June 12, 2024

Age Verification Law in Texas [Updated]

We’ve covered the new age verification law passed on 28th of April 2024 by the Texas state and shared the concrete steps to build identity verification procedure.

Customer Risk Assessment: How to Do it Right [Step-By-Step Guide]

Learn all about customer risk assessment, factors that help determine the level of risk, automation options, and concrete steps you have to take to comply with AML regulations.

How Does AML Apply to Crypto? [With Examples]

Learn all about crypto compliance, AML regulations, new Travel Rule updates, and what kind of measures are now required for VASPs.

May 28, 2024

How Does Driver’s License Verification Work?

Find out why so many platforms incorporate driver’s license verification into their onboarding flow and why it’s considered the go-to method to achieve a simple and efficient Know Your Customer (KYC) process.

Money Laundering in Forex Trading [AML Risk Guide]

The forex market isn’t an exception and, like many high-risk industries, is associated with money laundering risks. Learn how to build a proper AML program for your forex trading business, find out how to identify key red flags, and more.

April 30, 2024

Source of Funds (SOF) and Source of Wealth (SOW) Checks [Guide]

Get a bigger picture of the intricacies surrounding Source of Funds (SOF) and Source of Wealth (SOW) checks. Discover the main challenges in AML and KYC compliance, and learn the best practices that will help you enhance your compliance procedures and mitigate the risks of money laundering.

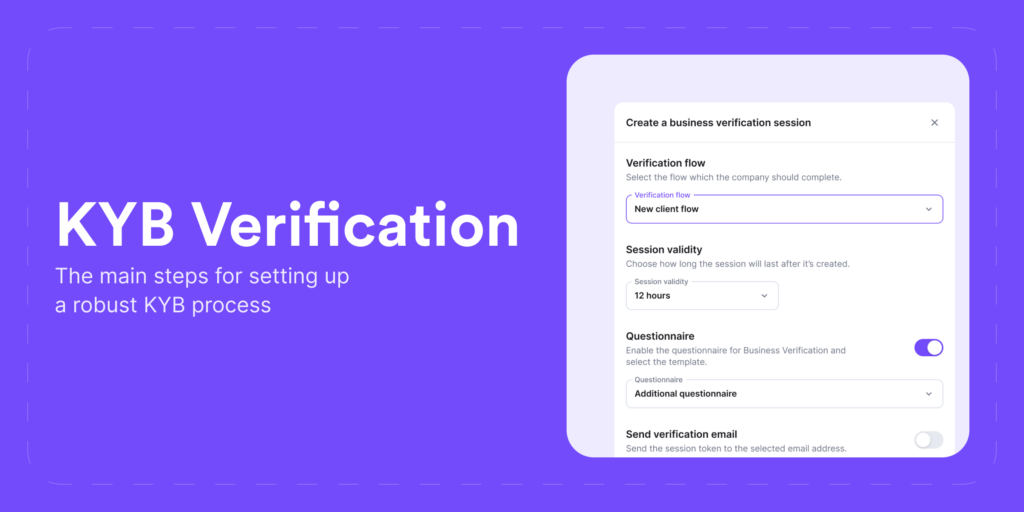

6 Steps to Conduct a KYB Verification Check [Guided Explanation]

Discover the specific steps and examples of how to conduct a compliant Know Your Business (KYB) verification process.

Get Ready for Your AML Audit [Best Practice Guide]

Understanding how to select the right automation tools, assessing the effectiveness of internal controls like prepared reports, and setting the scope and frequency of an AML audit can be challenging. Learn how to verify the effectiveness of your AML program with a straightforward AML audit guide.

April 22, 2024

What is the Crypto Travel Rule? An Overview

Explore the Crypto Travel Rule and learn what data needs to be collected, who qualifies as a VASP, as well as the necessary steps and tools for crypto platforms to comply with the FATF guidelines.

April 17, 2024

Third-Party Money Laundering Risks Explained

We dig deeper into how third-party money laundering can harm a company’s reputation, explain how to monitor suspicious activity, and go through the top key measures that can prevent such risks.

April 11, 2024

How Can You Detect Arbitrage in Sports Betting? [Simple Guide]

Learn what arbitrage in sports betting is, how arbers try to avoid getting caught by skilled bookmakers, and what it takes for companies to actually prevent unwanted arbing activities.

April 3, 2024

What is the eIDAS Regulation? [Simple Explanation]

Find out what eIDAS is, its history, importance and the key steps that are required to build a secure and compliant identity verification aligned with these regulations, ensuring digital trust and security.

The Risks of Shell Companies in Money Laundering

Shell companies can hide ownership and transactional details from regulatory and law enforcement authorities, which makes them less transparent and, at the same time, more attractive for fraudsters to use for money laundering. Read more.