And there’s a good reason for that. Criminals use anonymous shell companies to launder dirty money through real estate. These companies allow them to conceal their identities during the purchase of a property and to benefit from the resale or rental income of those properties.

But did you know that 84% of new homebuyers say the information they found online was crucial for their research? Well, businesses take a similar approach. For them, it’s important to verify the identity of buyers and understand the potential risks, as well as the applicable laws regarding this matter.

In this article, we dive deeper into the world of KYC and AML controls in the real estate sector, explaining how to stay compliant and protect your business with identity verification.

Why the Real Estate Industry Attracts Money Launderers

Millions of dollars are laundered yearly through properties, resulting in a bad reputation for real estate companies. But it’s no secret that real estate presents lucrative investment opportunities. Although regulated, this speculative market isn’t subject to the same scrutiny as a bank.

With its high value and relative anonymity, real estate is an ideal channel for money launderers to conceal the origins of their illicit funds. Here are a few examples of why:

- Purchasing properties with cash. Unlike other investments, real estate can be bought with large amounts of cash without creating suspicion. Cash purchases are especially attractive to criminals who want to avoid financial institutions that may report suspicious transactions to regulatory authorities.

- Concealing ownership. Properties can be held through shell companies or trust funds, which can make it difficult for authorities to trace the true owners. This anonymity helps criminals to hide their illicit funds behind a legitimate-looking facade, making it difficult to detect their activities.

- Flipping properties. This involves buying a house, making minimal improvements, and then quickly reselling it at a higher price. This can create the appearance of legitimate income and can be used to launder illicit funds by funneling them through the sale of the property.

In addition to these attributes, real estate can be attractive to criminals for its potential for capital appreciation. Since the market price of the property can increase over time, it becomes an opportunity for criminals to generate pseudo-legitimate profits when the property is eventually sold.

Common Money Laundering Ways in Real Estate

Criminals launder money in real estate in two ways, mainly by undervaluing and overvaluing property.

Undervaluation refers to the practice of purchasing a property at a price lower than its market value. This often happens with shell companies or business entities that conceal the true owners. In some cases, foreign criminals may purchase property by using a front that appears to be the legitimate owner but is acting on behalf of the criminal.

Money launderers can also overvalue properties to legitimize the funds they have acquired through illegal activity. For example, a money launderer could purchase a property for $500,000 and then claim it’s worth $1 million. They can then sell the property at the inflated value to a legitimate buyer and then generate a profit that appears to be legitimate.

Don’t forget that real estate is also a popular attraction for foreign investors looking to diversify their portfolios. Criminals can take advantage of this by investing illegally obtained funds in real estate in foreign countries. Once again, this makes it difficult for law enforcement agencies to track the movement of funds and detect the individuals involved in such a shady scheme.

Signs Indicating Money Laundering in Real Estate Transactions

Can you imagine that less than 1% of illegal funds are recovered and returned to their victims? That’s why it’s essential to be vigilant in spotting the main signs of money laundering.

Here are some red flags indicating suspicious activity in real estate:

- Suspicious purchase history. This includes wire transfers from overseas accounts with no clear reason for the transaction. Additionally, purchases made using multiple bank accounts, transactions involving unexplained third parties, and non-real estate businesses buying properties can be signs of fraud.

- Unusual payment methods. For example, the use of cryptocurrencies, offshore accounts, and other unconventional financing methods can be used to hide the source of the funds. That’s why it’s essential to conduct thorough due diligence on the parties involved.

- High-risk countries. Such territories have poor anti-money laundering policies and high levels of corruption. Screening buyers involved in such transactions require increased scrutiny and due diligence, including verifying the identity of all parties involved and the source of their funds.

- Lack of information. If a person participating in a real estate transaction is unwilling to provide personal information, or if there are discrepancies in the data provided, you should see it as a warning sign that they may be attempting to conceal something illegal.

How to Prevent Money Laundering as a Real Estate Business?

Property developers and real estate agencies prevent fraud by implementing a systematic and thorough process for verifying the identity of buyers. By doing so, real estate professionals can significantly reduce the risk of fraudulent activities and protect their business reputation.

To put it simply, identity verification is the process of comparing a person’s claimed identity with the supporting data they provide. This involves analyzing identification documents and evidence to confirm that the person claiming the identity is indeed who they say they are.

Using Know Your Customer (KYC) checks enables the identity verification of individuals before completing a real estate transaction and cross-referencing their identity with known global watchlists. This is part of AML procedures designed to comply with regulations and help real estate companies protect their reputation, prevent financial loss and fulfill ethical obligations.

AML Compliance Obligations in the Real Estate Sector

AML procedures can involve a range of measures, such as conducting due diligence on clients, monitoring transactions, and reporting suspicious activities to the relevant authorities.

These regulations help real estate professionals prevent criminal activities, such as money laundering and terrorist financing. Additionally, having a strong compliance program helps real estate companies and other businesses to ensure the stability of the economic environment.

In general, real estate agents must comply with AML obligations if they are:

- Representing a client who is purchasing or buying real estate

- Taking cash deposit on behalf of someone who is purchasing real estate

Check out how compliance obligations affect real estate businesses in different jurisdictions:

Canada

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) discovered that many real-estate companies were not following AML requirements back in 2018. Up to the point that some real estate businesses had even agreed to launder money for criminals voluntarily.

To address this issue, the Canadian authorities updated AML compliance rules in 2021. The changes made Politically Exposed Persons (PEPs) and beneficial ownership checks mandatory for all reporting businesses, including real estate professionals.

United States

The Financial Crimes Enforcement Network (FinCEN) renewed its geographic targeting orders (GTOs) to combat money-laundering risks in the real estate sector. Since 2016, the GTOs have required title insurance companies to identify the natural persons behind shell companies used in real estate cash transactions. This renewal of the GTOs has expanded the requirements to additional jurisdictions.

The GTOs have proven to be a useful tool for law enforcement as they allow agencies to compare GTO-reported legal entities with suspicious activity reports (SARs) filed by banks and financial institutions.

Although title agents and real estate professionals are not required to file SARs, this advisory emphasizes their importance in combating criminal activities, which could justify imposing Bank Secrecy Act (BSA) reporting requirements in the real estate industry.

Europe

The 4th European AML Directive (4AMLD) put real estate agents under its regulatory obligations in 2018, making it mandatory for them to comply with all AML requirements, including KYC verification.

Under the latest directive, 6AMLD, sanctions for money laundering now apply to businesses as a whole, not just employees. This means that if a single real estate agent collaborates with money launderers to overvalue a property’s price, the entire real estate company will face sanctions, such as closure or asset confiscation.

Note: We go more in-depth on how to create a robust compliance program in our step-by-step AML guide.

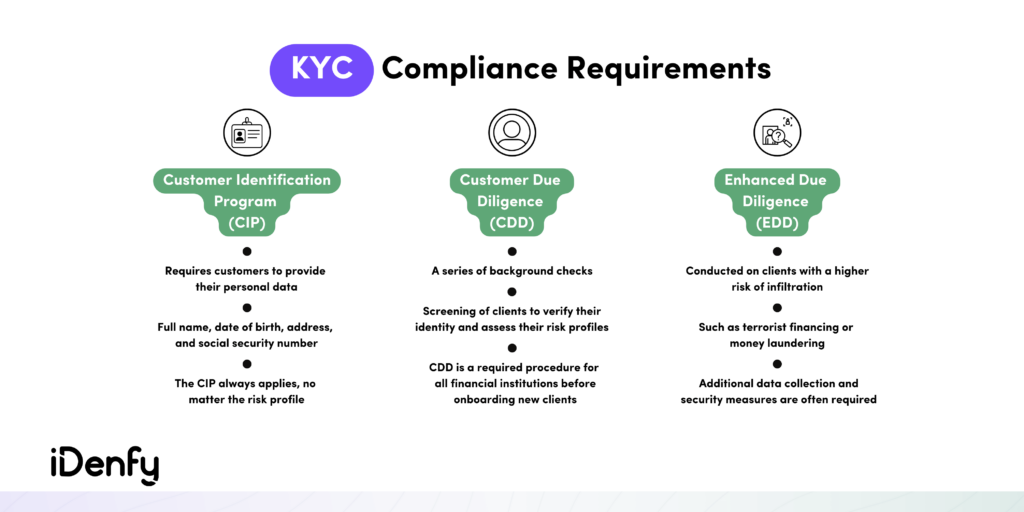

KYC Compliance Requirements for Real Estate

The first step in KYC compliance is to collect accurate customer data, including their full name, date of birth, address, and ID documents such as a passport or driver’s license.

This second step is to verify that the client is who they claim to be. It is essential to remember that compliance is a continuous process, and in case of any changes in the customer’s information, it must be promptly updated, and the customer must undergo identity verification again.

Typically, KYC documentation includes the following data:

- Full name and date of birth

- Address or registered office information

- Background data about the proposed relationship

- Company identifier or registration number

KYC, in practice, is the main element of the AML program. Before beginning to work with a new client or vendor, it’s necessary to carry out KYC procedures for all individuals and beneficial owners of the property or properties that the real estate business is selling.

Non-compliance with KYC regulations and identity verification guidelines, as well as AML laws, can result in severe consequences for real estate companies. Penalties can include fines, loss of license, or even imprisonment.

Rules Helping You Conduct KYC Checks in Real Estate

KYC regulations for real estate can vary across countries, but they all share a common rule, which is to verify and confirm the identity of prospective buyers. This is important due to industry-specific money laundering risks, such as the use of anonymous companies and third parties.

Here are primary guidelines that can assist you in preventing fraud when conducting KYC checks on your clients:

- Conducting sanctions screening. Compliance agents use government sanctions lists or watchlists to detect persons that are suspected of being involved in illegal activities, such as money laundering. It involves comparing the names and other data of potential customers against these lists to identify any matches. If a match is found, further investigation and due diligence may be required before continuing the business relationship.

- Screening for PEPs. This process helps identify individuals who hold prominent public positions or have significant influence in government organizations and their family members or close associates. PEPs can be at a higher risk of involvement in corruption, bribery, or other illicit activities due to their political status and access to power and resources.

- Checking adverse media. This procedure involves screening negative news articles, public records, and other open-source information to determine if a potential customer or business partner has been involved in illegal activities. This helps real estate firms to mitigate reputational risks and prevent financial crimes.

- Identifying beneficiaries. If the property buyer is another company, real estate agents should verify UBOs, the entities that ultimately control the company, including people who own more than 25% of a company’s shares or have significant control over its operations.

Note: We have another blog post providing more details on the differences between KYC and AML compliance.

End-to-End Identity Verification for Efficient KYC/AML Compliance Management

Sticking to regulations in the real estate sector can be a challenging task. From tracking down necessary documents to implementing new software, compliance can quickly become a full-time job in and of itself.

But fear not, compliance headaches can be eased with the right tools and strategies in place. Thankfully, we have fully automated tools that identify, collect, screen, monitor and keep the data records for you in accordance with ever-changing regulatory requirements.

With iDenfy, you don’t need to build a whole KYC/AML program from scratch. Our solutions help real estate companies conduct identity verification checks and incorporate AML services into a custom onboarding process.

Contact us for more info or get a free demo to see our anti-fraud services in action.