In the US, government and registry searches are a key part of the Know Your Business (KYB) process, especially for regulated entities like banks, crypto platforms, and similar financial players. To actually know the business means that before you start a business relationship, you should confirm that the other business is properly registered with the relevant government authorities. In B2B relationships and KYB compliance, this is important, as it helps to better understand the other entity: its registration status, ownership information, and other basic details, if it’s in good standing, for instance.

Business registration records are typically accessible through state Secretary of State (SOS) portals or using automated RegTech solutions like iDenfy, which streamline access to government databases and credit bureaus. These database lookups are used to assess other companies, such as potential third-party service providers, through various due diligence procedures to determine their legitimacy. This includes verifying that the company exists, is legally registered in all operating jurisdictions, complies with state and federal laws, and demonstrates reliability after internal risk assessment based on factors like financial stability and a solid reputation. And for that, the first step is to conduct a business registration lookup.

In this blog post, we’ll talk about how to look up a business and its registration details and what sort of information you can collect to conduct a compliant KYB verification process on your corporate clients.

What is a Business Registration Lookup?

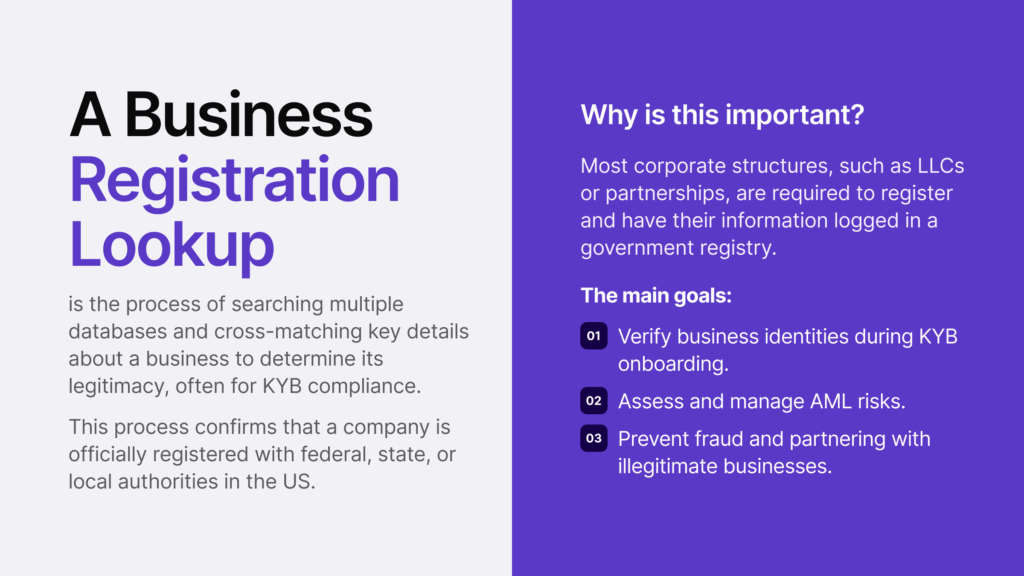

A business registration lookup is the process of verifying key information about another business in order to determine whether it’s registered properly or not, often due to regulatory compliance obligations or as a way to determine its legitimacy. This process is based on official documentation and records from regulatory authorities that keep track of corporate entities via special lookup services or government databases that show if a company is legally registered with federal, state, or local authorities.

Typically, this involves using data from official sources and registry search tools that collect details about a business, for example, its:

- Legal name

- Registration number

- Incorporation date

- Business status (if it’s active/inactive or dissolved)

- Registered business address

While there are different business structures, most companies, for example, limited liability corporations (LLCs), partnerships, or non-profit organizations, are required to register legally with their state or at least one level of government. This makes this lookup process a valuable tool to assess all sorts of businesses, especially when conducting due diligence or accessing regulatory filings.

Related: How to Check If a Company is Legally Registered

What is the Goal of the Business Registration Lookup Process?

From a business perspective, registration means that you can access several benefits. For example, depending on your business type, by registering an entity, you often gain access to tax deductions regarding business expenses, you can protect the owners from personal liability, establish brand visibility, and so on.

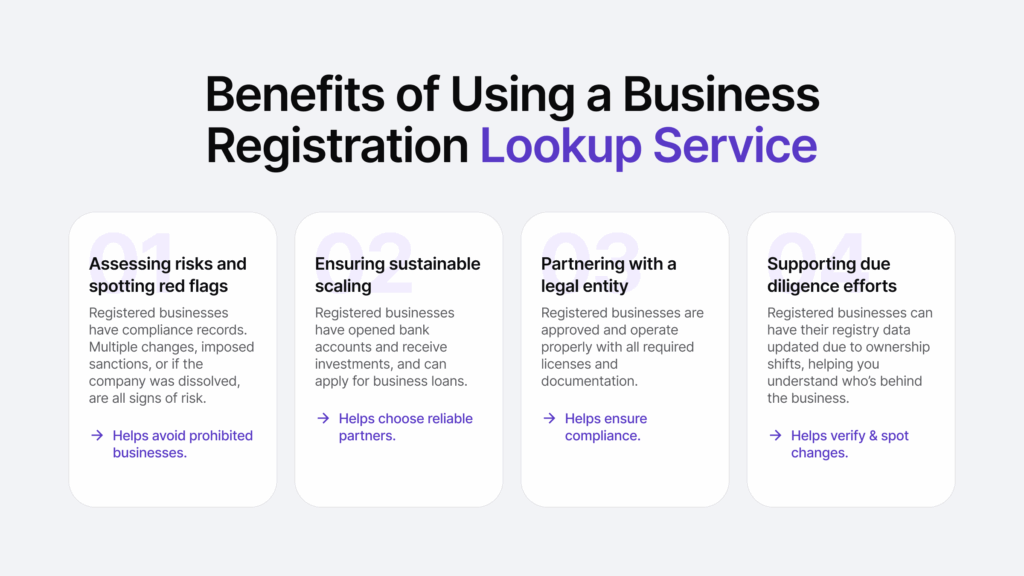

For other businesses from a due diligence standpoint, doing the lookup means that you review whether you’re dealing with a legal, compliant, and reputable business and find out more about its true ownership structure, especially if additional verification measures, such as UBO verification or EIN verification, are required for a KYB verification check.

Ultimately, the main objective of a business registration lookup is to:

- Prevent fraud. During this assessment, businesses can detect fake entities or fraudulent organizations used for financial crime, including other companies that might not fit their risk appetite, such as high-risk or prohibited businesses.

- Ensure KYB compliance. Looking up a business helps verify that the company is legally registered by cross-checking various data points for KYB verification, such as government registries, credit bureau records, and general onboarding information, along with details about shareholders and linked individuals.

- Maintain trust. This helps reduce chances of reputational damage, adverse media, lost interest of customers or potential investors, and promotes a more transparent overall business environment, which is vital for sustainable growth in the B2B field.

Related: How to Check if a Company is Legitimate [10 Steps]

Common Industry Use Cases for a Business Registration Lookup

Looking up various data points and forming a business profile, which is designed to assess risks linked to that particular company, is vital for high-risk, regulated entities, but also all companies that want to do a proper background check before starting a new B2B relationship.

Some industries that often use the business registration lookup process include:

Banks

For US banks, it’s required to be registered with the Secretary of State (SOS) to be able to open a commercial business bank account and access other benefits. At the same time, banks need to comply with strict requirements, such as the Customer Identification Program (CIP), which makes it essential to do business registration lookups on other corporate entities as part of the verification process.

Related: KYC in Banking Explained

Payment Service Providers (PSPs)

Customers, merchants, and other third-party service providers need to be carefully reviewed by the PSP to ensure that the company isn’t facilitating fraudulent transactions and dealing with illegally operating businesses. This is vital, as PSPs often deal with a high volume of merchants that need to be verified and onboarded before they are accepted to be allowed to process payments.

Lending Institutions

Lenders need to ensure that they finance businesses that are legally registered. Additionally, they are required to assess their financial health by conducting processes like bank verification to ensure they are approving a loan that’s low-risk. This is also a vital step for identifying AML red flags that indicate higher risk, such as the entity’s recent incorporation or inactive status.

So, in this sense, a business registration lookup works like a confirmation of the other company’s legal existence through verifying details like its registration status and other key identifiers. The underwriting process is also simpler when the registration data is pulled from various corporate databases, as it helps to make better decisions and determine appropriate loan terms.

3 Key Methods to Do a Business Registration Lookup

There are several ways to verify a business and do a proper business registration lookup that helps identify fraudulent, non-existent companies, as well as assess the key points that a proper, registered business should have. However, different business structures have different requirements or documents that they must file when registering.

So, while it’s best to combine and cross-check at least a few government databases for your corporate clients, we list the most effective methods for a lookup below:

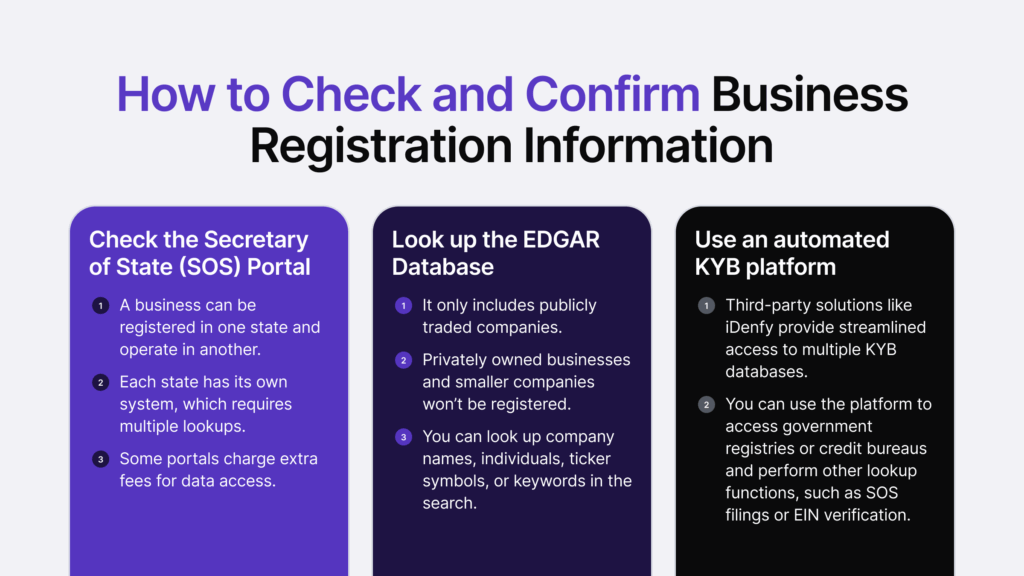

1. The SEC’s EDGAR Database

The Securities and Exchange Commission (SEC) has a special database, also known as the Electronic Data Gathering, Analysis, and Retrieval system, or simply EDGAR. The EDGAR Company Database is designed for businesses that are legally required to register and submit their information to the SEC.

Key challenges:

➡️ Publicly traded companies have their data listed on EDGAR. You won’t find data on smaller firms or local contractors, or privately held companies.

➡️ The EDGAR system has its records dating back to 2001. Older records don’t exist.

Filings include details like registration statements, ownership details, including other data, such as annual reports. The system allows users to search for specific company information using various criteria. For example, you can do a business registration lookup and search the company by certain keywords, like associated individuals’ names or the Central Index Key (CIK) number.

2. The Secretary of State (SOS) Office

State registration numbers and other important details about a business can be found when looking through the Secretary of State (SOS) office, since most businesses are regulated at the state level. In the US, there are special SOS portals that are used to search for company records, such as its tax reporting and other activities within the state.

Key challenges:

➡️ Companies operate in multiple states or are incorporated in a different state than where they actually operate.

➡️ There’s a lack of unity among the SOS lookup portals. Some have access fees, different search filters, and overall user experience, or even search results.

Sometimes, it takes a lot of time and effort to look up less obvious states and multiple SOS portals to collect all information regarding the company’s registration. To prevent this issue and streamline access to all SOS portals, third-party RegTech solutions like iDenfy offer SOS API and KYB solutions that have built-in access to company registries, SOS offices, credit bureaus, and other info that is required when assessing corporate entities.

This means you can look up each state’s SOS portal and return relevant results about a certain company without hassle. Any inconsistencies or missing company information are flagged by the automated system or compared with another database if needed, depending on your enabled workflow on the KYB dashboard.

3. An Automated System for Business Registration Lookup

A simple way to bypass restrictions and save time without manually looking up business data that might be inaccurate or outdated, or restricted with extra costs for certain databases, is to implement a third-party system that automates the process of business registration lookup (with details like EIN/TIN verification, SOS filings, built-in risk-scoring, business address verification, criminal background check, and more).

Dedicated solutions like iDenfy’s KYB platform extract data from multiple sources on the same dashboard, such as authoritative agencies, all at once. This makes it possible to scale and automate KYB onboarding, especially if you’re dealing with multiple corporate clients per day from various states or regions that require thorough due diligence.

With iDenfy’s Business Verification API, you can:

- Access up-to-date business registration data from legitimate, official sources, such as SOS filings and other documents that you can request from your client directly using automated workflows and features like the KYB Questionnaire.

- Look through multiple states at the same time by pulling up data on a certain person or company using keywords that connect all supported databases, and then download unique PDFs based on your selected filters and enabled onboarding workflows.

- Scale and improve efficiency in KYB onboarding, or simply for verifying business information on a client or partner as an internal risk assessment measure. This simplifies work for internal analysts who need to manage information and request documents.

Such software is also an efficient solution for downloading and generating audit-ready KYB/AML reports with data compiled and pulled from various registries or criminal watchlists, specifically designed for Enhanced Due Diligence (EDD) and a deeper look into a company’s background and ownership structure, including verifying UBOs, detecting PEP statuses, screening sanctions, and more. This helps improve risk management and detect risks before you start working with a certain company. For B2B relationships, this step can’t be missed.

Final Thoughts

For a proper business registration lookup, you need to access reliable information from official sources, like government databases. Otherwise, especially if you’re operating in a regulated industry like the mentioned use case examples, you risk missing important details and red flags that often make or break the decision on partnering with another company. Additionally, doing your due diligence simply isn’t possible without looking up basic details, and this process starts with checking the business’s registration details and whether it’s operating legally in your state, including all locations where your business provides services.

There’s a popular misconception that money laundering or facilitating illegal transactions isn’t that common, but year by year, big financial players and other businesses, such as e-commerce service providers, are hit with fines for non-compliance, such as not doing enough for EDD or high-risk clients, so not only onboarding, but the overall relationship with the business is important. That means automation is the only scalable solution for both verifying and monitoring the business later after its onboarding, as risk profiles change due to factors like sanctions changes, ownership changes in the business, or simple details like the business being dissolved also make a huge impact.

Book a free demo to see how iDenfy can automate KYB checks and access to various databases required for a detailed business registration lookup.