Financial fraud is an endless spectrum in the sense that new types are constantly added to the list. From standard identity theft to complex money laundering schemes, the term “financial fraud” has caused headaches to everyone involved in the global financial system. Individuals, businesses and governments face negative consequences and major losses — all “thanks” to illicit transactions and shady schemes. Some of the consequences are inconvertible, leading to reputational damage for businesses and monetary losses for the average consumer.

In this blog post, we review the most popular types of financial fraud while adding our expert insights on tips that’ll help you avoid getting caught up in dangerous schemes.

What is Financial Fraud?

Financial fraud is a type of crime that involves illicitly gained funds, often using deceptive practices or sensitive information, like stolen identities, to illegally acquire money and manipulate financial systems. Both individuals and professional criminal organizations can be involved in financial fraud. It works by building trust and creating an illusion of a real, legitimate situation.

Financial fraud has become more popular recently, mainly due to:

- More criminals who are getting skilled in exploiting vulnerabilities in modern financial systems, as well as other spheres like human psychology, or regulatory compliance and its limitations.

- The convenience of digital finance and newly opened channels, like the fraudulent use of AI and other technologies, like buying how-to “handbooks” from pro fraudsters.

Common financial fraud examples include embezzlement, investment fraud, phishing, and identity theft.

How Big of a Problem is Financial Fraud?

While it might seem like not a new thing and a challenge that’s handled adequately, financial fraud results in millions of losses. Organizations like Europol and the US Federal Trade Commission continue to report a steady growth in online scams, identity theft, and cyber fraud. Individuals aged 70 and older typically suffer the highest financial losses due to scams, but due to the rising level of sophistication, people in their 30s report the most fraud cases.

According to recent statistics, over £620 million was lost to fraud in the first half of 2025, mostly due to payment and other similar online scams. In this sense, financial fraud continues to be a global problem that companies try to tackle, no matter which sector they operate in, as almost all firms now handle their transactions online.

Related: Top 5 Merchant Fraud Types & How to Avoid Them

Five Common Types of Financial Fraud

Some financial fraud types overlap and are connected with each other, for example, like everyone knows how identity theft/synthetic identity fraud helps criminals with various scams. The same goes for other scams that aren’t directly put into the “financial” scam tier.

For example, document forgery, which is useful in a bunch of linked scenarios, such as bypassing standard Know Your Customer (KYC) checks that require uploading a government-issued ID and then further committing financial fraud. Other fraud types can be done without realizing that it’s illegal. For example, this goes for “friendly fraud.”

Naturally, it’s important to be aware of the most common types of financial fraud:

1. Payment Fraud

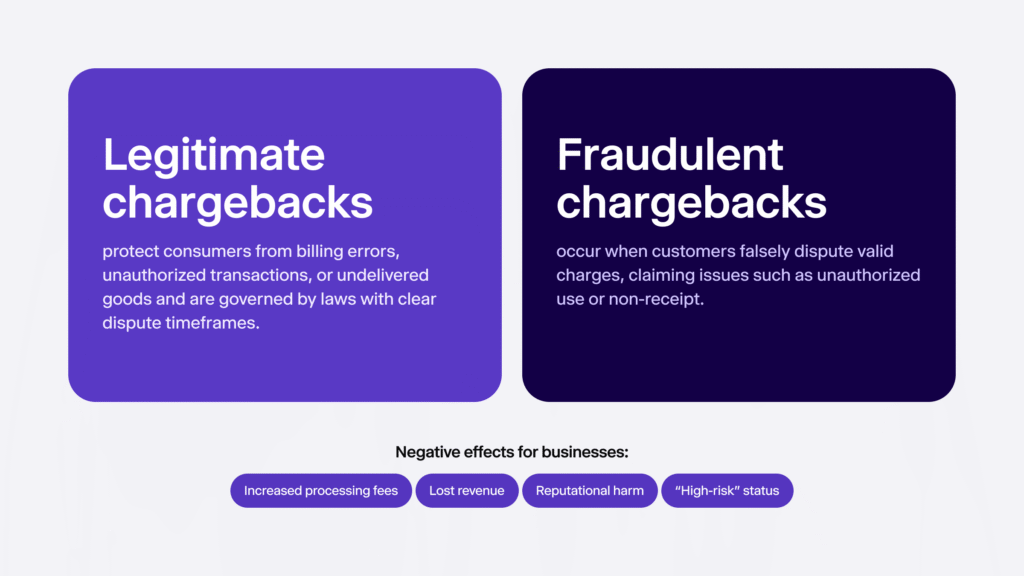

Payment fraud is a very popular form of financial crime, which is based on criminals exploiting financial systems to redirect the funds to their own accounts or use unauthorized charges for manipulation. By doing so, bad actors deceive merchants and steal funds that help them successfully abuse and weaken the payment infrastructure.

Common payment fraud examples include:

- Account takeover (ATO) fraud. Fraudsters steal existing accounts that have funds and financial information linked to them, modifying the account details and then initiating unauthorized charges on the individual’s behalf. This is done using malware and common techniques like phishing.

- Card-not-present (CNP) fraud. This is the type of financial fraud where the customer’s card isn’t physically present, aka used at checkout. Typically, fraudsters target e-commerce platforms and use stolen card details without using the real, physical card. However, CNP fraud includes all online and remote payments, such as purchases made on websites or over the phone.

For example, e-commerce and online marketplaces need to deal with chargebacks due to account takeovers, where fraudsters make unauthorized purchases using compromised accounts. To avoid disputes, merchants typically issue a refund.

Related: Top 5 Merchant Fraud Types & How to Avoid Them

2. Investment Fraud

Investment fraud is a type of financial fraud that occurs when fraudsters deceive victims by promising profit through investments that are supposedly “low risk”. For example, affinity fraud is a form of investment fraud where groups, like professional associations or religious communities, build trust and recruit new members to exploit their membership.

Other examples include tactics like a Ponzi scheme and similar methods based on pressure and pushing victims to act fast, among others. For instance:

- Promises of high returns

- Unlicensed or unregistered sellers

- Fake credibility through impersonated brands/individuals

- Used channels like dating apps, emails, meta ads, or cold calls

Victims are lured into investing in fake companies that are presented by scammers who pose as legitimate financial institutions or advisors, promising financial security and wealth. In reality, there are no guaranteed profits. Sometimes, upfront payments from victims are required to keep the scheme running until the bubble bursts.

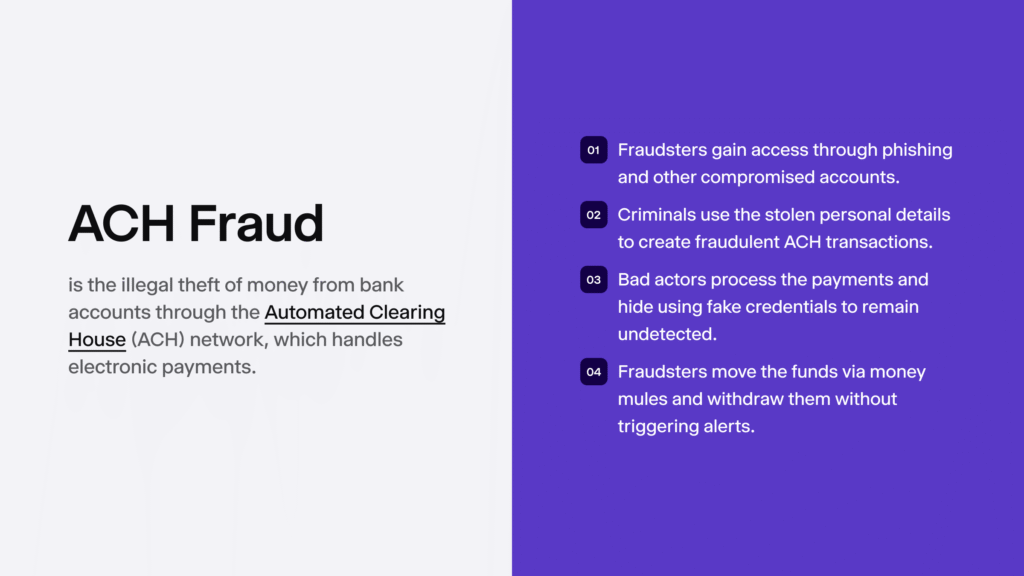

3. ACH Fraud

ACH fraud, or Automated Clearing House fraud, is based on the illicit use of the electronic ACH payment network, which is used in the US to move funds (such as direct deposits or bill payments) between bank accounts.

Fraudsters follow a standard scheme for ACH fraud to be successful, often:

- Gaining access and infiltrating into the network through phishing or malware

- Manipulating the payment details to make them look genuine

- Processing the ACH payments quickly to avoid detection

- Withdrawing the funds after moving them and, sometimes, using money mules

In the context of financial fraud, the ACH system can be abused for different scams, including payroll fraud or unauthorized withdrawals. That’s because it supports all sorts of payments, from automated bills to P2P transfers. In financial fraud, ACH scams are considered to be complex, since the execution is fast and hard to detect.

4. Loan Fraud

Loan fraud is a form of financial fraud where applicants provide false information to obtain credit they wouldn’t qualify for legitimately, or when they have no intention of repaying borrowed funds.

There are different types of loan fraud, depending on the intent:

- Straw borrowing. This means using a legitimate person’s identity and a person who has good credit to take out a loan for someone else, who wouldn’t typically qualify. Sometimes, this is done without the “straw borrower” knowing about the scheme. Other times, they earn a commission.

- Application fraud. This includes forging documents and using stolen or altered info to obtain access to loans, credits and similar services without a real intent to repay the service provider. More complex schemes can be based on other methods, like faking an entire profile of a company with its legitimately looking pay stubs and employment history.

For lenders, loan fraud can result in major losses, while victims’ credit scores get damaged, especially if extra fraudulent tactics, like synthetic identity fraud (using stolen Social Security number (SSN) data), are combined to trick the business into approving the illegitimate applicant. Ultimately, criminals steal the money and dip, leaving the lenders with the loss.

5. Cryptocurrency Fraud

Cryptocurrency fraud is a type of financial crime where criminals use deceptive practices to steal digital assets, like, for example, by using stolen data to create a non-existent identity or access someone else’s crypto wallet. Similar to how more traditional scenarios work, crypto assets can be linked to investment scams and Ponzi schemes.

Some popular crypto fraud examples include:

- Pig butchering. This can often be linked to a romance scam where the criminal builds trust before convincing their victims to invest in fake crypto platforms that appear profitable until the withdrawal attempts reveal the actual fraud.

- DeFi protocol exploits. In this scenario, bad actors can identify vulnerabilities in smart contracts governing decentralized finance platforms, draining liquidity pools or manipulating automated market makers.

More importantly, crypto fraud often results in irreversible damage, since blockchain transactions cannot be reversed. This is partially due to the less strict regulatory requirements for the crypto market.

Related: Cryptocurrency Regulations Around the World

How to Detect and Prevent Financial Fraud?

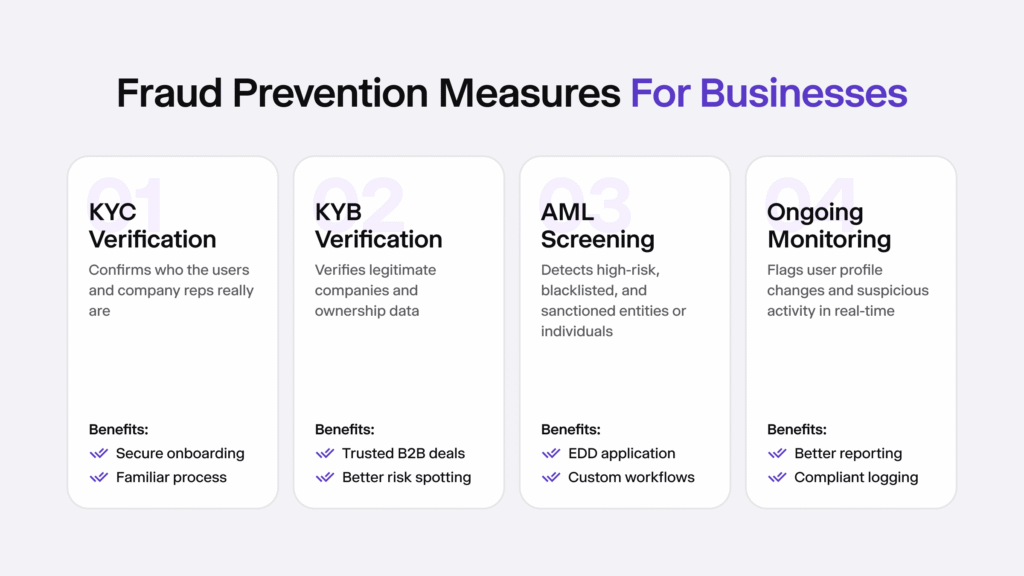

There’s no one-size-fits-all solution. Fraud prevention often starts at the account opening stage using measures like Know Your Customer (KYC) verification to prevent identity theft and all sorts of new scams, such as generative AI fraud and deepfakes (used to bypass the second IDV step, aka biometric verification).

Afterwards, since customer risk profiles change and even the “cleanest-looking” users can develop bad tendencies (like becoming money mules for money laundering), regulated entities need to use proper Anti-Money Laundering (AML) screening and monitoring tools. They help receive real-time alerts and understand why each alert was triggered properly, so that analysts can react and apply Enhanced Due Diligence (EDD) measures accordingly and report suspicious activity in a timely and compliant manner.

iDenfy automates financial fraud prevention and ensures that each business aligns with global/local AML compliance requirements, minimizing costs with automation. With our KYC & AML/KYB software, you save hours of manual work, as our platform ensures that processes like PEPs and sanctions screening, as well as PoA checks in different regions, are fully automated, reducing false positives. Different add-ons, like Bank Account Verification, are optional for KYC/KYB accounts.

Get started here, or feel free to jump into a quick demo call with our Sales team.