It’s convenient to pick up any vehicle, rent it, and then drive to your desired destination without needing to have your own car or driver. As the shared mobility sector becomes more popular, it has proven its value both to its users and businesses. According to McKinsey research, throughout recent years, various private equity firms and other players have invested more than $100 billion in shared mobility entities. One crucial aspect contributing to the industry’s success is the implementation of security measures, such as driver’s license verification.

Like many customer-centric industries, user experience stands at the top of the priority list, next to compliance and security. So, even though there are many identity verification solutions and automated Know Your Customer (KYC) tools in the market today, remote driver’s license verification is the go-to pick for businesses in the shared mobility sector. Asking the user to download the app and upload a photo of their driver’s license before they can access the vehicle is a common way to verify someone’s identity and age and, more importantly, check if they’re qualified to drive.

Driver’s licenses are commonly requested as a government-issued document during user onboarding for various digital platforms. That said, this type of verification isn’t exclusively tailored for the shared mobility industry. We’ll discuss the specifics, including main uses and features while explaining the step-by-step process of driver’s license verification.

What is Driver’s License Verification?

Driver’s license verification is the process of confirming that the person’s driver’s license is valid and belongs to the rightful owner. In other words, this form of verification helps assess the authenticity of the document and verifies their identity, including important details like the person’s age.

While driver’s license verification is mainstream in the sharing mobility or transportation industry mainly for its capabilities to onboard many different types of users on apps, such as renters, drivers, and ride-sharers, in order to minimize paperwork, it’s used for other purposes as well.

Businesses that sell similar age-restricted items or services also rely on driver’s license checks. For example, adult content apps and e-commerce platforms that sell goods like alcoholic beverages can use license verification as a way to guarantee that they’re not accepting minors into their network. This is considered a more secure way to approve a person’s age compared to relying on a standard age gate with a checkbox, which can be easily bypassed.

The Role of Driver’s License Verification in KYC and AML Compliance

From luxury goods auctions to sharing economy services or standard banks — these are all regulated entities that need to stick to KYC and anti-money laundering (AML) compliance requirements. Various digital service providers, including famous examples such as Airbnb and Uber, can’t be built solely on trust. They often use driver’s license verification as part of their remote identity verification process. This way, they can ensure security and comply with KYC/AML rules.

Beyond compliance and the use of ensuring adherence to these regulatory standards, companies aim to keep fraudsters away from accessing their services by implementing document verification, including driver’s license checks. That makes a driver’s license check a trusted anti-fraud measure in many industries since each valid ID card is issued by a government agency and can be easily verified as genuine or fake.

Industries that Often Use Driver’s License Verification

Financial institutions that heavily use government-issued document verification also use driver’s license checks to comply with KYC/AML laws and verify the identity of their customers. However, this is a popular ID verification method across various industries.

For example:

- Brokerage firms

- Crypto exchanges

- Lenders

- Investment companies

- Credit unions

What’s more, businesses like iGaming platforms or vehicle dealerships are considered financial institutions under the Bank Secrecy Act (BSA) because they handle large sums of money and can also be used for money laundering, terrorist financing, and other financial crimes.

So, for a vehicle dealership, for example, any sort of ID verification check is especially beneficial for job applicants who are trying to succeed in a role that requires them to drive. Such driver’s license checks ensure that only authorized and competent individuals are entrusted with vehicles in rental or ridesharing services.

What Does the Process of Driver’s Verification Look Like?

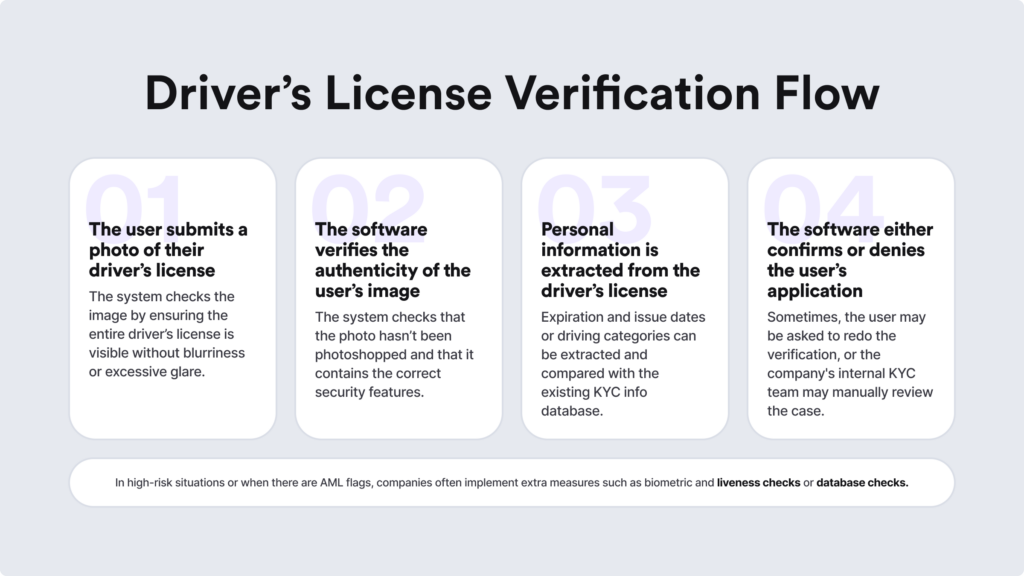

The driver’s license verification process that most online platforms adopt today typically involves these stages:

- The user is asked to submit a photo of their driver’s license.

- The system checks if the image on the document is properly photographed, which means that the software automatically checks that all corners of the license are captured and the picture isn’t blurry or too dark to read.

- The system then confirms the authenticity of the image and driver’s license, verifying that it’s genuine, hasn’t been tampered with, matches the issuing country’s templates, and includes all the right security features.

- Additionally, data like the user’s name or birthday, including the license expiration and issue dates, are extracted and then can be compared to the user’s existing profile.

By using these steps for driver’s license verification, companies can review the customer’s personal details automatically and confirm that the document is authentic. If all goes right, the customer is considered genuine and can access the services, for example, a vehicle through a car-sharing app.

However, if their verification fails, for instance, due to their poorly submitted photo with a glare, they’ll need to redo the check. Some companies have manual in-house Know Your Customer (KYC) verification teams specifically for this matter so that they can improve the success rate and change the person’s submission from “Denied” to “Approved”. This is also great for high-risk persons or users who are suspicious and show atypical behavior later on during the business relationship.

Custom Document and Biometric Verification Flow

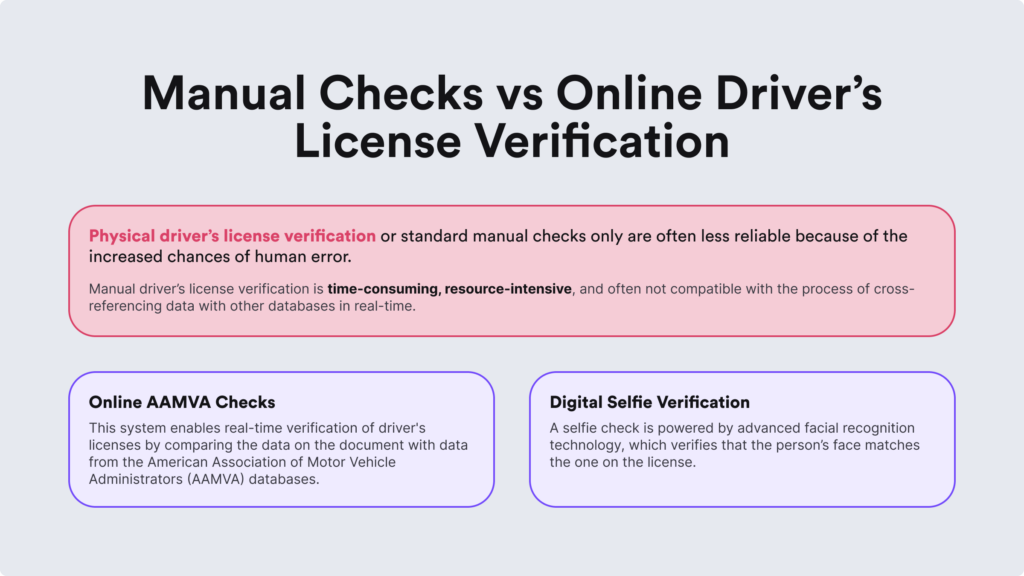

Based on their internal risk assessment strategies, some companies implement extra steps and customize their driver’s license verification. A popular approach in this case is customizing the customer onboarding flow and adding a selfie check, also known as biometric identity verification. This is particularly important due to the increasing number of evolving scams. Bad actors persuade victims to upload scanned copies online for fake IDs, use AI to make renderings, and so on.

An additional liveness check is part of a company’s identity proofing system, helping boost their driver’s license verification process and ensure the document wasn’t stolen and that the person is present during submission. A selfie check requires the person to take one or more selfies using a mobile phone. Sometimes, companies also conduct video verifications. Then, the captured image or video is compared to the driver’s license photo. Liveness detection algorithms confirm the authenticity of the biometric check and detect attempts to deceive the system.

It’s also a common practice in high-risk industries like finance, where selfie checks can be triggered as well after the onboarding process. For example, if a customer needs to confirm a large transaction, a selfie check may be triggered as a reverification measure when driver’s license verification alone is insufficient.

Manual Document Verification

Small enterprises not yet in their scaling stage often rely on manual document verification and KYC onboarding processes. This means they have a team of specialists responsible for manually checking documents like driver’s licenses and maintaining their own data records. Instead of partnering with third-party service providers that offer AI-powered solutions for automatic data extraction, collection, and verification, these businesses handle everything in-house.

While experienced KYC specialists who check documents can spot mismatches in physical documents, they often rely on the combination of AI or some sort of software and manual verification for edge cases. For example, as mentioned earlier, when a document is flagged as suspicious, businesses can either reject the document or forward it for manual review. Although less efficient and secure, manual document review helps reduce false negatives. This process may involve collecting additional or alternative documents for verification.

That’s why companies can also use manual document verification for non-identity information. For example, ridesharing platforms might need to confirm that a driver owns a vehicle and, on top of that, has valid insurance. The company can then request copies of relevant documents, such as a vehicle insurance card, and verify them manually, and, on top of that, use automated driver’s license verification to extract the rest of the required automation, like the person’s name, automatically.

What is a Mobile Driver’s License (mDL)?

A mobile driver’s license (mDL) is a digital ID that stores a person’s driver’s license information online as an alternative, more convenient method to a physical document verification process. Users who want to receive an mDL typically need to go through a standard KYC check and then store their mDL in a state-sponsored app or a mobile wallet like Apple Pay.

However, mobile driver’s licenses are only accessible to residents of states or countries that permit their use. They include the same data as a physical license, such as the name, date of birth, address, issue date, driving class, and so on. The first electronic driver’s license was introduced in Mexico in 2007 using the Gemalto smart-card platform. Later on, in 2016, the US National Institute of Standards and Technology (NIST) partnered with Gemalto to pilot the “digital driver’s license”.

When it comes to Europe, Norway was the first to launch a mobile driver’s license in 2019 through an app available in their marketplaces. To access it, users should verify their identity with BankID during the onboarding. The app then collects license information from the national driving license database. In general, this makes mLD a more user-friendly verification method compared to traditional document checks since there’s no need to request images and handle extraction issues due to poor quality.

The Biggest Benefits of Driver’s License Verification

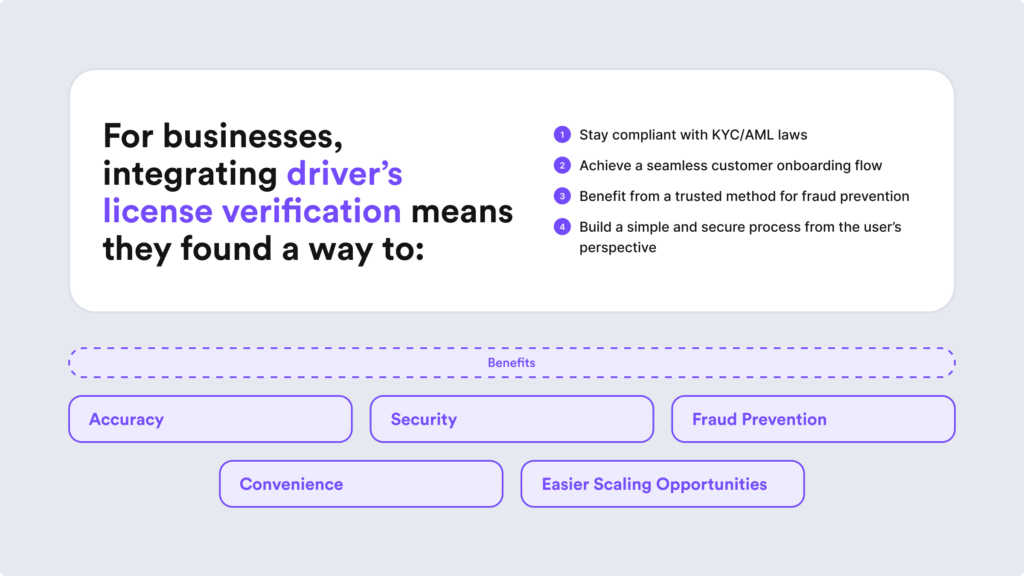

An increasing number of businesses depend on document verification, particularly driver’s license verification, to onboard drivers, expand their customer base, and enter global markets without necessitating physical documents from users. Driver’s licenses, being one of the most common government-issued IDs, offer a convenient means to establish a customer-centric verification process and ensure compliance.

That is why this method of verification is able to offer the following benefits:

- Great end-user experience. By accepting driver’s licenses, businesses can build an efficient automated system to verify these documents, reducing the time and effort needed for manual checks. This is very beneficial for large-scale platforms with a high volume of verifications.

- Improved fraud prevention. Driver’s license verification helps comply with regulatory requirements and, in some jurisdictions, enables businesses to accept mobile driver’s licenses and improve their eKYC processes. So, even for unregulated entities, these checks ensure that the digital platform is free from fraud, such as ATO or duplicate accounts.

- Enhanced accuracy. Features like facial recognition enhances security in driver’s license verification, preventing identity theft or fraud while ensuring accurate data capture and minimizing chances for human error.

So, depending on your industry, whether you need to check the person’s identity and age or verify them in order to accept only legitimate drivers to your network, as a business, you should build a smart KYC flow depending on your risk tolerance and use case.

iDenfy’s Approach to Helping Businesses Build a Beneficial Driver’s License Verification Process

At iDenfy, we have built a global RegTech hub with multiple identity verification tools based on your industry and use case. Instead of multiple unnecessary steps, through driver’s license verification, users can avoid the frustration that comes with lengthy KYC checks.

Werther you want to prevent minors and illegal drivers from hiring vehicles or accepting alcohol purchases from underage people online — our ID verification software can both ensure compliance and a great user experience.

We offer both document and biometric verification solutions, including other alternatives like NFC verification and more fraud prevention tools for complete KYC/AML and KYB compliance, now with freshly released features like our Risk Assessment.

Don’t hesitate. Book that demo.