Regulatory compliance consists of many rules and processes that organizations must follow. Anti-Money Laundering (AML) compliance guidelines aim to help prevent money laundering and terrorist financing while stopping other forms of fraud and illegal activities.

Whether a company must follow AML rules depends on the industry in which it operates. For example, in the US, the requirement for companies to implement AML compliance programs is defined in the Bank Secrecy Act (BSA). This legislation outlines specific criteria, mandating that financial institutions identify and report suspicious activities to the government through Suspicious Activity Reports (SARs).

However, if the business has financial transactions, it will be mandatory for them to follow AML compliance guidelines. So, it doesn’t matter if you’re just starting out or looking to improve your current AML compliance program; having a comprehensive checklist and guidelines in place is vital.

Key notes to remember:

- There are international (for example, Financial Action Task Force’s (FATF) rules), national, and country-specific (such as the Acts in the US) regulations.

- Depending on the location, the most common industries that are subject to AML compliance are banks, insurance firms, casinos and gaming establishments, lawyers, accountants, cryptocurrency exchanges, insurance companies, forex brokers, tax advisors, and others.

What is an AML Compliance Program?

An AML compliance program is a set of regulations designed to combat financial crimes. Regulatory authorities implement and regularly update these regulations to align with current conditions. To stay compliant with AML standards, companies must integrate internal controls such as employee training, account monitoring, detection of suspicious transactions, and the reporting of suspicious activities.

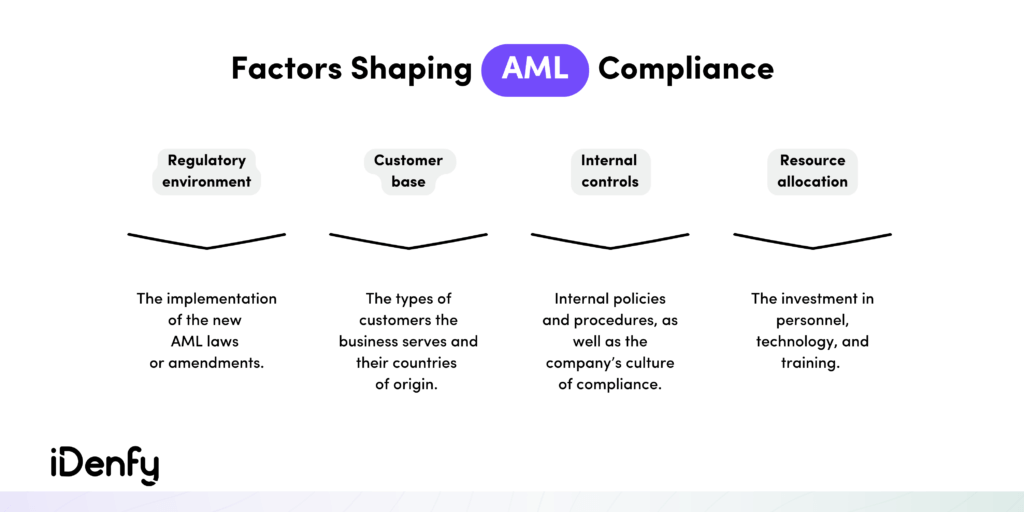

Due to the intricate nature of procedures and the dynamic nature of the financial landscape, creating a robust AML program can be challenging. That’s why companies need to assess all related factors that could be influencing compliance, including:

- Understanding the applicable local and global laws and the consequences of non-compliance.

- Identifying the risks associated with money laundering and potentially suspicious activities within the company.

To summarize:

The goal. AML compliance programs identify, react to, and eliminate fraud risks related to money laundering and terrorist financing.

The importance. An effective compliance program enables the business to find out about potential money laundering risks, learn in-depth about non-compliance laws, and prevent suspicious activities within the organization.

What Makes an AML Compliance Program Effective?

The Federal Financial Institutions Examination Council (FFIEC) outlines essential components for an effective BSA/AML compliance program, obliging institutions to:

- Implement an internal control system to ensure continuous compliance.

- Conduct independent testing for compliance, performed either by bank personnel or an independent third party.

- Appoint a compliance officer responsible for day-to-day oversight of compliance activities.

- Ensure ongoing training for employees.

- Establish a risk-based Customer Identification Program (CIP) to verify customer identities.

Include measures for Customer Due Diligence (CDD) and comply with beneficial ownership requirements specified in regulations issued by the Financial Crimes Enforcement Network (FinCEN).

Related: AML Regulations in the USA — Everything You Should Know as a Business Owner

What Risks Impact AML Compliance?

Before building a compliance program, every business must assess its potential risks and legal obligations, which include:

- Analyzing money laundering risks the company is exposed to.

- Researching local and global regulations to avoid non-compliance penalties.

- Considering any suspicious activity within the company.

That’s why several risk factors can affect a company’s AML program, especially considering the constant changes in regulations. Also, let’s not forget technology’s impact and the new compliance rules that were set due to the widespread use of mobile banking and digital currencies.

What Steps Complete a Compliant AML Program?

To develop a successful AML compliance program, organizations must follow some vital steps. Let’s explore them in more detail.

🟣 Step 1: Select a Compliance Officer

This is the go-to person in all things related to AML compliance. This person will play an important role in the company by evaluating various processes and keeping the business in line with regulatory requirements.

Key skills a Compliance Officer should have:

- They must possess knowledge in the legal sector, internal audits, and AML compliance.

- They must be experienced in managing regulatory procedures and analysis tools.

- They should be able to solve problems and communicate effectively.

- They must have an appropriate license and certifications.

🟣 Step 2: Educate and Train Employees

As AML guidelines change over time, compliance expectations evolve. That’s why employees should have a proper understanding of AML processes. To achieve this goal, companies must conduct ongoing monitoring and design special training programs. This ensures that all team members have the right skill set to help the company stick to its AML duties.

Key tips for helping conduct employee training:

- Choose the right training topic. For example, create an overview of penalties for non-compliance or talk about general AML rules and how to stop illicit activities.

- Develop a written training program. There’s no “all size fits all”. It can be anything from daily staff meetings about the latest AML news to weekly legislation guideline updates.

- Monitor and measure the results. No matter what training method you choose, it’s vital to calculate the success of the training by giving out evaluation tests.

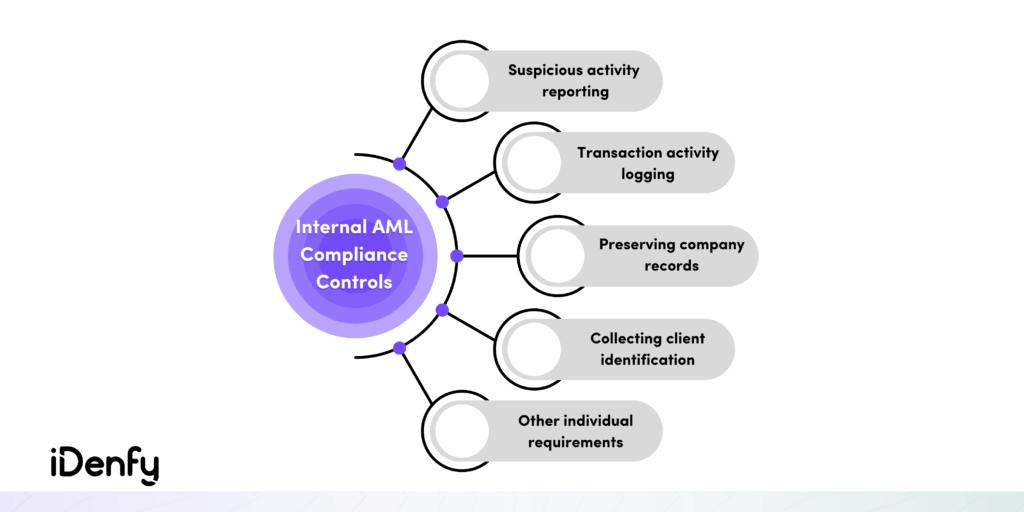

🟣 Step 3: Develop Internal Compliance Controls

Next, it’s essential to maintain regulatory compliance by implementing internal controls and policies. Obligated entities must perform Customer Due Diligence (CDD) and monitor suspicious activity while ensuring that applicable data is reported to appropriate agencies like FinCEN. Practices can vary depending on the individual company’s size and the associated risks.

Use this short checklist to navigate through AML policies more easily:

- Evaluate AML processes. Add periodic procedure evaluations into your standard AML practice. Automated transaction monitoring, together with AML customer screening, will reduce the time for compliance officers who are responsible for detecting potentially suspicious activity during this stage.

- Integrate identity verification. Using AI-powered verification solutions will ensure quick and accurate data validation while guaranteeing that the customer’s data is legit before they can complete any transactions.

🟣 Step 4: Ensure Independent Testing

While developing internal controls or training your employees is essential, AML compliance requirements also include regular independent testing.

To understand and assess the company’s program yearly, a qualified third-party company must take care of this testing. Instead of taking someone directly responsible for regulatory compliance in the company, independent audits check if all AML controls are in place and working correctly.

Key facts about third-party audits:

- Independent auditors test and audit AML programs regularly to ensure compliance.

- The goal of the audits is to discover potential weaknesses in the AML compliance program.

- High-risk sectors should undergo frequent audits, while low-risk institutions must conduct third-party testing once a year.

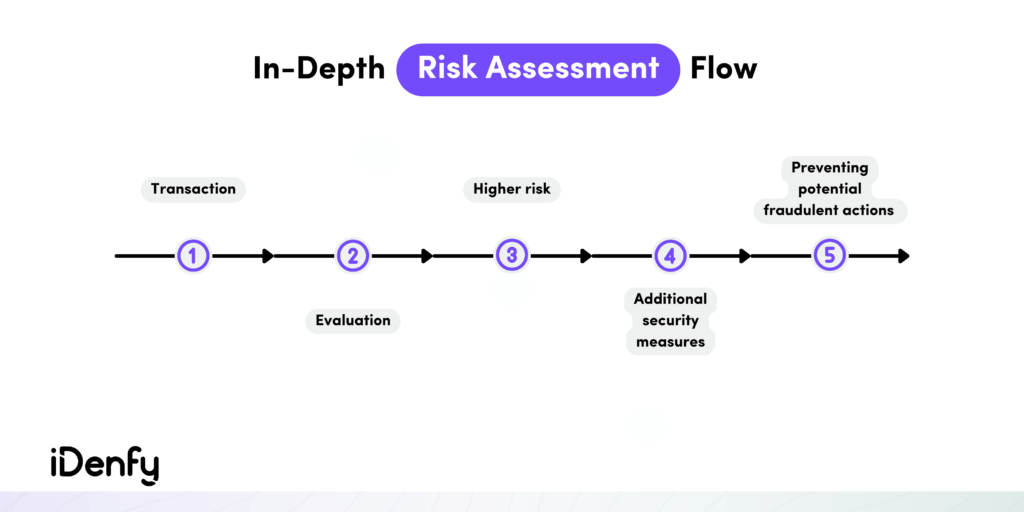

🟣 Step 5: Perform In-Depth Risk Assessment

Financial Crimes Enforcement Network (FinCEN) presented the CDD Final Rule in May 2018. After it became immediately effective, it was considered one of the top essential components of AML compliance.

The CDD rule recommends companies evaluate the risks of money laundering and terrorist financing by:

- Identifying customers,

- Verifying their identities,

- Continuously monitoring transactions,

- Detecting and reporting suspicious activity.

If a customer submits a fake document, engages in unusually large transactions, or tries to open a bank account with insufficient customer information, organizations need to take the necessary steps to report these red flags.

For instance, if a customer is trying to create a new account from a high-risk country or a blacklisted IP

address, it’s best to conduct additional checks before you approve their account and provide access to sensitive data.

So, what makes this rule important? The CDD regulation poses the need for a risk-based approach, obliging businesses to conduct a comprehensive risk assessment to identify AML threats in specific jurisdictions.

Related: What is an AML Risk Assessment? [With Examples]

Other AML Red Flags You Should Know

There are some indicators or AML red flags that suggest potential money laundering and other suspicious activities that require companies to conduct further investigation.

Companies should stay vigilant and look out for these signs:

- Large cash transactions.

- Sudden spikes in transaction amounts.

- A high volume of transactions, especially those that could be linked to structuring in money laundering.

- Transactions associated with cash-intensive businesses, for example, gambling establishments.

- Transactions linked to high-risk jurisdictions with a known history of money laundering.

- Transactions involving high-risk individuals or businesses that can be potential money launderers.

Related: AML Red Flags — Complete Breakdown

How to Maintain AML Compliance?

After you set up a successful AML compliance program, the question of how to maintain compliance at your organization becomes the next priority. That means sticking to the compliance checklist that you’ve established.

Companies must use their AML programs to monitor suspicious customer behavior, including the mentioned cases of surpassing thresholds and status changes, as well as internal controls, like employee surveillance, watchlists, market trends, and new compliance requirements for ongoing compliance with AML/KYC regulations. Continuous monitoring is a crucial step after customer onboarding to prevent fraud and detect potential money laundering or terrorist financing within the system.

As regulations change, companies are responsible for keeping their compliance program up-to-date. For example, now, under the EU’s 6th Anti-Money Laundering Directive (6AMLD), individuals working for organizations and entities acting on their behalf can now face criminal liability.

The risks of falling out of AML compliance can leave businesses with severe consequences. Fines range from $25,000 to $100,000 for failing to report a single suspicious transaction.

How Automated AML Software Can Help

AML software helps stay compliant with AML regulations easier by enabling organizations to identify, analyze and report suspicious activity in real time. It’s an entirely automated tool designed to benefit businesses that want to stick to ever-evolving AML policies.

Assigning internal compliance teams to manual compliance processes is an inefficient use of company resources. Automation in AML helps companies ensure ease of integration into current workflows to avoid staff and regulators’ resistance while guaranteeing a smooth end-user experience.

iDenfy can help you gain this competitive advantage by digitizing AML processes, including identity verification and AML screening or ongoing monitoring. With the ability to choose the level of friction, you can customize your customer onboarding flow by automatically verifying and additionally screening risky users to comply with CDD rules.

Simplify compliance without compromising on security or your conversions. Try iDenfy’s multi-functional ID verification and AML compliance software for free today.

This blog post was updated on the 9th of January, 2025, to reflect the latest inisghts.