Shell companies, also known as ghost companies, have a notorious label attached to them. That’s because they’re often used for illicit purposes, especially for money laundering schemes. They have the “shell” part in their name because they are hollow or empty—since they don’t have any active business operations.

Such enterprises without real operations, also known as shell companies, can be set up either in the US or in other countries. For example, even though all states have laws regulating the establishment of limited liability companies, most of them do not mandate the disclosure of ownership information to state governments during their formation or afterwards. Establishing such companies abroad is also a common choice for people who want to avoid paying taxes.

So, just like any tool, such ghost companies can be used for money laundering when in the hands of those with malicious intentions. In this blog post, we’ll dive deeper into the specifics and learn how shell companies help get away with such crimes.

The Definition of a Shell Company

A shell company is a type of business often formed to safeguard or conceal the assets of another company. A shell company can be created both for legitimate and illegal reasons. Such businesses usually don’t have a real office, don’t hire employees, and don’t generate much income on their own.

Shell companies are described as those who exist only on paper because they:

- Lack physical locations.

- Don’t have any employees.

- Do not generate steady income.

- Occasionally hold bank accounts or investments.

- Often are entirely inactive.

Shell Company Examples

The Panama Papers leak in 2016 is a perfect example of the modern history of shell company money laundering. It showed how such enterprises can be used globally for large-scale money laundering. Because of the leak, tax authorities got about $500 million and started cases against people and businesses involved. This scandal revealed that shell companies were set up in places with weak rules, like the British Virgin Islands. And on top of that, many parties that were involved were connected to powerful families and politicians.

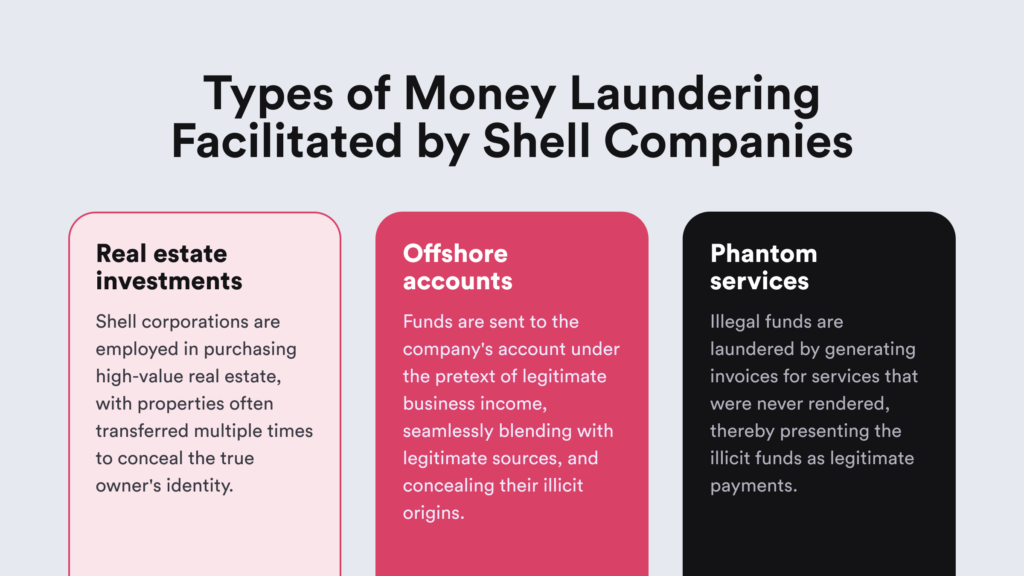

Generally, there are a few typical examples of shell companies commonly used for money laundering, such as:

- Real estate investments. Shell companies buy expensive properties. Criminals change who owns these properties several times on purpose to hide the real owner. If caught, authorities can seize properties bought illegally, causing financial losses.

- Offshore accounts. A shell company is created in a tax haven. Money is put into the company’s account to make it seem like legitimate business earnings. In general, offshore refers to business activities conducted outside an entity’s home country. This term describes foreign banks, investments, deposits, and corporations.

- Phantom services. A shell company sends invoices for services that were never actually done, making illegal money look like payment for real services. Phantom companies or trusts are common channels that international criminals and corrupt businesses use to hide money and cheat governments.

While shell companies can be registered anywhere in the world, some jurisdictions are more attractive to money launderers. That’s because of their strong privacy laws, relaxed regulations, and low corporate taxes. Surprisingly, countries like Switzerland, known for their financial stability and strong economies, are also the go-to option for such enterprises.

Related: Smurfing in Money Laundering Explained

Are Shell Companies Legal?

Yes, even if some shell companies aren’t doing any real business, they can be legal. For example, a person can create their own company to own a property’s title. In this scenario, the shell company legally owns the property, but it doesn’t do any actual business. This makes it a perfectly fine legal entity holding the property.

People also tend to choose shell companies to carry out various transactions, like moving money across borders or merging with other enterprises. Other use cases for legitimate shell companies include:

- Intellectual property protection. Shell companies can help safeguard intellectual property rights by establishing a separate legal entity to own these rights.

- Tax strategies. Although this part is highly controversial, some businesses use shell companies in tax planning to benefit from favorable tax rates in different locations.

- Asset management. People use such organizational sructure to hold and manage assets separately from their main business activities.

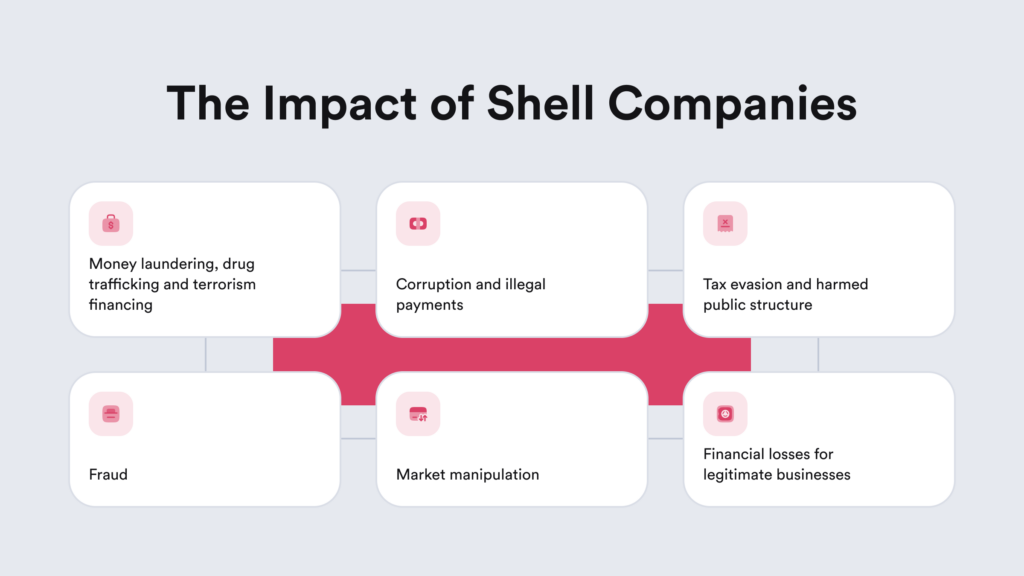

Despite that, even though there are legitimate shell companies and genuine use cases behind them, they are more often linked to fraudulent activities.

The Main Issue Regarding Shell Companies

The secrecy in creating and running shell companies can be beneficial for some legal businesses, but, according to FinCEN, it also creates a loophole for hiding ownership and intentions. That’s why these companies are the perfect instrument to stay off the radar from authorities, businesses, and the general public.

Shell companies are problematic because they make it easy to hide illegal money and avoid anti-money laundering (AML) rules and taxes. Despite that, all financial institutions governed by the Bank Secrecy Act (BSA) should examine AML measures to identify and address any risks related to money laundering effectively.

However, regulators are constantly imposing new rules to change the regulatory landscape for the better. For instance, the Anti-Money Laundering Act of 2020 (AMLA), mandates many US companies to disclose their beneficial ownership details, potentially making it more difficult for money launderers to use shell companies for money laundering activities.

Related: Financial Crime Compliance — Comprehensive Business Practices

How Do Shell Companies Launder Money?

Money laundering using a shell company involves hiding where illegal money comes from. Since they make it hard to track where money goes, shell companies can slow down economic growth and development. By using shell companies, people can avoid getting caught because the company’s actions seem legal.

Shell company money laundering depends on this type of scheme:

- Criminals set up a shell company in a place with strict privacy laws, like a tax haven. This makes it hard for investigators to follow the money back to the crime.

- The money launderers put lots of money into a shell company’s account. The amount of transactions makes it harder to trace where the money really came from.

- Criminals then move the funds to their own accounts, using fake invoices to make it look like the money came from somewhere else, making it seem clean.

Countries with loose rules, illegitimate transactions for things that don’t actually exist, and different financially confusing moves are brought to the table by money launderers, who use shell companies to make it look like they’re doing legitimate business when, in fact, they are laundering money and harming the economy in general.

Related: Structuring in Money Laundering Explained

Shell Companies in the Context of Money Laundering Stages

There are three main stages of money laundering: placement, layering, and integration. Each has its own characteristics that companies should be able to identify:

1. Placement

This is the first stage in money laundering where illegal funds enter the financial system. Criminals can use asset purchases, gambling, bank deposits, as well as other common tactics such as smurfing. It involves splitting large sums into smaller, less noticeable amounts.

Shell companies, particularly those established in areas with strict privacy laws, can open bank accounts to deposit these illegal funds. On top of that, they can use shell companies to make initial purchases of assets such as real estate or luxury goods, transforming cash and washing it into different forms.

2. Layering

This stage of money laundering is completed by creating complicated layers of financial transactions that confuse and obscure the paper trail. Criminals transfer funds between multiple accounts and various banking and financial institutions. That’s why layering makes it hard for authorities to trace the money back to its illegal source.

This strategic move adds layers of seemingly legitimate ownership, effectively concealing the true origin of the funds. When it comes to shell companies, money is moved with fake invoices for goods or services that don’t exist to make the transactions seem legitimate. Shell companies may also make loans or financial agreements with each other, adding more layers to the transactions and making it harder for investigators to follow the trail.

3. Integration

Integration is the last stage of money laundering, where illegally obtained funds mix with lawful ones, blurring the fine line between clean and illicit money. This stage marks the culmination of the laundered funds, which blend into the lawful economy through legitimate transactions. Naturally, this merging makes it hard for authorities to track the real origin or source of the funds.

Tracing integrated and laundered money is a hassle for authorities, mainly due to the following reasons:

- Complex schemes and cross-border financial transactions

- Some partial use of legitimate channels

- The use of some level of legitimate assets

- The scope and global nature of the transactions

Once again, criminals can use real estate deals, trade-based techniques, or shell companies, complicating detection and posing challenges for authorities. At this stage, shell companies can start participating in real business activities, invest in other businesses, or even sponsor events and cover their tracks.

How to Identify a Shell Company?

Shell companies pose a serious threat to the financial system. Consequently, businesses need to recognize the risks of money laundering with shell companies and watch out for clients who might try to use this anonymity of shell companies for illicit activities.

Shell companies have a few factors that are common pinpoints of suspicious activity, including:

- Complex ownership structure. One shell company can own another, and possibly even several others, creating deep ownership layers. For authorities, this makes it hard to trace back to the actual individual or entity.

- Nominee directors and shareholders. Shell companies can use such individuals or entities who lend their names for official records but have no real control or ownership in the company. This creates additional separation between the company and its actual owner.

- Zero real presence. Shell companies mostly exist on paper, which makes them difficult to examine or find. They also don’t have any or many operations, assets, and employees.

The line between legitimate privacy needs and pure fraud is thin. While the desire for privacy itself isn’t all bad, the tools to achieve it, such as shell companies, can be misused. As a result, financial institutions and regulations are always trying to find a balance. This both involves respecting legitimate needs for privacy and, at the same time, preventing the misuse of shell companies and similar structures.

Common Shell Company Red Flags

The key red flags to watch out for regarding shell companies include their secrecy and the deliberate withholding of information.

Other suspicious indicators that companies should learn to identify include:

- A business making transactions that don’t match its usual activities. This can be large volumes or odd spikes.

- Transactions involving products or services that don’t fit the businesses involved.

- Lots of large transfers between other shell companies.

- Difficulties getting details about the transaction or who benefits from it.

- Two businesses with the same address or registered agent.

- A single business transferring money to lots of different places.

- Various recipients in risky jurisdictions or offshore centers.

- Payments without clear reasons or for things that don’t make sense.

AML Measures for Combating Shell Company Money Laundering

To properly investigate and determine if the shell company has fraudulent intentions, companies should verify its beneficial ownership, conduct customer due diligence (CDD), obtain the company’s documentation, and scrutinize the company’s business structure as well as the nature of its transactions.

iDenfy can help with all that and more. Our comprehensive Business Verification platform offers all the necessary tools for your anti-money laundering program, helping detect suspicious entities, including fraudulent shell companies.

We provide CDD solutions (ID verification, document verification, address verification, etc.), transaction monitoring, sanctions screening, PEP monitoring, adverse media screening—and more fraud prevention tools—for both corporate and individual clients.