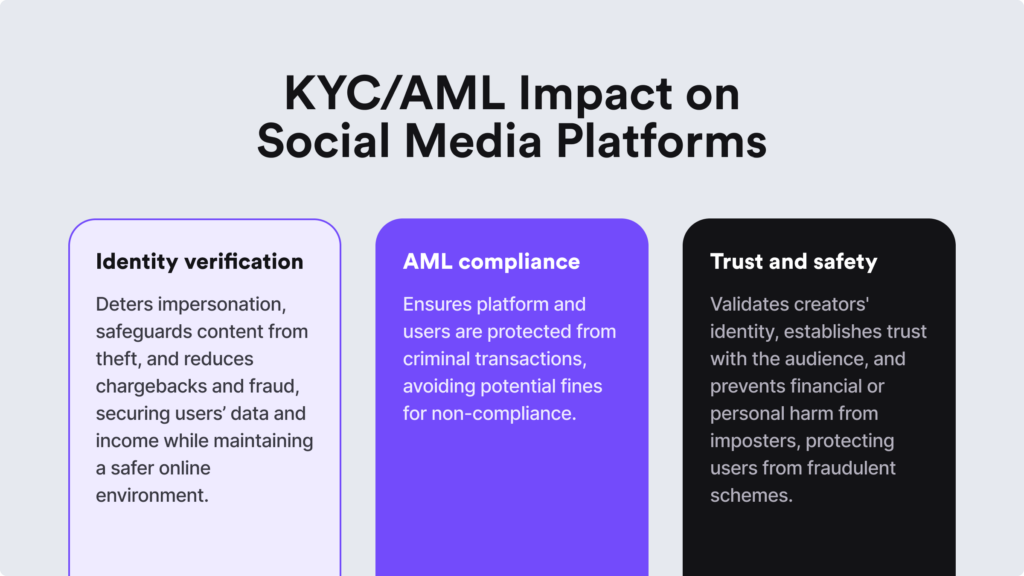

Facebook Marketplace scams with fake listings, X and hate speech, Tinder, and multiple swindlers with fake identities. The list goes on. Know Your Customer (KYC) verification or identity verification, has been a hot topic over the years, splitting the general public into two camps: those who agree that ID verification should be a mandatory requirement on social media and those who stick to the current stance that such measures should remain optional.

One thing’s clear. Social media platforms are responsible for ensuring a safe environment for their users. However, in the absence of KYC measures, this becomes far from reality.

Social media and dating apps have become a safe haven for misinformation, numerous identity theft cases, and online fraud. Not to mention the convenience of using social media platforms for new extremes, spreading ridiculous conspiracy theories, using propaganda during elections, or luring into investment schemes.

So, the real question is, should businesses, especially those without regulatory oversight, choose not to deal with these issues and avoid implementing identity verification measures? Tag along to see what notes we’ve prepared regarding social media, online dating, and due diligence.

How Social Media Became a Perfect Channel for Organized Crime

Being recognized as a great communication tool for users and a great sales opportunity for businesses, social media poses challenges through fraud. Organized crime groups, including terrorist organizations, drive the rise of social media crimes and are becoming more sophisticated and automated, with scams targeting specific groups for higher conversion rates. According to the Financial Action Task Force (FATF), over 90% of internet-based acts of terrorism occur through social media channels. That’s no surprise, as the convenience of social media broadened fundraising methods.

Terrorist organizations and organized crime groups use complex tactics to solicit funds from people, specifically targeting sympathetic individuals who are more likely to fall into the traps set by criminals. Apart from Instagram campaigns for terrorism financing, where the platform itself bans accounts with millions of followers, criminals also exploit apps like Telegram, an encrypted messaging service, to finance devious crimes — for example, inviting others to send money for the release of an ISIS member from prison.

Other advancements in online banking and cryptocurrency payments have further minimized the hassle for criminals to facilitate their operations.

So, without KYC verification and using crypto’s shield of anonymity, terrorist groups can remain undetected or caught after the crime has been committed. That’s possible because of their illicit financial activities that aren’t easily detected and often do not raise any red flags. On the other hand, there’s a silver lining between social media and financial crime compliance.

People who engage in illegal trades or such transactions online should be screened, particularly checked not only for adverse media but also for what they do on social media. Enhanced Due Diligence (EDD), particularly triggered by a suspicious activity alert, typically catches such behaviors. However, the key point is that since it’s all happening on social media, the financial institution can be unaware unless they actually conduct a proper social media profile review of all customers.

Assessing the Digital Identity and its Risks on Social Media

While providing a great environment for criminals, social media platforms also offer opportunities for authorities to identify and prevent crimes in progress. So it’s not all black or white. Social media can bring both convenience and challenges to criminal justice and regulations, of course, only if proper security measures, such as KYC verification, are enforced.

For example, a neglected aspect of Customer Due Diligence (CDD) is the lack of more stringent measures to the regulations in accordance with customer risk. This isn’t groundbreaking since financial service providers, such as banks or fintechs, must establish effective EDD practices. For instance, a high-risk customer such as a Politically Exposed Person (PEP) always undergoes a more thorough scrutiny compared to others.

This is where it becomes tricky. Digital identity elements, such as social media profiles, can be labeled as contemporary digital identities due to their differences in real-life actions and implications.

Users on dating websites and social media platforms can adopt different names and carry a new persona. This creates a major security risk and a fine line between their actions online (digital identity) and real-life identity, especially if they conduct criminal activities without getting caught since there are no KYC verification procedures on social media platforms. So, while not the sole requirement, KYC verification contributes to the comprehensive assessment of the customer’s online identity.

A Short Recap of the Three Most Reported Social Media Scams

$2.7 billion. That is how much social media scams have resulted in reported losses. Automatically, this number shows the scale of security issues, potentially to bad actors misusing their profiles, damaging the platform’s trust, and negatively affecting its revenue. However, certain types of scams were more popular than others in terms of better success for the criminals.

According to the Federal Trade Commission (FTC), the highest number of reports were related to three social media scams:

1. Fake Ads

Scammers liked to place shady ads and fake listings in 2023. This scheme works by uploading legitimate images that are stolen from the brand’s official website to deceive unsuspecting customers through a fake social media profile. Often, users don’t receive the items or get a counterfeit. Fake ads are dangerous because fraudsters can systematically target users with personalized data like previous purchases or likes and interests. What’s worse is that this method requires minimal costs, allowing criminals to reach a global audience consisting of millions of social media users.

2. Investment Opportunities

This scam was the largest financial loss for those who fell for fake social media promotions regarding investment opportunities. People fall for fake investment opportunities because they promise quick and easy money, obviously, without the high risk that often comes with this field. Scammers communicate through social media, luring their victims with an official tone and pseudo-professional language, often using terms like “guaranteed” or “proven” benefits from the investments.

3. Romance Scams

Fraudsters craft normal-looking profiles and work really hard to establish fake emotional connections until their victims feel comfortable enough to send them money. According to the FTC, not only dating sites, but particularly social media apps like Snapchat or Instagram were among the most popular channels for romance scams in 2023. Criminals often combine investment scams with the spice of romance and pretend to care about the other person. They start with a harmless friend request and later progress to love bombing and multiple money requests. Some falsely pose as successful cryptocurrency investors, promising to impart trading knowledge, yet the funds they receive benefit only themselves.

Why Some Still Argue Against Identity Verification on Social Media

While it seems that KYC rules are valid and a logical response in the growing context of security issues, some vote against this. Identity verification critics state that mandatory KYC verification in the context of social media might be risky for certain individuals.

For example, people who live in countries with anti-democratic political regimes, war victims, or people who are domestic abuse survivors and want to remain anonymous.

Considering this factor, the main social media players have already created some sort of identity verification systems, such as “Twitter Blue” or “Meta Verified.” However, neither is mandatory for all users at the onboarding stage. Additionally, many users were unpleasantly surprised by the fact that Twitter, now X, asked for a paid subscription fee for the verification and the blue badge. Based on ethics, this makes it unfair for those who want additional security measures but can’t afford them.

Nonetheless, X had to suspend its verification program due to falsely verifying fake accounts and creating even more security challenges. Yet, without KYC verification, the issue of multiple accounts exists, even if the account was opened with very little personal data and later closed. That means fraudsters are harder to catch unless they submit their IDs on social media or platforms like Vinted, where creating multiple accounts is prohibited. However, criminals still find ways to circumvent these rules and generate new accounts with fake listings.

The Perfect Scenario for Complete Security Without ID Verification Doesn’t Exist

Once you let fraud come through your door, it spreads like wildfire. That’s why many social media platforms or online businesses generally invest in additional tools, even if they choose to skip KYC verification. For instance, AI-powered IP analysis software allows companies to check if the user isn’t coming from a high-risk country or isn’t on a blacklist of fraudulent IPs that have been banned from the platform months ago.

Of course, paired with mandatory ID verification, social media platforms would prevent a larger percentage of bad actors at the first user cycle, most likely before they even commit a single crime.

At the end of the day, if regulators aren’t imposing strict laws on social media and dating platforms right this moment, businesses still have to choose how they will respond to the growing number of fraudulent accounts, fake identities, misinformation, etc.

And we at iDenfy can only strongly recommend protecting your users and revenue by creating a safe space online — with identity verification.