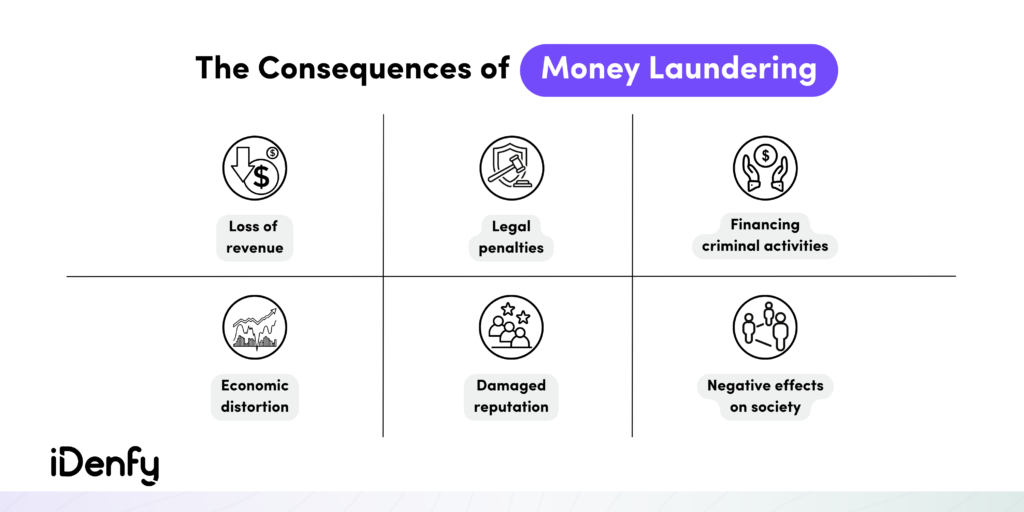

The nature of financial transactions and the potential for significant gains attract bad actors and their devious tactics. That’s why the financial sector is filled with all sorts of crime — starting from bribery or tax evasion and ending in cybercrime or money laundering.

Within the realm of these fraudulent crimes, two money laundering techniques stand out: structuring and smurfing. First of all, let’s set these two practices apart.

What is Structuring?

Structuring in money laundering is when criminals make transactions intentionally splitting larger amounts into a series of smaller sums to avoid scrutiny from law enforcement or compliance obligations. In other words, criminals strategically structure deposits just under the threshold to prevent unwanted attention.

In these cases, the individual or entity typically conducts smaller transactions without requiring the financial institution to file a report with a government agency. For instance, in the United States, a report must be submitted for all cash transactions exceeding $10,000 processed by a financial institution.

Such transactions are harder to notice as they do not trigger automated reporting systems. This enables criminals to continuously make regular deposits under the reporting threshold, as they don’t have an obvious pattern for the trigger to be made.

Examples of Structuring

Structuring is relatively simple because all the funds typically go into the same account or a small number of accounts under the same name. Despite that, it can backfire if a bank detects a trend of deposits that are all under the reporting limit:

- For example, John starts by dividing the total amount of cash, let’s say $250,000, into smaller portions.

- Instead of depositing the entire cash at once, he decides to deposit $10,000 at a time over multiple days. By doing so, John aims to prevent getting caught by the bank and regulatory authorities who monitor such transactions.

- To further complicate the trail of illicit funds, John decides to withdraw the money in a structured manner.

- Instead of withdrawing the entire amount in one transaction, he makes numerous withdrawals of $2,000 each from various bank branches. By repeatedly making smaller withdrawals, John wants to strategically avoid mandatory reporting thresholds and prevent raising suspicion on his end.

Is Structuring a Crime?

Even if the person obtained the funds for structuring legally, structuring is still illegal and is considered a criminal offense. Criminals employ structuring in money laundering to avoid anti-money laundering (AML) or counter-terrorist financing (CTF) compliance regulations. They may also create multiple accounts to maintain their “under the radar” status and prevent filing a suspicious activity report (SAR).

Criminals also utilize structuring to conceal how they actually earned the money. Sometimes, individuals use this tactic to avoid tax obligations. Typically, this happens if a person or a high-ranking individual with power and influence receives a monetary bribe. To avoid paying tax on these funds, they make several smaller deposits across multiple accounts.

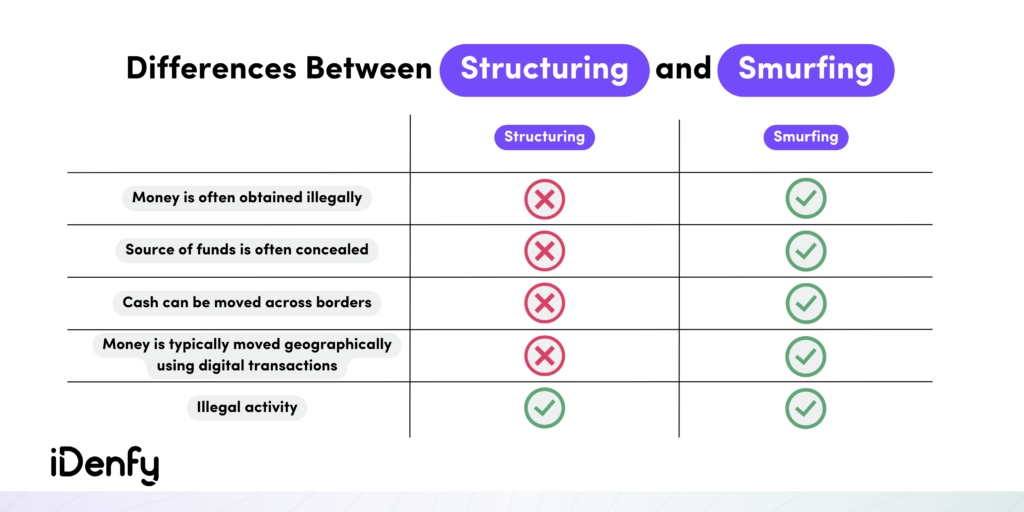

What is the Difference Between Structuring and Smurfing?

Even though, in banking jargon, smurfing has a similar meaning as structuring, these are two different things. Overall, the main difference is that unline structuring, smurfing is a more sophisticated money laundering strategy involving a bunch of people rather than depending on a single person who makes several deposits just below the reporting threshold.

Smurfing is a form of structuring and a money laundering tactic that contains illegally obtained money and low-level financial criminals called smurfs. The term “smurf” has roots in illegal drug manufacturing and now, in the context of money laundering, refers to an individual who’s a junior money launderer. Keep in mind that both structuring and smurfing are illegal.

Smurfing happens when illegally obtained cash is given to smurfs, who then make multiple deposits into several bank accounts. Smurfs can use different identities (including fake identities) and various financial institutions to make foreign and offshore bank deposits.

Examples of Smurfing

One of the other differences between structuring and smurfing is their prevention and detection measures. Banks are required to deploy different solutions that identify and prevent both structuring and smurfing, such as transaction monitoring tools, which detect red flags and smurfing patterns of suspicious activity.

Nonetheless, smurfing is considered a more complex scheme because it’s difficult to detect due to the involvement of multiple smurfs:

- For example, let’s get back to the same character, John. He enlists the help of several individuals, aka “smurfs,” to assist in his money laundering scheme.

- Each smurf is given a specific amount of cash, for example, $5,000, and is instructed to deposit the money into different bank accounts.

- By using multiple individuals and accounts, John aims to distribute the illicit funds across different banks, making it harder to trace the source.

- That’s not all. In addition to smurfing, John sets up multiple shell companies, which are fictitious entities used for money laundering purposes. He transfers the illicit funds into these shell companies’ accounts, disguising the proceeds as legitimate business transactions.

- By channeling the funds through a complex network of companies, John aims to obscure the money’s origin and once again make it difficult for financial institutions to trace his activity.

This way, the smurfs prepare the money for layering, the second stage of money laundering. Transactions made by smurfs are hardly traceable since the link between the people, all of the accounts, shell companies, and various deposits is difficult to establish.

Some popular examples of layering in money laundering include:

- Selling high-value items.

- Investing in real estate through shell companies.

- Making complex transactions to disguise the trace of funds.

- Moving cryptocurrency from one blockchain to another.

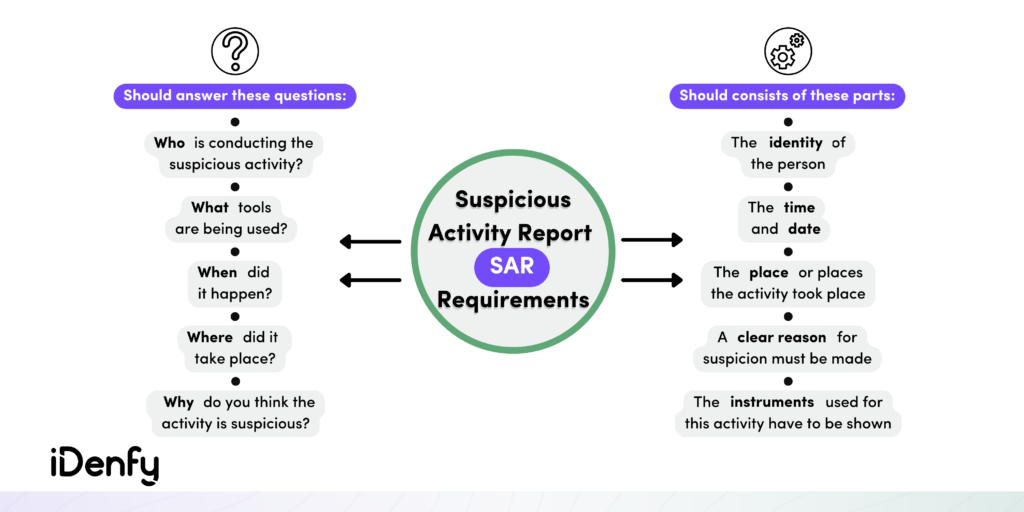

How is Suspicious Activity Reporting Linked to Structuring and Smurfing?

In cases where a financial institution suspects a customer of structuring or smurfing, they are legally obligated to file a Suspicious Activity Report (SAR). The report is submitted to the Financial Crimes Enforcement Network (FinCEN).

Financial institutions must file SARs within 30 days. If additional evidence needs to be collected, the institution can request an extension of up to 60 days:

- In the UK, the government recommends that companies and financial service providers designate a nominated compliance officer, who’d be responsible for taking all of the reports regarding suspicious activity. Naturally, other teams should receive training on common AML practices and understand how structuring or smurfing works.

- In the US, financial institutions must report all transactions over the $10,000 threshold. Keep in mind that this applies to foreign currency transactions as well. In general, this reporting threshold can be found in other countries, such as Australia, Ireland, or Canada.

It’s essential to understand that the financial institution must only report and raise awareness of suspicious activity and doesn’t have to prove that a crime has occurred. That means the bank doesn’t have to inform the customer about the report.

How to Detect Structuring and Smurfing?

In case of suspicious activity, companies and financial institutions rely on AML professionals to understand the common methods employed by structuring. Only trained compliance specialists are responsible for detecting suspicious patterns and must be prepared to carry out enhanced due diligence (EDD) procedures for high-risk customers.

Some red flags indicating structuring and surfing:

- Multiple cash deposits are made on the same day across multiple branches or ATMs.

- Multiple deposits over several days are made just under the $10,000 threshold limit.

- Users of financial platforms who are providing suspicious and inconsistent explanations for multiple transactions or the opening of new bank accounts.

- Multiple customers are sharing similar or the same addresses, nationalities, or devices registering for new accounts within a short timeframe.

Benefits of Using an AML Compliance Platform

There are special AI-powered tools and AML compliance software that are designed to detect money laundering signs in real-time, minimizing the manual workload for compliance officers. Regulated entities, such as those operating in crypto, fintech, gambling, etc., are required by law to conduct AML screening and employ EDD measures for suspicious, high-risk individuals.

To automate the complex, data collecting and screening part, businesses today use AML platforms that propose several benefits:

- Screening and monitoring. Automatically scans and detects suspicious behavior in real-time, sends out notifications about suspicious activity, finds red flags, and easily explains the cause of fraud. Additionally, it has built-in features that can screen users against global watchlists, sanctions lists, adverse media, and PEPs to ensure complete compliance.

- Identity verification. Accurately and quickly verifies the identities of newly registered customers during the onboarding process. This ensures that people who are accessing the financial platform or any digital services are real and not committing fraud. Typically, ID platforms allow businesses to customize their workflows depending on the level of risk so that low-risk users don’t have to undergo multiple checks.

iDenfy is the leading fraud prevention software provider that has both AML tools and identity verification services under a single platform. So if you’re looking for a KYC, KYB, or AML service provider — you’ve come to the right place.

Try out a free demo today, or check out our customer stories to see how our tools perform in various industries.