Identity theft cases are at an all-time high. In the first nine months of 2023, there were 2.6 million cases of identity theft and fraud. Partially, that’s because the range of ID theft methods has shifted from traditional ones like payment card theft and presented more complex cases, such as synthetic identity theft.

Experts believe that a person becomes a new identity theft victim every 22 seconds globally. Most studies predict that this rate will increase in 2025, becoming an even bigger issue for all online platforms that are required to ensure the safety of their customers.

Identity theft happens when someone steals your personal information and uses it without your consent. There are numerous types of identity theft, each affecting you differently.

Let’s briefly explore some of the main identity theft methods and how to prevent them.

How Safe is My Identity Online?

Nobody’s fully secure on the internet. For this reason, over the years, children at school and their parents at their workplaces have been receiving cybersecurity training and proper tips on cyber hygiene. Despite the efforts, with significant advancements in AI, some fraudsters and bad actors are ahead of their time.

But why should you fear identity theft? Stolen personal information means losses for the victim, resulting in both emotional and financial damage. Typically, the main goal of stealing identities is to access data and use it for the fraudster’s financial benefit. This can be taking out a loan in another person’s name or even buying real estate under a false name, or using forged documents. Consequently, the dark web is full of stolen credentials at a funny price.

However, bad actors have various methods to target your identity, not just buying stolen data online, which we’ll discuss throughout this blog.

Types of Identity Theft

1. Child Identity Theft

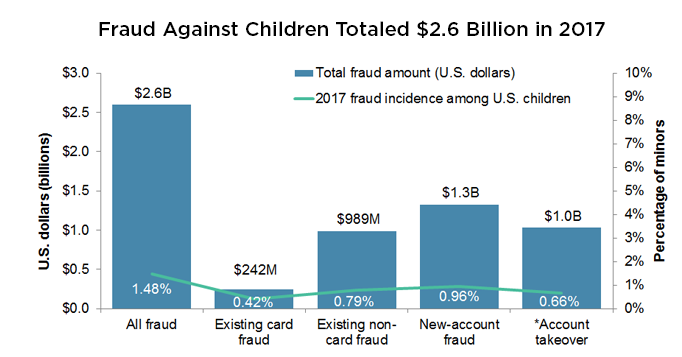

Child identity theft is a growing concern, with criminals exploiting minors’ innocence and clean credit history. Child identity theft happens when someone uses a child’s Social Security number (SSN) to commit fraud. Frauds can include applying for government benefits, opening credit accounts, or taking out loans unlawfully.

Image source

Cybercriminals can steal a child’s information from accounts at a kid’s favorite store or school databases. Therefore, parents must keep their child’s details private, including the Social Security number. According to a Javelin Strategy & Research study, child identity fraud hit around 1 million U.S. victims in 2017. In addition, almost one-third of Americans have been a victim of identity theft at least once.

How to Prevent Child Identity Theft?

Here are some essential steps that parents can take to prevent child identity theft and ensure their children’s future remains secure:

✅ Educate on Phishing and Scams: Teach your child about common phishing scams and fraudulent schemes. Make them aware of the tactics used by scammers, such as impersonating trusted institutions or individuals. Emphasize the importance of never sharing personal information or passwords via email, text messages, or phone calls.

✅ Regularly Monitor Accounts: Regularly review your child’s financial accounts, such as savings or college funds, to ensure there is no unauthorized activity. Set up account alerts to receive notifications for any suspicious transactions or changes made to the accounts.

✅ Be Wary of School-Related Data: Inquire about the security measures schools have in place to protect student’s personal information. Be cautious when providing consent for school-related activities that require personal data, such as field trips or online accounts, and ensure that the information is handled securely.

✅ Teach Responsible Online Behavior: Educate your child about the potential consequences of sharing too much information online. Encourage them to create strong and unique passwords for their online accounts and to avoid using the same password across different platforms.

By implementing these preventative measures and fostering open conversations about online security, you can significantly reduce the risk of child identity theft. Remember, your vigilance and guidance are essential in safeguarding your child’s future and ensuring their identity remains intact.

2. Synthetic Identity Theft

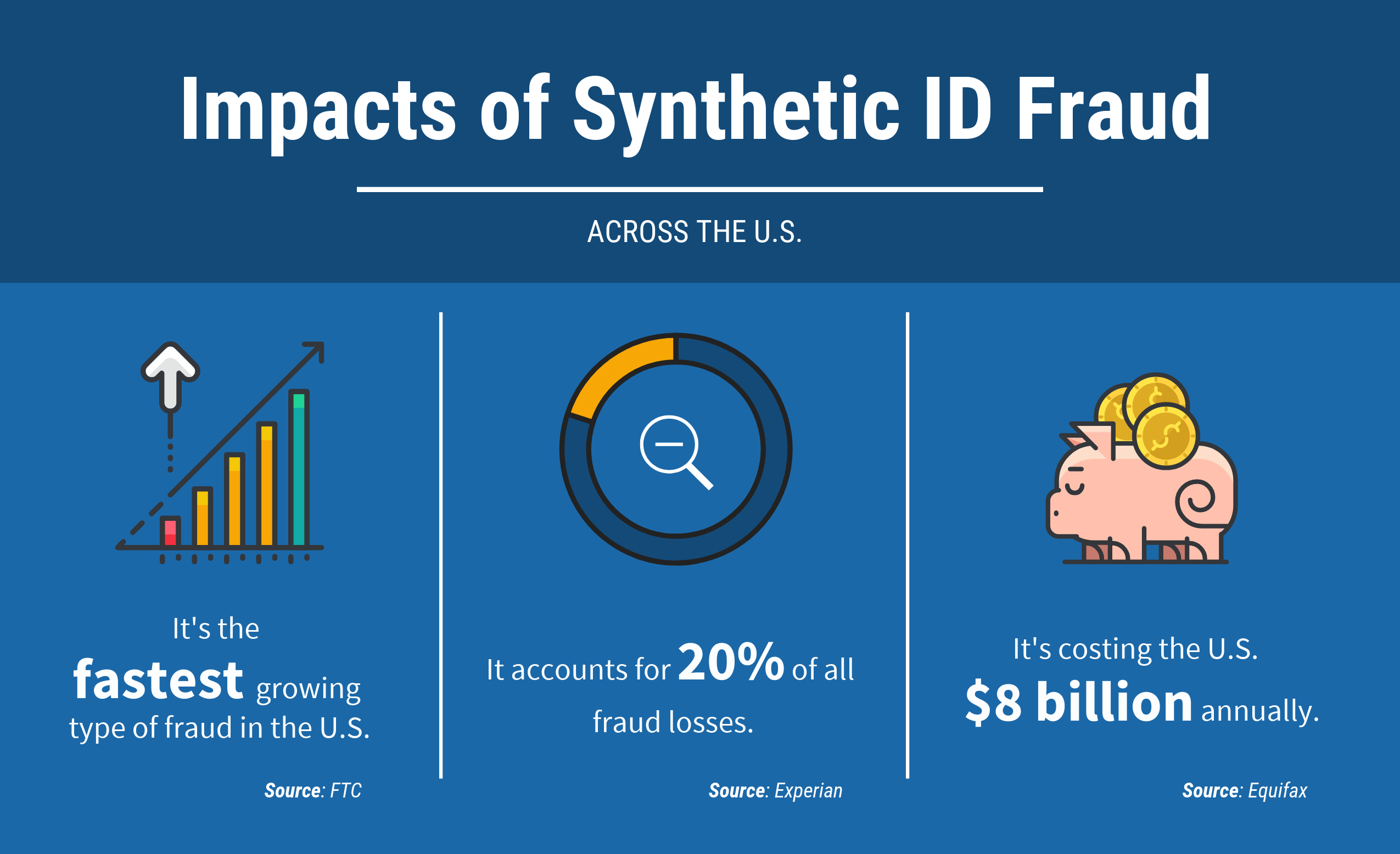

Synthetic identity theft includes creating a fake identity by combining real and fabricated data. It is used to take out loans or sign up for credit cards. Unlike traditional identity theft, where an individual’s personal information is stolen, synthetic identity theft is harder to detect.

According to the Federal Trade Commission (FTC), it is one of the fastest-growing fraud types in the United States, accounting for 20% of all fraud losses. Statistics from Equifax show that it costs the U.S. around $8 billion annually.

Image source

How to Prevent Synthetic Identity Theft?

Here are some essential tips to protect yourself and your finances from synthetic identity theft:

✅ Protect Your Social Security Number (SSN): Your SSN is a valuable piece of information sought by identity thieves. Keep your Social Security card in a secure location and avoid carrying it with you unless absolutely necessary. Be cautious when sharing your SSN and only provide it to trusted entities with a legitimate need.

✅ Check Your Credit Reports: Regularly monitor your credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion). Look for any discrepancies, unfamiliar accounts, or inaccuracies. If necessary, report any suspicious findings to the credit bureau and request a fraud alert or credit freeze.

✅ Strengthen Your Security Practices: Safeguard your personal information by adopting robust security practices. Use strong and unique passwords for all your online accounts, and consider using a password manager to store them securely. Enable multi-factor authentication whenever possible to add an extra layer of protection.

By implementing these proactive measures, you can significantly reduce the risk of falling victim to this type of fraud. Stay vigilant, protect your personal information, and regularly monitor your financial accounts to ensure your identity remains secure in an increasingly digital world.

3. Medical Identity Theft

Medical identity theft might cause severe problems for the victim. It occurs when someone steals the victim’s personal information and utilizes it to gain medical services, drugs, or treatments in his/her name. Sometimes, bogus medical bills come to victims. If false bills that come to victims go unpaid, it might cause a big problem.

Other examples of security issues that medical identity theft causes:

- A stolen medical insurance card can provide fraudsters with access to medical services under their identity, resulting in unauthorized treatments and financial liabilities.

- If you find a medical service listed on your EOB that you did not receive, it could indicate that someone has fraudulently used your identity for medical purposes.

- Inaccurate or altered medical records can lead to incorrect diagnoses, inappropriate treatments, and compromised care. Monitoring your records helps detect and rectify any discrepancies.

- If you get bills or collection notices for medical services you did not receive or discover errors in your medical records, these could be signs of medical identity theft. Report the incident to protect your identity and seek resolution.

If you suspect any instances of medical identity theft, act immediately. Report the incident to your healthcare provider, insurance company, and the appropriate law enforcement agencies. Follow their instructions to mitigate the impact of the theft.

By implementing these steps and staying vigilant, you can reduce the risk of falling victim to this type of identity theft. Remember, protecting your medical identity not only safeguards your financial well-being but also ensures the integrity of your health records and the quality of your healthcare.

Related: Know Your Patient (KYP) — How to Prevent Fraud in Healthcare?

4. Financial Identity Theft

Financial identity theft is a criminal offense that involves gaining access to someone’s personal information to commit financial fraud.

Imagine waking up one day to find your bank account drained or receiving notifications about credit cards you never applied for. These are the unfortunate consequences of falling victim to financial identity theft. It occurs when someone obtains and misuses your personal information, such as your social security number, credit card details, or bank account information, without your consent.

One typical example of financial identity theft is fraudsters stealing credit card details to make purchases without a credit card holder’s consent. With more than 271,000 cases, credit card fraud was the most prevalent form of theft in 2019.

How to Prevent Financial Identity Theft?

Remember, prevention is always better than dealing with the aftermath of identity theft. By following these tips, you can significantly reduce the risk of financial identity theft and protect your personal and financial information:

✅ Use Strong Passwords and Enable Two-Factor Authentication: Ensure that your online accounts are protected with strong and unique passwords. Avoid using easily guessable passwords, such as birthdates or sequential numbers. Include uppercase and lowercase letters, numbers, special, and invisible characters. Enable two-factor authentication (2FA) whenever possible, as it adds an extra layer of security by requiring a verification code in addition to your password.

✅ Be Cautious with Public Wi-Fi Networks: Public Wi-Fi networks can be vulnerable to hackers who may attempt to intercept your data. Avoid accessing sensitive information, such as online banking or shopping accounts, when connected to public Wi-Fi. If you must use public Wi-Fi, consider using a reputable virtual private network (VPN) to encrypt your internet connection and protect your data from prying eyes.

✅ Consider Identity Theft Protection Services: Explore reputable identity theft protection services that can provide an extra layer of security and peace of mind. These services typically monitor your personal information, such as social security numbers, credit card numbers, and addresses, and alert you to any suspicious activity. Some services may also provide assistance and insurance coverage in the event of identity theft. Do thorough research and select a trusted provider that meets your specific needs.

Stay vigilant, stay informed, and take control of your financial identity to ensure a safe and secure financial future.

5. Social Security Identity Theft

Social security identity theft is another common identity theft type. When a thief steals your Social Security number (SSN) and utilizes it to obtain other personal details about you is called social security identity theft.

Once a fraudster knows your name, address, phone number, and date of birth, they might use your identity to commit various crimes. Identity hackers can use your SSN to apply for new credit cards, open new bank accounts, register for home and car loans, and rob your tax return. They might even demand Social Security payments that you have received.

One crucial step in preventing Social Security identity theft is to be extremely cautious about sharing your SSN. Avoid providing your SSN unless absolutely necessary and to trusted entities. Be wary of any requests for your SSN through unsolicited calls, emails, or text messages.

Legitimate organizations typically have secure methods of obtaining your SSN and would rarely ask for it over the phone or through unsecured channels. Additionally, be cautious of phishing attempts, where scammers impersonate legitimate institutions to trick you into providing personal information, including your SSN. Stay vigilant and verify the legitimacy of any request before sharing your Social Security number.

If you notice any unauthorized changes or activities, immediately report them to the Social Security Administration. By actively monitoring your Social Security account, you can detect and address potential identity theft issues promptly, minimizing the damage and protecting your financial future.

Fun Fact: Equifax Inc, theU.S. credit bureau, suffered a hack that exposed the personal information, including SSNs. of 145 million individuals.

Other Tips Helping You Prevent Identity Theft

Now, you have a good understanding of different types of identity thefts. Let’s find out some tips and tricks to protect yourself from these frauds.

Adhere to Know Your Customer (KYC)

If you run a business where you have to contact several people in a day, you must adhere to Know Your Customer (KYC). Complying with KYC not only helps you avoid legal and reputational issues but also prevents fraudsters from using your platform for malicious purposes. An effective KYC process involves knowing a customer’s identity, financial activities, and the risks they pose.

Remember, businesses need to meet Customer Due Diligence (CDD) and KYC as per the law. Failure to liabilities might impose hefty fines and even imprisonment.

Be Alert About Fraudulent Activity

Never take the confidentiality of your personal information for granted. If you notice something unusual, report it immediately to the responsible organization before it causes any harm to you. Nowadays, companies provide robust identity verification features, including AML screening, face verification, and digital identity verification services, to reduce fraud risks.

Avoid Giving Out Personal Information

Fraudsters in the disguise of a credit card company employee or customer care executive can ask for your personal information like SSN, credit card PIN, etc. Remember, no legitimate firms ask for such personal details. If you doubt a call is potentially fair, ask the caller to hang up and contact the organization for confirmation.

Limit Your Exposure

There is a saying, “Prevention is better than cure.” It’s always a good idea to limit your exposure. You can limit the number of credit cards you carry in your wallet. Also, don’t carry a social security card until it’s essential.

Employ a Robust Identity Verification Solution

If you’re a business person, you must implement verification solutions to deal with different identity fraud types. Furthermore, it will improve your customer’s experience and help you comply with directives like AML (Anti-Money Laundering) and (Know Your Customer). To ensure high accuracy in identity verification, adopt the latest solution.

Ensure the identity verification system you invest in uses advanced technology like artificial intelligence, machine learning, and deep learning. When you combine such a powerful verification system with human intelligence, you get almost 100% results.

iDenfy is a renowned identity verification solution provider that offers AI-enabled ID verification solutions that let you mitigate fraud and meet regulatory compliance. We combine various verification solutions so that you can get everything you need in just one solution.

If you want to know more about our fraud prevention tools, feel free to book a meeting.

This blog post was updated on the 7th of August, 2024, to reflect the latest insights.