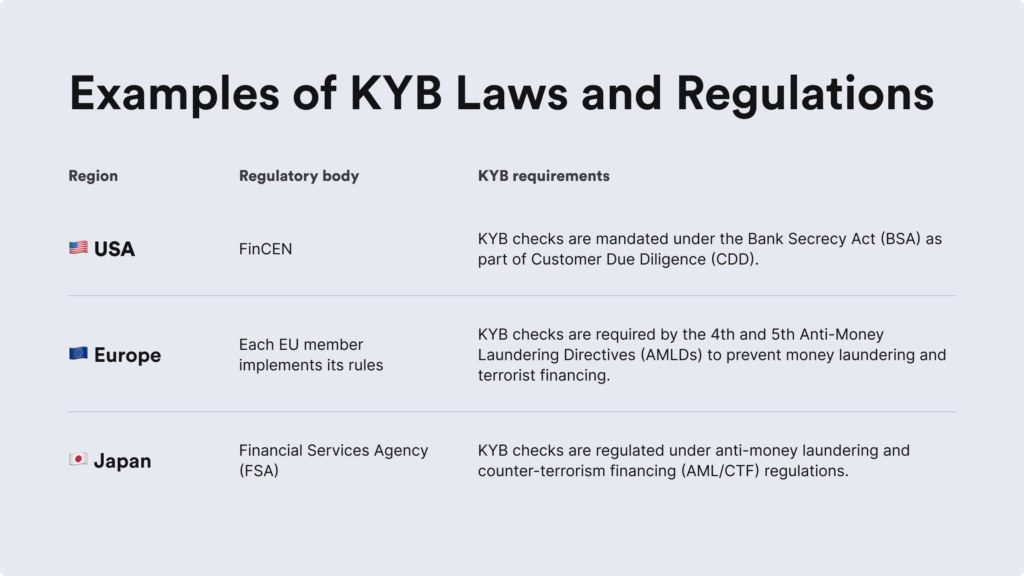

Know Your Business (KYB) compliance can be a complex task for businesses that operate internationally. That’s because global KYB compliance regulations have multiple levels. Once you peel one, another one appears, depending on the customer, partner, distributor, or entity that you’re verifying. So, it all boils down to the jurisdiction and the type of legal entity.

For example, if the company’s management has Politically Exposed Persons (PEPs), you’ll require additional due diligence procedures, such as verifying the source of funds. Additionally, if you want to enter a new marker, the same rules won’t apply when trying to apply the existing KYB framework in a new country.

That’s why global KYB compliance requires consistency and adaptability, both of which should be considered when determining your company’s risk tolerance, client expectations, and, more importantly, both international and local compliance requirements.

We’ll discuss these nuances in this blog post.

Why a KYB Process Without Automation Ends Up Ineffective

KYB compliance itself is complex. That’s because the regulatory environment is always evolving. Many businesses operate on a global level, which makes it difficult to navigate through different jurisdictions and different requirements. Many companies prioritize KYC compliance while neglecting KYB. As a result, they have streamlined their KYC processes but left KYB operations outdated, relying on large data sets and manual searches.

In a traditional KYB process that isn’t backed with automation, compliance teams are responsible for manually collecting, verifying, and storing large amounts of data from various sources.

This is what a manual KYB process looks like:

🔴 Requires Collecting Extensive Company Data

This involves gathering information like the company’s name, address, and business registration number. The company can either set up some sort of form or exchange PDF files through email to receive the data and confirm its legitimacy with the other company that’s being verified.

Related: e-KYB Explained — A Comprehensive Business Verification Guide

🔴 Needs Accurate Beneficial Owner Identification

The company looks for beneficial ownership information, which means they are required to contact the other businesses and ask them to provide its ownership information. Sometimes, this can be achieved by manually searching for such data online. Once that’s done, the company will use this data for beneficial ownership identification and in-house KYC checks or use a third-party provider.

🔴 Involves Manual Verification and Important Decision-Making

In this stage, the responsible company conducting the KYB check verifies the collected information about the other business. Without automated software, this step is often completed through standard Google searches by manually entering data and cross-checking its legitimacy.

This is important because the company makes the final decision whether it wants to onboard the other company and accept it or decline its partnership. Either way, without automated KYC, the decision is communicated through an email or a simple phone call.

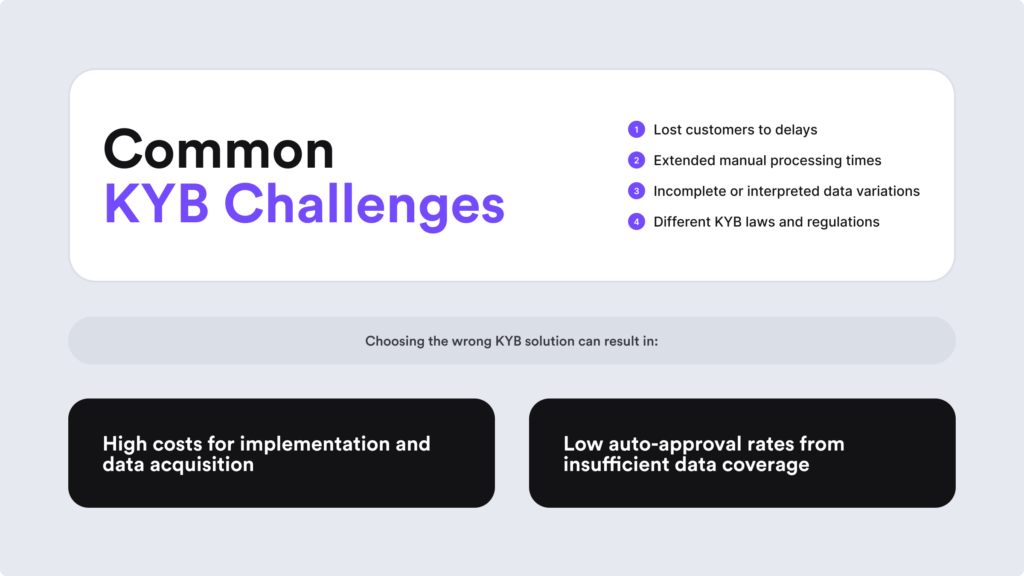

What are the Biggest Challenges in Global KYB Compliance?

One of the key challenges in KYB verification and the global markets it comes with is the general justification for why you need to collect personal information from your partners. KYB means asking for the other company and related persons for their data and ID documents. However, when explained properly or done through third-party custom KYB forms, it’s easier to understand why you’re asking for specific data and how you’ll use it.

Other common challenges companies face in global KYB compliance include:

1. Managing Different Regulatory Rules Across Jurisdictions

Even though regulations are easy to research, some companies don’t have the time or resources to hire internal legal teams. This adds complexity to the constantly changing regulatory environment. Consequently, staying compliant requires continuous monitoring and quick adaptation of compliance processes across different markets, especially if you’re operating a global business.

➡️ To manage KYB compliance processes more effectively, you should:

- Conduct ongoing monitoring of clients to detect any changes in their risk profiles. Managing risks in real-time is always a better option than dealing with non-compliance penalties.

- Expect different markets to eventually meet stricter regulations despite their current status in the regulatory landscape.

- Focus on already established compliance regulations to build a baseline around your internal KYB procedures.

- If you want to expand quicker, choose a KYB service provider that’s centralized and global and knows how to juggle both international and local laws.

This is vital because regulatory bodies frequently update KYB, KYC, and AML requirements to address new risks, for example, such as the new DAC7 regulation for online marketplaces. This is necessary because AI and other sophisticated tools are making crime harder to identify, adding at least a slight level of uncertainty to companies that are obliged to stick to strict regulatory standards.

2. Identifying and Verifying Ultimate Beneficial Owners (UBOs)

Identifying and screening ultimate beneficial owners (UBOs) is challenging because some companies have layered and hidden ownership structures. Since beneficial owners are individuals who ultimately own or control a company, transparency in this step of the KYB process is very important for preventing crime.

➡️ To identify and verify complex beneficial ownership structures, you should:

- Conduct proper investigations beyond primary checks. That means scrutinizing the company’s structures and identifying the true individuals behind the business.

- Be diligent and use external resources. This includes various databases, such as publicly available registers (for example, the UK’s People with Significant Control (PSC) and other sources provided by your clients to approve ownership claims.

- Cross-reference the collected data. This is vital in order to ensure accuracy and avoid accepting incomplete information or verifying misleading ownership details.

The opacity of beneficial ownership can complicate the KYB process. Often, companies need to sit down and unfold layers of subsidiaries. That means compliance teams need to break down those structures to see who owns and is truly in control of the company. Some bad actors also use intricate corporate structures to hide their identities by building shell companies and using them for money laundering.

3. Juggling Inconsistent Registries and Varying Formats

Compliance teams can struggle when it comes to verifying the accuracy and reliability of data stored in separate systems. For example, there’s the challenge of assessing documents in different languages. Especially for those businesses that want to scale faster, sometimes checking ten different markets can take a while since there’s no single business register with all the needed information in one space unless the company uses a global KYB software that carries them all.

➡️ This is what you need to keep in mind when dealing with registries and different formats:

- Not all countries have UBO registries. That’s because database verification only works if the database exists and is accessible.

- There’s no unified database. Different existing and accessible registries might not have the complete information necessary for the verification.

- Complex integration process. Businesses that operate in different countries will need to check different databases or UBO registries. This makes the whole process more costly and time-consuming.

So, querying authoritative databases to confirm details is challenging because most compliance teams encounter a lack of consistent data. This happens due to differences in varying datasets and formats. For example, ownership structure and business owner’s names can be completely different from the names you encounter in your home country due to differences in word structures and characters.

Steps for Effective Global KYB Process Management and Scaling

By ensuring a robust KYB process that aligns with global and local regulations, your company shows commitment to effective risk management. However, in practice, this requires multiple steps, such as choosing the right KYB automation tools and understanding industry-specific nuances tailored to your business model and operating markets that require different levels of scrutiny.

Here are the key steps and factors that are vital for an effective KYB process:

🟢 Implementing a Global, AI-Powered KYB Solution

AI-powered solution means having software that helps automate different KYB processes. This is the primary step and the key tool for your compliance team. A proper, simple-to-use dashboard eliminates the pain points associated with manually cross-checking data registries or conducting AML screening and verifying beneficial ownership details.

The most important benefits that automated KYB solutions bring are:

- Higher conversion rates. Since the onboarding process is optimized and fully streamlined, business customers can fill out special onboarding forms and get onboarded in a few hours instead of waiting for days.

- Improved scalability. Using automated KYB software, compliance teams can perform accurate data analysis, download generated government reports, and automate other repetitive tasks, creating more opportunities for the company to scale and onboard more customers.

- Better problem-solving for edge cases. Relying on a third-party KYB solution provider means that companies can work with experienced compliance specialists who already know some of the cases most companies deal with when conducting KYB checks. This helps overcome challenges and solve issues more efficiently.

Of course, another important point to consider is the experience of your business clients who are being onboarded. With automation and its capabilities, such as customized KYB workflows for different clients depending on their risk scores, you can adjust the process, add extra steps, and decide whether to onboard high-risk entities.

Factors to Consider When Choosing a KYB Vendor

You should integrate a KYB solution that automates three key KYB processes: data collection, verification, as well as screening and monitoring. A robust automation solution will help ensure a faster onboarding of new business clients.

When selecting a KYB service provider, consider these factors:

- Proper fraud detection capabilities. This is for actually helping you identify and spot any red flags, bad actors with false claims, and suspicious patterns.

- Smooth and automated operations. This aspect is vital for compliance audits and overall everyday operations in order to ensure consistent results and data logs.

- Increased conversion opportunities. A swift and simple user experience means that the KYB automation tool will help you minimize the time between data submission and approval.

- Ensured compliance and global coverage. Your KYB service provider should cover all markets that you operate in and adapt to each country’s regulatory landscape.

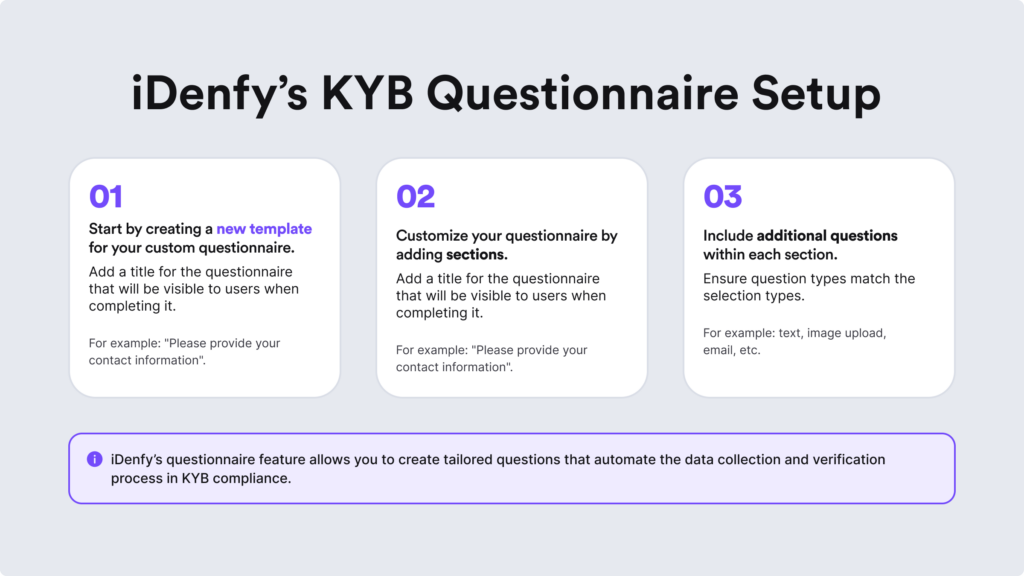

For example, iDenfy’s questionnaire feature in the KYB dashboard enables companies to automatically gather company incorporation documents, financial data, or contact information.

This global KYB solution is designed for more efficient corporate client onboarding and includes:

- Creating conditional questions that appear only when specific answers are selected.

- Dividing the questionnaire into sections, each focused on collecting specific types of data, with mandatory questions clearly marked.

- Using custom forms tailored to different use cases, such as gathering information on customers’ business relationships with partners, financial data, such as annual turnover, as well as information about related persons like UBOs, and more.

Related: 6 Steps to Conduct a Know Your Business (KYB) Verification Check

🟢 Ensuring Internal Staff Training

The company’s compliance team is often considered the first line of defense regarding preventing and detecting financial crime. To ensure the company’s team is up-to-date with the latest KYB requirements and can perform seamless KYB checks, companies conduct regular training sessions.

This is also part of mandatory AML programs. Focused AML training allows the organization to identify suitable roles based on employees’ strengths. For example, an employee skilled at spotting AMLred flags can be responsible for transaction monitoring. Similarly, KYB training enhances employees’ knowledge of money laundering and the measures needed to combat it.

Apart from learning national and global KYB processes, KYB training usually covers:

- Internal policies to prevent financial crime.

- Procedures to assess beneficial ownership.

- How to escalate and report suspicious activity.

- Patterns that show potential forgery in clients’ documents.

- How to identify red flags based on the firm’s risk assessment.

🟢 Adopting a Risk-Based Approach

A risk-based KYB process helps companies allocate resources efficiently by focusing on higher-risk entities. This is vital, as not all business clients carry the same level of risk. Corporate environments are changing. At the same time, risks associated with business relationships change over time as well.

Implementing a risk-based approach in global KYB compliance also enables businesses to mitigate potential risks more effectively. Companies that want to build robust risk assessment strategies should follow these steps:

- Use a customer risk assessment tool. It will automatically categorize clients by risk level based on specific channel groups, such as geography, business product type, ownership structure, or other custom risk categories. Most solutions, including iDenfy, provide custom frameworks that allow for assessing risks more accurately while saving time and manual effort that’s often a hassle for the internal analyst team.

- Apply appropriate KYB measures. This ensures that low-risk clients undergo basic due diligence checks and that high-risk clients face more stringent verification and monitoring measures while maintaining a balanced end-user experience.

- Continuously update your risk assessment. Since legal issues can arise and circumstances change based on new information, performing audits and adapting your risk management strategy is vital to upholding reputation with regulators, clients, and partners.

You should ask yourself, what are the risks if I don’t collect this information? What products am I offering? What geography am I operating in? What risks emerge from offering my product or services in this geographic area? The risk-based approach helps you answer these questions in various international KYB processes.

Related: What is the Difference Between CDD and EDD?

10 Steps that iDenfy’s Global KYB Solution Automates

Our expertise in RegTech and KYB onboarding solutions can help you streamline your KYB compliance operations, including tasks like:

- Verifying legal name and registration status.

- Checking registration documents and licenses.

- Identifying and verifying UBOs.

- Verifying their share percentages and relationships.

- Assessing the type of business activities.

- Understanding the industry sector and the specific risks.

- Analyzing financial statements and automatically downloading PDF reports.

- Evaluating financial stability and performance.

- Screening against adverse media, sanction lists, watchlists, and PEP databases.

- Conducting ongoing monitoring of all business relationships with corporate customers.

In a single KYB dashboard, you can verify clients, create custom questionnaires, use templates and forms to easily collect data, apply automated risk scoring for robust risk management, and more.

Book a free demo for a hands-on experience.