March 31, 2025

What is KYC

KYC – a solution that keeps all of the digital world together, verifying users’ identities, preventing financial crimes, and ensuring regulatory compliance, all the way from banks to fintech companies, KYC keeps compliance in place by assessing risk levels and monitoring unusual activities.

March 28, 2025

Case Study: Liquid Noble

Find out how Liquid Noble adjusted its KYC flow and automated AML screening in a highly regulated environment, reducing noise in the account creation process and cutting ID verification time in half.

Best KYB (Know Your Business) Software Providers of 2026

Explore the latest review of best KYB (Know Your Business) software providers and recommendations on where each of the service excels the best.

How to Find Out Who Owns a Business [Guide]

Look through the main government databases and other online methods leading you to accurate sources to break down a company’s ownership structure and find out who really owns it.

March 14, 2025

Top 10 AML Software Solutions for Banks

Nobody is secured from money laundering, until, of course, you implement the right solutions. Sometimes it could be hard to choose one, well this list will help you to choose the best one.

March 13, 2025

5 Online Casino Scams You Need to Know in 2025

Access this online casino and iGaming guide to learn about the most popular casino scams and find out what kind of concrete measures help gambling platforms stop scammers who use bots, multiple accounts, stolen credit card details, or forged documents, and more.

March 12, 2025

Best KYC Software Providers of 2026

Explore the latest coverage of best KYC software providers and recommendations on where each of the service excels the best.

Best AML Software Providers of 2026

Explore the latest coverage of best AML software providers and their PEPs, sanctions and adverse media capabilities.

March 10, 2025

How to Choose The Best KYC SaaS Platform for 2026

KYC SaaS in 2025 is not an optional choice – it is a necessary one. If you want your company to be safe, consider choosing one, but how to choose the right one, when there are already so many existing with various features? Let’s take a look at that.

March 10, 2025

Case Study: Proxyrack

Find out how Proxyrack automated the whole identity verification process and, instead of relying on its team to handle re-verification attempts manually, used iDenfy’s software to improve verification times, even during volume spikes.

Know Your Business (KYB) Service: Ultimate Compliance Guide

Verifying the legal status of a company, identifying its beneficial owners, and monitoring risks to ensure ongoing compliance are all important stages of Know Your Business verification. But this process remains a mystery to some organizations, often resulting in many challenges.

How to Check if a Company is Legitimate [10 Steps]

Especially in business, signing a contract without doing detailed research can result in becoming a money laundering channel. That’s why in today’s complex digital environment, it’s essential to take your time to research every single company that you’re interested in doing business with.

March 3, 2025

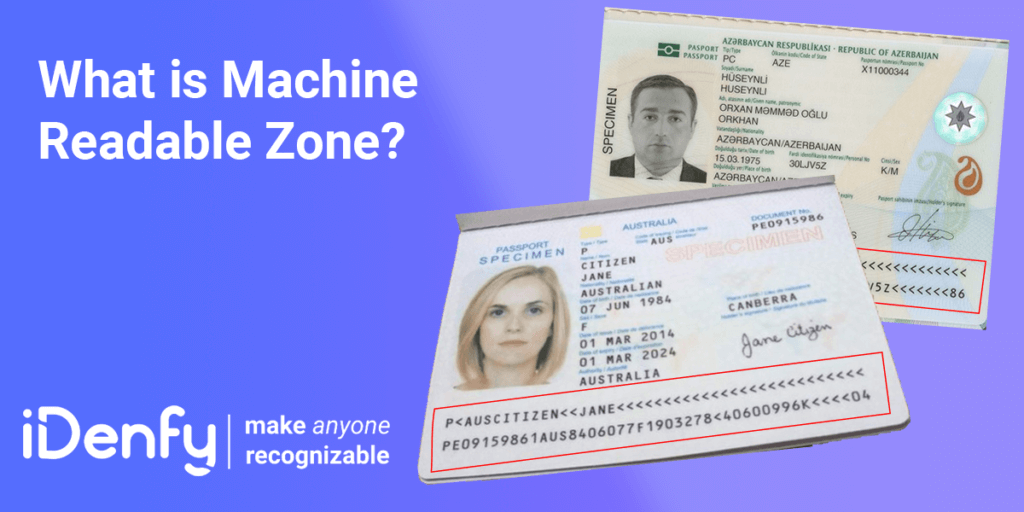

Machine Readable Zone

Wondering what is a machine-readable zone (MRZ)? Do you want to know its role in identity verification? If the answer to these questions is “yes.” Read this blog until the end.