Gabija Stankevičiūtė

April 22, 2024

What is the Crypto Travel Rule? An Overview

Explore the Crypto Travel Rule and learn what data needs to be collected, who qualifies as a VASP, as well as the necessary steps and tools for crypto platforms to comply with the FATF guidelines.

April 17, 2024

Third-Party Money Laundering Risks Explained

We dig deeper into how third-party money laundering can harm a company’s reputation, explain how to monitor suspicious activity, and go through the top key measures that can prevent such risks.

April 11, 2024

How Can You Detect Arbitrage in Sports Betting? [Simple Guide]

Learn what arbitrage in sports betting is, how arbers try to avoid getting caught by skilled bookmakers, and what it takes for companies to actually prevent unwanted arbing activities.

April 3, 2024

eIDAS Regulation: What You Need to Know

Find out what eIDAS is, its history, importance and the key steps that are required to build a secure and compliant identity verification aligned with these regulations, ensuring digital trust and security.

The Risks of Shell Companies in Money Laundering

Shell companies can hide ownership and transactional details from regulatory and law enforcement authorities, which makes them less transparent and, at the same time, more attractive for fraudsters to use for money laundering. Read more.

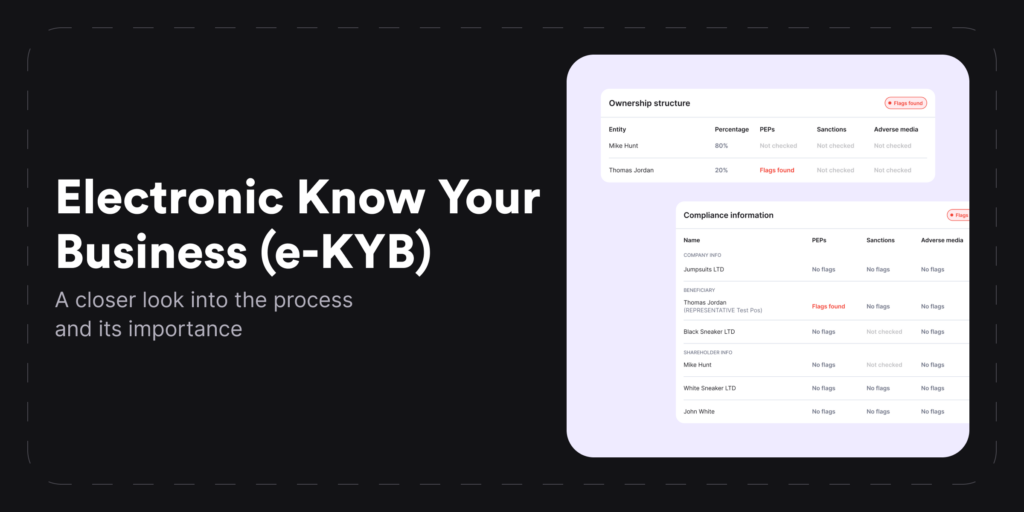

e-KYB Explained — A Comprehensive Business Verification Guide

Learn how to prevent partnering with illegitimate companies and build trusted business relationships easier with a streamlined approach to business verification — e-KYB.

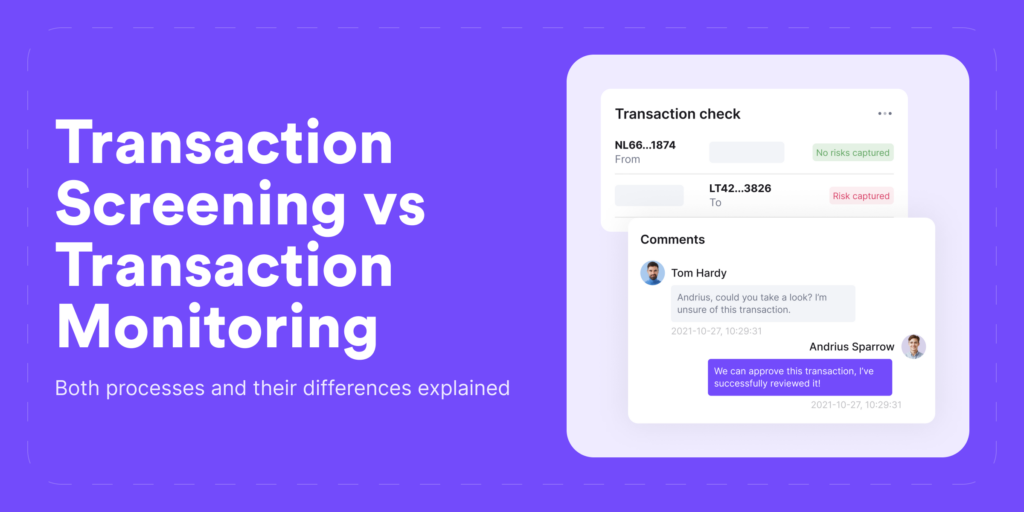

Transaction Screening vs Transaction Monitoring [AML Guide]

Explore the key differences between transaction screening and transaction monitoring processes, learn why they’re vital for AML compliance, and find out the best ways to manage emerging fraud risks.

March 19, 2024

An Overview of the Anti-Money Laundering Act of 2020 (AMLA)

A major milestone in AML compliance occurred with the passing of the Anti-Money Laundering Act of 2020 (AMLA), which perfectly reflects the expansion of US AML laws in recent times. Discover the key changes and their impact on today’s AML landscape.

March 18, 2024

Case Study: Payset

Find out how Payset integrated iDenfy’s AI-powered identity verification solution and transitioned from a manual KYC process to a fully automated onboarding system, tailoring user interface with their brand.

March 15, 2024

Know Your Employee (KYE) Explained

You should know your customers, but what about your employees? We dive into the process of Know Your Employee (KYE), pinpointing the key challenges of identifying individuals and specific background checks that are vital before the hiring and onboarding stage.

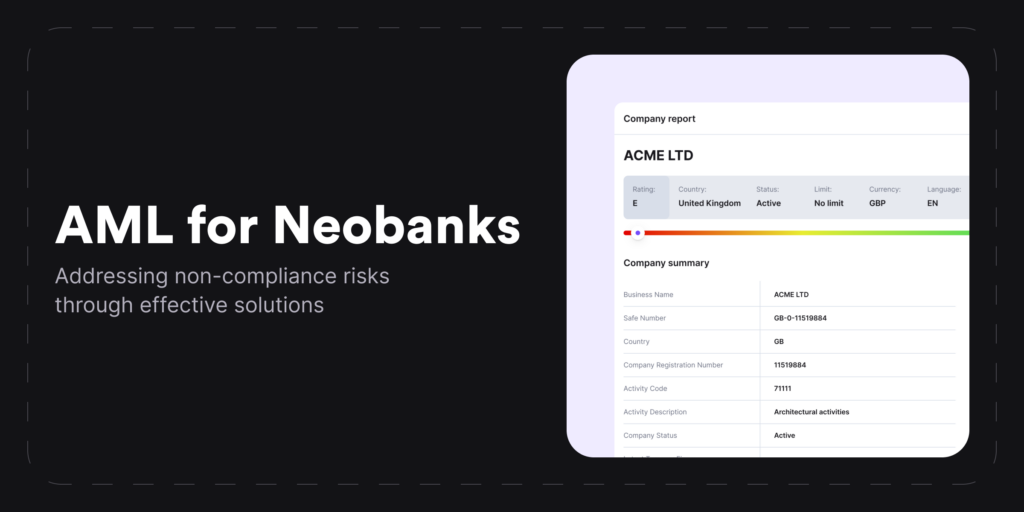

AML for Neobanks: Compliance Challenges and Solutions

Find out which qualities make up a neobank, how this new form of a bank differs from traditional financial institutions, if neobanks are obliged to stay in line with the same AML requirements and learn how they overcome their compliance challenges.

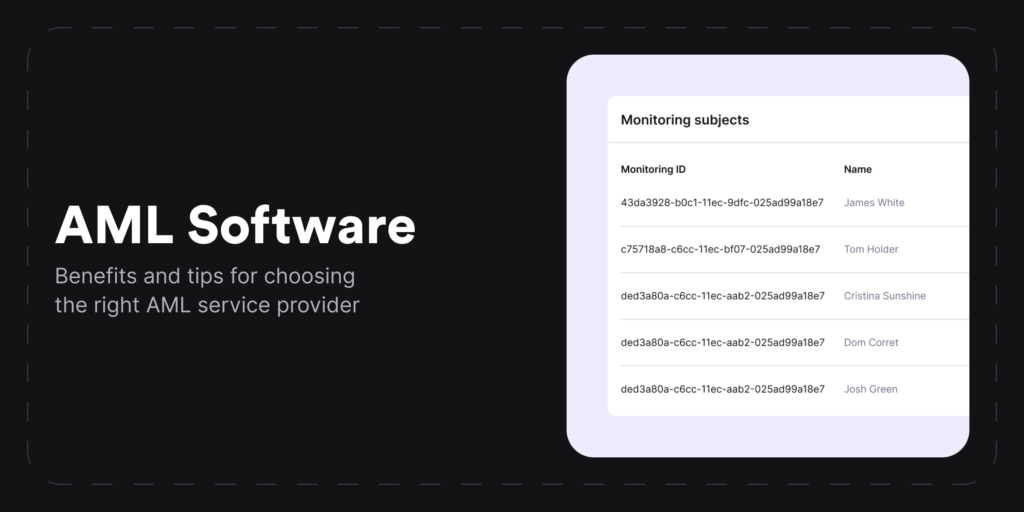

Anti-Money Laundering (AML) Software: Explanation, Features & More

Explore the world of anti-money laundering (AML) compliance, access insights on selecting the right AML software, identify what crucial features AML automation should have, and understand what AML procedures AI-powered solutions can actually automate.

KYB vs KYC — What is the Difference? [Explanation Guide]

KYB and KYC checks are vital for AML compliance, ensuring safety through verifying identities, reporting suspicious activities, and maintaining detailed financial records. Discover the distinctions between both processes and learn the essential steps helping businesses prevent financial crime.