Imagine trust as a currency for a minute, that drives deals and accelerates partnerships, but there is one significant problem: trust is harder to earn and easier to lose. With rising incidents of business fraud, ownership structures, and increasing regulatory demands, companies can no longer afford to take their partners at face value – KYB (Know Your Business) verification becomes critically important.

KYB is a decent way to build credibility, hold long-term partnerships, and protect your company from mistakes that could be costly. Let’s see why KYB verification is central to having trust in B2B relationships, how it works, what it is, and what best practices can help your business implement it effectively.

What Is KYB Verification?

KYB, or Know Your Business, is a due diligence process that verifies whether a business is legitimate, lawfully registered, and operated by identifiable individuals, similar to counterparty identification, verifying and understanding the identity of the other party involved in a financial transaction, Know Your Customer (KYC), on the other hand, focuses on verifying individuals, and KYB examines companies – their legal status, ownership structures, and risk profiles.

This verification process typically involves validating business registration details, identifying ultimate beneficial owners (UBOs), checking for sanctions or adverse media, and verifying official documentation such as business licenses and tax identification numbers. The most important thing that KYB does is answer one essential question: Can you trust this business to be what it says it is?

Related: The Guide to KYB Onboarding

KYB and Its Importance to B2B Trust in 2025

You see, businesses operate across borders and digital platforms, and the chances of encountering fraudulent entities have grown exponentially. In B2B partnerships, the stakes are higher – contracts are larger, responsibilities are more significant, and reputational risks are more profound.

KYB verification lowers these risks by making sure that the businesses you work with are compliant, legitimate, and transparent.

Fighting Corporate Fraud

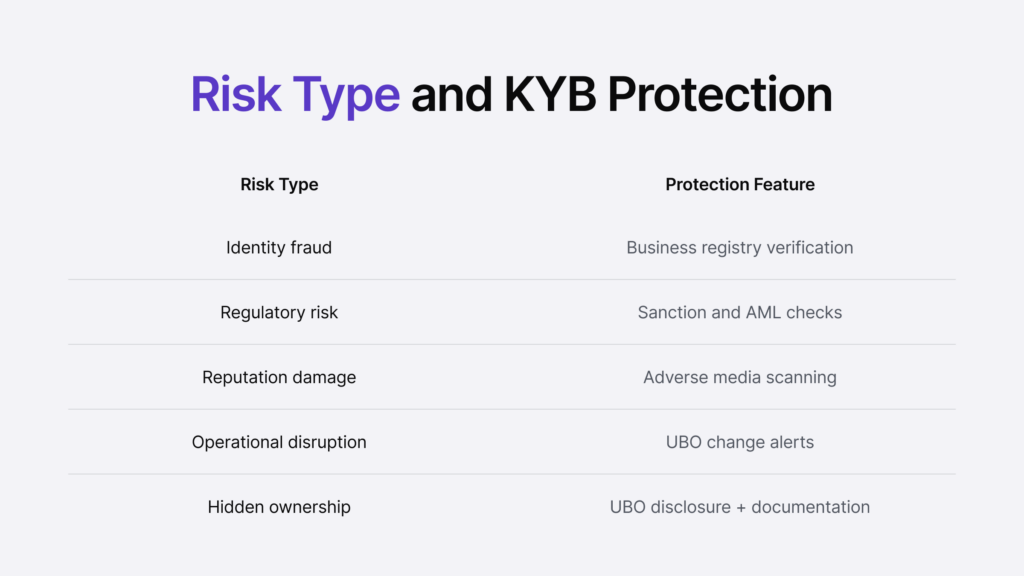

Fraudulent businesses often operate as shell companies or fronts for illicit activities. Partnering with them – knowingly or not – can result in serious consequences. KYB identifies patterns early by verifying credentials and ownership structures before any transaction or partnership begins.

Regulatory Compliance

Financial institutions, fintech startups, and marketplaces that handle transactions are under increasing scrutiny from regulators. Anti-Money Laundering (AML) laws require businesses to check their partners thoroughly. KYB satisfies these regulatory requirements and protects companies.

Trust With Growth Together

Startups and scaling companies often onboard hundreds, or even thousands, of vendors, partners, or clients. Conducting KYB verification manually can be inconsistent and unscalable. Automating KYB processes helps ensure consistent risk assessments, accelerates onboarding, and allows teams to focus on value-driving activities instead of manual checks.

Related: KYB vs KYC — What is the Difference? [Explanation Guide]

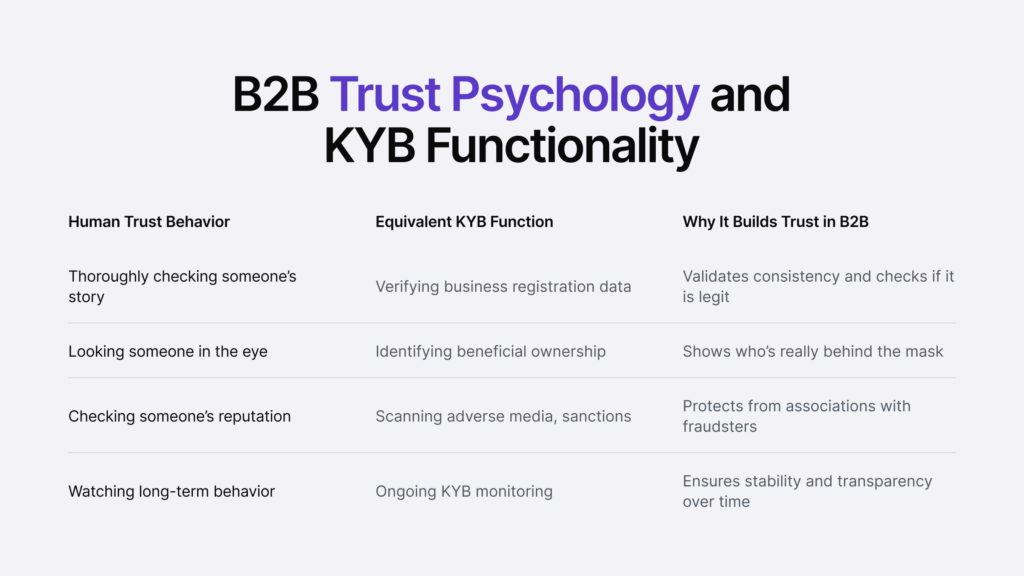

KYB and Trust in B2B

Trust in B2B relationships is built on transparency, predictability, and compliance. KYB enables all three.

When a business undergoes KYB verification, its credentials are cross-checked with official government databases, credit bureau reports, and third-party data providers. Ownership hierarchies are mapped out, red flags such as sanctions or legal proceedings are flagged, and the company’s operational status is confirmed.

This is not just about placing a checkmark. When your company engages with a fully verified partner, you know exactly who you are dealing with, and there is no room for ambiguity, hidden agendas, or compliance surprises down the line.

Verified partnerships lead to:

- More confident negotiations

- Shorter onboarding timelines

- Easier internal approvals

- Improved platform integrity

- Enhanced regulatory readiness

Here are some more details about how KYB builds relationships in B2B:

1. Legitimacy Verification

Trust starts with legitimacy. Before your business can confidently onboard a supplier, partner, or third-party vendor, you need to confirm that the business is who it claims to be. KYB helps you:

- Confirm that the company is legally registered and in good standing

- Validate the company’s structure and location through government databases

- Assess if the business has the authority to operate in a given jurisdiction

This prevents fraudsters from entering your ecosystem and makes sure that every relationship begins with a foundation of verified facts, not assumptions.

Example: A logistics platform working with international freight companies uses KYB to screen new carriers. By verifying licenses and legal registrations, the platform filters out fraudulent operators before shipments ever begin.

Related: How to Check if a Company is Legitimate [10 Steps]

2. Transparency Establishment Around Ownership

In B2B, who you are really dealing with matters. Many companies have complex ownership structures, with shell companies or nominee directors hiding the true beneficiaries.

KYB makes ownership transparent by identifying Ultimate Beneficial Owners (UBOs) – the individuals who ultimately control the business. This helps build trust by:

- Ensuring you know exactly who is behind the company

- Avoiding entanglements with sanctioned or high-risk individuals

- Demonstrating your own compliance commitment to regulators and investors

When businesses disclose this level of detail, it signals openness and accountability—two critical ingredients in any trust-based relationship.

Related: The Main KYB Risk Factors You Should Know

3. Mutual Commitment Demonstration to Compliance

Trust goes both ways. When both parties in a B2B relationship invest in compliance measures like KYB, it creates a mutual understanding: “We take risk seriously, and so do you.”

That shared commitment builds:

- Confidence in business continuity (you are less likely to be affected by a partner’s compliance failure)

- A stronger brand association (your company is not at risk by proxy)

- Peace of mind during audits or regulatory reviews

In highly regulated sectors, such as fintech, procurement, SaaS marketplaces, and logistics, this commitment to compliance can be the difference between a quick onboarding and a deal falling through.

4. Long-Term Support Collaboration

B2B relationships are not built on one-off transactions. They transfer into long-term collaborations involving data sharing, various agreements, ventures, and financial dependencies. The deeper the relationship, the greater the need for consistent, verifiable trust.

KYB supports long-term partnerships by using:

- Ongoing monitoring of business status, ownership, and risk profile

- Alerts when a company changes directors, UBOs, or legal standing

- Better visibility into a partner’s health and compliance posture over time

This is especially important when your partner’s regulatory or financial position can directly impact your business.

Example: A SaaS company integrating third-party developers into its ecosystem uses KYB monitoring to detect sudden changes in vendor structures. If a key vendor is sanctioned, they are alerted immediately, protecting system integrity and compliance.

The Role of Business Verification in Protecting Platform Integrity

One fraudulent or non-compliant entity can damage the credibility of the entire platform.

KYB here prevents fake businesses, sanctioned organizations, or politically exposed persons (PEPs) from gaining access. That kind of screening is necessary to keep on growing without weakening trust.

Automated KYB tools can flag risks during onboarding, monitor ongoing changes to business status, and strengthen verification based on jurisdiction or transaction volume. This makes sure your platform remains open and secure.

Best for Business Verification in 2025

Implementing KYB does not have to be complicated. Here are some practices that can help you balance trust, speed, and compliance.

Choose an Automated KYB Solution

Manual verification slows down onboarding and has inconsistencies. A better approach is to use an automated KYB provider that pulls data from global business registries, integrates UBO data, and screens for sanctions or media alerts.

Related: 6 Steps to Conduct a KYB Verification Check [Guided Explanation]

Customize Verification Based on Risk

Not every business relationship needs the same depth of verification. For instance, onboarding a small software vendor does not require the same scrutiny as partnering with a high-risk financial institution. Design a tiered verification system that adjusts based on risk level, jurisdiction, or service category.

Prioritize User Experience

Trust does not come at the cost of convenience. A well-designed KYB process should be smooth, transparent, and fast. Make it easy for partners to submit documentation, understand why it is needed, and receive updates on verification status.

Avoid overcomplicating the process with unnecessary paperwork or unclear instructions. The goal is to verify, not frustrate. Take a look at the guide for choosing the best KYB provider in 2025.

Keep Data Secure

KYB requires handling sensitive data, so ensure you have strong data governance practices in place, such as encryption, limited access, and compliance with GDPR or other applicable regulations. The way you protect your partner’s data is also part of how you build trust.

What Happens If You Skip Company Onboarding?

Skipping or delaying KYB may save time in the short term, but it exposes your business to significant risks. You may end up partnering with non-existent or fraudulent companies, failing audits, facing compliance violations, or ruining your brand reputation. Worse, if regulators catch you onboarding unverified individuals.

In the worst-case scenario, a lack of KYB processes could even derail your fundraising or exit opportunities. Investors and acquirers want to see that your compliance operations are scalable and mature.

Conclusion

Every fintech startup, a B2B marketplace, or a software provider working with enterprise clients needs to have KYB, which helps you vet potential partners quickly, stay compliant, and protect your brand. More importantly, it creates a business environment where transparency and accountability are the norm, not the exception.

Investing in a streamlined, risk-based KYB process helps you build partnerships that are safer, stronger, and scalable for the long run.