Mobile identity verification SDKs are necessary for fintech mobile applications. A recent study reveals that 97% of millennials use mobile banking applications. As a result, KYC compliance is a must for financial institutions. The question could arise whether mobile SDK is required or whether web flow is sufficient.

The truth is that not a single customer prefers redirecting to a web browser, seeing an unfamiliar interface, and returning to the application while potentially experiencing redirection issues. What’s more is that Native SDKs have an advanced camera control system, resulting in an increased success rate. Even though mobile SDKs provide a better verification flow to the clients, selecting the most viable one is an essential step.

No matter how functional and error-free software development kits are, unless they provide a great user experience, they are not fulfilling their core purpose — successful user onboarding. SDK developers face a variety of challenges in ensuring that.

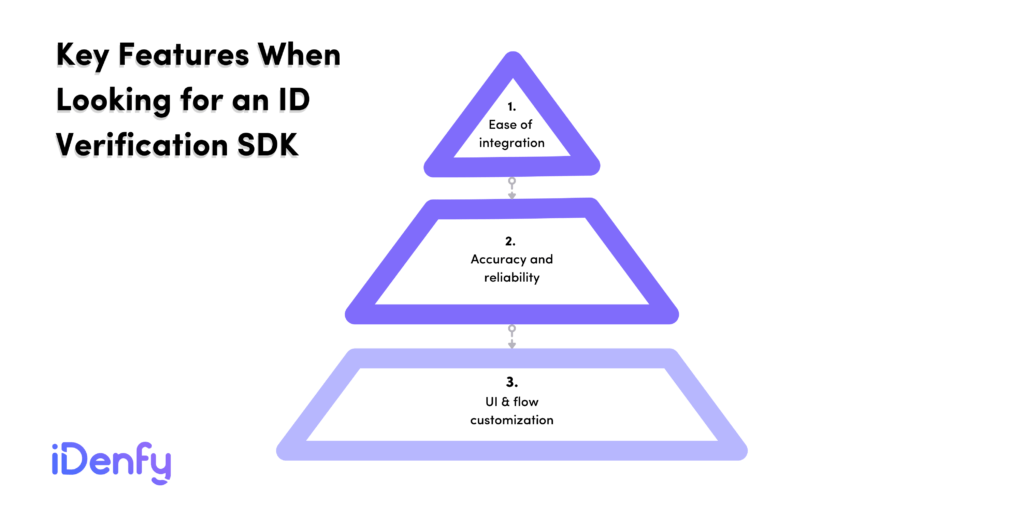

That said, here are the top three features to focus on when selecting an ID verification SDK:

- Ease of integration. The SDK should be easy to integrate into your app, with minimal coding required.

- Accuracy and reliability. The SDK should provide accurate and reliable results to ensure confidence in the verification process.

- UI & flow customization. The SDK should be blended into an existing mobile app without customers noticing it.

Let’s dive deeper and explore why these aspects are crucial to having a seamless onboarding flow in your killer mobile application.

Easy integration of software development kit is a must

Suppose you need to support both IOS and Android and dedicate two people to integrate mobile SDK. At iDenfy, clients estimated 1-2 weeks of work to integrate our mobile SDK. Knowing that the average hourly rate for a Mobile Developer is 48$ as of June 28, 2022, the total costs of integration could skyrocket to an additional 3000-5000$ without considering the maintenance costs.

We’ve challenged this idea and are happy to hear that customers can integrate our SDK within hours. It is especially beneficial to have official plugins for cross-platform development. React-Native and Flutter come to mind. By implementing them, developers can use the programming language of their existing mobile application, e.g., Javascript or Dart.

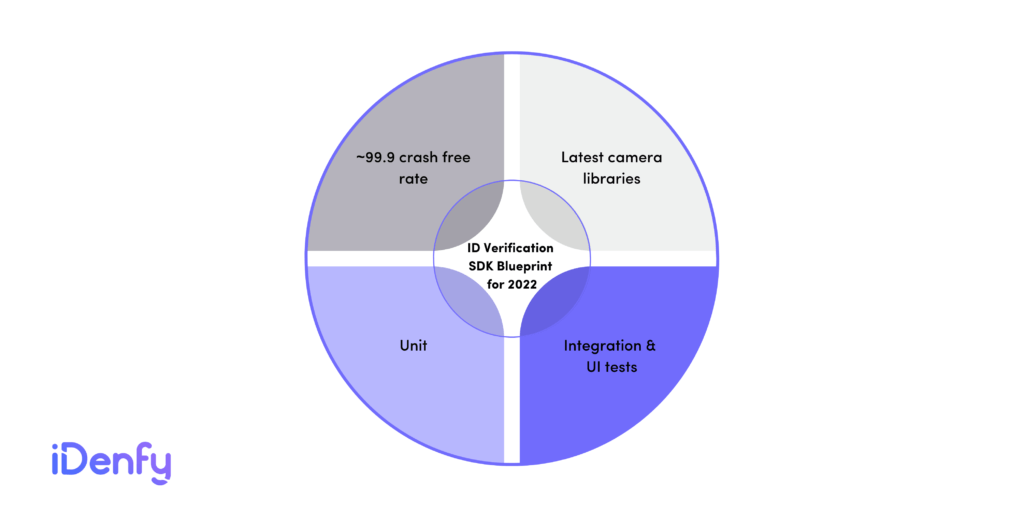

Crashes, runtime errors, and legacy technical decisions are not acceptable for identity verification solution

With great power, indeed, comes great responsibility. Identity verification SDKs certainly provide a complete customer onboarding journey just by themselves. However, any issue or crash would make new customers’ journey a nightmare. It is essential to constantly track the performance by utilizing Firebase Crashlytics or Sentry logs. For mobile SDKs, it is rather complicated since many stability analytics are supported exclusively for mobile apps. As a result, teams should enforce strict testing guidelines, utilizing unit, integration, and UI tests to supplement this limitation.

Moreover, one of the core pillars of identity verification aspects is document & selfie capturing. The camera must ensure high photo quality since it affects the success rate of identity verification because of MRZ reading accuracy and face-matching scores. However, guaranteeing excellent camera quality is not an easy task. From our experience, using the newest camera libraries for Android and IOS operating systems is the most significant contributor to great images and documents. For instance, Google is actively developing the Camera library called CameraX (iDenfy developers also contributed!). Developers working with this library are amazed by the speed of integration and camera reliability. It is not a surprise considering that this library powers 90+ devices representing ~450M active Android devices with installed different OS levels daily. The upgrade to CameraX at iDenfy ensured that images were clear and the phone camera operated on all devices, which is not a guarantee for exclusively web-based applications.

Be careful with API downtimes and breaking integration changes for your mobile SDK

API downtimes seem to be an unavoidable theme in the modern SAAS world. No wonder they all have a dedicated status page showcasing occurring outrages. Yet even if an error occurs, the SDK should handle it so that the customer understands he cannot complete verification at the moment and needs to wait for the specified time frame. Regarding breaking changes, they are often misused. KYC SDK is not some open-sourced library; it is proprietary software requiring delicate testing and a well-managed backend API.

Any breaking changes in an integration level and significant UI changes would require the clients to spend resources on rechecking the flow, ensuring the expected outcome. Also, clients integrating the SDK need to know the entire verification flow and possible returned results with various UI states to supplement internal documented testing processes. All these actions would bring additional costs to mobile app maintenance. That’s why we firmly believe that breaking changes is the only option if there are strict compliance changes; otherwise, every upgrade should be optional and only suggested as the preferred one. Paradoxically following this mindset, the SDKs are updated more frequently since the track history of zero new crashes provides trust and confidence in the service.

Identity verification mobile SDK needs a great customer experience

No matter how functional and error-free software development kits are, unless they provide a great user experience, they are not fulfilling their core purpose, which is what we’ve talked about earlier regarding successful user onboarding. SDK developers face a variety of challenges in ensuring that.

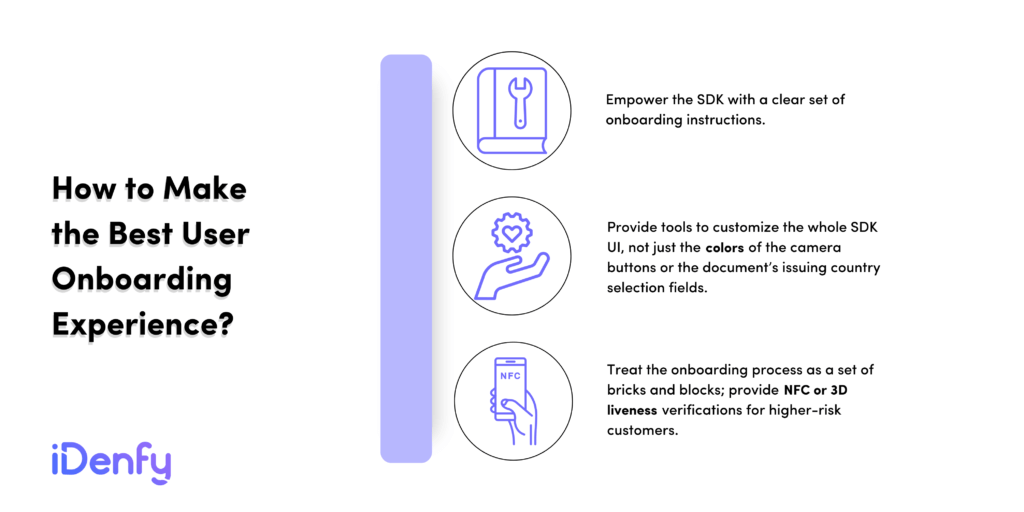

- Identity verification SDK needs to have a clear set of onboarding instructions. At iDenfy, we constantly analyze customer journeys and bring new approaches to the onboarding steps. One of those is a video of a person performing KYC documents and selfie capturing with a displayed list of most frequently made mistakes: glared or blurred document data, low light environments, etc.

- The user journey must match existing brand guidelines. The current customers of your application should feel familiar with the buttons, icons, font, and layout structure, which is rarely emphasized in mobile KYC SDKs. We understood the clients’ pain during the integration process and the requirement to have the functionality of customizing the whole UI, not just applying colors and font changes. During our experience, we saw some great implementations in our clients’ apps: completely custom documents and issuing country selection, which was already familiar to the users during the phone confirmation procedure. We also saw a custom UI for identity verification results, containing messages and graphical elements from the existing mobile application.

- SDKs must have an implemented solution to customize the onboarding process as a set of bricks and blocks. The KYC requirements are becoming nuanced since they depend on the different strictness needed to comply with anti-money laundering (AML). For instance, onboarding customers for mobile banking systems or cryptocurrency exchanges would require proof of address included in the onboarding flow. If manual supervision is not needed, it is a great idea to utilize NFC-powered identity verification with 3D face recognition technology. Knowing all that, a great mobile SDK should accomplish those goals by providing configurations during the initialization process. Another scalable option is allowing the client to customize the verification process using API, and then the mobile SDK would automatically adjust the onboarding stages depending on changes.

Mobile SDKs for KYC have indeed a set of challenges to overcome. It starts with fast SDK and API integration, followed by stable releases and crash monitoring. Don’t forget a great customer experience with the custom UI and onboarding steps. As a result, such strict requirements should empower the development of KYC SDKs to create the best onboarding experiences and increase the success rate. At least, that’s what happened to us.

Contact us and try to implement our mobile SDKs yourself. Just don’t get lost in UI customization; it is quite an addictive process!