May 24, 2023

Customer Due Diligence Solutions — How to Build CDD Compliance?

Customer due diligence solutions can collect and analyze large data volumes from multiple sources, helping companies more efficiently check ID documents, financial records, and overall online presence. But it all sounds easier than it actually is in practice.

August 16, 2020

Understanding: Customer Due Diligence

CDD or Customer Due Diligence is an ideal way to determine whether or not a potential customer is worthy. It is a crucial element of managing your risk and protecting your business against financial crimes. If you want to know everything about Customer Due Diligence, read this post until the end.

December 18, 2023

What is Enhanced Due Diligence (EDD)? [With Examples]

Enhanced due diligence (EDD) is a set of measures designed to assess customers based on their risk profiles. EDD is based on a risk-based approach that helps companies gather comprehensive information about their customers and safeguard against crimes, such as money laundering or corruption. Enhanced due diligence plays a crucial role in addressing these challenges and is the key process for dealing with high-risk customers.

September 13, 2023

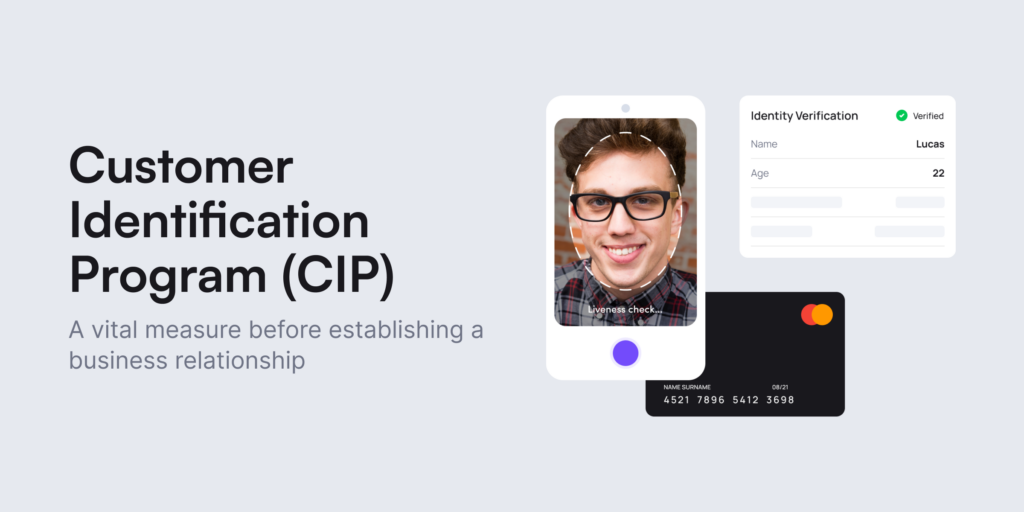

What is a Customer Identification Program (CIP)?

As a piece of a broader Know Your Customer (KYC) strategy, companies must conduct Customer Identification Programs (CIP) to establish their customer identities. Any business classified as a financial institution, according to the Bank Secrecy Act (BSA) is required to create a CIP. Learn more about its requirements.

June 22, 2023

A Quick Guide to Simplified Due Diligence (SDD)

Before forming a new business relationship, financial institutions must evaluate what level of due diligence suits the new customer. Whether it’s an account opening process on a financial platform or a potential customer looking to purchase real estate, companies must determine how much risk an individual presents: low, medium, or high risk of money laundering or terrorist financing.

April 21, 2022

eKYC (Electronic Know Your Customer) Explained

Explore the different benefits and opportunities that eKYC can bring to many industries and learn how to optimize compliance workflows.

April 13, 2021

Enhanced Due Diligence: Complete Checklist for 2024

When you start dealing in business, companies usually focus on the profit instead of who they’re dealing with. But as times change and online frauds increase staggeringly, companies are taking customer identity verification and due diligence very seriously.

March 19, 2020

Know Your Customer (KYC): How Does It Work?

Know Your Customer or KYC is a vital customer identification tool that companies and financial institutions use during the customer onboarding process. Since its inception, KYC has become a significant tool to fight financial crimes and cyberattacks. Countering the financing of terrorism (CFT) and anti-money laundering (AML) define and constantly update their guidelines to fight financial crimes.

April 25, 2023

What is the Difference Between CDD and EDD?

Businesses perform different levels of Know Your Customer (KYC) processes on their customers, namely Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD). To understand CDD and EDD better, we’ll discuss the differences and key aspects of how to ensure proper compliance for low-risk and high-risk customers.

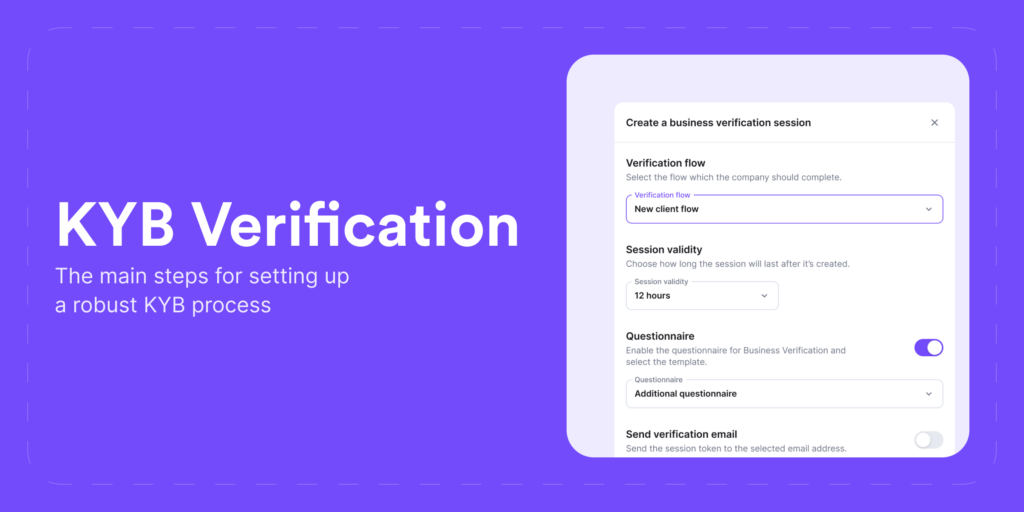

6 Steps to Conduct a Know Your Business (KYB) Verification Check

Discover the specific steps and examples of how to conduct a compliant Know Your Business (KYB) verification process.

Get Ready for Your AML Audit [Best Practice Guide]

Understanding how to select the right automation tools, assessing the effectiveness of internal controls like prepared reports, and setting the scope and frequency of an AML audit can be challenging. Learn how to verify the effectiveness of your AML program with a straightforward AML audit guide.

April 17, 2024

Third-Party Money Laundering Risks Explained

We dig deeper into how third-party money laundering can harm a company’s reputation, explain how to monitor suspicious activity, and go through the top key measures that can prevent such risks.

April 3, 2024

eIDAS Regulation: What You Need to Know

Find out what eIDAS is, its history, importance and the key steps that are required to build a secure and compliant identity verification aligned with these regulations, ensuring digital trust and security.