Credit unions offer services like loans, mortgages, savings and similar services. Banks operate for profit, but credit unions focus more on serving their customers, opening doors to those previously denied loans by other financial institutions. As a result, banks offer higher savings rates compared to credit unions. But where does this leave the ultimate factor — compliance? Naturally, like any financial company, a credit union is also exposed to many risks because it handles a large movement of funds.

Despite that, previously, credit unions were exempt from certain Bank Secrecy Act (BSA) requirements. With the implementation of FinCEN’s Final Rule, credit unions are now required to comply with the regulatory framework, which also mandates having an Anti-Money Laundering (AML) compliance program. While this all seems like a straightforward path to ensuring that credit unions’ operations run smoothly, building proper AML processes and ensuring they are effectively managed can be challenging.

In this blog post, we’ll explore the primary crime risks that credit unions face and look through different AML measures that can help identify key red flags while ensuring compliance.

What are the Basics of an AML Compliance Program?

One of the key challenges that credit unions face is the need to keep up with industry rules that are consistently changing. This requires monitoring and setting clear policies, then polishing them and updating them to fill any potential regulatory gaps. However, there are standards that help companies build their internal processes, and one of them is the AML compliance program.

It includes the essential steps and guidelines that companies must follow to remain compliant, prepare for audits, and know how to report suspicious activity, among other steps, such as:

- Appointing a compliance officer.

- Implementing internal AML controls.

- Training staff so that they could be aware of the latest laws.

- Establishing compliance-related processes and keeping all policies up-to-date.

- Defining reporting responsibilities within the company.

- Conducting independent testing and auditing to see if the program is effective.

- Providing a step-by-step guide for reporting fraudulent and suspicious activities to the authorities.

All of these measures help identify inconsistencies in user behavior, report them and reduce the likelihood of financial crime. However, other factors, like following a risk-based approach to AML, are also important in this context because they help organizations build a proper risk assessment strategy based on risk factors that are applicable to their industry (for example, the business itself, its location, executive hierarchy and so on).

Related: What is an AML Compliance Program?

Effective Risk Management Questions for Credit Unions

Unfortunately, like with many AML processes, there’s no one-size-fits-all solution, but there are certain guidelines that can help you meet your compliance obligations.

For example, think if you can answer these questions about your business:

- What kind of services do you offer?

- How do you provide these services to your clients?

- Who are your customers, and do you have a proper customer due diligence (CDD) process?

- What is the jurisdiction in which you operate, and do you work on a global scale?

Having a proper AML program means being able to identify, manage, and mitigate potential risks in your credit union. This involves setting up different processes, like verifying your clients and partners through Know Your Customer (KYC) and Know Your Business (KYB) measures or screening all related parties against Politically Exposed Persons (PEPs) and sanctions lists.

Related: What is an AML Risk Assessment?

What Should a Practical AML Program for Credit Unions Have?

In practice, your AML program should help you:

- Implement the right AML tools to manage and update compliance-related processes.

- Assess the risks associated with all parties your credit union has a business relationship with.

- Hire and train the staff who are skilled and know how to detect suspicious activities related to money laundering.

- Identify all sorts of crimes, including illegal acts like terrorism financing, corruption, tax evasion, or fraud.

- Create clear guidelines on how to report these criminal or suspicious activities and report them to appropriate authorities.

- Ensure that everyone in the company knows how to comply with AML regulations.

In other words, credit unions can effectively address risks within their organization by implementing a proper AML program and understanding its role in managing these risks. Clear guidelines and thorough risk analyses provide the information needed for effective risk management. Without a detailed, step-by-step strategy, any organization risks of leaving fraud unnoticed. With advanced technologies like AI in document forgery or skilled fraud rings that launder money for a living, AML measures are more important than ever.

Which Regulators Offer Guidance for Credit Unions?

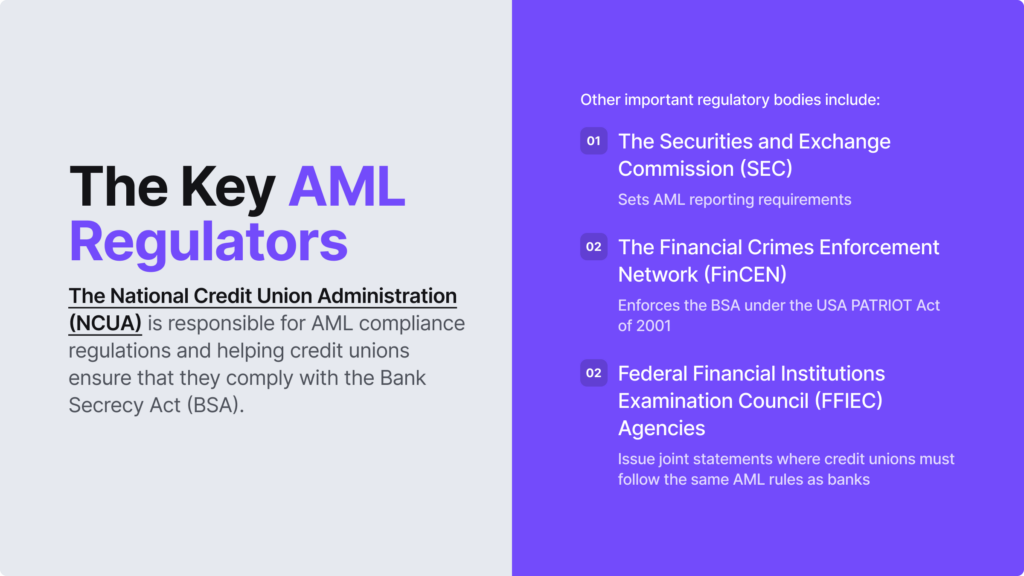

The main government-backed organization responsible for overseeing the regulatory landscape for credit unions in the US is the National Credit Union Administration (NCUA). It also plays a crucial role in helping credit unions comply with the BSA, which is one of the key regulations for AML. However, there are other important agencies that issue guidelines on this matter. For example, the Financial Crimes Enforcement Network (FinCEN) also enforces compliance with the BSA under the USA PATRIOT Act. In the meantime, the Securities and Exchange Commission (SEC) regulates AML reporting requirements, which are also approved by NCUA.

For example, the NCUA states that the same regulations that are approved by FinCEN for banks also apply to credit unions. This means that the line between a traditional bank and a credit union has become very fine, and more regulations have been introduced over the years. Another example is the Anti-Money Laundering Act of 2020 (AMLA), which also requires credit unions to follow FinCEN’s AML compliance recommendations.

Three Key AML Requirements for Credit Unions

Apart from risk assessment, which includes documenting changes in customer profiles and updating due diligence data to provide more accurate insights for risk management, there are other AML processes that credit unions should pay attention to.

To build a proper AML compliance program, you should implement:

1. Customer Due Diligence (CDD)

The standard CDD program consists of these measures:

- Identity verification. Before establishing a relationship, credit unions need to verify the customer’s identity and business activities by collecting and confirming their personal information. Credit unions must also review documentation and background information to verify that a customer isn’t sanctioned and doesn’t pose any risks.

- Risk classification. Once verified, credit unions should assess and classify the customer’s risk level. They also need to securely store this information for easy access during audits. Since risks can add up, institutions need to screen customers consistently, including their transactions, changes in personal data, and other risk factors that might alter their risk profile.

- Due diligence level selection. Based on the customer’s personal information and financial background, credit unions should determine the appropriate due diligence level (simplified, standard, or enhanced due diligence (EDD)). For example, when ensuring ongoing due diligence, with EDD, the customer would be reviewed for unusual transactions, which are typically designed to bypass AML thresholds.

In general, EDD is a more stringent approach to due diligence and is required for high-risk customers. For example, all PEPs are high-risk because they are more likely to get involved in a money laundering or corruption case due to their status and power. This means that during the onboarding stage, the client with a PEP status should be investigated more closely, diving into their background and network.

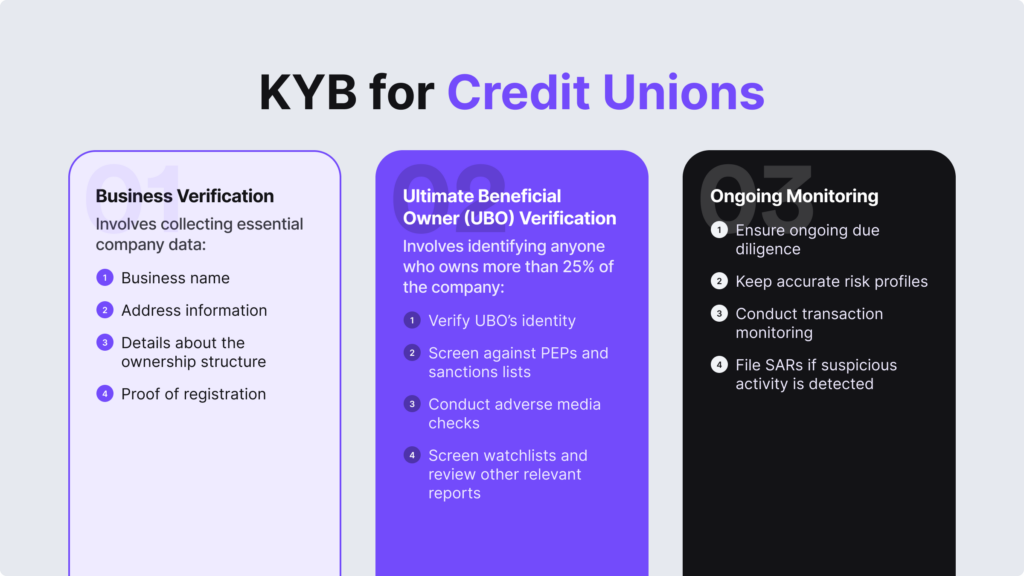

Identity Verification for Other Businesses

Due diligence means that identity verification is required for both individual customers and corporate clients (other companies, partners, or third parties that the credit union works with). For companies, this process is called Know Your Business (KYB) verification. KYB helps determine if a company is legitimate and free from criminal activity, such as money laundering.

As part of KYB compliance, institutions need to verify ultimate beneficial owners (UBOs), along with its shareholders, directors, and other stakeholders who could potentially be involved in corruption, sanctions evasion, or other crimes. This step also involves assessing UBOs’ share percentage while determining if they have indirect control over the company to establish their status as UBOs.

Related: The Risks of Shell Companies in Money Laundering

2. Ongoing Monitoring

Ongoing monitoring, also known as continuous monitoring, is a critical component of a credit union’s AML compliance program. It involves regularly reviewing and verifying customer information to maintain compliance with regulatory requirements.

According to the FATF Recommendations, ongoing monitoring is the continuous examination of transactions and customer behavior throughout the entire business relationship. This is a very important step because it helps detect risk after the user onboarding process, meaning that it extends beyond the first interaction with the entity.

This process includes periodically reviewing key information, such as collecting and verifying customers’ transaction histories and other relevant measures, including transaction monitoring, collaboration with law enforcement, adverse media screening, watchlist screening, as well as the mentioned PEPs and sanctions checks. All these measures should work together, aligning with the credit union’s risk management strategy.

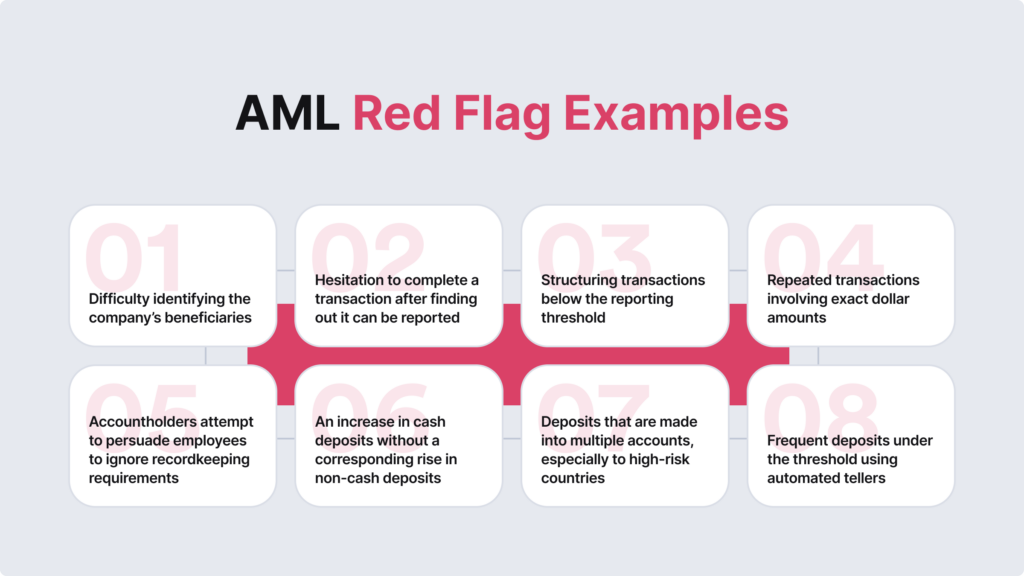

AML Red Flags that Credit Unions Should Pay Attention to

According to the FATF, these are the main indicators of potential money laundering and other financial crimes:

- Suspicious assets

- Cross-border transactions

- Use of foreign currency

- Changes in customer behavior

- Suspicious cash transactions

- Unusual payment methods

- Inconsistent payments

- High-risk counterparties

- Rapid movement of funds

- Operations involving multiple products

- Suspicious transaction details

- Transactions involving unusual amounts

For example, specific transaction types, like cross-border or correspondent banking transactions, are considered high-risk. During transaction monitoring, credit unions should implement stricter monitoring rules for high-risk customers, including clients from high-risk countries and entities such as gambling establishments and non-profit organizations, which are more vulnerable to money laundering.

If the credit union is using AML software and a potential flag is found, compliance officers should investigate the case manually, confirming if the match is actually true or just a false positive. Keep in mind that you should always adhere to reporting laws.

Related: AML Red Flags — Complete Breakdown

3. Reporting

Regulatory bodies require credit unions to report suspicious activity, including transactions under a specific threshold (if the company suspects a transaction of $5,000 or more when it involves illicit activity). Other signs of potential misconduct, such as structuring or smurfing (when transactions are split into smaller ones on purpose), should also be reported.

Reporting means that the company should submit a Suspicious Activity Report (SAR) differ. It differs by country and business type. For instance, the US requires SAR filings in the following situations:

- If the institution detects possible money laundering or violations of the BSA.

- If the institution suspects an employee of insider activities.

- If there are other indicators, such as customers running unlicensed credit unions.

Most SARs come from the financial sector, but they can also be submitted by law enforcement, lawyers, accountants, state officials, business owners, and public members who simply suspect or have knowledge of money laundering.

Challenges You Can Expect to Face as a Credit Union

Some common limitations that credit unions tend to face in their operations include:

- Too many manual operations. Some smaller credit unions have tight budgets and don’t have access to the advanced tools utilized by larger banks. This makes it hard to keep up with regulations and auditors.

- Lack of expertise or staff members. Limited resources also negatively impact the level of training or the number of employees in the compliance department. However, this doesn’t mean that credit unions can lay low. They have the same obligations and need to implement practical AML processes aligning with their risk assessment strategies.

- Poor or late risk mitigation. Credit unions must proactively take corrective action when problems or issues arise. With fewer financial resources, credit unions need to take immediate action when an issue occurs, but since they’re often less equipped than banks, ever-changing compliance requirements are harder to manage.

- Misalignment with overall business strategy. Credit unions sometimes overlook the importance of compliance management in their business strategy. They don’t recognize the priority of optimizing AML compliance processes and try to apply the same approach across different departments, which doesn’t work because certain nuances need to be customized to each case.

Even though some credit unions are smaller than most banks, that doesn’t mean that they don’t face the same challenges or risks linked to fraud. This also means that credit unions must thoughtfully allocate their budget to the appropriate AML tools and risk management systems. Smaller organizations often cannot implement numerous automation solutions, so they typically choose a single AML software to automate their compliance processes instead of partnering with multiple vendors.

iDenfy is one of the few RegTech solution providers in the market right now that offers a complete suite for AML compliance, including multiple extra solutions for KYC and KYB compliance. We can help you automate AML screening & monitoring processes, including PEPs & sanctions checks, adverse media screening, watchlist screening, risk assessment (for KYC & KYB), KYB data scross-matching, database verification (eIDV), bank verification, and more.

Let’s chat to discuss your unique case.