The number of fraud cases and financial crimes in the digital world is increasing, and organizations must solve these issues, maintain their security, and make users’ experiences as smooth as possible. Maybe someone wonders how organizations can do this? One way is to use the Know Your Customer (KYC) process, which helps prevent money laundering, identify users, avoid fraudulent activities, and much more.

However, verifying users through KYC alone is not enough. What if their address information changes? What if the data they provided during the onboarding stage becomes outdated after some time? And this is where KYC remediation comes in. Let’s discuss its importance.

What is KYC Remediation?

First, if we want to talk about remediation, we must get familiar with it. The KYC remediation is a process in which the information collected through KYC is revised from time to time, or if there are any significant life events, to review, search for missing information, update it, and ensure it remains updated for that time.

The remediation process includes:

- Checking and identifying users’ documents that are incomplete, inaccurate, or outdated

- Contacting users to check their information and confirm that it is incomplete

- Validating and confirming the new data

There is more to discuss about remediation processes, so we’ll get back to these later.

Why is KYC Remediation Important?

Nobody wants to deal with unsafe companies, and remediation should be more than a regular checkbox; it makes the company trustworthy, manages risk easier, and makes it more organizational. If the data about users is inaccurate, it could underestimate the risks and fail to prevent fraudulent activities.

In successful organizations, it can’t be an optional part. If your company wants to maintain compliance with the Anti-Money Laundering (AML) directive or General Data Protection Regulation (GDPR) to avoid reputation harm, it is a necessary step to implement KYC remediation. If a user knows about the KYC remediation in the company, it elevates their trust significantly and confidently gives the data to deal with.

The correct data reduces inefficiencies caused by checks or miscommunication, streamlines workflows, saves precious time, and offers efficient service to the user.

The KYC Remediation Process

We have discussed what KYC remediation is before, so let’s get deeper into it. If KYC remediation has a structured approach – we could call it successful.

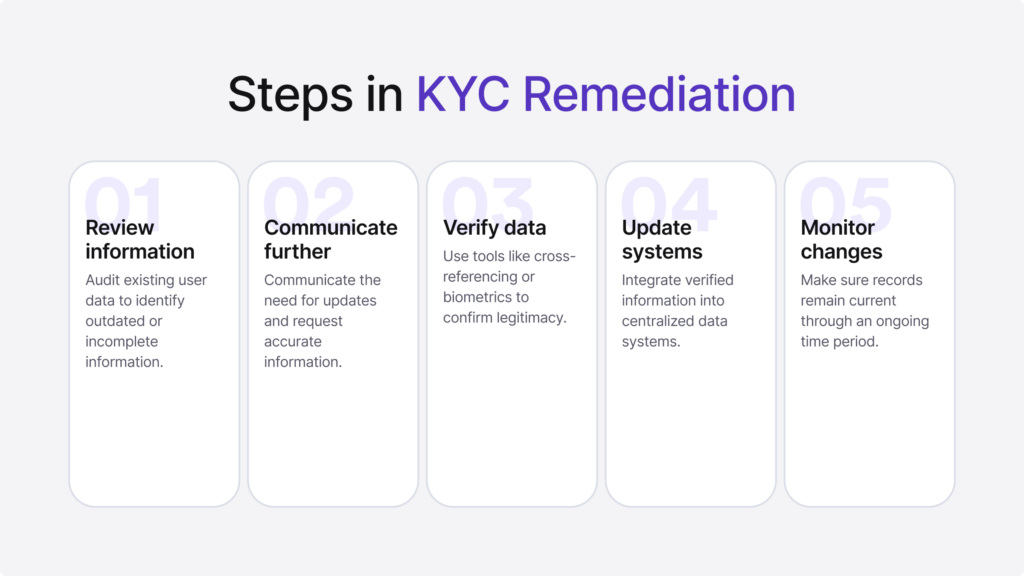

It consists of the following steps:

1. Data Analysis

There could be a case where older users have not logged in or made any transactions for a while due to avoiding contact with your company. For example, the user may have found a better one or simply forgot about the one he was using before. The first step in the KYC remediation process begins with identifying inaccuracies and gaps – a broad audit of the existing customer data.

The users’ documents are monitored to:

- Identify old documents

- Detect missing or incomplete information

- Highlight missing information in the user’s data

Organizations must update the regulations with the new data to reflect changes regarding KYC information concerning their fields of operation and jurisdiction.

2. Outreaching Users

Let’s say identifying the missing or mismatched information was successful. What’s next? The company must contact the users to update their information. Companies could inform users through a call, phone message, the company’s website if it has such a function, or simply an email. Make sure that the message you send to the user is formal and precise, as it can reduce the response time.

3. Data Integration and its Verification

Now that the company has contacted and the user has provided new data, it should be verified and integrated. The newly provided data can be verified through cross-referencing in various databases and biometric verifications. After verification, the data should be updated in the systems.

4. Ongoing Monitoring

The new, updated, and integrated data can’t be left just to stay there. Continuous monitoring has to be in place, as users can change the data at any time, and it needs to be updated again if necessary.

Related: What is Ongoing Monitoring? [With Examples]

Creating a Successful KYC Remediation

Financial companies must create successful KYC remediation to ensure compliance and manage risks.

Some key tips to create a successful KYC remediation include:

Advanced Technology and Data Analysis

Analyzing user data can be complicated, so companies must approach it efficiently and look at it with care. Numerous KYC solutions are designed to manage substantial information effectively. These technologies can fulfill local and global Enhanced Due Diligence (EDD) standards throughout the KYC lifecycle, incorporating features that support a risk-based approach vital for ensuring continuous compliance with KYC regulations.

Related: What is the Difference Between CDD and EDD?

Automating Remediation

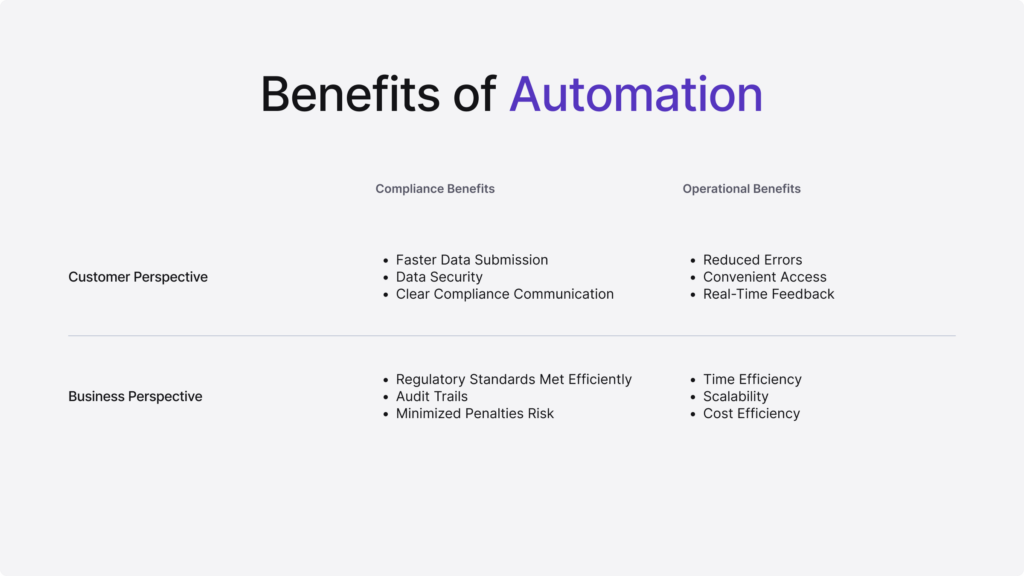

To implement the best KYC processes in your company, automate them as much as possible. Automation can reduce manual work and human errors, help sort data efficiently, provide consistency, and improve the overall customer experience. We will discuss automation more later on.

Regular Updates

To maintain accurate and reliable KYC data on your systems, update it annually or follow any significant life events or transactions (depending on the user’s risk level). Optimization, such as automation, or other tools like AI or machine learning in KYC remediation and continuous monitoring, would make it easier and more efficient to follow this data.

Collaboration With Other Organizations

Collaborating with other organizations and sharing data with them could help to monitor customers’ data more efficiently, preventing illicit activities or fraud if there is a potential risk. Training all relevant staff in KYC compliance ensures a safe space in customer data management and the organization itself.

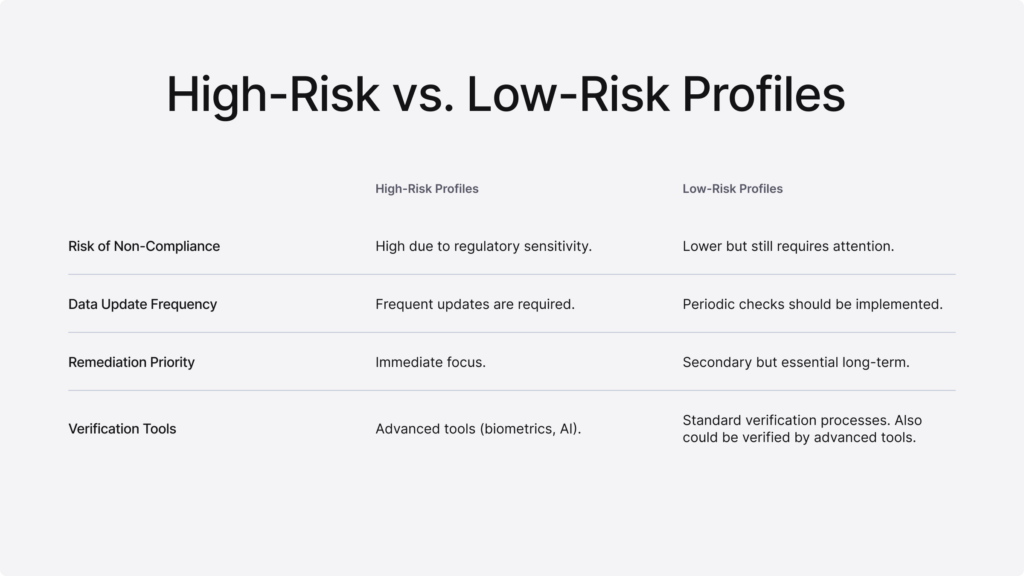

1. Risk-Based Prioritization

Risk can occur anywhere, so companies must prioritize risks from high to low. This risk-based approach ensures that users with high-risk and more complex case accounts are contacted first and reviewed manually, while the lower-risk accounts are addressed systematically later to prevent higher-risk profiles from possible risks faster.

2. Central Data Management

With central data management, companies can keep their users’ data in one place – easing the search and avoiding duplication by sustaining consistency. This way, remediation is much more effective and scalable.

3. Encourage User Cooperation

Companies can’t do everything themselves, so they can encourage users to submit their updated information if there are any changes. They should also make it clear and available to users why updating data is necessary.

KYC Remediation Automatization

Specific actions trigger automated data remediation. In this case, the system would notify which users’ data is outdated or mismatched. Many tools can automate remediation when any change in the data is detected. Of course, it is the user’s choice whether to update the new information or not.

Specific workplace teams may be busy with certain tasks, and manually checking to see if users’ data is still valid can be annoying. By automating remediation, Companies can improve their system reliability and consistency and implement more strategic projects that benefit the company.

Monitoring automated KYC remediation data to detect issues and ensure everything functions well is necessary, as well as other factors, such as:

- Identification: Automatization identifies accessibility issues in the organization and notifies specific teams about them.

- Monitoring: Ongoing monitoring always maintains the organization’s accessibility compliance and standards.

- Optimization: Ensures that automated remediation optimization is in place, helping improve the overall user experience.

Related: Top 3 KYC Automation Benefits for Businesses

What if the KYC Remediation is Ignored

KYC restrictions are already strict, and incorrect implementation could negatively impact regulations. No one ever recommends ignoring KYC remediation – if it is, it always has serious consequences. In this case, it could have financial or even reputational impacts. If that is not enough, it could also lose users’ trust and keep potential investors away.

Ignoring inaccurate data from users can result in inefficiency, delay transaction processing, or frustrate the user himself.

Without the correct data, it becomes way more complicated for organizations to detect fraud and illegal activities, and this may expose organizations to lawsuits, so they shouldn’t wait for users to update their information because they can easily forget it. Instead, do remediation and ask them to update it.

Conclusion

KYC remediation is critical for many modern organization operations. It is always a trustworthy choice for maintaining trust and digitally securing users’ privacy. Although the process could seem complex, best practices like automation, clear communication, centralized data management, and other optimizations can make it more manageable.

Organizations can turn a regulatory necessity into a strategic advantage by treating KYC remediation as an opportunity to improve customer relationships and operational efficiency. Prioritizing KYC remediation is an investment in security and long-term success.

Interested? Book a free demo with us and ensure your company is safe and sound.