The concept of Know Your Customer (KYC) has become central in the traditional financial world, turning it into a primary tool that could help reduce possible fraud and money laundering. Necessary KYC protocols are increasingly complex and expensive to maintain, particularly in a globalized environment with everything digital. Financial Institutions must manage regulatory requirements, balance customer experience, and leverage technological advances to stay efficient. The blog post highlights some of the key things of KYC in TradFi, the role of new technologies, and the regulatory landscape.

What is TradFi?

Traditional Finance (TradFi) refers to a conventional financial system consisting of established institutions like banks, credit unions, insurance providers, and stock exchanges that facilitate lending, investment, and wealth management services. Founded on the bedrock of regulatory frameworks and operating on centralized lines, TradFi is all about compliance, stability, and protection of consumer interests. Examples of traditional finance include JPMorgan Chase, Bank of America, and the London Stock Exchange.

In the context of cryptocurrency, TradFi can interface with the crypto ecosystem through custody, trading infrastructure, or through partnerships with fintech companies. Adaptation from traditional financial institutions with the crypto space has been seen in instances such as Goldman Sachs offering Bitcoin derivatives and partnerships such as Visa partnering with crypto wallets for payments. The efforts mentioned above show how the TradFi institutions are bridging the gap with DeFi (Decentralized Finance) within a context of innovation in blockchain and a more traditional concept of financial regulation.

TradFi vs DeFi

Traditional Finance (TradFi) and Decentralized Finance (DeFi) represent two distinct approaches to financial systems, each with its own strengths and weaknesses. Here are some key differences:

Regulatory Framework

- TradFi: Bound by tight regulatory frameworks to facilitate stability, user protection, and risk management; regulated by SEC or FCA.

- DeFi: Unregulated or self-regulated. This way promotes innovation at the cost of security, fraud, and consumer safeguards.

Accessibility

- TradFi: Access to an open banking system and credit history is required, often excluding underbanked populations; services are usually location-based and intermediary-reliant.

- DeFi: Open to everyone who has access to the internet and a crypto wallet, opening the way for financial institutions and making it more accessible worldwide.

Transparency

- TradFi: Operates on private, proprietary systems with limited public access to financial operations and decision-making processes.

- DeFi: Built on public blockchains, ensures the transparency of transactions and protocols, where anyone can verify activities performed.

Speed and cost

- TradFi: Transactions, particularly cross-border ones, can take up to several weeks, which is slower and more expensive because of the many intermediaries and their legacy systems.

- DeFi: Utilizes blockchain technology, allowing for faster and cheaper transfers, although more network congestion can increase the fees.

What is KYC?

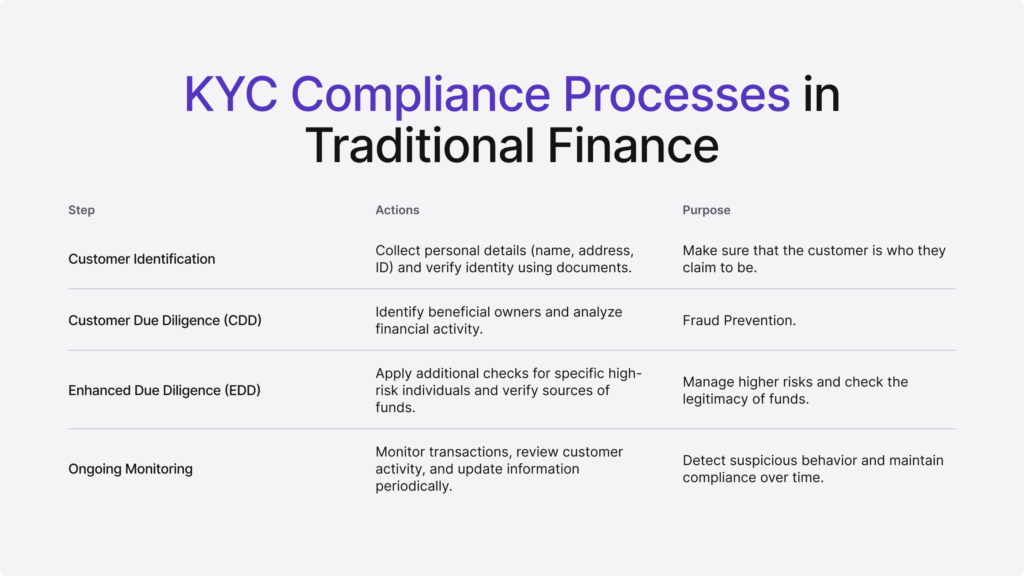

Know Your Customer (KYC) is a financial compliance process that aims to verify a customer’s identity against criminal activities like money laundering and fraud. The so-called KYC processes allow businesses to deal with actual and rightful individuals or entities by collecting and verifying personal details, including IDs and proof of address. Tied initially to TradFi, in today’s world, KYC plays an important role in the cryptocurrency industry and helps achieve regulatory requirements and a degree of trust in digital finance.

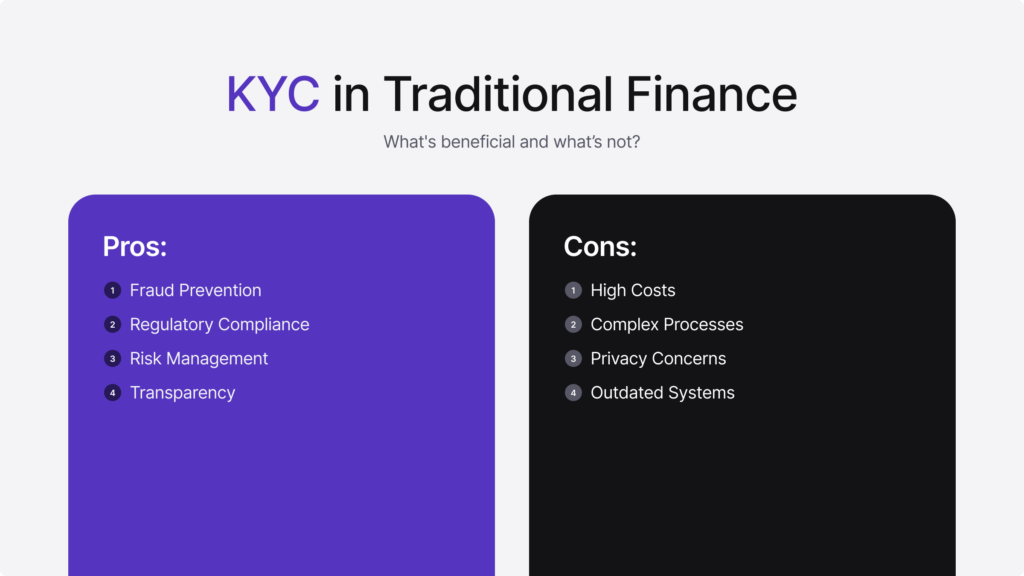

The Importance of KYC in TradFi

KYC is the fundamental building block of compliance and safety in TradFi. It makes it possible to protect against fraud, precisely estimate its actual risk exposure, and comply with strict Anti-Money Laundering (AML) requirements. By verifying customer identity and monitoring transactions, KYC provides essential safeguards. However, both the demand for – and difficulty of – recent changes in technology and regulatory oversight have increased effective KYC programs.

Financial institutions worldwide face the burden of high operational costs linked to KYC. For example, recent studies highlight a 17% increase in the average price of KYC reviews, with some financial firms spending between $2,500 and $3,500 per client review. The time to conduct these reviews has also increased, averaging around 11 additional days per case.

Key Challenges in KYC Implementation

These challenges reflect the growing complexity of using proper and effective KYC processes under a continually changing regulatory and technological landscape; financial institutions must use innovative solutions in an effort to solve these issues without sacrificing security, compliance, and customer experience.

- Data privacy and security: Data privacy laws, such as the GDPR in Europe and CCPA in California, further complicate how financial institutions collect and store customer data. For example, privacy laws introduce friction into the KYC processes by complicating cross-border data sharing, which is required in today’s digital age.

- Rising compliance costs: One of the biggest headaches in TradFi is the ever-growing cost of KYC procedures. Where regulatory complexity is present, so is the fact that financial institutions are usually upgrading their systems and retraining staff to maintain compliance. The locally enhanced AML directives and local financial crime regulations have caused significant operating costs, and many firms need help to be cost-efficient without compromising security.

- Outdated legacy systems: Traditional banks still operate legacy technology systems that need to integrate newer KYC solutions. It leads to inefficiencies in processing customer data and handling transaction monitoring, often resulting in high rates of false positives.

- Cross-jurisdictional compliance: International-scale financial institutions need to work more efficiently because different countries have different regulatory frameworks. Different regions have other demands, making it increasingly complex.

Innovations in KYC Technologies

With growing challenges in KYC, financial institutions are increasingly looking at advanced technologies that provide quicker, more secure, and cost-effective solutions.

Some of the key technological innovations in KYC include:

- AI and machine learning: With real-time risk analysis and reduction of false positives in transaction monitoring, AI and machine learning are the real game changers of KYC. These can be deployed to accelerate the identity verification process by making an institution notice unusual behaviors without human interference. Moreover, machine learning models can adapt to evolving fraud tactics and analyze huge amounts of customer data more efficiently.

- Blockchain for secure verification: With blockchain technology, the possibility of having immutable records for customer data opens ways to enhance transparency and security in the KYC process.

- Biometric verification: Biometric technologies, such as facial recognition and fingerprint scanning, are gaining widespread use in KYC as a secure, quick way to verify identity. Instead of traditional document-based verification, biometrics will help institutions reduce onboarding time by improving security for compliance with regulations and customer experience. Passive biometric technologies that continuously confirm one’s identity without repeatedly entering inputs represent newer security measures for verifying KYC.

- Self-Sovereign Identity (SSI) models: Self-sovereign identity (SSI) models allow individuals to control their personal data, providing access as needed. A decentralized identity management approach can reduce financial institutions’ burden to store and secure sensitive information while also aligning with emerging data privacy regulations.

Trends in Regulations That Affect KYC

Using consumer protection, AML regulations, and market innovation principles, while currently having cryptocurrency regulations by the Financial Conduct Authority (FCA), the UK has been more nuanced in its approach to regulating cryptocurrencies. The important move from the FCA was to institute new AML regulations, requiring all crypto-related businesses to comply with the KYC requirements.

Regulators worldwide are investing more and more in KYC in the hunt for financial crime and growing concern over digital transactions. In the UK, the FCA leads from the front to reduce financial crimes and improve market integrity. The 6th Anti-Money Laundering Directive in the EU will further raise compliance and introduce stricter KYC and AML standards across financial institutions.

In the United States, new proposals are being made to target a consistent method of digital identity verification to promote cross-border transactions. The evolving trend toward tightening up regulations marks the importance of financial institutions adopting complete KYC solutions that keep up with compliance demands without sacrificing efficiency.

Future for KYC in TradFi

The growing desire will design the future of KYC in traditional finance for more efficiency, security, and customer experience. Financial institutions are invited to implement necessary approaches that put advanced technology in dialogue with a customer-centric perspective.

Some examples of what factors you should look for in a proper KYC solution:

- Multiple RegTech tools: Integrated solutions of KYC and transaction monitoring will become necessary to ensure smooth operations. All-in-one platforms that cover the whole customer lifecycle would contribute to reducing compliance costs at institutions while improving fraud prevention.

- Customer-centric onboarding flow: Improving customer experience is a top priority, with investments in digital channels and self-service options. Better digital onboarding reduces institution weakening and makes them forward-thinking and responsive to client needs.

- Improved fraud detection capabilities: AI and machine learning will become essential in fraud detection and the KYC processes of financial institutions. Such algorithms will be reworked, and continuous identity verification will make such tools act against changing tactics for economic crimes.

Conclusion

Rapidly changing regulations and increasing security concerns, traditional finance has some challenges facing KYC. On the other hand, the evolution of technology opened new horizons for achieving efficiency in many ways, from improved AI fraud detection to verification models based on blockchain.

While developing regulatory environments that have grown increasingly complex, financial institutions must become agile – playing fields that implement leading solutions to ensure sustained compliance approaches and customer satisfaction. With the power of advanced KYC technologies and the need for balance in regulatory demands, TradFi institutions are in a better place to sustain their leadership in secure and compliant financial operations.

Curious about how iDenfy can make KYC faster, more secure, and customer-friendly? Let’s continue the conversation and see how we can help you stay ahead in the growing financial landscape.