For those who don’t know, identity checks are employed by a business to verify the identity of customers. They play a significant role in helping businesses build trustworthy relationships with their customers, improve their experience, and protect themselves from fraud. Additionally, by law, online businesses must authenticate their customers’ identities and comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance rules.

In this post, we will learn about different types of identity checks and find out how to balance speed and security when deploying an identity verification solution for onboarding. However, before that, let’s take a quick look at some significant benefits of identity checks.

Fraud detection and prevention service from market leaders. Schedule a free demo here.

Why Identity Checks Are an Essential Part of the Onboarding Process

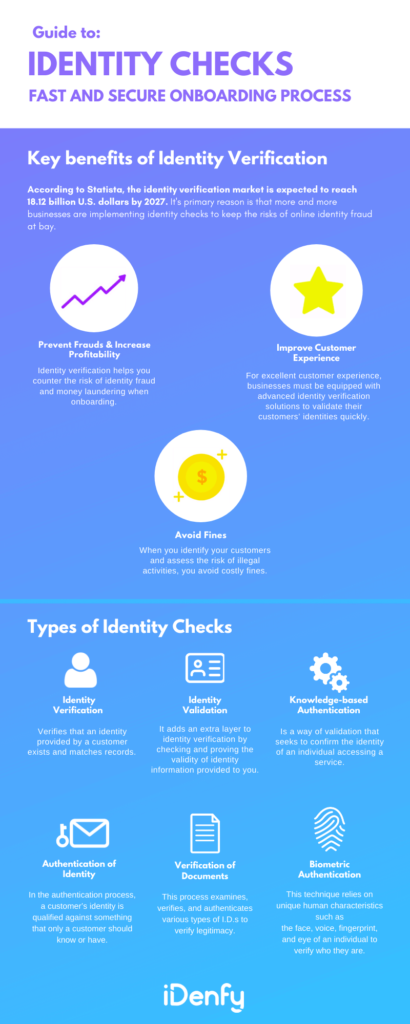

According to Statista, the identity verification market is expected to reach 18.12 billion U.S. dollars by 2027. Its the primary reason is that more and more businesses are implementing identity checks to keep the risks of online identity fraud at bay.

In general, identity checks are a crucial component of the onboarding process for various reasons. They help organizations verify the identity of individuals before granting them access to sensitive information, systems, or resources. This verification process enhances security, ensures regulatory compliance, and protects against potential fraud or unauthorized access.

The Key Benefits of Identity Verification Checks

The main reason why companies use identity verification checks is that they provide an extra layer of security by ensuring that the person being onboarded is who they claim to be.

This prevents unauthorized individuals from gaining access to confidential data or critical systems. For instance, a financial institution might require new employees to provide government-issued IDs to prevent imposters from entering the organization and potentially engaging in fraudulent activities.

We go into more details below:

1. Enhancing Fraud Prevention and Increasing Profitability

Identity verification helps you counter identity fraud and money laundering risks when onboarding. With proper verification, you rest assured that you have genuine customers who are not involved in any illegal activities. When you accept legit customers, you naturally gain more profit.

For this reason, by verifying the identities of individuals during onboarding, organizations can reduce the risk of malicious actors using stolen or fake identities to gain access to valuable resources. For example, an e-commerce platform may implement identity checks to prevent individuals from setting up fake accounts to exploit promotional deals.

2. Reducing the Risk of Fines

Many industries, such as finance or healthcare, are subject to strict regulations regarding the handling of sensitive information. Proper identity verification helps organizations comply with legal requirements, such as KYC and AML regulations. For instance, a cryptocurrency exchange must verify the identities of its users to prevent money laundering and ensure a safe trading environment.

You avoid costly fines when you identify your customers and assess the risk of illegal activities. Don’t forget that, not complying with KYC and AML regulations can cause huge penalties. In 2019, Standard Chartered was fined $1.1 billion by U.K. and U.S. authorities for improper money laundering controls.

3. Improving Customer Experience

Today, consumers expect to have an excellent customer experience from businesses they buy or take service from. According to a survey, about 74% of people want same-day access when opening an online bank account. To provide such a great experience, businesses must be equipped with advanced identity verification solutions to validate their customers’ identities quickly.

Automated KYC solutions offer a smoother onboarding experience by minimizing the number of steps users need to complete. By streamlining the process, users are more likely to complete the registration without feeling frustrated or overwhelmed. A ride-sharing platform can integrate automated KYC checks to ensure that new drivers provide necessary information seamlessly and start earning quickly.

Verify customers identity within 15 seconds. Schedule a free identity verification demo here.

The Main Types of Identity Checks

Depending on your business’ nature, you can employ different types of identity checks.

Some of the primary ones include:

Identity Verification (IDV)

IDV, or identity verification, verifies that an identity provided by a customer actually exists and matches records. However, it does not designate whether or not that identity is authentic or whether a person is who they say they are.

Organizations, platforms, and institutions commonly use IDV to establish trust, prevent fraud, and ensure compliance with regulations. It typically involves checking personal information, official documents, and sometimes biometric data to confirm the individual’s identity before granting them access to services, resources, or privileges.

Document Verification

Document verification involves confirming the authenticity of official documents provided by individuals. This process examines, verifies, and authenticates various types of ID documents to verify their legitimacy. For instance, when a person opens a new bank account, they might be required to submit a government-issued ID such as a driver’s license or passport. The bank then verifies the document’s validity to ensure the person’s identity matches the information provided.

Biometric Verification

Biometric verification relies on the unique physiological or behavioral characteristics of an individual. This could include fingerprint scans, facial recognition, voice recognition, or even retinal scans. An example is using facial recognition to unlock a smartphone – the device matches the person’s facial features with stored data to grant access.

Authentication of Identity

Authentication is the process of identifying a user’s identity. The process verifies if the person is the same as who they say they are. Authentication often relies on data that is not easy to produce or change. In short, in the authentication process, a customer’s identity is qualified against something that only a customer should know or have.

Knowledge-Based Authentication

KBA or Knowledge-Based Authentication is a way of validation that seeks to confirm the identity of an individual accessing a service — for example, by asking a question that supposedly only that person knows. For example, favorite singers or sports.

This is often used in call ceners to confirm a caller’s identity before providing sensitive information. For instance, a credit card company might ask a customer to verify the last few transactions on their account.

Two-Factor Authentication

Two-factor authentication, also known as 2FA, is an authentication process that combines two different factors:

- Something an individual knows.

- Something an individual has or is.

In this type of verification, a person is asked to provide knowledge such as an alphanumeric secret and possession to verify them. An excellent example of 2FA is withdrawing money from an ATM using an ATM card (something the user has), and a PIN (something the user knows).

Ensure your customers are real. Schedule a free demo here.

How to Create Both Fast and Yet Secured Onboarding Process?

As we mentioned above, people are nowadays looking for a better customer experience. That’s why you must look for an identity verification solution that speeds up the verification process and onboarding.

To help you with that, we’ve compiled a short list of tips that’ll guide you in the right direction:

-

Automated Identity Checks: Implement automated identity verification solutions that utilize AI and machine learning. These systems can quickly compare submitted information against trusted databases, enhancing speed while maintaining accuracy.

-

User-Friendly Interface: Design an intuitive and user-friendly interface for onboarding. Clear instructions and visual cues guide users through the process, reducing errors and frustrations.

-

Digital Document Submission: Enable users to submit identification documents and information digitally. This eliminates the need for physical paperwork and accelerates the verification process.

-

Real-Time Verification: Utilize real-time verification checks whenever possible. This allows users to receive instant feedback and access once their identity is confirmed.

-

Third-Party Integrations: Utilize trusted third-party verification services that specialize in identity checks. This can expedite the process by leveraging their expertise and databases.

iDenfy is a Lithuania-based identity verification provider that turns a customer’s device into a face recognition and ID scanning system to conduct verification in seconds. Our identity verification software is fully automated, minimizing the risk of errors to a great extent.

So if you’re looking for fast yet secure onboarding, you can rely on iDenfy.

Every year, we stop thousands of fraudulent activities across the globe with our advanced ID verification solution. With our quick yet secure solution, businesses can save a lot of budget on onboarding new users. If you want to know more about our services, book a meeting.

This blog post was updated on the 17th of August, 2023, to reflect the latest insights.