Still confused about cryptocurrencies? Let’s just say that you’re not alone. Before you invest in any digital currency, it’s essential to learn the key ways to secure your identity and prevent becoming a victim of a crypto scam.

How Much Was Lost in Crypto Scams?

Even though the cryptocurrency market will most certainly fluctuate, and crypto non-believers will continue to bash the use of digital currencies, it seems that recent years have proved otherwise. Crypto is here to stay.

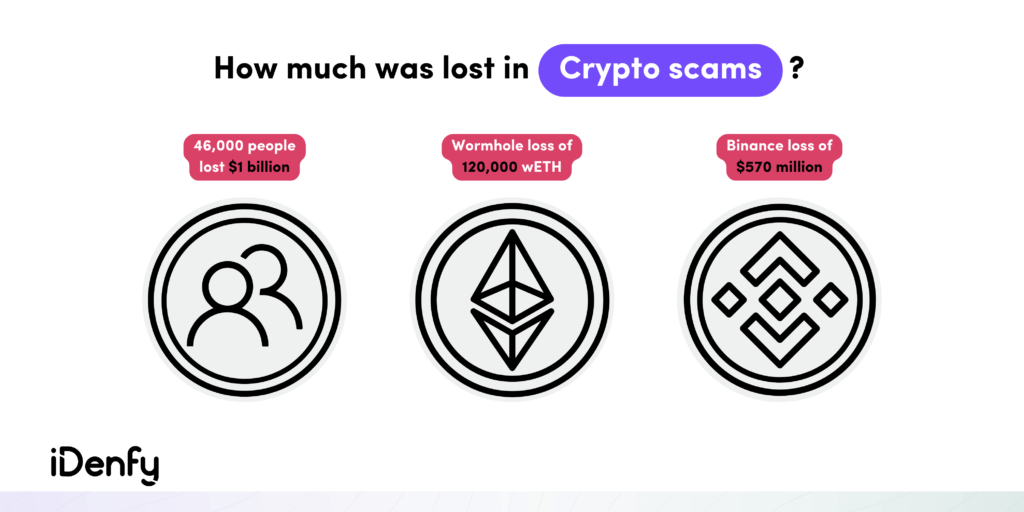

Despite the shiny outside, there’s a darker side to crypto, one of the most discussed topics of today’s digital scene. For starters, the number of crypto-related scams is increasing. Let’s jump straight into some facts:

- Despite volatility, a good number of people enjoy the ease of using crypto, but more than 46,000 people have reported losing over $1 billion to crypto scams (Source: FTC).

- Wormhole is a blockchain bridge that also reported a loss of 120,000 wETH to a cyberattack resulting from improper account validation (Source: TechTarget).

- The biggest cryptocurrency exchange, Binance, also suffered an attack of $570 million caused because of a loophole from a DeFi cross-chain platform (Source: Investopedia).

To minimize fraud and the overall level of crypto scams, crypto exchanges were classified as money service businesses (MSBs) back in 2019. That meant regulated entities were subject to stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) rules.

What is Identity Verification?

Identity Verification is the process of validating the genuineness of your customers. It involves requesting legal documents that show the authenticity and ownership of data.

Typically, to enjoy and access the services that traditional financial institutions provide, KYC or identity verification process is compulsory.

The procedure requires customers, clients, or investors to submit documents such as valid ID cards, utility bills, passports, or any other legally approved documents that identifies an individual.

What is Identity Verification in Crypto?

For cryptocurrency platforms, identity verification helps easily trace or track each successfully verified user. That’s what identity verification makes transactions that seem anonymous linked to real-life identities, automatically lessening the chances of fraudulent activity.

In a similar sense, platforms like Binance also limit what users that are not verified can do. After the user completes the KYC process, the platform verifies the uploaded data according to the KYC and AML rules.

Onchain scammers and illicit fund siphoners have taken advantage of how the blockchain uses pseudonymous alphanumeric characters to protect users’ identities. For this reason, today’s KYC processes are strengthened with human supervision and advanced proxy or phone number validations.

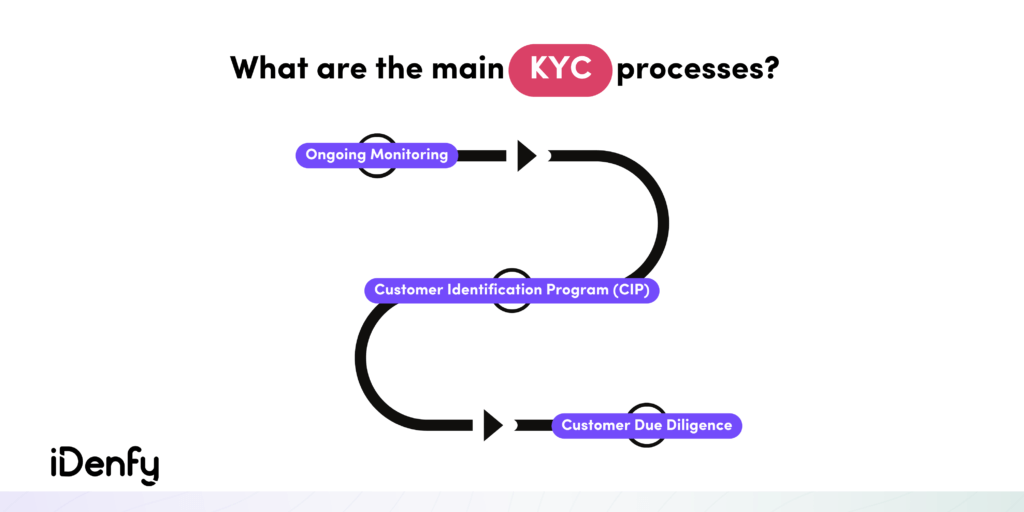

What are the Main KYC processes?

In identifying customers or clients, there are processes to consistently check for validation of data and proof of authenticity. These procedures help crypto platforms to detect incoherence in supplied data. We’ve categorized the main KYC processes down below:

Customer Identification Program (CIP)

This is known as the first key process to KYC. Crypto exchanges allow their users to sign up for their services and request them to run identity verification. This way, they can get access to other services available for verified users. It’s the basic way to differentiate human users from bots.

Customer Due Diligence

In this process, a thorough investigation of the user’s history is performed to ensure they are risk-free. Customer Due Diligence requires cross-checking users that have been through illicit transactions and bad financial records.

Ongoing Monitoring

This process ensures that the information is valid and up to date. For example, when a user officially has a change of name, it’s mandatory for the user to submit a document that legally proves it. That said, this procedure ensures that users abide by how transactions are to be made and raises the alarm for any suspicious move. Also, cryptocurrency exchanges’ KYC rules and transaction regulations might differ in each country.

What Are the Challenges of IDV or KYC for Crypto Platforms?

Crypto platforms are effectively securing both parties, the exchange and the users, through KYC processes. Various KYC-oriented challenges are being faced by these brands, which have led to how brands strategically position themselves to build a solution that works against these challenges. We’ve listed a few of them for you:

Rampant use of fake Identifications. The dark web and black market forums on Telegram produce already verified accounts for users who wants to run illicit transactions on crypto exchanges. Fraudulent identification happens due to synthetic IDs, fake pictures, or videos. Some people sell their data to be used for cheap bucks, the data is then tweaked to be accepted by the verifying system.

Users’ FOMO. Another challenge faced by crypto platforms is FOMO, which stands for the fear of missing out. Users who want to enjoy the benefits of specified platforms such as “ape in” to trade or emergency arbitrage are limited by the KYC process of such crypto platforms.

The Decentralization belief. Cryptocurrency is believed to operate using a decentralized system, a system whereby third parties and regulations are exempted. This belief is a major challenge faced by crypto exchanges which, to some extent, is a turn-off to some enthusiasts. Regulators believe cryptocurrencies have become one of the easiest means of money laundering.

Here’s what we’re dealing with right now. Simply put, the challenges faced by crypto platforms have indirectly categorized them into two types, those that observe a well-scrutinized KYC system while others are just random platforms with basic sign-up requirements.

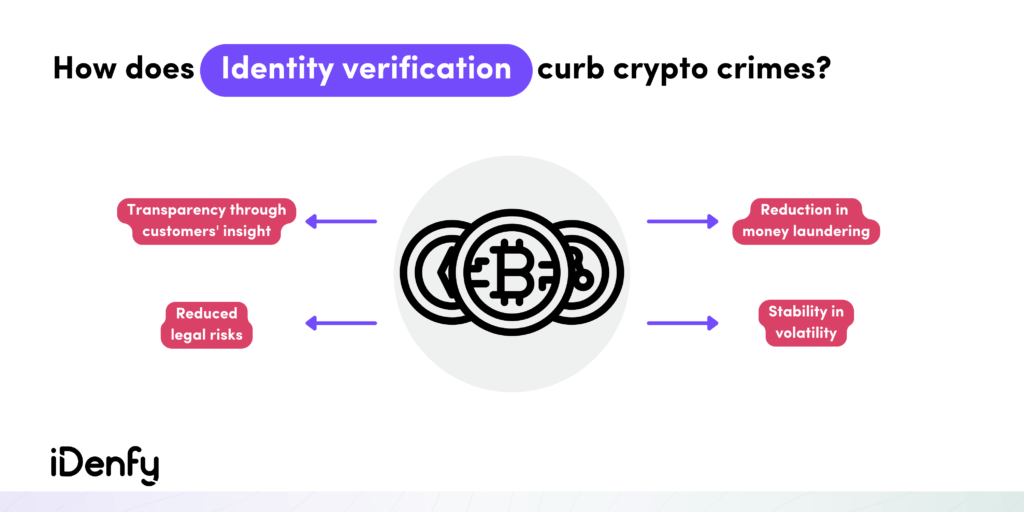

How does identity verification curb crypto crimes?

According to a recent report, illicit transactions have been down to 15 %, but this can be tied to the decline in the price of the crypto market. Hacking and stolen funds numbers notably increased in 2022 amidst all cryptocurrency illicit transactions.

The crimes in cryptocurrency vary and occur through diverse means. Despite that, criminal activity can be reduced. Just take a look at a few ways in which IDV curbs crypto crimes:

Transparency through customers’ insight. Identity verification assures crypto platforms of who their customers are. It gives an insight into whom they are dealing with. Through KYC, the person’s financial behavior can be studied when thorough research is put into place. It puts the business on the safer side of regulators and ensures AML schemes are put into check. For users who pass KYC, the process ensures they are given a well-protected service and due for all benefits the platform gives.

Reduction in money laundering. Due to the anonymity of cryptocurrencies, scammers now prefer to go through blockchain services to have a protected identity. Identity verification and a well-informed KYC process reveal information about suspicious activity carried out using cryptocurrencies.

Reduced legal risks. Identity verification ensures crypto platforms are rendering legally backed services and actions. When identity verification follows AML criteria, it prevents brands from becoming victims of fraudulent schemes.

Stability in volatility. There are illicit transactions that have affected the movement of crypto prices in the past. Identity verification restricts individuals from distorting the crypto price movement for illicit actions.

Why is identity verification essential to crypto exchanges?

Money laundering, terrorism financing, tax evasion, and human trafficking are part of illicit activities that fraudsters use to conceal through cryptocurrencies. Most of these activities involve heavy funds in digital currencies and are being moved into crypto exchanges to swap into fiat.

As mentioned earlier, cryptocurrency exchanges are now considered money service businesses (MSBs), making them subject to AML and KYC regulations under the Bank Secrecy Act, according to a joint statement from the Financial Crimes Enforcement Network (FinCEN), the Commodity Futures Trading Commission (CFTC), and the Securities and Exchange Commission (SEC) released in 2019.

The new laws governing cryptocurrency wallets and cryptocurrency holdings at international exchanges were so intentional that the US bitcoin industry got challenged with a difficult decision to either start over with new KYC and AML laws and maybe alienate customers used to an unregulated market or completely withdraw their business from the market and possibly lose customers.

How do we strike the IDV balance?

We understand the complexity of regulations and ensure that identity verification acts as a simple add-on to the existing blockchain projects. Additionally, iDenfy uses 3D liveness detection to tackle impersonation threats while eliminating fraud probability.

To make developers’ work easier, we provide our clients with an easy-to-use API and a multitude of mobile SDKs that are 100% compliant with GDPR, CCPA, and all other associative data laws.

Let’s make NFT collections and their owners verified! Book a free demo here.