A criminal background check is a popular due diligence process in the US (including other countries) that focuses on assessing a person’s track record and whether they have any links to crime and criminal behavior. Most know this process as a key part of a company’s employee background check, when a potential candidate needs to be reviewed to ensure that their skills, values and reputation, which also includes their criminal history, align with the company’s priorities.

However, a criminal background check in the context of due diligence and compliance is dedicated more to high-risk industries, such as banking, crypto, or fintech, where all partners, potential third-party vendors and related persons need to be assessed in a more detailed way. That means in order to comply and maintain a proper risk management strategy, the business conducts identity checks and more thorough background checks on the person, which involve looking into their past and criminal history.

We explain below what kinds of checks there are, and how exactly you should run a criminal background check using automation, different screening techniques, and official databases.

What is a Criminal Background Check?

A criminal background check is a security process that involves verifying a person’s criminal record by screening, often using an AI-powered solution, multiple databases that hold information linked to criminal records. It helps determine whether a potential client has a criminal record before allowing them to access certain services, such as a fintech platform.

Other common use cases for criminal background checks include:

- Before granting a loan

- Before hiring a candidate

- Before approving an insurance application

Companies that handle sensitive information and are regulated by laws like Know Your Customer (KYC) and Anti-Money Laundering (AML), are required to verify their customers and do due diligence, which involves not only checking ID documents but also digging deeper and screening the customers against AML lists (PEPs & sanctions), and other databases that can show red flags, such as links to crime — from financial misconduct and fraud to substance abuse or child support violations.

To put it simply, a criminal background check is a vital process and a part of a company’s risk management. Companies can have different risk appetites, meaning that some have a zero tolerance when it comes to one’s criminal past, while others, in less regulated environments, can accept individuals who have had minor charges in the past.

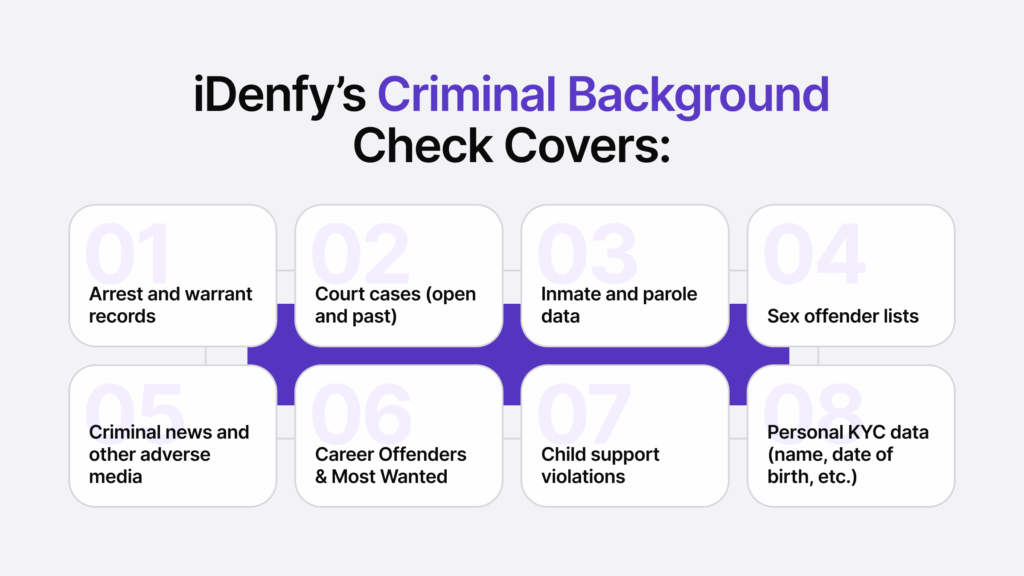

What Kind of Data is Assessed During a Criminal Background Check?

A criminal background check backed by accurate, up-to-date information extracted from official government sources helps evaluate the credibility and potential risk each individual brings to a business relationship or transaction. The goal here is to build a clear risk profile of the individual.

Important sources that are typically used during criminal background checks include:

- Court records (for example, lawsuits linked to fraud or embezzlement)

- Regulatory watchlists (for example, SEC enforcement actions or FATF high-risk jurisdictions)

- Criminal databases (for example, county records, police databases, or FBI records)

- Sanctions lists (OFAC, UN Sanctions, EU Sanctions, etc.)

Due diligence can reveal fraud charges, corruption, and other red flags that could jeopardize a business deal or partnership. In other words, screening criminal records helps determine whether the person is involved in ongoing litigation or past legal issues that could impact the company negatively. In employment, this helps assess if their claimed experience and qualifications align with their current role and responsibilities.

When is a Criminal Background Check Performed?

Before onboarding a new client, the company, such as a financial institution, needs to perform several checks, including:

- Conducting a criminal background check

- Verifying the client’s source of wealth

- Screening the client for political exposure

- Reviewing them against global sanctions lists

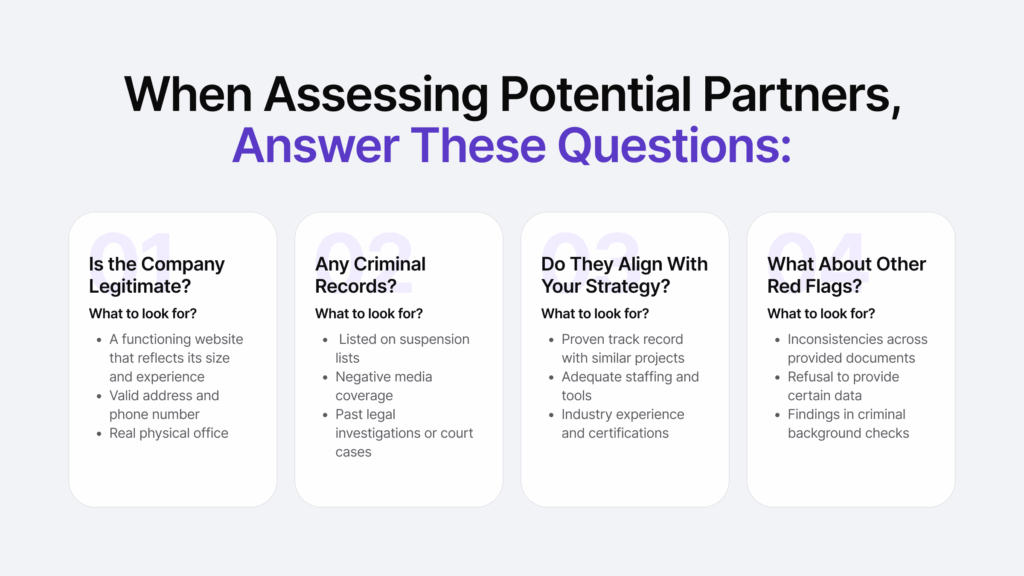

A popular example where a criminal background check is used is before investing in another business, such as a tech startup. Similarly, a publicly traded company can investigate a potential acquisition target. The company running the screening process needs to review the potential partner, or a corporate entity, and all its related individuals, including directors and shareholders. By verifying if a person has a criminal record, businesses assess potential negative factors and ensure that they aren’t working with high-risk individuals.

In practice, this means screening them against criminal watchlists, doing KYC on ultimate beneficial owners (UBOs), and so on, based on regulatory requirements and internal risk assessment practices. So, in this sense, a criminal background check can be part of KYC risk assessment and a company’s Know Your Business (KYB) onboarding process. All third-party vendors and service providers should also go through KYB checks and criminal background checks as part of standard due diligence.

What Steps Should Be Included in a Criminal Background Check?

Landlords, employers, lenders, and similar organizations, especially those that juggle financials and high volumes of transactions, need to implement due diligence and ongoing monitoring measures that prevent their services from being used for crime.

Some common due diligence measures that include a criminal background check go along with steps like:

- Identity verification, or KYC verification, which often consists of document verification (passport, ID card, or driver’s license check), biometric verification (selfie verification), and database verification (where another reputable source, such as a criminal database, is used; also very common in SSN verification in the US).

- Criminal records screening, or a criminal background check, sometimes also referred to as a due diligence background check, consists of looking up individuals in various databases (searching by their onboarding data, such as their full name or date of birth and address data) to assess risks and look for any convictions, arrests, registered sex offenders and other similar records in the applicant’s both local jurisdictions and national levels for additional details on criminal activity.

- Sanctions and watchlist screening. Screening sanctions lists and global watchlists (for example, Interpol Red Notices or World Bank Debarred Firms) to detect sanctioned users (both individuals and businesses) and those linked to crime for potential security risks.

- Reporting. This includes collecting all verified data from databases that were used for screening and verification to summarize red flags and findings. Often, there are automated solutions like iDenfy that use AI to extract and compile data into a detailed report that can be downloaded in PDF format and later used by analysts for enhanced due diligence (EDD) or when reporting and filing a suspicious activity report (SAR) is needed.

Often, regulated companies are required to track changes in their customer profiles. As a result, they implement continuous monitoring systems to track customers after onboarding. If a client is flagged, for example, due to charges of financial fraud, the monitoring system detects the change and triggers an alert, prompting the analyst to conduct further checks. This is a must to ensure compliance, as a client with a squeaky-clean record can develop bad tendencies.

Related: What is the Difference Between CDD and EDD?

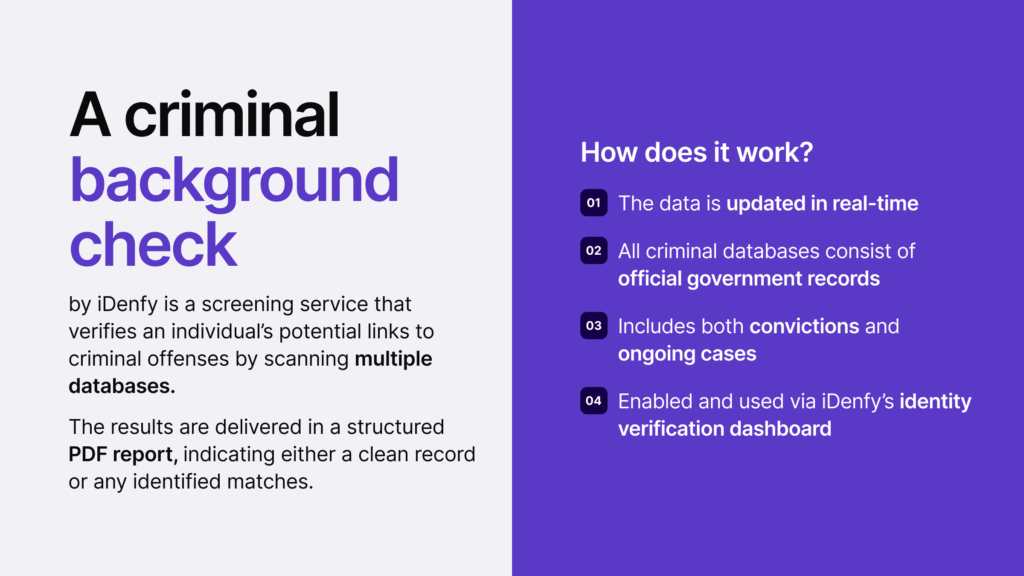

How Does iDenfy’s Criminal Background Check Work?

iDenfy’s API provides automated access to criminal records across all 50 U.S. states, pulling data from thousands of federal, state, county, and local databases.

You can easily integrate the API and seamlessly customize the criminal background check along with the preferred KYC method, such as government-issued ID or biometric verification. This not only improves approval rates but also:

- Keeps identity verification fast, efficient, and user-friendly.

- Improves accuracy for a better risk assessment (with the ability to integrate extra fraud prevention tools that are managed on the same dashboard, for example, AI risk assessment & scoring).

Information That Goes Into The Criminal Background Report

Along with simple, universal access and data extraction from multiple criminal sources, iDenfy’s criminal background check allows you to download a comprehensive due diligence report with a focus on their criminal profile.

The criminal background report combines the extracted criminal data and helps assess data, which contains information like:

1. Standard report and KYC data

- Verified full name

- Date of birth

- ID verification number

- Jurisdiction of the records (state or county level)

- Report generation date

2. Overview of all criminal records

A list of criminal offenses linked to the person, which includes details like:

- Financial crimes

- Property crimes

- Drug-related offenses

- Violent crimes

- Traffic violations

- Other unspecified or sealed charges (listed under general offense classes)

3. Expanded individual’s offense insights

For each finding or incident, the report includes:

- Type and classification of the offense (for example, financial, harm, or traffic)

- Offense description (for example, “forgery,” or “dangerous drug violation”)

- Offense level (for example, felony, infraction, or unknown)

- Sentence date (if available)

- Release date (if applicable)

- Court name and jurisdiction

- Case number

4. Complete case history across jurisdictions

The report pulls entries from multiple U.S. courts and law enforcement agencies across different counties, ensuring a proper view of the person’s criminal record, even if their records come from multiple regions or different databases.

iDenfy’s solution combines this data so that you don’t have to look up these sources manually.

For example:

Criminal background check

31 Jul 2025, 10:09:20 UTC +0

Status 🔴 Suspected 🔴

Full name JORDAN ALEXANDER SMITH

Check ID DUMMY12345ABC67890XYZ

Date of birth 1982-04-15

Last check date 2025-07-31

Criminal background findings

Full name & County State

JORDAN A SMITH Ridgeview County CA

Offense forgery

Offense class financial

Offense description FORGERY OF DOCUMENTS

Offense level UNKNOWN

Sentence date 2008-03-14

Court name CA Department of Corrections

Court case number 2008012345001C

Release date –

Offense forgery

Offense class financial

Offense description CHECK FRAUD

Offense level UNKNOWN

Sentence date 2008-03-14

Court name CA Department of Corrections

Court case number 2007022204002C

Release date –

& so on, depending on the person and the number of criminal records associated with them.

What is the Difference Between a Manual and an Automated Criminal Background Check?

Like many compliance-related tasks, criminal background checks can be automated using RegTech solutions like iDenfy, with built-in features for KYC/KYB and AML compliance or a simple, easily implemented API solution. There’s no right or wrong solution, as it depends on the company and factors like the operating markets, industry, volume of customers, overall risk levels, or the scale of the business.

Here’s a more detailed explanation of each method for criminal screening:

Manual Criminal Background Check

This involves collecting and reviewing criminal records manually, meaning that there’s no unified system, and the human analyst needs to access government databases, court records, and public registries on their own. Alternatively, some organizations submit formal background check requests to government agencies and local law enforcement authorities that are then obliged to provide criminal data (for example, Europol (EU) or the FBI (US)).

🟢 Pros: Works well for high-risk situations, such as before doing a high-value financial deal, due to providing a more in-depth explanation.

🔴 Cons: Takes up much more time and resources, which can slow down operations and shift the focus from tasks that also require manual input from analysts.

Automated Criminal Background Check

This involves using an AI-powered platform that offers streamlined access to criminal databases and all related records when you search and look up a person’s name. In this case, instead of looking through multiple state and federal databases, you use one universal system that extracts and collects related data for you in one place. Most solutions, including iDenfy, connect to global and local databases, which saves time and lets analysts take appropriate action sooner, lowering the risk of fraud or missing any red flags that arise when certain criminal charges are found.

🟢 Pros: Handles large volumes of customers fast, especially in industries like banking or fintech, while allowing businesses to scale and instantly access multiple databases in real-time.

🔴 Cons: Often requires integrating a third-party solution that includes extra costs (however, for large organizations, this remains the preferred method, especially for ongoing due diligence).

Bottom Line

Onboarding a high-risk individual with a heavy criminal record isn’t the situation that a reputable business wants. For this reason, a simple API integration and an automated criminal background check solution can minimize any company’s exposure to unwanted risks. This approach not only helps improve risk assessment but also caters to the overall goal of preventing financial crime, complying with regulatory rules, and safeguarding the company’s operations.

Inconsistent user profiles, gaps and missing details, adverse media, and unexplained discrepancies between the provided user’s information and found records or found AML red flags can be overwhelming factors when it comes to manual criminal background checks. At iDenfy, we help automate this process and customize your preferred onboarding workflow, tailored to industry specifics.

Let’s talk, and we’ll walk you through real examples of our ID verification, AML screening, business verification, criminal background checks, SOS verification, and more in a free, quick demo.