Despite that, the ultimate question remains ‘How?’, as the number of millions for non-compliance fines remains alarmingly steady, once again proving that the crimes affecting the financial sector and the Business-to-Business (B2B) relationships aren’t going away any time soon.

Through both KYB and KYC processes, companies can get an in-depth look into their customers and comprehend the nature of their financial activities. That’s why KYB plays a crucial role in upholding the financial system’s integrity by minimizing risks linked to money laundering or terrorist financing.

We discuss the differences between each compliance measure, explaining where you can utilize KYB and KYC checks in your industry.

KYB and KYC: The Basics About Each Process

Due to the huge amounts of money flowing around and the widespread issue of illicit activities, implementing Know Your Business (KYB) procedures isn’t a choice anymore – it becomes an obligation.

Companies need to monitor their financial transactions and screen the customers to prevent money laundering and terrorist financing; otherwise, businesses risk losing money along with their reputation. While KYB shares the same goal with Know Your Customer (KYC), to follow Anti-money Laundering (AML) regulations and protect financial interactions, there are some distinctive factors.

In brief:

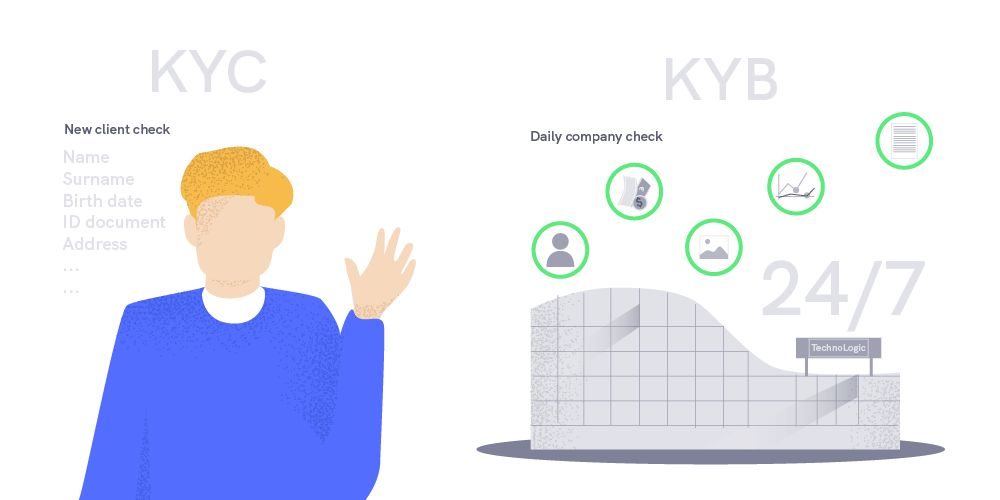

- KYB helps businesses verify the legitimacy of an entity, distinguishing between genuine organizations and those potentially established as fronts for illicit activities, such as shell companies.

- KYC is a process that verifies a customer’s identity and monitors their financial behavior. It is initiated during the onboarding of a new customer and persists throughout the ongoing business relationship.

- Both KYC and KYB are integral components of a company’s customer due diligence (CDD) process. The extent of ongoing monitoring in the business relationship is determined by the risk level identified during these checks.

Related: What is the Difference Between KYC and CDD?

What is the Main Difference Between KYB and KYC?

KYB and KYC both help companies meet compliance requirements, but the target is different. While KYC concentrates on an individual, KYB analyzes the whole organization’s identity. In other words, KYC gathers data about individuals, and KYB involves the collection and verification of information about a company.

The companies’ backgrounds and financial transactions can be monitored daily in extended CDD processes. They include KYB measures that are designed to ensure security. For example, real-time ongoing monitoring identifies risks and informs if they change. Such information is pulled from AML databases, International Sanctions, or Worldwide Politically Exposed Persons (PEPs) lists.

Why is KYB Important?

KYB is vital when forming a B2B relationship with another company in the supply chain. Like KYC, where the new clients are verified, KYB helps understand what’s behind a business and its structure.

It’s very important, as there are many risks associated with financial crime, and nobody wants to onboard a company that turns out to be involved in money laundering. For example, businesses that work with freelancers need to establish KYB procedures to identify legal representatives and verify their connection with the client company.

Why is KYC Important?

Similarly, the KYC process is essential in mitigating the risk associated with onboarding customers engaged in money laundering, fraud, or illicit activities such as financing terrorism. This becomes particularly crucial when onboarding politically exposed persons, such as those in public office, who can be susceptible to corruption or bribery.

At the very least, conducting KYC checks during the customer onboarding process is essential. However, it is considered best practice to periodically revisit and reevaluate these checks to ensure ongoing compliance. This monitoring of customer accounts enables the swift detection of any suspicious behavior, facilitating further investigation when necessary.

Related: How to Improve KYC Verification? Tips For a Frictionless User Experience

KYB vs KYC: How It Started Before Automation

When we talk about KYC, we usually refer to eKYC (Electronic Know Your Customer). It’s the digitized version that was created due to the demand for efficiency and productivity. Paper-like methods aren’t as effective anymore, and with the digitized process came productivity, lower costs, and zero bureaucracy.

Before the digitization of KYC and KYB, financial fraud was at its peak in proportion to the total crime. Along with organized criminal groups, professional money launderers performed their money-laundering services as their core business.

It’s hard to tell the exact number, but the estimate, according to the United Nations Office on Drugs and Crime (UNODC), is that between 2 and 5% of global GDP was being laundered annually.

Regulatory Requirements for KYB Throughout the Years

With no detailed laws or ways to combat fraud before digitization, Anti-money laundering legislation had to be improved in an effort to take action against financial crimes.

That’s why the Bank Secrecy Act of 1970 presented new AML guidelines, which were later integrated into the 2001 USA Patriot Act. A few years later, KYC and its terms were born to monitor financial progress and ensure the safety of transactions.

The improvement in regulatory requirements demonstrated to work but left some cracks in the system. Banks were not obliged to verify their partners and other businesses they worked for; therefore, it left space for the illicit activities to go undetected and for the criminals – unpunished.

One of the most famous cases that impacted the birth of KYB compliance was the Panama Papers. The documents from 2016 leaked 11.5 million financial and attorney-client details of over 214,488 offshore entities.

Fraud detection and prevention service from market leaders. Book a meeting.

Digital Revolution: What is KYB Now?

Even though the digital arena comes with benefits, such as reduced costs or eliminated bureaucracy, it comes in a package with a broader platform for scammers to perform their illegal activities. Like KYC, digital KYB solutions are now an alternative to traditional identity verification methods that help many sectors overcome challenges.

Financial institutions are pressured to develop better AML and Countering the Financing of Terrorism (CFT) initiatives. Still, the banks bump into outdated systems and lack agile solutions. This is where KYB comes into play.

Understanding the Difference Between KYB and KYC in a More Detailed Way

There are different KYC and KYB as well as AML laws among various countries, and that’s why some companies are obliged to follow stricter compliance regulations. KYB and KYC checks are both needed for new customer onboarding. The safest combination is when companies use both processes for their clients’ constant monitoring and screening.

KYB/measures are built around identity verification, but KYB involves a greater compliance burden intended to detect crime among drug traffickers, terrorist financiers, and other groups that concern law enforcement institutions like the FBI or Interpol. The main difference between KYB and KYC lies in the information needed to verify the identity:

- With a regulatory requirement of KYC, banking, the Fintech industry, and other institutions aim to identify individuals before they open an account.

- Meanwhile, KYB checks approach a wider, not-so-straightforward range of data in the existence of a whole business. In this case, businesses are obliged to review beneficial owners, the company’s annual returns or financial statements as well as the people who benefit financially from the company’s operations.

Related: Know Your Business (KYB) — Detailed Explanation and Examples

How to Ensure KYB Compliance?

If we look into the standard KYB compliance process, it’s designed for companies to verify themselves as legitimate businesses through ownership information and financial activity monitoring.

Modern KYB services have built-in, fully automated AML checks to provide in-depth data regarding the entity that is being scanned. Paper-like methods and traditional manual analysis physically can’t cover so much data at once.

As for AML Screening, the process reviews multiple databases in real-time, providing the necessary information regarding the company. This way, you can check if it’s reliable and worth partnering with.

Now that we’ve established the basics, let’s review the whole AML Compliance program that KYB offers.

AML Screening

That’s why the integrated AML Screening process during KYB ensures complete compliance and reduces the chances of fraud. The service monitors a company or an individual through multiple International Sanctions Lists, Law Enforcement Watchlists, including Sanctions, PEPs (Politically Exposed Persons), and Europol: Europe’s Most Wanted lists.

If the system finds suspicious information in any of the lists, the audit’s ‘bad’ data points get flagged. Afterward, you receive an alert regarding the risk of stopping fraudulent activity.

Ongoing Monitoring

AML Monitoring feature is similar to AML Screening. AML Monitoring proceeds with Real-time Ongoing Monitoring of the global AML Watchlists every 24 hours. This section of the KYB service is essential since fraudulent activities can occur at any stage. That’s why onboarding a client with a criminal history can do so much harm.

In case the algorithm detects something suspicious, for example, a sign that the business is possibly involved in money laundering or there’s negative news floating around that company, you should probably think twice about your relationship with that business.

Adverse Media

Adverse media screening during KYB helps find negative news or any sort of negative information about the company or the customer. This type of news scanning contains various sources with the goal of exposing an entity’s involvement in money laundering and other fraudulent activities.

How KYB Measures Complete Your Fraud Prevention Strategy

KYB is much more than a single service. With exclusive KYB’s digital solutions and the help of AI, banking operations can be improved, especially considering that the KYB procedure can be implemented in all industries with money flow. Now’s the era of cost-effective solutions that help reduce money laundering.

KYB services not only guarantee compliance but also ensure that the company and its customers’ internal information is following regulations. As an extra feature, businesses can customize their Business Verification and compliance flow based on specific needs. In addition, KYB services provide audit reports, such as balance sheets or credit reports. Usually, companies use this data for internal research.

Just take a look at iDenfy’s approach to see what features complete KYB:

✅ Internal information

The name is pretty self-explanatory. This portion of KYB contains data about the company and its internal information: the status, ID numbers, compliance details, and the company’s Adverse Media data. The goal is to check the entity’s primary data to prevent money laundering and similar illegal activities.

✅ Related Persons

This KYB section shows detailed compliance information about the company’s Representatives, Shareholders, or Ultimate Beneficial Owners (UBOs). The company has the option to screen certain customers and conduct KYC verification.

The organization can also add all of the related people to the company’s KYB registration form. This way, the system will provide data regarding the registered people showing Adverse Media and AML Monitoring results.

✅ GOV Checks

An essential part of KYB is the option to gather specific company reports. Currently, iDenfy suggests downloading two types of reports: the Government (GOV) Register report and the Credit Bureau report.

GOV Register report lets you know about the company’s historical background by providing Business Information, Financial Information, and Ownership details gathered from more than 180 Business registries and 540 million company records.

The Credit Bureau report lays out up-to-date information about the company’s Business Status, Credit Rating, Ownership details, Registration Activity, and Negative information. You can download the KYB reports in PDF format to view all the details in one place.

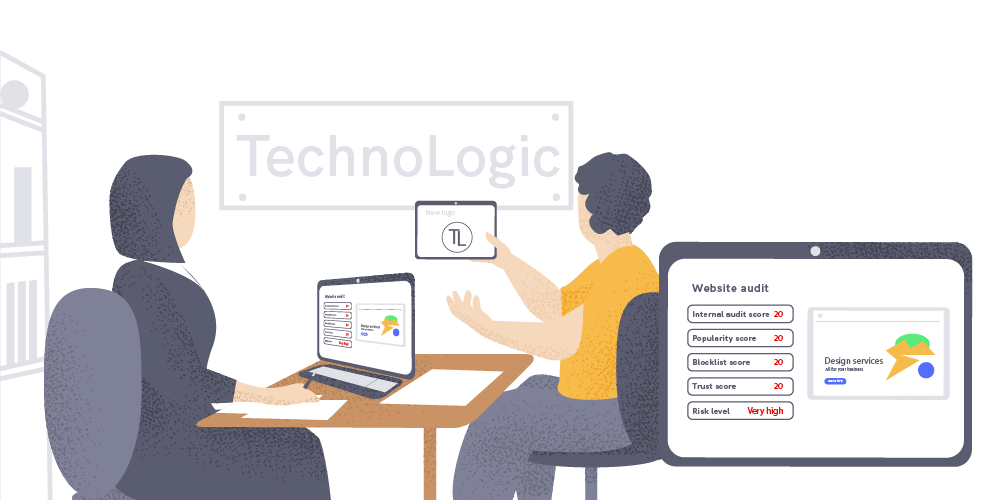

✅ Website Audit

Who knew that screening a website to gather so much information so efficiently could be possible? This KYB feature helps you analyze the company’s website by providing risk scores.

For instance, the Risk Level shows how many news agencies and other media websites are mentioned on the well-audited website. Then there’s the Internal audit score. It shows how the audited website is built: how many pages it has and how well search engines and even social media index it.

✅ Address Audit

This KYB fragment allows you to investigate a company’s address and check if it’s legitimate. Analyzing address data helps detect shell companies and fake addresses. The address audit even shows real images of the firm’s building and how it looks from the inside alongside Google Maps’ pictures of the street view.

Want to find out more about who you’re partnering with? Click to try out a quick demo here.

How to Turn KYB Into a Competitive Advantage?

Many organizations treat KYB as a compliance exercise but fail to seek its true value. While KYC has been in the game longer, KYB needs to match its level of complete automation.

For instance, in banking, due to different teams that are responsible for risk management (from legal to onboarding specialists), each department uses separate technology, which leads to the struggle of gathering data to conduct proper KYB checks. This way, the issue of a prolonged onboarding process arises.

Choosing one optimal solution and gathering as much data as possible prevents businesses from risky customers and those who hide behind corporate structures with the intent to conduct crimes. The difference between KYB and KYC is that the business compliance check provides companies with a wider picture of the business, its growth, and its risk profile.

How iDenfy Can Help Your Business

While KYC and KYB are regulatory requirements, nowadays, you need to know and protect your business from risks in the rapidly changing cyber world. Without proper tools and risk assessment, you’re exposing your business to more significant trouble.

Forget lengthy and energy-consuming research. Avoid the consequences, the fines, and protect your company from partnering with the wrong crowd with iDenfy’s Business Verification services.

Here, we provide a blended experience of compliance and a smooth automated onboarding process! Get started right away.