Some may know, and some may not know, what a Money Laundering Reporting Officer (MLRO) is — a complex role that has to help organizations prevent money laundering, fraud, terrorist financing, and other illegal activities that could occur in the companies. So let us cover the most important aspects associated with MLRO to understand it more easily, sit back, relax, and have a good read.

What is a Money Laundering Reporting Officer (MLRO)?

A Money Laundering Reporting Officer (MLRO) is a senior compliance professional primarily responsible for helping organizations prevent various illegal activities and a primary point of contact for regulatory authorities responsible for ensuring that their company complies with Anti-Money Laundering (AML) regulations.

An MLRO not only ensures compliance but also acts as a strategic advisor for a company, helping out regulatory authorities and internal operations. For example, in the UK, the Financial Conduct Authority (FCA) sets various expectations for MLROs, especially with accountability and proactive measures to reduce possible risks.

Work Requirements for an MLRO

To be successful as a Money Laundering Reporting Officer, one must have several skills that are not easy to acquire — strong analytical skills are a must, as MLROs must be able to process not-so-small amounts of data to identify unusual activities and assess risk accurately. It also requires in-depth legal knowledge to work with constantly changing AML regulations and compliance across jurisdictions. Managing complex compliance systems, often involving new technologies, is also helpful.

Excellent communication and leadership skills are equally important, as MLROs must interact with regulatory authorities and guide internal teams.

The Expectations of an MLRO in 2025

As financial crimes continue to rise, so do expectations placed on MLROs. In 2025, MLROs are expected to improve by integrating advanced technologies for AML red flags/risks, which could be unusual transaction sizes and sudden changes in transaction frequency, and act accordingly if they occur.

If we would talk about new threats like cryptocurrency-based money laundering and similar cybercrimes — they were in 2024 and are likely to stay in 2025. MLROs must expand to a more complex financial landscape and adopt innovative approaches.

A Day in the Life of an MLRO

Everybody has a different daily routine with different tasks and responsibilities. Let’s see what a typical day for an MLRO might look like in 2025:

Briefing

- Reviewing reports from automated transaction monitoring systems – systems powered by AI and machine learning flag unusual activities based on predefined rules, such transactions MLRO prioritizes first.

Investigations

- Collaborating with compliance teams to analyze unusual activities and conducting Enhanced Due Diligence (EDD) for high-risk users.

Team Training

- Conducting various training sessions for employees would help to recognize unusual activities more accurately and report them more efficiently.

Reporting

- Preparing and submitting Suspicious Activity Reports to Financial Intelligence Units (FIUs).

This is just a short example of what MLROs’ standard day would look like. There are way more activities than these, but these are the main ones.

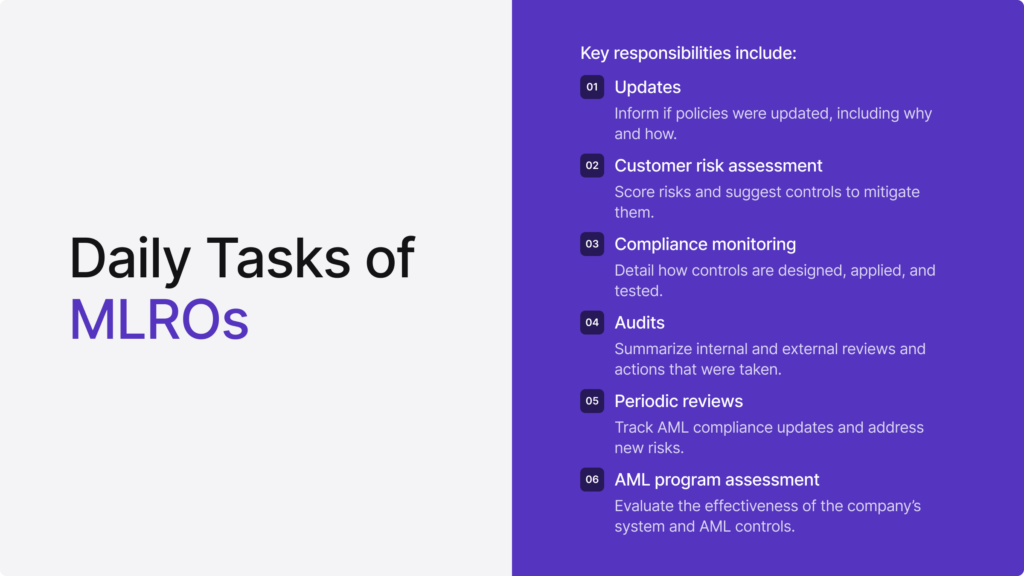

Main Responsibilities of an MLRO

The main responsibilities of MLROs are connected to the work requirements. For example, teamwork is important when preparing and submitting reports to senior management and regulators. Effective collaboration also ensures the timely and accurate filing of Suspicious Activity Reports (SARs) to maintain compliance.

- Regulatory Compliance: AML policies and procedures must align with the latest regulatory requirements. MLROs must ensure that, involving constant monitoring of changes in AML legislation across jurisdictions and adding necessary updates.

- Monitoring Transactions: One of the most important responsibilities of an MLRO is to monitor transaction systems constantly. Such systems use advanced algorithms to flag unusual activities. MLROs then investigate these uncommon transactions and decide whether they fill SARs.

- Enhanced Due Diligence (EDD): For high-risk clients, MLROs perform EDD, which involves deeper investigations into a client’s financial background, sources of funds, and transactional behaviors.

- Training and Awareness: MLROs are the best source of information about AML policies and procedures. The company’s employees must also understand AML policies, so MLROs must try to implement various training programs with their organization’s help.

- Internal Audits and Reporting: Internal audits are important if the company wants to ensure its safety. MLROs must submit reports to senior management and regulators to provide transparency into the organization’s compliance status.

- Collaboration with Regulatory Authorities: MLRO is a middleman between an organization and regulatory authorities. It is responsible for participating in audits and submitting required documents, such as SARs or KYC reports. It may not sound like much, but it is complex.

- Handling Data Privacy and Security: MLROs must ensure that all compliance activities are relevant to data protection laws, such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA).

Issues That MLROs Could Face in 2025

There are many tools out there that can help, but it doesn’t mean that MLROs are safe from everything. Let’s break down a couple of issues that they could encounter in 2025.

Financial Crimes

Fraudsters are constantly trying to develop new techniques that they could take advantage of, for example, launder money or even commit financial terrorism. Remember non-fungible tokens (NFTs)? They have created a lot of new potential for illicit activities, as well as decentralized finance (DeFi) and everything that comes with it. MLROs must stay ahead of these trends to prevent financial crimes successfully, and one way to make it happen is to keep the knowledge above everyone else.

Our automated AML screening and monitoring solution scans for risks during KYC processes; this way, the information is more secure, and with instant notifications, unusual activities are detected faster, allowing MLROs to take necessary action immediately.

Regulatory Complexity

Governments are introducing stricter AML regulations more commonly. Operating in multiple jurisdictions adds more complexity, as each region may have unique laws and guidelines. This way, MLROs have to deal with many rules and regulations that can sometimes be confusing.

Resources

Adding AML programs can be resource-intensive. Small organizations might struggle to allocate sufficient funds and personnel, putting MLROs under additional pressure, who must ensure compliance with regulations while working with limited tools and support.

Employee Training

Employees must understand AML policies to prevent unusual activities. However, to ensure this is quite a challenge, companies must develop effective training programs with the help of MLROs, which can be an issue because these trainings are time-consuming and costly.

Related: What is an AML Compliance Program?

The Importance of Automated AML Tools

Monitoring transactions, analyzing data patterns, or doing similar activities can be complex and slow if done manually. This is where technology tools come in to manage workload efficiently.

Identity Verification

Tools like Artificial Intelligence (AI) and Machine Learning (ML) are often used by modern MLROs. For example, our identity verification tool uses biometric recognition to verify users accurately and efficiently, as well as ensure compliance and reduce fraud risks. These technologies enhance accuracy and reduce the time spent on manual processes.

Know Your Business (KYB) Verification

Know Your Business (KYB) processes are gaining more importance and are just as important as Know Your Client (KYC). Our KYB solution simplifies corporate client verification by automating the shareholder and Ultimate Beneficial Owner (UBO) data. It ensures thorough due diligence while saving time and resources.

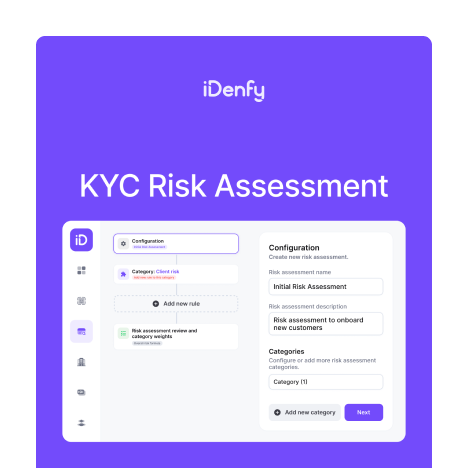

AI-Powered Risk Assessment

Risk assessment tools provide MLROs with a thorough view of user activities. By continuously analyzing transactional data and flagging red flags, such tools help with risk management.

Analyzing user data can be complicated, so companies must approach it efficiently and look at it with care. Numerous KYC solutions are designed to manage substantial information effectively. These technologies can fulfill local and global Enhanced Due Diligence (EDD) standards throughout the KYC lifecycle, incorporating features that support a risk-based approach vital for ensuring continuous compliance with KYC regulations.

How Do MLROs Adapt to Regional and Global AML Requirements?

The future of AML compliance depends on regional differences and global issues and understanding them. Also, don’t forget the fast changes in financial crimes. MLROs need to adjust their strategies for specific areas in 2025. For example, the EU and the US have different laws and regulations, so MLROs must adapt to these variations flexibly.

Let’s take a look at what these regions have to offer in the context of rules and regulations.

European Union (EU)

The EU’s 6th Anti-Money Laundering Directive (6AMLD) promotes teamwork between countries and ownership transparency. Without it, MLROs in the EU often have issues coordinating across borders and meeting strict reporting standards. Tools like Know Your Business (KYB) simplify automating business data collection and help organizations stay compliant.

United Kingdom (UK)

In the UK, the AML is guided by regulations like the Proceeds of Crime Act (POCA) and Money Laundering Regulations, and to ensure everything works as it should — MLROs work on compliance, adopt risk-based approaches, and use some of the advanced tools to maintain transparency and accountability.

United States (US)

The US takes a stricter approach to AML. Agencies like FinCEN demand detailed reports, such as SARs, which we discussed earlier, to track financial crimes. MLROs rely on tools like AML screening systems, which include watchlist checks and media screenings, to help investigate uncommon activities more smoothly.

MLROs working across different countries must know these differences in rules and regulations to manage compliance efficiently.

To implement the best KYC processes in your company, automate them as much as possible. Automation can reduce manual work and human errors, help sort data efficiently, provide consistency, and improve the overall customer experience. We will discuss automation more later on.

Final Words

Financial crimes often involve cross-border activity, so cooperation between countries is important. Programs like the EU’s Anti-Money Laundering Authority (AMLA) and global frameworks from the FATF promote the sharing of information internationally. In the US, partnerships between governments and businesses also improve AML systems. Technology makes global teamwork possible.

MLROs help organizations prevent various fraudulent activities — using advanced tools like identity verification, AML screening, risk assessment solutions, and many others. MLROs can improve their efficiency and effectiveness against financial crimes. However, the road ahead is not without obstacles, and MLROs must stay above fraudsters to succeed.

So, if you’re interested in learning more about iDenfy’s KYC products, book a free demo with us today. We offer the newest identity verification solutions to meet businesses’ needs in an improving digital landscape.