February 7, 2023

A Definitive Guide on KYC for Crypto [Updated]

It’s an open secret that cryptocurrencies were introduced to tackle the problems of centralization and lack of authority in finance after the 2008 financial crisis. Though they have been used in illegal activities, they have ended up causing billions of dollars in damage. Read more.

December 1, 2022

How Identity Verification is Helping Combat Cryptocurrency Crimes

While the use of cryptocurrency for payment is gradually getting into the mainstream and inviting more users to experience what the fuss is about, regulators seek to implement more robust security measures to tackle the ongoing issue of crypto crimes.

November 24, 2022

AML Regulations in the USA: Everything You Should Know as a Business Owner

Since 2002, more than 38 institutions in USA have reached settlements or pled guilty due to non-compliance with AML regulatory requirements and paid substantial fines in settlements.

October 4, 2022

AML Guidelines in the European Union. What Should Financial Companies Know When Applying Business Verification?

Over the past decade, the EU has been considering how to combat the potential illicit flows through banks and other financial institutions. It’s clear that stricter financial processes call for a more robust action plan from all financial players. This time, we’ll review the EU and its standards by providing all the necessary guidelines.

Know Your Business (KYB) Verification: What You Need to Know

Learn what Know Your Business, or KYB verification, is, focusing on the main compliance challenges in regulated, high-risk industries while learning about key automation solutions.

May 31, 2022

Identity Verification in the Art Market: KYC/AML Checklist to Prevent Fraud

While some use art to awaken their imagination or express themselves, others see it as a great way to invest. You can argue about the taste in art or what piece to put in your living room, but one thing’s for sure: art has always been a part of luxury and an entry into the elite. It also comes with a huge price tag and a possible risk factor. In this article, we discuss how identity verification helps combat fraud in the art market.

Screening and Ongoing Monitoring: Using AI Tools for AML Compliance

Are you wondering what tools and methods can detect and prevent vicious crimes, such as illegal earnings and money laundering? Will it be Customers’ AML Screening and Ongoing Monitoring? Keep reading to find out.

October 6, 2021

What is Politically Exposed Person (PEP) Screening?

PEP stands for Politically Exposed Person. But what exactly does this term mean, and why is it essential to understand? Find out in this blog post.

Why Know Your Business (KYB) is Crucial for Your Company

KYB, or Know Your Business verification, is crucial for onboarding and monitoring corporate clients. Learn how to onboard your partners, identify the individuals controlling the organization and help prevent money laundering.

July 21, 2021

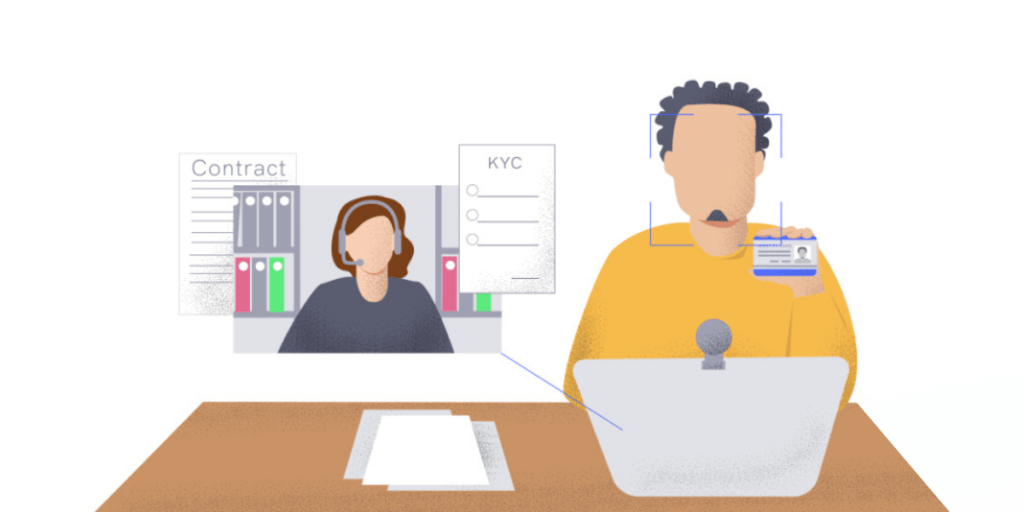

Video Identification: What it is and How it Benefits Businesses

As the financial and banking sectors shift more and more of their services to digital platforms, the need for remote identification services is higher than ever. But more reliance on digital platforms means more significant cyber threats. Fraudsters and scammers are getting smarter with each day, looking for an opportunity to pounce on prey.

January 4, 2021

Identity Theft: Definition, Prevention, and Examples

Identity theft is a serious concern all across the globe. It’s a crime of obtaining personal details of another person to commit fraud. There are numerous identity theft types, ranging from synthetic identity theft to social security identity theft to financial identity theft. Each theft can harm you in different ways, but you can prevent them by using simple tips and tricks. Let’s find out what these tips are.

What is AMLD5? The 5th Anti‑Money Laundering Directive

On 19 April 2018, the European Parliament adopted the 5th Anti‑Money Laundering Directive. Read more.

Prohibited Businesses [Common Types & Examples]

Find out which entities are considered to be prohibited businesses and what sort of high-risk companies it’s best to avoid to prevent brand damage or non-compliance. Review the most common due diligence measures, KYB requirements, and other useful tips on company background checks.