In response to evolving business onboarding regulations and requirements, KYC procedures have undergone substantial changes. eKYC, or electronic Know Your Customer, is an automated method that enables companies to verify customer identities digitally. Today, it emerges as a solution by leveraging technology to provide businesses with a more streamlined and scalable approach to the traditional KYC processes.

One thing’s sure. We live in a modern age of technology that has many perks. With the help of the internet, you can find an answer to a complex question in seconds. Such power comes with risk. Today, one of the most talked-about topics is data breaches and how the number of identity thefts and account account takeover cases has skyrocketed. That’s why more companies switch to eKYC solutions for a safer and more efficient identity verification process.

What is eKYC?

eKYC or Electronic Know Your Customer is the digital conception of the standard KYC process. It describes the widely used online identity verification process, which has become the new normal. Many organizations left papers and bureaucracy behind, as the digitalized alternative of the KYC procedure minimizes the costs and is known for its efficiency.

Key eKYC facts you need to remember:

- eKYC simplifies verifying identities and meeting KYC requirements through digital means. eKYC also offers users convenience, speed, and enhanced privacy.

- For businesses, eKYC brings many benefits, including faster verification processing times, decreased manual workload, and reduced human errors.

If you have read any of our blog entries, you have already heard of identity verification and the term Know Your Customer. It’s a process designed for security purposes – the customer’s identity is verified via a series of checks. In today’s digitized sphere, we usually bump into eKYC, especially in the background of finance.

Nowadays, businesses are obliged to build solid fraud-prevention systems that go along with Anti-Money Laundering (AML) measures, including KYC compliance. So the question is, do you really know your customer? The answer’s honest – you need to.

eKYC vs KYC

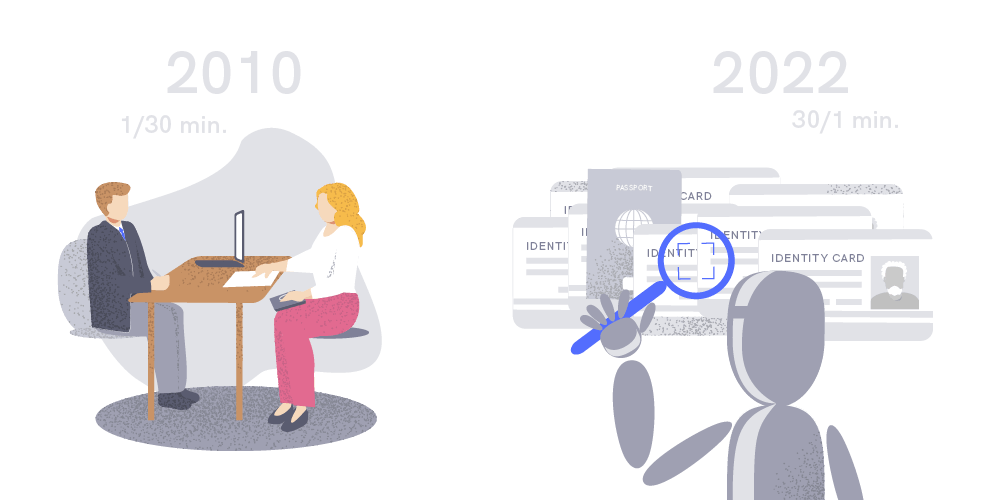

The distinction between KYC and electronic KYC lies in the method of collecting and verifying customer information. While KYC may involve offline processes like handling physical documents, eKYC employs AI and digital technology. In the meantime, KYC is a standard identity verification procedure in regulated industries, occurring during transactions or the initiation of financial relationships.

With eKYC, compliance risk assessment occurs digitally, eliminating the need for physical meetings or document exchanges. It represents a crucial evolutionary step in a process that safeguards businesses and society from fraud, terrorism, and other illicit activities. In general,

KYC compliance regulations apply to interactions between businesses or between a business and an individual, with significant implications in sectors like financial services. Legal mandates for KYC exist in various global markets, including the EU, US, and UK.

Related: Top 3 KYC Automation Benefits for Businesses

Three Key Benefits of eKYC

Traditional KYC processes are slower and more intricate than other customer onboarding aspects. Unlike with KYC automation, companies can’t provide swift experiences using paper-based or only manual verification methods. Traditional KYC may be more labor-intensive than the simpler process of extracting data, automatically comparing it with various databases, and only then manually checking them in other user-friendly services.

These things considered, businesses notice various benefits when using eKYC, including:

- Speed and scalability. eKYC uses automated software, drastically reducing the time required for KYC processes.

- Enhanced compliance-related operations. Through real-time online and Anti-Money Laundering (AML) database checks, companies can provide additional customer screening and monitoring, ensuring heightened compliance with KYC laws.

- Cost-effectiveness. A streamlined approach enhances the efficiency of the customer experience by minimizing costs, achieved through reduced workloads for internal compliance officers.

Other processes that are required for a KYC-compliant onboarding flow, like verifying Proof of Address (PoA) documents, are much easier with automated solutions. Think about it. Nobody wants to wait in line for hours, and no business wants to create unwanted friction for their users. Additionally, manual procedures increase the risk of human error. Certain customers, depending on the effort required in KYC, may see this process as a hassle, hindering their access to financial services.

Related: How to Improve KYC Verification? Tips For a Frictionless User Experience

Why You Need to Adapt and Implement an eKYC Solution

Even though some organizations struggle to adapt, these changes are vital in terms of saving clients and the company’s reputation. We are now used to receiving help fast and preferably – remotely. With the assistance of artificial intelligence (AI), the eKYC process is a new and improved version.

This adaptation best describes the digitalization of today’s reality, where consumers strive for security measures and fast results. If we take the global pandemic as an example, we know for a fact that it influenced our habits, which were drastically changed. Many elevated their retail businesses to e-commerce platforms as well. Naturally, the need for digital identity verification rose to combat the wider sphere of fraud.

Furthermore, eKYC enables scalability, as it can handle a larger volume of customer verifications without sacrificing accuracy or efficiency. This scalability is particularly crucial for businesses experiencing rapid growth or catering to a large customer base.

In addition, eKYC also reduces the workload on businesses by automating various processes and leveraging technology to collect and analyze customer data. This automation minimizes the need for manual data entry, resulting in fewer errors and freeing up valuable resources within the organization.

How to Choose the Best eKYC Provider?

For companies that want to switch from traditional KYC to the eKYC approach, it’s best to analyze the market and implement the best automated KYC solution. Key goals should be focusing on compliance, the balance of security and end-user experience and other considerations, such as the solution’s integration options or acceptable ID documents.

That said, don’t forget to consider the following features of the potential eKYC solution:

- Easy integration options, APIs, and plugins for every use case, such as WooCommerce or WordPress.

- Ability to build a smooth customer onboarding process, preferably with customizable KYC workflows, for instance, minimal friction for low-risk users.

- Compliance with regulatory requirements based on your location, customer base, and operating industry, preferably automating other processes, including verification for corporate clients.

- A built-in feature of real-time AML screening for automated database checks, such as PEPs and sanctions lists.

- Proper proof of security and safety values, for example, the ISO 2700 certification.

The Main Types of eKYC

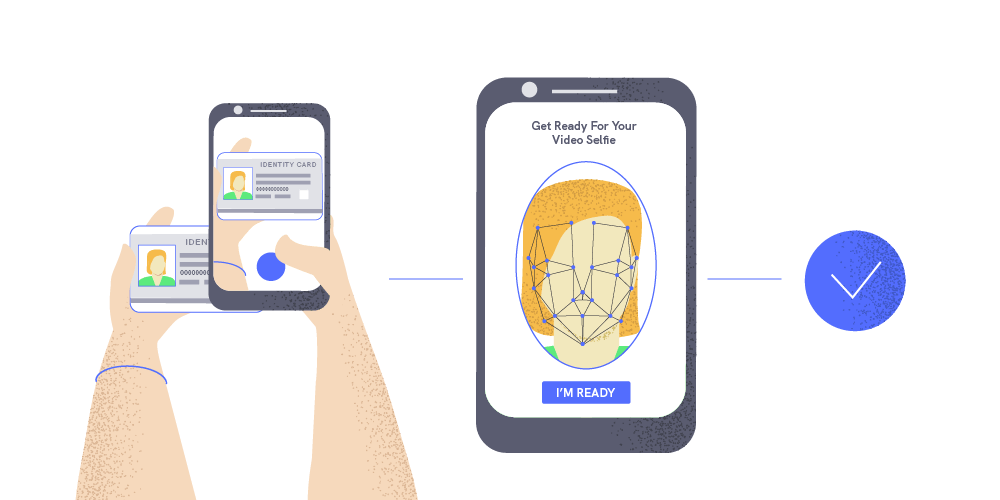

The need to adapt is also required to meet the standards of traditional verification security measures. With the help of AI and machine learning, facial recognition via video and submitting your ID document are great eKYC methods that provide quick and accurate results. Since it’s much harder to falsify videos than still images or selfies, videos lower the risk of fraud. This method adds a liveness factor, ensuring that the video can’t be pre-recorded.

There are two main types of eKYC:

1. Document Verification

One of the other well-known eKYC practices is document verification. Capturing your ID, driver’s license, passport, or residence permit allows you to determine if the submitted photo shows an authentic document quickly. At iDenfy, it takes up to 30 seconds to complete the whole ID verification process. Of course, a real document doesn’t automatically give you the green light – the information needs to be valid; otherwise, you’re dealing with a forged document.

2. Biometric Verification

Nothing can beat biometric data. Biometrics are a person’s special features that companies can use to verify their identity. Biometric data generally includes facial features and other unique traits, such as voice or fingerprints. When it comes to eKYC, the multiple data points of the face come in handy.

For instance, using our Face Authentication feature allows companies to authenticate their users faster. AI-powered algorithms compare the user’s onboarding selfie and the passport or ID capture to determine its legitimacy. All in all, it ensures accuracy and adds another layer of security since both the document and the user’s onboarding selfie data are reviewed during the identity verification.

Use Cases of eKYC in Various Industries

With constant developments in the technological background, it’s expected to request enhancements in the identity verification sector as well. People are gaining knowledge regarding eKYC, and with it comes responsibility. Customers want to have control over their data. To gain their trust, companies want to completely eliminate fears when it comes to verifying a user’s identity.

While eKYC is commonly associated with the banking industry, it has also found applications and adoption in various other industries.

Here are some examples:

- E-commerce: Online marketplaces and e-commerce platforms implement eKYC for user registration, seller verification, and fraud prevention. It helps establish trust and ensures secure transactions within the digital marketplace.

- Fintech: Fintech companies leverage eKYC for user onboarding, digital wallets, peer-to-peer lending, and other financial services. It enables quick and seamless customer verification, enhancing the overall user experience.

- Real Estate: Real estate agencies and property management firms adopt eKYC for tenant screening, lease agreements, and property transactions. It simplifies identity verification and helps prevent fraudulent activities.

- Healthcare: The healthcare industry utilizes eKYC to verify patient identities, manage electronic health records, and ensure compliance with privacy regulations. It streamlines administrative processes and enhances patient data security.

Since some argue regarding the lack of trust in eKYC and the identity verification process in general, the most mainstream concerns remain to be ID theft or banking fraud. This goes to show that this factor is well-grounded. Every year, ID theft costs banks billions of dollars. A recent report from The Identity Theft Resource Center (ITRC) indicates that there were 1 291 data breaches, from January to September 2021, compared with 1 108 in 2020.

Both parties, consumers and businesses, are becoming more security conscious. Due to the widespread issue of fraud, new and more effective tools are being created to keep up with the market’s needs. That’s why we now have eKYC, a digital way to verify customers that also identify security threats.

How to Make eKYC Effective?

At first glance, you might think that eKYC is just an identity verification procedure. This isn’t quite right, as effective ID verification is one of the components of the whole system. The question is, how can you make eKYC successful? You’re obliged to have powerful due diligence; otherwise, you might not know who you’re dealing with.

Any organization with money flowing needs to do its Customer Due Diligence (CDD). By creating a smart system, you benefit from its effective risk management. It comes along with avoiding potential crimes and fines. Basic identity verification isn’t enough, and as we progress, financial institutions take extra security measures. This helps build a valuable connection based on trust because consumers rely on institutions to keep their money and personal data safe.

Related: What is the Difference Between CDD and EDD?

eKYC in the Context of Enhanced Due Diligence (EDD)

The non-standard, or as we call on iDenfy, the Enhanced Due Diligence (EDD), is applied for high-risk customers who have better chances of being involved in money laundering activities. People from the Politically Exposed Person (PEP) list automatically fall into this category.

Doing the due diligence helps find out extra information that isn’t covered through eKYC, such as the nature of the business relationship or the purpose of the transaction. This process also answers the “how” questions – how the money was obtained and how much money the customer handles.

Effective eKYC can be defined as detective work, as a proper investigation must be done, and all questions must be answered. Once the true nature of the client’s transactions is deconstructed, the risks are minimized. In the digital world, paper leads to trials and additional expenses, whereas eKYC is a solution to reduce human error and the risk of corruption or tax evasion.

iDenfy’s Approach to eKYC

To think that data leaks will disappear in the future is a promising but naive approach. Many businesses require customers to add their personal information (name, address, date of birth, etc.). Despite that, more organizations need their customers to complete their onboarding with identity verification. This is where eKYC comes into play, as its speed and accuracy are major wins in the digital world. We have the technology, and we can use it wisely.

Understanding the needs and the power of technology, we have created a combination of advanced Liveness Detection, ID Verification, and Face Recognition into one user-friendly 4-step remote verification process. The secure, AI-powered identity verification protects businesses from compliance fines and detects fraud risks, such as fake identities.

Also, did you know that our special team of experts supervises and reviews the results manually to ensure accuracy? More importantly, you’re charged only per successful verification. Learn more about the safe and swift, fully automated identity verification here, or book a free demo.