Regulated industries, such as banks, credit unions, real estate agencies, luxury item resellers, crypto platforms, iGaming operators, and other high-risk sectors where chances of financial crime are higher, need to implement strict anti-money laundering (AML) measures. While this doesn’t seem like a big challenge to some, many still don’t know the scope of modern money laundering. Millions of fines are placed for reputable banks and financial institutions that fail to have proper AML case management programs.

To comply with AML rules, companies need to implement measures to detect, assess, and report suspicious activity. These activities can range from unusual customer behavior to transactions originating from high-risk, corruption-prone countries. That, once again, shows the importance of bringing all your efforts to actually detect AML risks and shady individuals who use legitimate financial systems to clean dirty cash.

Below, we explain how to use a systematic approach to AML case management and why this component of an entity’s AML program is vital to better detect critical issues while preventing money laundering activities.

What is AML Case Management?

AML case management is a structured system management technique that’s designed to help companies track and improve their internal anti-money laundering compliance processes. Ultimately, AML case management helps companies track, investigate, and report suspicious activities that are potentially linked to financial crime and money laundering.

AML case management consists of processes like:

- Investigating unusual customer behavior

- Identifying high-risk customers or their transactions

- Profiling customers determining their risk level

- Managing specific use cases

- Reporting suspicious activity to relevant regulatory authorities

- Conducting ongoing monitoring

AML case management plays a key role in a company’s AML compliance program, offering a clear framework for handling specific use cases accurately and efficiently — from the initial alert or AML hit to escalation and resolution.

This helps internal compliance teams dedicate their time and resources to more complex cases while streamlining and automating more simple AML-related tasks that don’t require that much manual intervention.

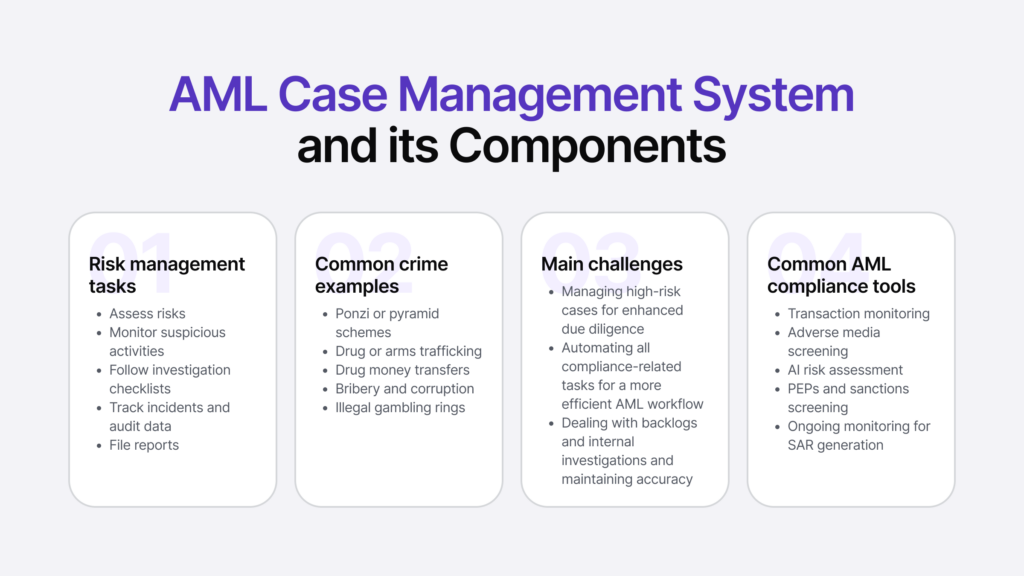

What are the Components of AML Case Management?

There are several elements that typically go into an AML case management system:

Transaction Monitoring

Transaction monitoring is an ongoing process that involves constantly screening and looking through incoming and outgoing transactions, including processed transactions, to identify potential threats, signs of fraud, and suspicious activity. By analyzing both historical and real-time customer data, this process in AML case management helps build a more accurate customer risk profile. Effective monitoring relies on accurate data collection to detect and manage threats proactively.

Transaction monitoring helps identify the risks of:

- Money laundering

- Terrorism financing

- Sanctions violations

- Other illicit activities

If suspicious activity is detected during transaction monitoring, the company needs to gather all transaction details and submit a Suspicious Activity Report (SAR) to the appropriate regulatory authority within the required timeframe.

Related: AML Fraud — Types and Detection Measures

Alert Management

Alert management in AML involves handling suspicious activity alerts, which are often provided by AI-powered fraud prevention systems that use special algorithms to detect atypical behavior and risks. Internal compliance teams use such solutions to respond to alerts in real-time, allowing them to prioritize critical cases and continuously monitor them for any changes.

However, regulated entities need to first define which types of activity within their organization are considered suspicious and should trigger an alert. For example:

- The value of each transaction

- The timeframe when the account was opened

- The location used to initiate a transaction

- The volume or frequency of the user’s transactions

- Atypical actions taken during multiple transactions

- How this sort of activity or transaction is compared to usual user behavior

By detecting these patterns, companies identify unusual behavior and improve the overall accuracy of their alert management process. However, to spot alerts accurately in AML case management, companies need to use proper AI AML solutions that are based on custom rules. This level of automation enables companies to set up custom flows and configure alert triggers, minimizing false positives that can lead to unwanted backlogs and other operational disruptions.

Related: AML Red Flags — Complete Breakdown

Case Creation and Investigation

The case creation process begins when the alert is triggered. It involves evaluating whether the trigger or red flag found by the system is legitimate. Simply put, compliance officers decide if the alert is valid and needs further action. If so, the second part of this procedure, investigation, begins. Otherwise, the alert is deemed a false positive and dismissed.

If the alert is escalated, it’s assigned to an investigator who:

- Determines its severity, risk exposure, and the reason for the alert

- Collects extra information and relevant customer details for further review

Often, existing data, such as user information gathered internally during customer due diligence (CDD), is used alongside external sources like government registries or credit bureaus to cross-check information and further assess the client’s risk. For this reason, AML investigators also review Know Your Business (KYB) data (if applicable), general payment system data (covering both domestic and cross-border transactions), PEPs and sanctions, as well as adverse media findings.

Case Documentation

Documenting the case and steps of the investigation is mandatory for AML auditing purposes. Above all that, it provides a clear record of each step leading to the final decision, enabling companies to report suspicious transactions more effectively. That’s why all key AML findings, including any recommendations, must be recorded.

With proper case documentation companies can better:

- Ensure full compliance with applicable laws and AML regulations in every jurisdiction they operate

- Establish detailed internal policies and AML controls specifically designed to prevent money laundering and terrorist financing

- Perform regular risk assessments to identify and address potential new risks

When documenting and assessing if the alert and its linked activity are truly suspicious, investigators determine the appropriate action plan. There are a few resolution options here. For example, filing a SAR if the case is found to be truly suspicious. Alternatively, enhancing ongoing monitoring for the customer might be needed. If no substantial evidence of crime is found, the case is closed.

Suspicious Activity Reporting

Reports are essential to AML case management, covering key areas of compliance and documenting the company’s efforts to gather, verify, and report data, particularly suspicious activity and its supporting evidence collected by investigators. This includes data on transactions (those flagged as suspicious) and the documentation of identified risks and the outcomes of the company’s risk evaluations.

In general, there are two types of reports in the AML case management system:

- Internal reporting. Most companies report suspicious activity internally within the 24-hour timeframe. Senior management and key stakeholders are often informed without delay. The company’s staff is encouraged to report suspicious activity internally using an Unusual Activity Report (UAR).

- SAR submission. A Suspicious Activity Report (SAR) must be filed to the appropriate regulatory authority within 30 calendar days, counting from the day the suspicious activity was flagged and evidence to support the case was found.

The company’s investigators should be constantly trained to adequately identify and report suspicious activity cases. That’s why staff vigilance and even intuition are important during direct interactions, helping identify transactions that deviate from a customer’s typical financial behavior.

Ongoing Monitoring

Ongoing monitoring involves regularly reviewing customer data and transactions to identify any new risks and new cases that might have emerged since the initial customer onboarding stage. It’s a continuous process designed to detect new AML risks and prevent financial crime throughout the entire customer relationship.

For example, a customer can be flagged for a specific risk, and the investigator may later determine that ongoing monitoring is necessary for that individual and their case. This is important due to:

- Exposure to high-risk or sanctioned jurisdictions. If a customer operates from a region different from the company’s location, the relationship warrants closer scrutiny. That’s why cross-border transactions are typically considered higher risk.

- Changes in the customer’s risk profile. This includes cases like the customer being newly identified as a Politically Exposed Person (PEP). Failing to detect changes in PEPa and sanctions statuses can expose the company to non-compliance fines.

Additionally, ongoing monitoring of the whole AML case management system and overall AML program is equally essential to ensure ongoing compliance and make sure that the current AML measures are effective for the business. This helps identify newly emerged risk factors and conduct a better, in-depth analysis of how to adapt the company’s internal controls.

How Does an AML Case Management System Work?

An AML case management system is a centralized fraud prevention and compliance process kit that is designed to align collected customer data with corresponding alerts or transactions, which are then compiled to build AML cases and individual customer risk profiles.

To streamline data collection and verification in the system, regulated entities often use AML software that:

- Automates the data collection and investigation process

- Helps document and report suspicious activity more efficiently, allowing investigators to prioritize critical AML alerts

- Ensures compliance with the AML framework in line with changing regulations by providing accurate databases, such as up-to-date PEPs and sanctions

In general, a structured AML case management system depends on two factors: responsive planning and a risk-based approach. That means compliance teams should have the capacity to manage day-to-day compliance tasks, respond to high-risk cases immediately, and, at the same time, develop new strategies to address emerging AML risks.

Implementing a risk-based approach in case management involves identifying the most time-sensitive and high-risk alerts while prioritizing them accordingly. This involves designing controls based on the potential impact each risk could have on the client and the company. For example, by monitoring transactions, investigators can identify layering in money laundering and all related clients (for example, shared beneficial owners) who are involved in the scheme.

What Features Should an AML Case Management Solution Have?

A proper AML case management solution should help streamline various AML-related tasks and help analysts save time in two major areas:

Risk Assessment & Risk Management

Identifying high-risk customers and transactions, evaluating geographic and industry-specific risks, as well as continuously updating risk profiles based on new data are all key factors in a proper risk assessment, which is required when building an effective case management system. These tasks can be challenging without automation.

That’s why heavily regulated industries, such as banking, rely on automated risk assessment solutions to automatically categorize customers as low, medium, or high risk, using custom rules and industry-specific risk factors tailored to each institution’s needs. For example, iDenfy’s client risk assessment tool allows analysts to customize risk categories and risk weights or use predefined rules from the library while receiving instant data regarding AML risks and alerts that need to be reviewed further.

PEPs and Sanctions Screening

AML compliance requires performing due diligence and implementing various screening procedures. This means all regulated entities must verify their customers and assess their risk levels using KYC verification and PEPs and sanctions screening measures, and then continuously update customer profiles to reflect the most current information:

For the KYC part, most companies use a combination of AI-powered document verification and selfie checks. In the background, customers are automatically screened against PEP lists, sanctions lists, and often adverse media. AI and ML algorithms streamline this process by running all background checks simultaneously, efficiently processing vast amounts of data with high accuracy rates. For example, iDenfy’s API solution for AML screening includes one-time PEPs and sanctions checks or daily AML screening across multiple databases for full coverage.

Final Thoughts

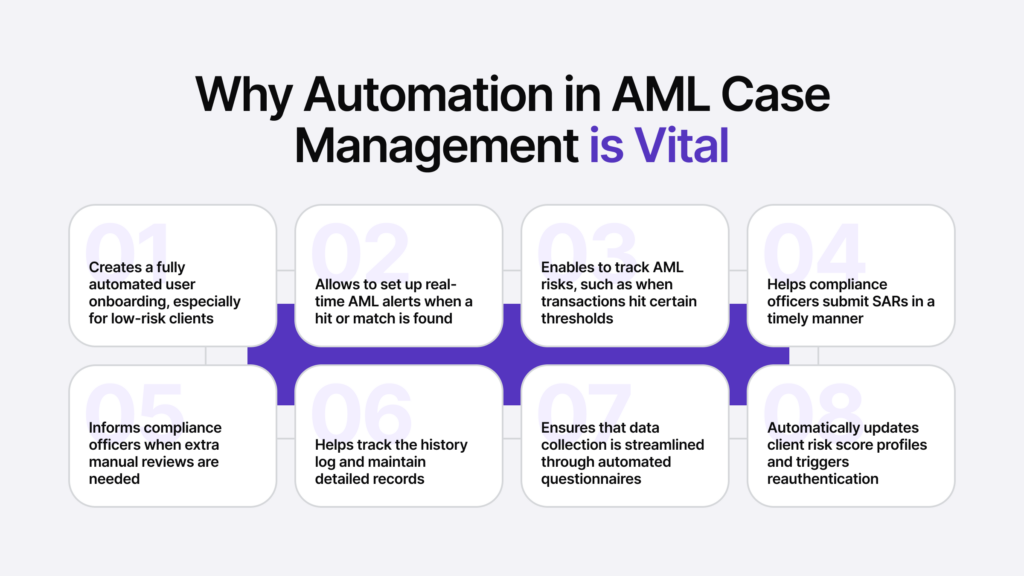

A well-structured case management system in AML compliance can’t be mentioned in a good light if no automation is used. A modern AML case management system is supported by various automation tools that help analysts access up-to-date databases and high-quality data required for screening, assessing, and verifying data. Without such an approach, it’s impossible to detect AML alerts in real-time or effectively detect suspicious transactions that need to be reported to regulatory authorities.

So, with an automated solution like iDenfy’s AML platform, compliance teams can perform KYC checks, monitor user profiles, and detect AML flags identified during screening. The platform also offers a customizable alert dashboard, enabling teams to tailor workflows, add notes to specific cases, and determine where Enhanced Due Diligence (EDD) or additional manual review is necessary. This helps assign AML case management tasks internally and generate reports, which provide a full review of a certain customer’s profile if needed. This applies both to individual customers and corporate clients (required for KYB checks).

Get started and get a free dashboard tour right away.