In recent years, retail has been outshined by e-commerce as online transactions have grown in popularity. The global pandemic has acted as a catalyst, compelling even the most hesitant internet users to embrace the convenience of online shopping. This shift in consumer behavior is expected to have a lasting impact, with projections indicating that worldwide e-commerce sales will reach a solid number of $7 trillion in 2025.

The history of the e-commerce sector is closely associated with the history of the Internet. The year 1991 was the first time the Internet was opened for commercial use, and online shopping became possible for the public. However, in the beginning, the term e-commerce was used to execute transactions electronically with the help of technologies like Electronic Funds Transfer (EDT) and Electronic Data Interchange (EDI). Now, we have different marketplaces, like Temu or Amazon, with various dangers for users, including account takeovers, triangulation fraud, and more devious scams.

Thankfully, automated Know Your Customer (KYC) solutions can help minimize the chances of fraud in digital marketplaces. Continue reading to find out more.

What is KYC in E-Commerce?

KYC, or Know Your Customer in e-commerce, is the process of verifying customer identities in order to check that the person purchasing items or services is legitimate. There are cases when customers use chargeback fraud to get refunds for received items or, on a more serious level, use stolen credit card details to make purchases.

By verifying customers and conducting additional security measures, such as transaction monitoring or address verification, online merchants can assured that their platforms are fraud-free.

Later in the blog post, we’ll discuss this matter in more detail.

The History of Retail and E-Commerce

People started defining eCommerce as buying products and services online in 2000. During this time, numerous companies in Europe and the United States started repressing their internet services:

- Amazon and eBay were among the first internet-based companies to permit electronic transactions. In the United States, Amazon.com was one of the first e-commerce to start selling products.

- Thanks to these companies, we now have a robust retail and e-commerce sector. Amazon, eBay, Jingdong, Rakuten, and Alibaba are renowned names in the e-commerce industry today.

Undoubtedly, the retail e-commerce industry has reached its zenith, but it doesn’t mean it will not be going through any challenges. From ever-increasing competition to maintaining customer loyalty to identity theft, many challenges exist for businesses in the retail e-commerce sector.

Major Challenges of the Retail and E-Commerce Industry

1. Absence of a Proper Identity Verification

When a prospective buyer visits an e-commerce website and signs up, the website is unaware of the customer. Though a customer provides some basic information, whether the information is genuine or not remains questionable. Cash-on-delivery purchases using fake addresses or contact details can lead to significant revenue losses.

According to a recent report, the most common type of fraud causing concern for e-commerce businesses is identity theft. Though security protocols such as SSL, firewall, and DSL are there, verifying customers’ identities is a big challenge for e-commerce businesses. To cope with this challenge, businesses need to have a proper identity verification system that identifies fake ID documents and other details offered by the customer.

Related: How to Improve KYC Verification? Tips For a Frictionless User Experience

2. High Cart Abandonment Rates

Cart abandonment is when a prospective buyer starts a checkout process for online purchases but leaves the process in the middle. There could be plenty of reasons for it, such as unexpected costs, not enough shopping and payment options, improper product details, etc.

Besides this, the biggest reason people drop out of the process before completing the purchase is a lack of trust. By implementing a proper identity verification setup during the e-commerce app development phase, businesses can enhance customer trust and reduce cart abandonment. Remember, companies that focus on the prevention of identity fraud naturally improve their reputation.

3. Struggles to Attract Customers

Nowadays, people don’t shop the same way as they used to back in the day. They seek information about the service or product on multiple platforms before buying them. They even ask for recommendations on social media. As a result, e-commerce retailers must figure out what their audience is looking for before targeting them. Focusing on providing a safe shopping experience can be an excellent way to attract customers.

Some of the other significant challenges of the retail e-commerce sector include:

- Analyzing competition

- Delivering an omnichannel customer experience

- Order fulfillment

- Cybersecurity

- Visitor conversion, and more.

Why is Identity Verification Important in Retail and E-Commerce?

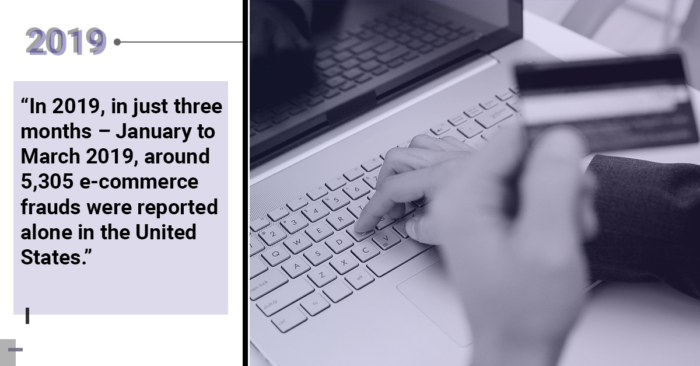

In addition to the challenges mentioned above, one big challenge that almost every small or big retail eCommerce firm is struggling with is online fraud. A recent report reveals that each year worldwide, organizations lose billions of dollars to online scams. In 2019, in just three months – from January to March – around 5,305 e-commerce fraud cases were reported alone in the US. This is why giant firms like Amazon have invested in AI-powered RegTech fraud detection solutions.

Let’s look at how identity verification can help the retail & e-commerce industry cope with identity-related fraud.

Identity Verification Helps Reduce the Risks of Payment Fraud

Identity verification in the retail eCommerce industry can significantly minimize the risk of payment fraud. Don’t forget that security is customers’ primary concern; they expect that e-commerce retailers must protect their identity from falling into the wrong hands. Fortunately, with a reliable identity verification solution, you verify your customers’ identity and ensure only legit people are using your platform.

Identity Verification Helps Prevent Credit Card Fraud

Credit card transactions are the primary source of payment fraud in the e-commerce industry. Cybercriminals make an online purchase from a stolen credit card and pretend to be genuine users by taking over someone’s legitimate account. This results in major chargebacks, as well as increased costs due to staff training and internal Trust and Safety teams that have to monitor fraudulent users and their purchases.

By conducting recertification later in the customer lifecycle, e-commerce platforms can minimize the chances of such fraudulent acts. Typically, recertification occurs before large purchases, when the user hasn’t logged into their account, as well as in other high-risk scenarios.

Identity Verification Secures Business Transactions

In the e-commerce sector, businesses need to protect not only their customers but also themselves. Mergers and acquisitions have become common in the e-commerce industry. However, before entering any business relationship, you must confirm that the company is legit. By conducting identity verification, you can rest assured that the firm is genuine and does not perform business transactions to make money laundering and financial fraud.

Identity Verification Ensures AML and KYC Compliance

Today, the law requires almost every online business to perform Anti-Money Laundering (AML) and KYC checks on their customers or users. More importantly, for that purpose, a reliable identity verification solution is required.

If you are looking for a reliable identity verification partner for an e-commerce business, don’t hesitate to give iDenfy a try.

We are a Lithuania–based identity verification solution provider, working with more than 500 global brands. We can turn your device into a robust identity verification system that can identify 3000+ types of ID documents from 300 countries. It will boost your onboarding process and ensure you have legitimate customers on your platform.

To learn more about our services, book a meeting.

This article was updated on the 28th of June, 2024, to reflect the latest insights.