Blog

Identity Verification Blog

September 21, 2023

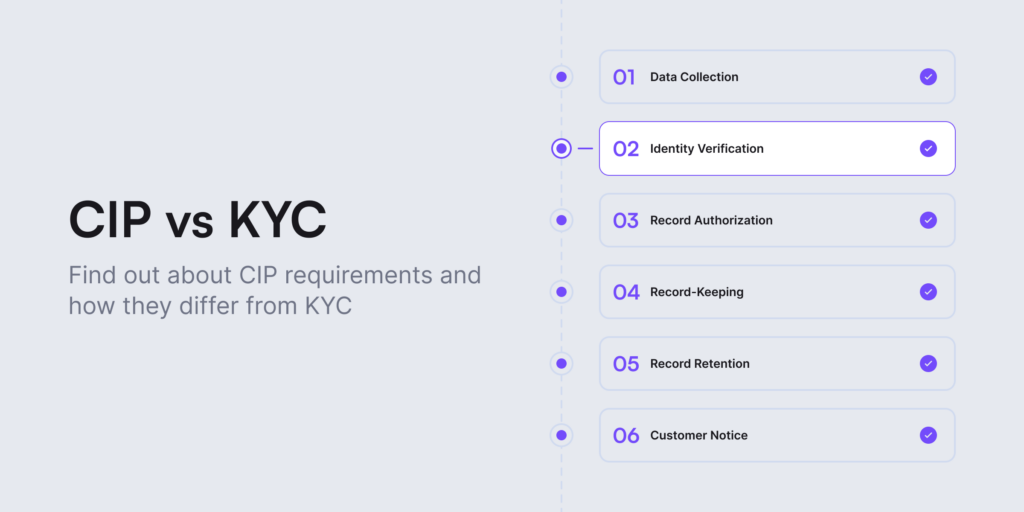

What is the Difference Between CIP and KYC? Examples & FAQs

Customer Identification Program (CIP) and Know Your Customer (KYC) are two different business operations that don’t work the same. However, businesses often confuse these terms when talking about ensuring Anti-Money Laundering (AML) compliance and preventing illegal activity. In this blog post, we’ll explain each process in detail, highlighting the key differences to help you create a strong customer identity verification system.

September 19, 2023

What is Identity Proofing? Complete Security Guide with Examples

The Federal Trade Commission (FTC) reported receiving a total of 5.7 million reports related to fraud and identity theft, with 1.4 million of these reports specifically involving identity theft cases. With this level of crime and illicit activity, identity proofing is an inevitable process for businesses that want to protect their assets and their customer’s data.

September 15, 2023

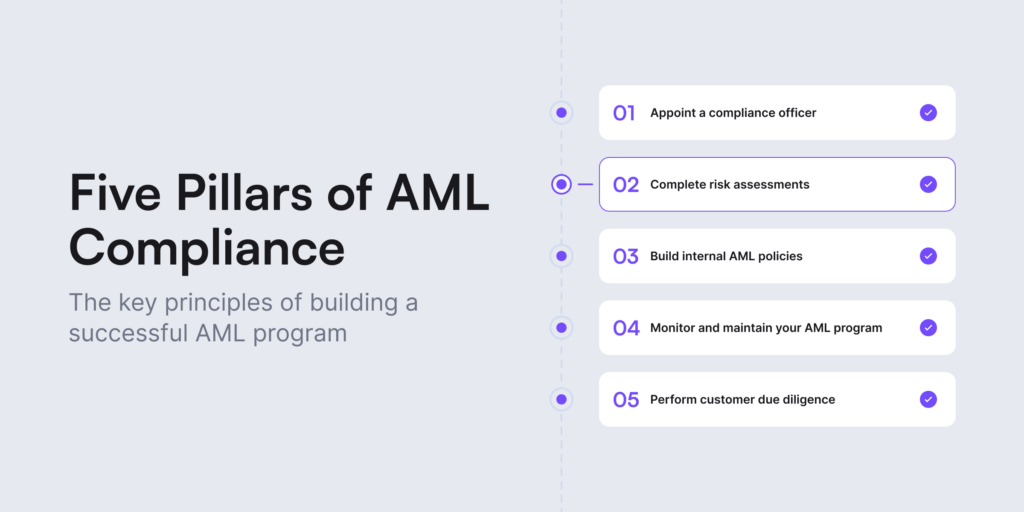

What are the Five Pillars of AML Compliance?

When establishing a robust AML compliance program, financial institutions must prioritize their ability to identify and assess potential risks. This is particularly crucial when dealing with customers who pose a higher risk of engaging in money laundering. To achieve this, a robust compliance program with the five key AML pillars is required.

September 13, 2023

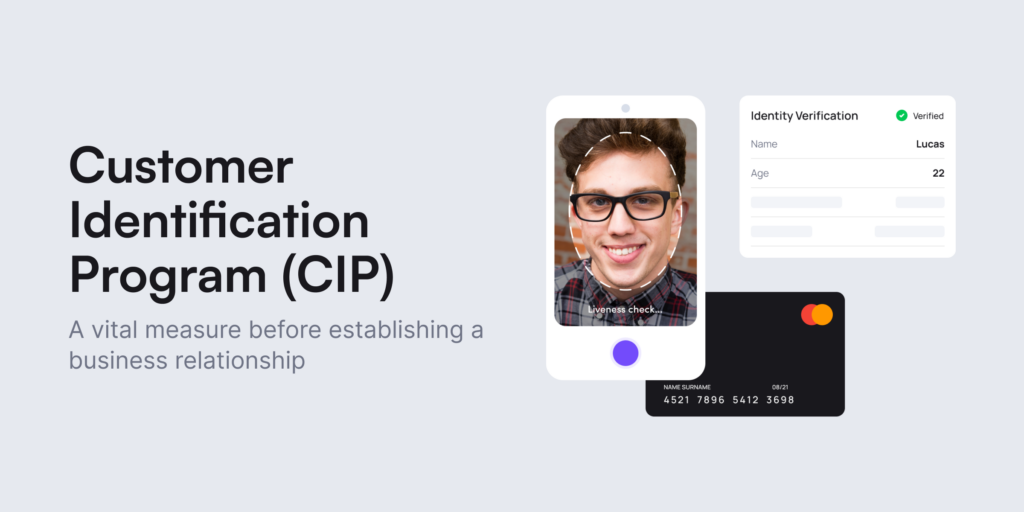

What is a Customer Identification Program (CIP)?

As a piece of a broader Know Your Customer (KYC) strategy, companies must conduct Customer Identification Programs (CIP) to establish their customer identities. Any business classified as a financial institution, according to the Bank Secrecy Act (BSA) is required to create a CIP. Learn more about its requirements.

August 30, 2023

What are the EU’s Anti-Money Laundering Directives (AMLDs)? Complete History Overview

EU anti-money laundering directives (AMLDs) require obliged entities — financial institutions and companies that handle transactions in EU member states — to conduct due diligence checks, including identity verification and transaction monitoring, when forming new business relationships. Learn more.

August 25, 2023

What is a Risk-Based Approach to AML?

A Risk-Based Approach, known as RBA, facilitates proactive risk management rather than a post-analysis of a money laundering incident. It’s one of the most used terms in Anti-Money Laundering (AML) compliance. A risk-based approach to AML helps companies focus on preventing money laundering, bribery, corruption, or terrorist financing while taking dynamic precautions against financial crime. Read more.

August 22, 2023

New Account Fraud: Alarming Red Flags and Ways to Fight Back

New users are great…Unless they turn out to be fraudsters creating accounts only for their devious scams. Yet, companies always search for ways to attract new customers who help them scale and earn profit. But what about protection? We explain how not to get tangled up in the growing threat of new account fraud.

August 10, 2023

How to Improve KYC Verification? Tips For a Frictionless User Experience

KYC verification shouldn’t take multiple steps and more than five minutes. Compliance regulations are getting stricter, at the same time, customers are getting more demanding. Now that not only banking, but sectors like crypto or online gambling are regulated, many consumers don’t want to disclose their identities, not to mention get stuck during a lengthy identity verification process. Read more.

August 3, 2023

What is Watchlist Screening?

Watchlist screening is a vital process and a part of the AML compliance program, which mandates financial institutions and other regulated entities to check if their customers and business partners appear in certain databases, including global watchlists, including crime and sanctions lists. Read more.

July 31, 2023

Know Your Patient (KYP): How to Prevent Fraud in Healthcare?

KYP is a necessary measure for healthcare professionals when preventing data breaches, drug abuse, medical identity theft, and other fraudulent activities. Most importantly, a properly implemented digital KYP process can help any healthcare organization onboard its patients easily, preventing criminals from using stolen credentials or personal details to access healthcare services. Learn more.

July 27, 2023

What is AML Screening?

Rapid technological advancements, inconsistent regulatory frameworks in different jurisdictions, or complexity in the modern financial scope all play crucial roles in one thing — yes, we’re talking about facilitating money laundering. In this context, AML screening, or checking whether potential customers pose risks of money laundering, is vital. Read more.

July 25, 2023

What is Chargeback Fraud?

Chargeback fraud happens if a customer opens a transaction dispute with their payment provider, either for legitimate or fraudulent purposes. While this process is particularly designed to fight crime, businesses, especially e-commerce merchants, have experienced many challenges, with one major issue being substantial financial losses. Find out how to prevent chargeback fraud and identify legitimate chargebacks.

July 20, 2023

KYC in Online Gaming (iGaming Guide 2025)

Online gaming companies are part of the regulated iGaming industry, where there are many strict Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. Sports betting, online casino, video game or poker betting platforms must verify the user’s identity, their source of funds and location. Learn more.