Business verification has become a vital process for companies to avoid getting tangled with high-risk entities. With the right technology and automation, ensuring Know Your Business (KYB) compliance is possible without causing delays for customers. This is where e-KYB, or Electronic Know Your Business comes into play — a key component of the company’s Anti-Money Laundering (AML) program.

e-KYB helps businesses answer fundamental questions regarding their business relationships, including solving security challenges. For example, it can help businesses determine whether a potential partner is reputable and dependable and identify legitimate transactions by breaking down the true owners of the business.

In simpler terms, e-KYB processes assist companies in identifying their customers and understanding their financial activities. But what specific steps must companies take, and how can they prevent losses from fraud and non-compliance? We’ll address these and other key questions below.

What is e-KYB?

Electronic Know Your Business (e-KYB) is an advanced method for corporate identity verification, helping companies to comply with AML and Counter-Terrorism Financing (CTF) regulations. e-KYB is designed to verify the companies you are interested in or currently involved with, whether they are customers or service providers, along with the individuals associated with those companies.

e-KYB helps businesses achieve these process goals:

- Verify if a person’s position allows them to represent a company

- Confirm a person’s ownership stake in a company

- Verify a company’s financial information

- Validate company documents to reduce business risks

e-KYB also serves as an electronic alternative to traditional KYB methods. That’s whye-KYB solutions help streamline various tasks such as data gathering, verification, and risk assessment to ensure compliance with regulatory requirements and to enable informed decisions when onboarding new corporate clients.

How Does e-KYB Work?

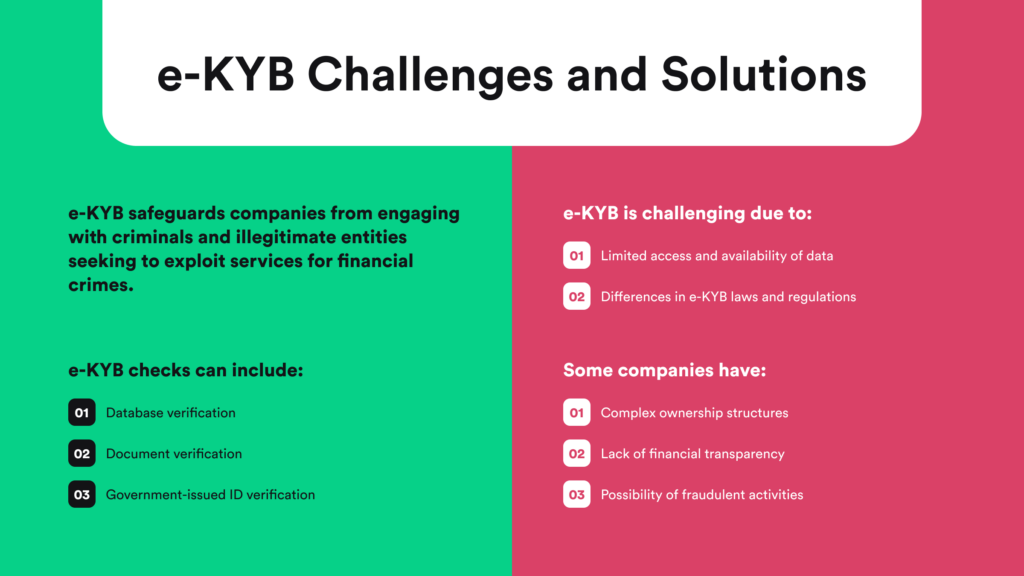

e-KYB works by identifying companies and avoiding partnering with high-risk entities. To achieve this, organizations use e-KYB to check whether the corporate entities they engage with are legitimate businesses or shell companies. Although shell corporations aren’t automatically all fraudulent, they are typically assessed with caution in mind.

As a result, e-KYB helps detect fraudulent shell companies and illicit companies in general by breaking down another company’s ownership structure, conducting proper due diligence, and ensuring that the entity isn’t engaged in financial crime.

Due diligence involves assessing customer risk to gain insight into potential business partners. The CDD Final Rule mandates that financial institutions identify and verify the identity of ultimate beneficial owners (UBOs). That’s why it’s essential to verify both the company and its beneficial owners — the individuals who profit from the company — to stay compliant with KYB regulations.

Examples of KYB Regulations for the e-KYB Process

Here are the key regulatory compliance laws that businesses should follow when building their e-KYB procedures:

- The Bank Secrecy Act (BSA)

- Anti-Money Laundering Directives (AMLDs)

- The CDD Final Rule

In general, to comply with AML/CTF regulations, companies must establish the identity of their corporate/individual customers and understand their financial activities, which means they have to conduct Business Verification checks, which can involve a streamlined, automated process through e-KYB solutions.

The Process of e-KYB Verification

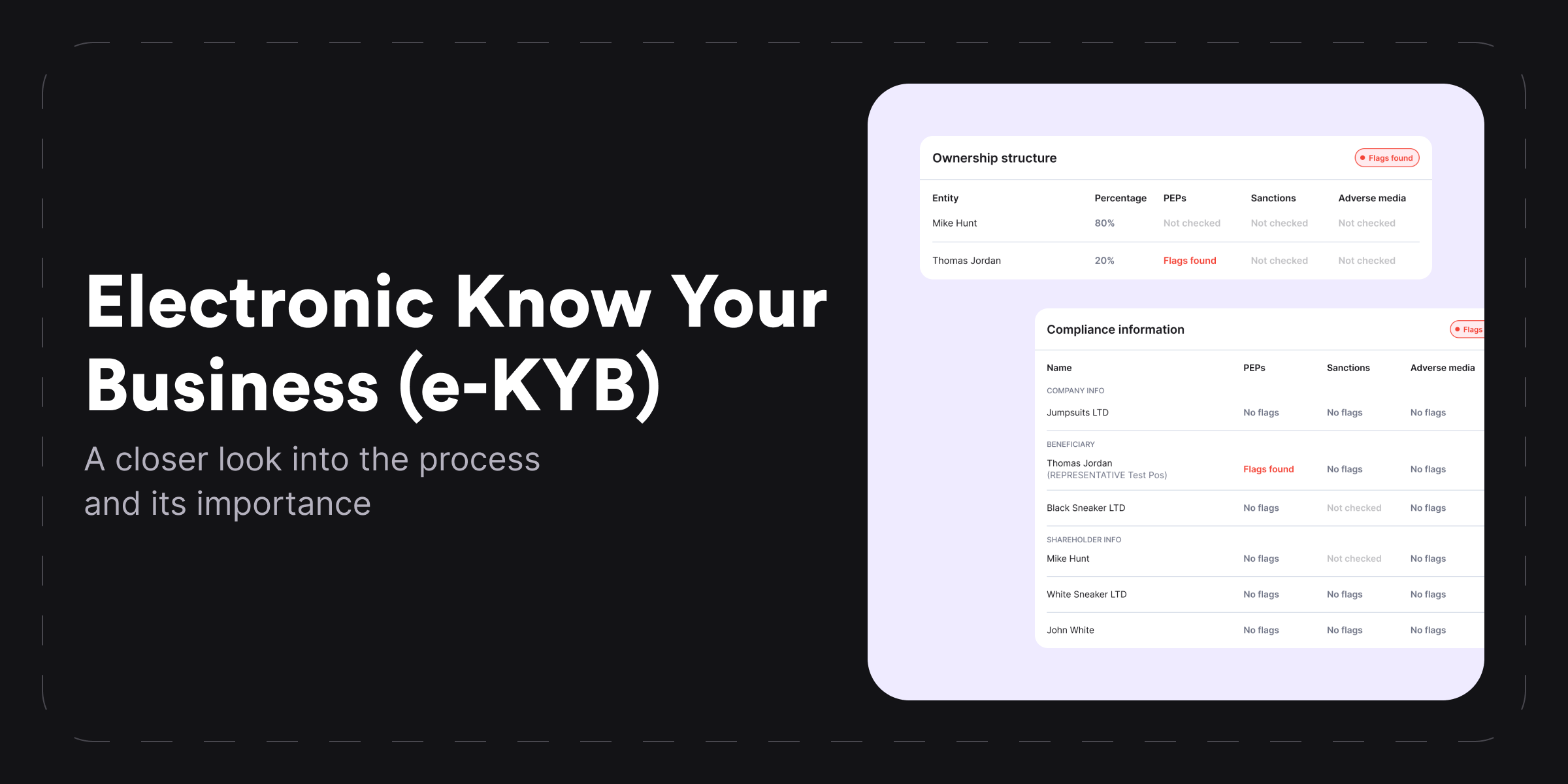

Through the process of e-KYB verification, companies can access comprehensive details about any specific company that’s being verified, including general information, internal operations, and beneficiary details.

Companies can use e-KYB to develop a streamlined approach to KYB compliance. This automated system helps them solve multiple challenges, such as:

- Minimize communication inconsistencies. e-KYB helps gather additional information and enables the company to provide updates on the decision-making progress, without having to visit physical branches.

- Handle different KYB compliance aspects using a single e-KYB solution. Since e-KYB solutions are based on digital filing systems, they reduce research time and help streamline other processes, such as KYC verification for beneficial owners.

Some automated RegTech tools may also provide personal information, AML compliance data, and insights from official reports as part of the integrated features offered within the e-KYB solution.

Steps that typically should be integrated into the e-KYB verification process include:

1. Data Collection

The first step in e-KYB involves collecting data in order to confirm the company’s legitimacy and ensure that the organization runs secure financial and transactional activities. To achieve this, companies gather information about the business, such as:

- Company name and address

- Business registration (license) number

- Ownership structure information (shareholders and UBOs)

Related: Best KYB Software Providers

2. UBOs Verification

Beneficiaries, shareholders, and authorized representatives of the company are required to undergo e-KYB verification. This process aims to verify that UBOs, shareholders, and authorized representatives are not politically exposed persons (PEPs) or individuals on blacklists.

Customers are UBOs if they are the main owners or control of the company. This means they are:

- Receiving at least 25% of the company’s capital.

- Owning at least 25% of the company’s shares.

- Holding at least 25% of the voting rights in meetings.

UBO requirements vary by country. For example, in the US, self-reporting complicates ownership verification, but upcoming regulations may establish a central database. Meanwhile, the CDD Final Rule mandates firms to verify ownership with a “reasonable belief.” To identify UBOs, companies typically request a document listing each person’s ownership and equity. Then, they conduct standard KYC checks on each individual.

Related: Ultimate Beneficial Owner — Understanding UBO Compliance

3. Document Verification

After gathering company data and checking UBO information, it’s crucial to verify its legitimacy. Document verification in e-KYB contributes to helping to confirm the company’s legal existence. e-KYB solutions are able to cross-reference the data collected previously to ensure accuracy, helping companies build a clearer picture of their business partners.

In other words, companies should use document verification to check uploaded legal documents, such as proof of incorporation or details about the company’s ownership structure, to support their verification claims.

This step can involve third-party providers that offer advanced technology, for example, optical character recognition (OCR) for extracting text from the documents. During this stage, companies cross-check all information and ultimately decide whether to collaborate with the other company and its stakeholders.

For example, iDenfy’s e-KYB solution offers the ability to download verified company PDF documents and reports to simplify this process. Additionally, all information is categorized under status labels (Under Submission, Need to Process, Need to Review, or Completed). This centralized dashboard allows internal compliance specialists to assess legitimacy and make accurate decisions quickly.

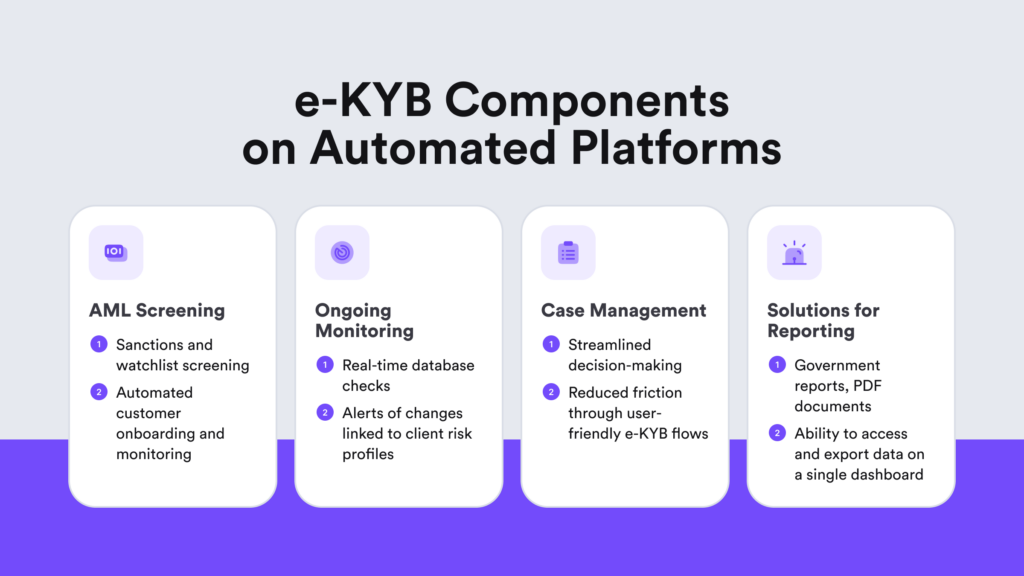

4. Ongoing Monitoring

It’s insufficient to check if a business is on a watchlist only at the start of the business relationship. Ongoing monitoring in e-KYB helps assess whether the company’s risk profile aligns with the intended business relationship. It also helps businesses continuously screen, preferably in real-time, company and customer activity for any signs of suspicious behavior.

This step shows the company’s efforts in terms of ongoing due diligence, further guaranteeing that the company and its stakeholders are trustworthy partners. The mentioned CDD Final Rule also mandates obliged entities to “conduct ongoing monitoring to identify and report suspicious transactions and, on a risk basis, to maintain and update customer information.” Since risks change and customer profiles evolve, continuous monitoring is crucial for a robust e-KYB process.

Traditional KYB Challenges that Companies Often Face

Traditional KYB processes are often a hassle due to their labor-intensive nature. Without e-KYB solutions and automation, companies manually gather company and UBO information from various sources. For example, companies also use search engines to conduct research for adverse media manually, including other important tasks, such as using publicly accessible sanctions lists and communicating with company representatives to identify beneficial owners.

This can result in:

- Inconsistencies. Including room for error due to manual KYB checks and data collection.

- Poor user experience. Clients that end up in long waiting lines tend to switch to other platforms.

That’s why traditional KYB processes can add extra costs and inefficiencies for the company. Other challenges that companies often face regarding their KYB compliance include:

- Limited number of qualified KYB specialists. Establishing in-house compliance infrastructure with IT experts and qualified compliance officers can be challenging since they need skills and knowledge, necessitating robust quality assurance and process control. Typically, companies require hiring a proper compliance team for conducting screenings across numerous watchlists, sanction lists, and PEP lists.

- Spending excessive time and energy on KYB compliance management. This involves hiring, training, and equipping staff with the necessary tools and support services. Without automated e-KYB solutions, companies must rely heavily on in-house resources to uphold due diligence and ensure ongoing compliance.

e-KYB Compliance Using Automated vs Hybrid Approach

Specifically, fully automated e-KYB compliance workflows streamline real-time verification of companies and individuals, ensuring compliance and smooth onboarding and assisting later in ongoing monitoring by sending alerts about changes in risk scores and so on.

However, when it comes to more complex processes like enhanced due diligence (EDD), even regarding complete KYB compliance, a hybrid approach is the go-to solution for most businesses, allowing some level of human intervention for tailored solutions while addressing the complexity of company structures or industry nuances.

The Key Benefits of e-KYB

With the help of a robust e-KYB process, companies pave their way to a bunch of benefits. For example, organizations can assess client risks more easily based on the collected information and categorize them as low, medium, or high-risk in order to follow a risk-based approach and stick to their reporting requirements.

Other advantages of e-KYB include:

Efficiency

While manual KYB verification processes are often time-consuming and tedious,e-KYB systems quickly cross-reference information from multiple sources, eliminating long waiting lines for customers. This helps companies scale and handle large volumes of user requests.

Accuracy

e-KYB solutions are powered by advanced technology for precise data gathering and verification. Using automated algorithms on existing data ensures consistent and reliable results for companies. This level of accuracy helps maintain trust between companies and their clients, minimizing the risk of data entry errors.

Fraud Detection

e-KYB services screen various business documents, such as registration certificates, licenses, or tax documents. This makes it easier to detect bogus companies or fake and altered documents, maximizing risk assessment capabilities and ensuring financial stability.

Customization

With eKYB, companies can build a personalized business onboarding flow to gather all necessary business information. This enables smooth communication, with the option to create custom questionnaires and request additional documents from the verified business at any stage of the process.

Switch to e-KYB with iDenfy

iDenfy’s all-in-one e-KYB suite helps you quickly verify the legitimacy of any business without the need for multiple vendors. We cover all compliance procedures through automated KYB/KYC and AML solutions tailored to your specific industry and use case.

Our e-KYB platform enables you to:

- Access governmental and credit bureau reports. Connect instantly to 180+ company registries from 120+ countries for real-time data.

- Create forms for companies that are being onboarded. Send them to representatives for completion.

- Integrate KYC verification. Initiate ID verification sessions directly in the dashboard after receiving shareholder information from company reports.

- Implement blocklist rules. Prevent non-compliant companies from onboarding.

- Screen and cross-reference different databases. Continuously monitor AML compliance for both companies and individuals.

- Use address verification to check the location’s legitimacy. Verify companies’ addresses and assess potential risks.

Get started right away.