Decentralized exchanges (DEXs) currently operate without proper KYC/AML regulations. However, as the regulatory landscape for crypto exchanges has already set its foot, we can clearly expect the same result for DEXs. That’s why many believe that decentralized exchanges need to proactively enhance their KYC compliance measures before getting hit with the wave of regulations.

Cryptocurrency exchanges, such as Coinbase, Crypto.com, or Binance, generate revenue using the same model, much like traditional brokerages and stock exchanges. DEXs are a new category of exchanges that seek to push away intermediaries like Coinbase and empower users to conduct transactions directly with one another in a peer-to-peer (P2P) manner. Their goal is pretty simple — to increase transaction speeds and reduce transaction costs.

DEXs prioritize customer anonymity and prevent the sharing of personal information with any external parties, including central authorities. That’s why they struggle to identify their customers’ true identities, which regulators often see as unacceptable.

Understand in a minute:

- The absence of a central authority in DEXs also contributes to the level of anonymity they hold. Traditional exchanges are usually centralized and require users to trust the exchange with their funds, which some fear can lead to hacking or misuse.

- DEXs operate on blockchain technology and use smart contracts to facilitate P2P trades directly between users, eliminating the need for a middleman. This decentralized nature reduces the risk of funds being held or controlled by a central entity, further enhancing user privacy.

- These platforms are often automated and autonomous, primarily relying on programming. However, if they fail to meet the necessary compliance standards, they can be vulnerable to security issues.

The rapid expansion of DeFi applications, working via smart contracts and decentralized autonomous organizations (DAOs), complicates this matter further. In this blog post, we look into it and explain how DEXs can prepare for the potentially stricter KYC rules in the near future.

What is a Decentralized Exchange?

A decentralized exchange (DEX) is a peer-to-peer marketplace where users can trade cryptocurrencies directly with one another without relying on an intermediary, such as a bank or a payment processor, to oversee the transfer and custody of funds. This distinction allows DEXs to offer significantly lower transaction fees in comparison to traditional crypto exchange alternatives.

Compared to traditional financial transactions, DEXs provide full transparency regarding fund movements and the mechanisms supporting asset exchanges. Since user funds don’t pass through a third-party cryptocurrency wallet during trading, DEXs minimize counterparty risk and contribute to reducing systemic centralization risks within the crypto ecosystem.

DEXs play an important role in decentralized finance (DeFi) by serving as a primary “Lego” building block. This element is what enables the creation of more complex financial products. In general, there are various DEXs out there. Some of the famous examples include SushiSwap, Kyber Network, Balancer, PancakeSwap, and more.

DEXs vs Traditional Crypto Exchanges

DEXs are more anonymous compared to traditional cryptocurrency exchanges because of the way they operate. In traditional exchanges, users typically need to complete a rigorous registration process, including providing personal data and verifying their identity through the KYC process. Companies then collect and store this data to comply with regulatory requirements.

In contrast, DEXs offer a higher level of privacy. Users need to connect their cryptocurrency wallet to the exchange to begin trading. That means they aren’t required to disclose personal information or go through additional KYC checks. That goes to show that DEX users can start their transactions without revealing their real identities, making it a more private and pseudonymous way to trade crypto.

This is what the basic KYC process in crypto looks like:

- Obtain and verify an official ID document containing the user’s personal information.

- Verify and confirm that the user undergoing the KYC process matches the person shown on the provided ID document through document verification, selfie verification, etc.

- Cross-reference the user’s data against official databases, including lists of Politically Exposed Persons (PEPs), to prevent access by sanctioned individuals.

So what comes with the DEX level of anonymity? Illegal activities. DEXs are more prone to money laundering and illicit trading, which has led to these regulatory concerns around the industry. That’s why governments are considering or implementing regulations that would require DEXs to implement KYC measures to combat misuse while still preserving some degree of privacy for users.

What Does KYC Mean for DEXs?

Regulators are increasingly prioritizing KYC protocols, stressing the necessity for DEXs to prepare themselves for more stringent regulatory requirements proactively. In today’s DEXs ecosystem, the KYC framework means that it’s used in a somewhat inconsistent manner:

- Pro-KYC DEXs. Typically, more centralized platforms implement KYC procedures that are very similar to traditional financial institutions, requiring at least an ID verification process.

- Zero-KYC DEXs. Some platforms operate on a more straightforward “plug-and-play” basis, where having a crypto wallet is sufficient to get started. In other words, users can sign up on these exchanges without having to provide their data. That means using these exchanges can come with limitations, such as lower withdrawal limits and restricted features.

Pros and Cons of KYC and Zero-KYC DEX Policy

Naturally, one of the primary reasons people opt for Zero-KYC DEXs is privacy. With KYC-compliant DEXs, users are required to share personal information, including their name, address, and ID document.

Other Pros:

- Accessibility. DEX users directly engage with the smart contracts that manage its liquidity pools. That means anyone can contribute their tokens to these pools to earn a portion of the transaction fees they generate.

- Convenience. Users can exchange their tokens, often with minimal KYC requirements. From a Zero-KYC DEX standpoint, this process offers a convenient and simple means of transferring value across various token ecosystems.

But there’s always…a but. Even though the blockchain is generally a secure source for conducting financial transactions, mistakes, data breaches, and cyberattacks in smart contracts can happen. That results in putting DEX users’ funds at risk.

Other Cons:

- Greater risk of money laundering. The absence of KYC measures creates a vulnerability in DEXs, enabling dishonest individuals to potentially exploit the industry for money laundering and other illegal financial activities.

- It is actually impossible to detect fraud. This happens when users aren’t required to verify their identity or the source of their funds when registering with a DEX. Consequently, it becomes significantly easier for such users to evade scrutiny compared to other financial institutions that actually use KYC verification.

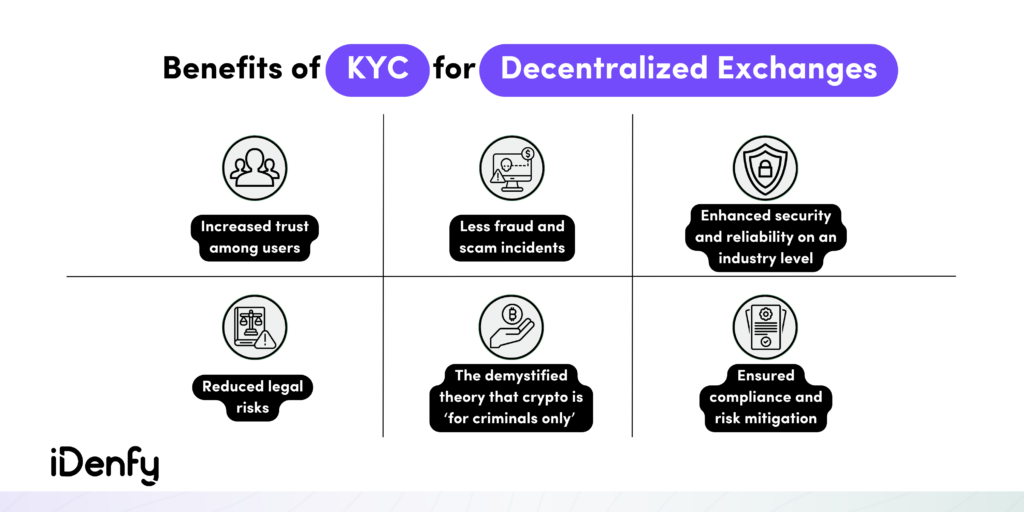

Of course, this is where both KYC and AML compliance tools come in handy. Monitoring users and their transactions, using identity verification, at least for high-risk users, and conducting security audits are great practices to maintain vigilance for DEXs.

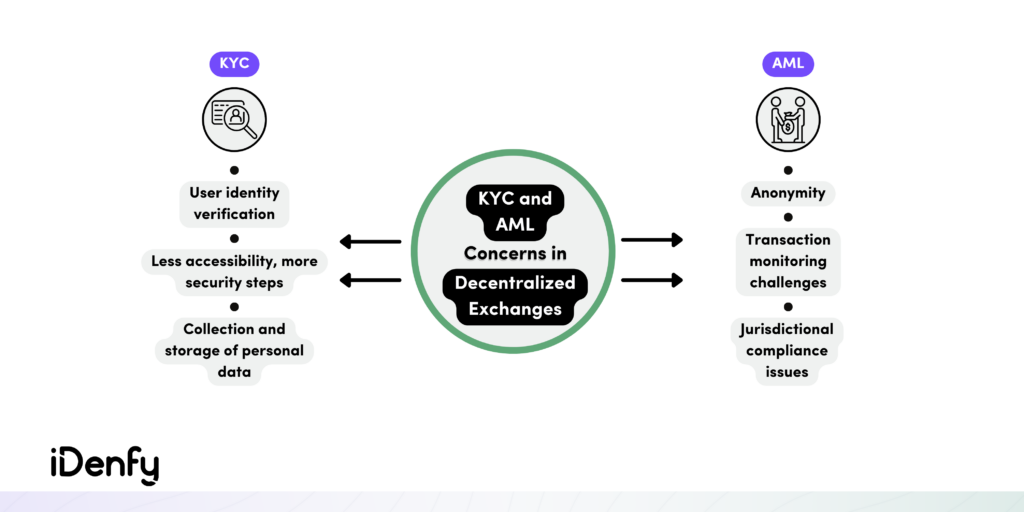

The Main KYC Compliance Concerns in DEXs

The primary concern with KYC in decentralized exchanges is the debate surrounding the potential loss of anonymity. Some argue that implementing identity verification could fundamentally alter the essence of decentralized exchanges by eliminating the option for anonymity.

Despite such talks, in 2019, regulators imposed KYC and AML compliance requirements on cryptocurrency exchanges, which later led to many non-compliance fines, even for the industry leaders. For instance, in 2020, the crypto exchange BitMEX faced a series of violations, including issues with the lack of KYC measures. The company later agreed to pay a $100 million penalty and enforced mandatory verification for all its users.

For example, complying with the FATF Travel Rule represents a chance for virtual assets to gain widespread acceptance in everyday scenarios. Companies like decentralized exchanges that stick to these regulations can have better access to traditional banking services, facilitating easier engagement with institutional investors. Additionally, regulators state that KYC can offer enhanced transaction transparency and trust to DEX customers.

The Main AML Compliance Concerns in DEXs

There are two important challenges DEXs face in terms of AML compliance: difficulties regarding transaction monitoring and jurisdictional issues due to different global and local rules. When traditional financial institutions conduct transaction monitoring to prevent money laundering and flag suspicious patterns, they have all the needed customer data.

Since some DEXs don’t employ KYC verification, they have limited personal information, making it hard to monitor their transactions. This leaves a security gap and opens a door for potentially suspicious activity for the DEX. Another critical aspect of AML compliance is continuous customer due diligence. Sanctions lists and watchlist databases undergo updates, with names being removed or added. Companies must check their existing customers against these lists periodically; otherwise, they risk facing penalties.

On top of that, DEXs function globally without being restricted by geographical borders. That means they may come under the regulatory oversight of multiple countries, each having its own set of AML regulations and demands. This AML compliance complexity creates a challenge for DEXs because they must identify which regulations are applicable and how to ensure complete compliance.

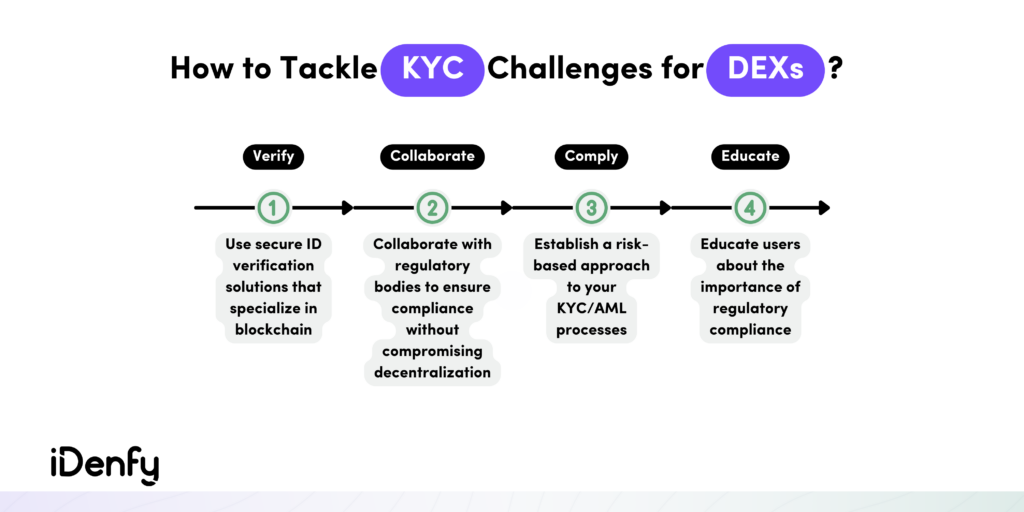

How to Tackle KYC Challenges for DEXs?

Today, almost all highly secure crypto exchanges and trading platforms require their users to provide personal information. Otherwise, they limit their transaction capabilities. This KYC-prone approach contrasts with the original crypto principles of freedom, decentralization, and deregulation that characterized the cryptocurrency market. After all, digital currencies were initially created as a way to be free from financial authorities.

Times have changed, and DEXs will inevitably face the need to tackle their KYC challenges. Nevertheless, despite these concerns, with or without KYC, there are many users who find the concept of using DEXs appealing.

So, to gain broader acceptance and recognition in the financial ecosystem, DEXs should proactively address KYC concerns by:

- Working with KYC providers that specialize in decentralized identity solutions.

- Collaborating with regulatory bodies to create guidelines that match both compliance requirements and decentralization principles.

- Adopting a risk-based approach (RBA) to KYC and AML and concentrating on higher-risk activities while ensuring compliance.

- Raising awareness about the importance of KYC and educating the DEX community.

KYC for your Decentralized Exchange

Finding the balance between decentralization and KYC compliance is crucial for the overall expansion and future of DEXs within the financial ecosystem. So, despite the talks about anonymity and the deteriorating nature of decentralization, stricter regulatory compliance is right at the doorstep for DEXs.

At iDenfy, we can help your decentralized exchange implement a proper KYC structure, both using AI software and manual KYC reviews. Multiple customization options based on the required KYC flow/risk level, various plugins to optimize your development experience, and many more fraud prevention solutions under one platform.