last few years.

These positions could include heads of state, high-ranking government officials, senior politicians, military officers, and leaders of state-owned enterprises.

An independent inter-governmental body responsible for the development of policies to fight money laundering and terrorist financing – The Financial Action Task Force (FATF) – defines the term in the FATF recommendation 12 this way:

“A politically exposed person (PEP) is defined by the Financial Action Task Force (FATF) as an individual who is or has been entrusted with a prominent public function. Due to their position and influence, it is recognized that many PEPs are in positions that potentially can be abused for the purpose of committing money laundering (ML) offenses and related predicate offenses, including corruption and bribery, as well as conducting activity related to terrorist financing (TF).”

It’s not enough for PEPs to be monitored more carefully. Family members, siblings, and partners of PEPs should also be involved in the PEP screening processes.

Related: PEPs and Sanctions Checks Explained

What are the Main Types of PEPs?

Practical and broad as it is, the definition of PEP requires some clarity to distinguish various entities from one another. For this reason, FATF defines different categories that the term PEP encompasses:

- Foreign PEPs are individuals entrusted with prominent public functions by a foreign country.

- Domestic PEPs are the individuals entrusted with prominent public functions domestically.

- International organization PEPs are persons entrusted with prominent functions by international organizations, refer to senior management members, or are entrusted with equivalent functions.

- Family members are individuals related to a PEP – either directly or through civil forms of partnership.

- Close associates are individuals closely connected to a PEP, either socially or professionally.

It’s important to note that both individuals who are currently entrusted with prominent public functions and those no longer holding such a position should be marked when PEP screening is performed. The same can be said about people related to or associated with them.

Depending on which of the categories an individual falls under, different measures should be taken in response. For example, the enchanted risk mitigation measures should be applied whenever dealing with a foreign PEP. At the same time, these measures should only be used when establishing a higher-risk business relationship in the case of domestic or international organization PEPs.

Related: Domestic PEPs and Foreign PEPs — What You Need to Know

Why is PEP Screening Important for Businesses?

Detecting PEPs is important for businesses because it helps manage risks tied to their positions. Given their influential roles in government or international organizations, PEPs may have access to public funds and wield significant power, making it important to assess and address associated risks. Consequently, financial institutions and other regulated businesses must exercise enhanced due diligence (EDD) when dealing with PEPs.

Regulators, such as anti-money laundering authorities and central banks, often require banks, insurance companies, and other financial entities to have robust systems in place to detect and manage the risks associated with PEPs. In general, identifying the PEP status and following with EDD measures are crucial to prevent money laundering, terrorist financing, and other illicit activities.

It is important to note that being a PEP does not imply involvement in illegal activities. The designation indicates potential risk, necessitating a higher level of scrutiny to protect the integrity of financial systems and prevent abuse.

The goal is to strike a balance between preventing financial crimes and avoiding undue discrimination against individuals based solely on their political connections.

Here are other reasons explaining why PEP screening is important for businesses:

1. Minimizes Corruption

Understanding the concept of Politically Exposed Persons is crucial in the fight against financial crimes and corruption. By implementing enhanced due diligence measures, financial institutions can contribute to maintaining transparency, integrity, and stability in the global financial system.

We all want to live in an orderly world, and there’s nothing like corrupt politicians, agencies, or government entities to get our blood boiling. The company’s reputation may be irreversibly damaged if it’s found to be responsible for doing business with unreliable entities – and no amount of promises or apologies will help if the public loses its trust in it.

2. Helps Companies Stay Compliant

PEP screening is currently mandatory in most countries worldwide. The regulations differ from country to country – some only require identifying Foreign PEPs, while the strictest obligations require screening Domestic, Foreign, and International PEPs. Only a handful of countries impose no obligations on their residents to identify PEPs – and they likely will in the future.

The companies’ reputations are not the only things on the line – failure to adhere to the regulations puts them at risk of being fined. Between 2008 and 2018, $27 billion was levied in fines against financial institutions for sanctions violations globally.

Automation and Technology in the Process of PEP Screening

Traditional manual PEP checks are time-intensive and susceptible to human error, putting companies at risk of regulatory violations and reputational damage. To make the PEP screening process more accurate and less time-consuming, more businesses use automation and technology, which, in general, are automated PEP screening solutions powered by AI and ML.

Here are some examples where automated solutions are beneficial for businesses in terms of AML compliance:

1. Automated Sanctions Screening

Sanctions play a pivotal role in preventing financial crimes and are widely employed as both a political tool and a business security measure. Companies use sanctions checks to shield themselves from association with sanctioned entities, mitigating the risk of non-compliance fines and preserving their reputation. Automated sanctions screening solutions offer integrated sanctions technology, which consolidates information from diverse and reliable global sources, including governments, regulators, and credit agencies.

For this reason, it’s vital for businesses to conduct both PEP and sanctions checks to minimize the likelihood of involvement with high-risk individuals or entities. This approach ensures the maintenance of a robust due diligence process, enhancing overall risk management.

2. Streamlined Adverse Media Checks

Adverse media screening is a crucial element within the PEP screening process, which is designed to uncover any negative news linked to individuals. Through this process, businesses can identify risks and manage potential threats to their reputation. Continuous monitoring of news sources is necessary for companies to stay informed about any negative information concerning their existing or prospective clients.

Automated adverse media solutions use such real-time monitoring of many global news media sources, ensuring the swift identification of arrests, court cases, and other potentially negative activities. That’s why streamlined screening and monitoring solutions can enhance the quality, efficiency, and speed of adverse media checks, thereby strengthening the overall effectiveness of the company’s AML compliance program.

Related: What is Adverse Media Screening?

3. Identity Verification for Automated Customer Onboarding

The onboarding process comprises necessary procedures for verifying a customer’s identity and assessing their risk level. This involves incorporating thorough sanctions data encompassing PEPs and associated entities. Through the integration of identity verification into their AML screening procedures, businesses can verify the authenticity of customer identities, confirming the accuracy of provided data to ensure the rightful owner is identified.

These procedures must be completed before granting the new customer access to any product or service. Verification involves confirming the accuracy of the provided data to ensure the rightful owner is identified, aligning with AML requirements. This automated PEP and identity verification approach facilitates real-time updates, grants access to comprehensive data, and ensures dependable customer verification. This empowers institutions to identify PEPs and effectively mitigate the risks linked to financial crime.

Related: Top 3 KYC Automation Benefits for Businesses

What Data is Required for Effective PEP Screening?

For PEP screening to be effective, financial institutions must collect and verify this data about their potential clients:

- Full name

- Date of birth

- Gender

- Country in which the person held a politically exposed position

- Roles, appointment dates, and duration of said position

- The date a person left his post (if he is no longer a PEP)

Along with PEPs, financial institutions often conduct checks against adverse media sources and sanctions lists to identify any negative associations or legal restrictions linked to the PEP. This includes searching news articles, reports, and official sanction lists to assess whether the PEP has been involved in any illicit activity.

What are the Challenges of PEP Screening?

Now that the importance of complying with governmental regulations are established let’s move on to the challenges.

Screening customers against various sanctions and regulatory lists is a costly and time-consuming task if done manually. Even then, there’s a risk of false positives, tampering with the experience of customers unnecessarily flagged, and missing the real positives, making companies susceptible to fines due to negligence.

Other challenges that companies face when screening PEPs involve:

1. Evolving PEP Profiles

PEPs can change their political positions, affiliations, or roles over time. New PEPs can emerge, while others may no longer hold positions that warrant their designation as PEPs. Keeping track of these changes and updates requires continuous monitoring and timely data updates to maintain the effectiveness of the screening process.

2. Cross-Border Complexity

Financial institutions operating globally encounter the challenge of dealing with PEPs from various countries with different regulatory frameworks. Understanding and complying with the diverse regulatory requirements for PEP screening in different jurisdictions can be complex and resource-intensive.

3. Data Privacy and Compliance

PEP screening involves handling sensitive personal information, which requires strict adherence to data protection and privacy regulations. Financial institutions must ensure that the collection, storage, and processing of personal data comply with applicable laws while maintaining the necessary security measures to protect against data breaches or unauthorized access.

How iDenfy Helps Solve the Challenges Related to PEP Screening

Addressing these challenges requires a combination of technological solutions, expertise in compliance and risk management, and a commitment to ongoing monitoring and improvement.

Financial institutions must continually enhance their PEP screening capabilities to effectively mitigate the risks associated with Politically Exposed Persons.

An automated identity verification system powered by AI is the solution iDenfy can offer its clients. Among other features, iDenfy allows its partners to meet KYC and AML regulations and directives – including PEP screening. It supports more than 2000 documents from 200+ countries and extracts relevant identity information in just 0.02 seconds.

For enhanced due diligence, iDenfy offers AML database monitoring, which means that in the event of a person’s PEP status changes during the year. iDenfy will flag this and show which actual PEP, sanctions, or other law enforcement database was triggered.

Get started today!