Money laundering is a financial crime that involves hiding the originality of illegally gained funds. Fraudsters use this process to integrate “dirty money” into legitimate financial systems, making money legal, and so, due to globalization and digital improvements, money laundering schemes are becoming more complex and harder to trace.

Let’s begin by learning what money laundering is, reviewing the biggest money laundering cases worldwide, discussing possible measures to prevent similar occurrences, and familiarizing ourselves with their impact.

What Is Money Laundering?

We talked about money laundering in our first sentence, but one sentence is not enough, right? So, what exactly is it? Money laundering is the act of making illegally obtained money appear legal. How is it done? It usually has three stages:

- Placement: Gambling establishments and cash deposits for fraudsters are like an escape to hide illegally gained funds in the financial system.

- Layering: Transferring funds using countries and separate accounts to hide funds’ origin.

- Integration: Reintroducing the laundered money into the economy, making it appear as though it was earned legitimately.

Nobody was sitting around waiting for some miracle to happen, and governments and financial institutions have implemented Anti-Money Laundering (AML) solutions to prevent this from happening. However, as the following cases show, the most enthusiastic fraudsters can break even the biggest and most anticipated security systems.

The Biggest Money Laundering Cases

As we know, you must be creative to make something big. Money laundering cases are not an exception. They are often as creative as they are illegal, and by examining these cases, we better understand how such schemes operate and impact financial institutions, governments, and societies.

Wachovia Bank and the Mexican Drug Cartels

In 2010, Wachovia Bank, a U.S. financial institution, laundered an estimated $350 billion for Mexican drug cartels. The one mistake that the bank made was that they hadn’t implemented strong AML controls, this way allowing criminal organizations to finance their operations, leading to a rise in violence and illegal drug trafficking.

Investigations that were made revealed that drug cartels used the bank’s services to transfer cocaine sales in the United States all the way back to Mexico. This money was often deposited into cash-intensive businesses such as currency exchanges and wired through Wachovia Bank accounts. Wondering what happened next? The case ended with a $160 million penalty – relatively small compared to the scale of the crime.

The Danske Bank Scandal

Between 2007 and 2015, Danske Bank processed approximately $228 billion in suspicious transactions. Most of these funds originated from Russia, and despite the internal warnings, the bank failed to take immediate action.

The money was transferred through a lot of companies and was moved into accounts that did not belong to the residents. Criminals this way were allowed to hide their funds’ destinations and their true origin from where they came from. Such scandal caused many doubts about the bank, finally leading to its downfall of shareholder trust and, in this way, introducing stricter regulations across Europe.

1MDB Scandal

The 1MDB scandal was one of the bigger cases because it involved more than one billion dollars in funds and involved people like former Prime Minister Najib Razak, who was accused of using illegal funds to cover expensive purchases and political campaigns. The stolen funds were also run through a large network of global banks and businesses, which does not improve the situation.

Real estate in major cities like New York and London, luxury yachts, and even Picasso artwork were all bought with the same illegal funds, triggering international investigations. Goldman Sachs faced lawsuits for underwriting bonds linked to the fraudulent scheme.

HSBC in Laundering Drug Money

U.S. authorities in 2012 fined HSBC with a fine which reached $1.9 billion for letting launder money for drug cartels, allowing them in Mexico and Colombia to transfer hundreds of millions of dollars through HSBC accounts.

Drug cartels were acting freely as HSBC was accepting bulk cash deposits without asking or investigating where the money came from and why it was deposited into the bank, investigators said. Later, we discovered that the money had been deposited into the bank physically. The bank packed it into specially designed boxes that fit perfectly into the bank’s deposit slots, and that is exactly where the drug cartel implemented the whole creativity process.

The Bank of Credit and Commerce International (BCCI)

Drug cartels and corrupt governments were laundering billions of dollars, and BCCI was involved in all of this as they were their clients. The scandal was undisclosed and reached the public in 1991, which led to the bank’s closure.

The bank system had various exposures to international banking regulations, which is why the BSSCI case occurred in the first place. The bank, which operated in multiple jurisdictions, exploited money laundering and evaded tax – did not see everything through, which led to the bank’s closure and the introduction of stricter compliance to the world.

Nauru

Nauru – It is one of the smallest island countries but is famous for one of the biggest scandals in the world. Lax banking laws allowed an estimated $70 billion in laundering, eventually forcing the country to reform its banking system.

In 2002, the U.S. treasury decided that Nauru was a money-laundering state and declared it as that, imposing hard sanctions. Until 2005, Nauru passed AML laws with the help of the Financial Action Task Force (FATF).

Al Capone and Laundromats

And here we are, at the very start of money laundering history. Al Capone, one of the biggest American criminals, is often credited with inventing and coining the term “money laundering.” The Prohibition era brought him an opportunity to legitimize proceeds from bootlegging and gambling, which he and his associates used.

The laundromats provided a plausible explanation for significant cash flows, masking the illegal sources of the funds. Though the term has evolved, his methods remain a foundational example of money laundering. His eventual conviction for tax evasion rather than direct criminal activity was very effective in targeting financial crimes to disrupt organized crimes.

The Impact of Money Laundering

Money laundering causes instability, including:

- Economic Instability: As illegal funds are being added to the legitimate economy, it causes economic instability and weakens fair competition.

- Increased Crime Rates: It is way easier to fund organized crime, including drug trafficking and terrorism, with illegal, laundered money than with legal.

- Reputational Damage: Reputation is ruined with those institutions that were involved in money laundering, especially with those that knew about it and did nothing about it.

Preventing Money Laundering

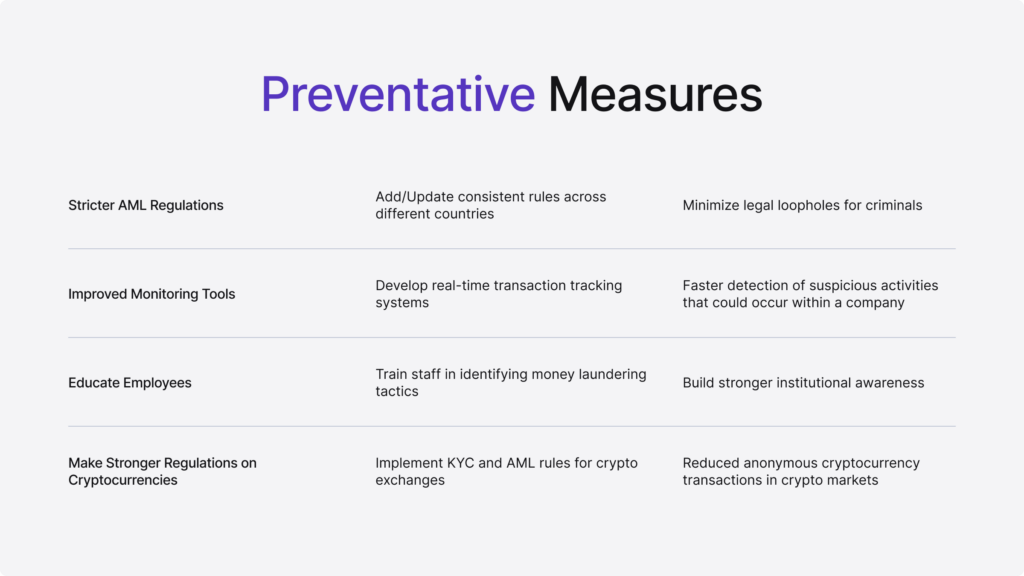

These cases have taught us lessons, and additional security measures are being implemented to prevent such outcomes. The governments and various institutions must:

- Improve AML Technologies: Add technologies such as AI to detect unusual transactions faster and more accurately.

- Strengthen Regulations: Add strict AML rules to have compliance across different jurisdictions.

- Promote International Cooperation: Money laundering often involves multiple countries. Governments and institutions must try to collaborate globally to track and prosecute offenders.

- Increase Transparency: Have financial institutions disclose information about high-risk clients and transactions.

Conclusion

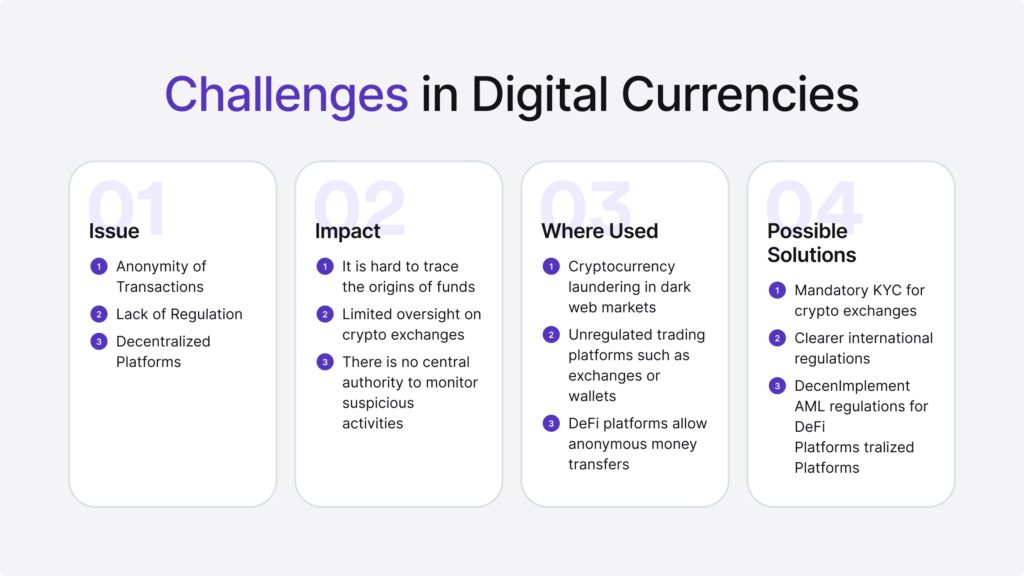

In the previous days, while there were no strong AML measures, criminals and fraudsters could launder money whenever they wanted, but that does not mean money laundering has disappeared in today’s world. With the rise of cryptocurrencies, the risk of money laundering is as great as before, so banks, businesses, companies, and various other financial institutions have to implement strong AML compliance to be secure. If you are interested in it and want to be more secure – book a free demo with us.